* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Presentation

Economic growth wikipedia , lookup

Full employment wikipedia , lookup

Non-monetary economy wikipedia , lookup

Long Depression wikipedia , lookup

Phillips curve wikipedia , lookup

Inflation targeting wikipedia , lookup

Early 1980s recession wikipedia , lookup

Transformation in economics wikipedia , lookup

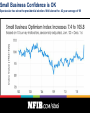

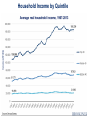

THE ECONOMY IN 2017: MUCH LIKE 2016, I THINK! Presented by: Elliot F. Eisenberg, Ph.D. President: GraphsandLaughs, LLC January 24, 2017 St. Paul, MN The Economy is Solid! GDP = C+I+G+(X-M) Households are Repairing their Balance Sheets Trillions in Net Worth Recovered, at a New Record Level Households Deleveraging is Done!!!!!! Lack of income growth hurts, but debt is growing once again. Down 6.5% from peak Single-Family and Multifamily Starts – A Weak Recovery Lack of lots, gun shy lenders, high prices, rising rates, SF gets better slowly To Many Big Houses New Home Prices Are Too High Due to Regulation University of MI Consumer Confidence is Good Index is now at or near a cyclical high, after being flat for about two years. Small Business Confidence is OK Spectacular rise since the presidential election. Well above the 42 year average of 98 US Light Vehicle Sales are High but Flat Annual Y-o-Y Percent Change in PCE A solid growth rate of 2.75% Oil Prices are Firming Cheaper oil is a benefit to households, but not the economy. Corn Prices are in a long Bear Market Corn prices have flat-lined at a level first reached in a decade ago. Corporate Profits are Again Rising After Weakening OK. Now, Look at Capital Goods Orders! Minus Defense and Aircraft Fiscal Policy Looks Increasingly Expansionary Defense, infrastructure, tax cuts will boost the deficit The Dollar is Strengthening Against all Currencies It will hurt employment growth but will reduce inflation Strong Stronger Weak GDP Growth Goes Nowhere Slowly Trump probably boosts GDP growth by 25 or 30 bps due to tax cuts as infrastructure. Best of All, No Recession is in the Cards! Designed to track real macroeconomic activity in real time How About Labor? Y-o-Y Percent Change in Hourly Earnings Changes in Median Wage Growth Looks Good! Looks only at those continuously full-time employed Household Income by Race Unemployment By Education The rates for the better educated have stopped falling but the rate for those without a high school diploma are still declining. All but blue are slightly elevated. Household Income Growth by Quintile Household Income by Quintile Differences in Household Income by Education Between 1990 and 2013: Women are doing much better than Men! Household Income by Gender Among men who work, they earn what they did back in the late 1960s. Women’s wages grow Cumulative Change in Household Income It is Finally Starting to Rise! Hopefully it will continue to do so. Both Men and Women Are Now Working Less But, the LFRP for men and women appears to have stopped falling of late. Fewer of Us are Working! Especially Youngsters. ……More Renters? Among 25-54 year old persons it’s looking up! 25-54 20-24 Tot Pop 16-19 55+ Fewer of Us are Working, but There is Improvement! Especially when you strip out demographics Inflation Becomes a Concern Little labor force slack left. Maybe 1% of labor force. Upward Mobility in America Location, segregation, social capital, inequality, marriage Inflation? It’s Here! Import Prices for all Commodities: Inflation!! Rising nicely, but largely due to energy price increases Producer Prices Show Signs of Inflation!! Consumer Price Index: Inflation is Up a Bit Headline inflation is rising due to energy but Core is largely flat. Core PCE Price Index: Inflation is Rising! It’s due to rising wages, a weakening dollar and rising energy prices. Federal Reserve Behavior • Fed funds is 0.625% • 12/31/17: 1.375% 10-yr Treasury @ 2.60% • 12/31/18: 2.125% 10-yr Treasury @ 3.05% • 12/31/19: 2.875% • Hike in June? Lots of Trump Uncertainty! What About Things Here? The Future Looks Better than the Present State Unemployment Rates Significant differences exist: However, unemployment is below 7% everywhere! Unemployment Rates in The Twin Cities All are insanely low! Carver and Scott are lowest. Anoka and Ramsey are relatively high. Population growth is Slowing and Converging Scott and Carver grow fastest. Anoka and Dakota are slowest growing. Labor Force Growth in The Twin Cities All are converging. Carver and Scott were last to converge. Per Capita Personal Income Around Here Minneapolis and Carver are highest. Anoka and Ramsey are lowest. Scott is on the move. Let’s Do this Without A Lawyer, Thank You! Foreclosure inventory is 1% of homes with mortgage, still double the historic average. Housing Prices In and Around Minneapolis MSP is most volatile, Rochester is least volatile and is at a record. MSP & St. Cloud recover. Housing Starts in Minneapolis-St Paul Single-family is largely flat, Multifamily is strong and is maybe strengthening. Interstate Migration Patterns 2016 ANY QUESTIONS? Elliot F. Eisenberg, Ph.D. Cell: 202.306.2731 [email protected] www.econ70.com Do you want to get my daily 70 word economics email? Please give me your business card or text “bowtie” to 22828 Thank YOU all very very much! @ECON70