* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Price transmission in the pig meat sector main findings

Survey

Document related concepts

Transcript

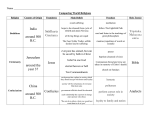

Food chain functioning in the pig meat sector Ⓒ Olof S. Pierluigi Londero – Simon Kofoed-Dam DG for Agriculture and Rural Development European Commission Outline • Context of the Commission work related to the food supply chain • Reminder of key challenges identified for the food supply chain and policy initiatives • Ongoing discussions related to the food chain, and future processes • Focus on results for pig meat sector 2 Institutional and economic context • CAP reforms, including big cuts of intervention prices, for many sectors • Strong turbulence on commodity markets since 2007 • Market monitoring exercise of the food supply chain since 2008 – Communication May 2008: high prices – Communication December 2008: policy directions on the food supply chain (roadmap: competitiveness, competition and consumer protection, regulation, monitoring and speculation) – Communication October 2009: final report presenting concrete initiatives along the line of the roadmap • HLG on agro-food competitiveness – 30 recommendations • Food Supply Chain Forum 3 Key challenges identified for the food supply chain 1. Sub-optimal relationships between the stakeholders of the chain – Diversity of markets and actors along the chain => necessity to monitor potential anti-competitive practices; asymmetry in bargaining power can lead to inefficiencies 2. Lack of transparency on price formation along the chain and increased volatility of commodity products – Increased delays and asymmetry in price transmission; low comparability of retail prices – Excessive speculation and volatility on commodity markets 3. Fragmentation of the Internal Market and low competitiveness of EU agro-food sector compared to the rest of the world – Big price differences across Member States – Identification of barriers to market integration (territorial supply constraints) 4 Changes in the distribution of value added Distribution of value added in the EU-25 food supply chain (1995-2005) 476 bio € 522 bio € 537 bio € Food retail 27% 28% 30% Food wholesale 11% 11% Food industry 31% 100%= 13% 31% 33% Agriculture 31% 1995 29% 2000 24% 2005 5 Source: EU KLEMS, EUROSTAT Structural Business Statistics Price developments in the EU food chain FOOD PRICE CRISIS PRODUCER LAG DÉJÀ VU? RETAIL LAG 120 Agricultural commodity prices Food consumer prices Food producer prices 115 110 105 Overall inflation (HICP) 100 Nov-10 Sep-10 Jul-10 May-10 Mar-10 Jan-10 Nov-09 Sep-09 Jul-09 May-09 Mar-09 Jan-09 Nov-08 Sep-08 Jul-08 May-08 Mar-08 Jan-08 Nov-07 Sep-07 Jul-07 May-07 Mar-07 Jan-07 95 Source: European Commission – DG Economic and Financial Affairs, based on Eurostat data 6 Recent initiatives on food supply chain • Commission: Communications and staff working documents (latest in October 2009) • Council: Presidency conclusions (March 2010) • European Parliament: own-initiative report (MEP Bové) adopted (September 2010) • Economic and Social Committee: Narro/Kapuvari report (September 2010) • High Level Group of the Competitiveness of the Food Supply Chain • High Level Expert Group (HLG) on Dairy (June 2010) • High Level Forum (launched on 16/11/2010) 7 Focus on the High Level Forum • High Level Forum for a Better Functioning Food Supply Chain – set up by the European Commission – composed mainly of representatives of • selected Member States, • European companies dealing with food production, processing or distribution, • professional associations and • non-governmental organisations representing the citizens' expectations. – The exercise is led by Commissioners in charge of • Industry and entrepreneurship (Tajani) • Agriculture and Rural development (Dacian Cioloş) • Health and Consumer Protection (John Dalli) and • Internal Market and Services (Michel Barnier) – Work organised in 4 Platforms 8 Focus on the High Level Forum • A three-tier structure: – the High Level Forum which will report according to the Forum's mandate; – the Sherpa group mirroring the membership of the Forum, whose role is to prepare the discussions, position papers and to recommend actions and/or policy measures to the High Level Forum; – the working groups or expert platforms, which will focus on flagship issues requiring a specific expertise, and where the involvement of a wide range of stakeholders - whether represented or not in the High Level Forum - is encouraged, in order to impulse a bottom-up process. 9 Focus on the High Level Forum • The 4 expert platforms: 1. Business to Business (B2B) contractual practices in the food supply chain 2. Food price monitoring tool 3. Competitiveness in the agro-food industry 4. Agro-logistics • Other initiatives and actions in favour of a better functioning of the food supply chain in general will be followed directly by the group of Sherpas. The Commission may create additional platforms to respond to future needs. 10 Focus price transmission, in particular for pig meat 11 Price transmission Objectives: assessment of magnitude, speed and asymmetry of price transmission to assess effectiveness – efficiency of the chain Methodology: statistical/econometric analysis (causality, cointegration, asymmetry tests etc.) at aggregate level & for the dairy and pork supply chain Limitations of the analysis: data quality, diversity of situation across products and countries, measurement (but no causation) Imperfect price transmission does not necessarily mean market malfunctioning (e.g. low share of agricultural commodity in total cost of food products, marketing strategies – price levelling, perishable nature of many food products, long-term contracts etc.) 12 Price transmission analysis at aggregated level Objectives - Look at price transmission between: - agricultural sector and food industry - food industry and retail sector - Investigate whether price transmission pattern has changed after the price surge in 2007 - Compare behaviour across Member States (EU-15 vs. EU-12) 13 EU15 Lags in consumer price decrease following agricultural commodity price decrease; number of months New Member States EU27 20 15 10 5 0 -5 PT SK CZ EE IE MT BG DE DK FR FI CY ES SI IT UK AT LV RO LT EU SE BE GR HU PL NL 14 Source: EUROSTAT LU Pass-through of price increases and price decreases along the food supply chain in the EU Price increases Price decreases Pass-through from agricultural commodity prices to food producer prices – Up to 6-month lags 53% 4% Pass-through from food producer prices to food consumer prices – Up to 3-month lags* 3% 72% 1% 3% 68% 67% 55% 2000-2009 44% 71% 47% 2000-2006 2007-2009 15 Price transmission at aggregated level Main findings Low price transmission between agricultural sector and food industry, but high price transmission between food industry and retail sector Major change after the price surge in 2007 (“rocket and feather” pattern) Major differences across Member States (~ EU-15 vs. EU12) Price transmission is not “mechanical”, difficult to assess, explain and foresee 16 Price transmission analysis – limits of aggregated data Existing empirical studies have found large variability in the degree and asymmetry of price transmission between product chains and countries. However, - most of these studies are based on price indices at aggregated level (e.g. for the category “milk, cheese and eggs”) and not on absolute price levels due to the lack of reliable data, in particular at consumer level. - the structure of the food supply chain across Member States and between product chains is very diverse and cannot be entirely reflected by aggregated price indices - this prevents from drawing conclusions on the functioning of the price transmission mechanism in the food supply chain. 17 Price transmission analysis based on absolute prices objectives and coverage Product coverage: specific in-depth enquiry on the dairy and pig meat sectors (particularly affected by the economic crisis and which raised some concerns regarding the functioning of the chain). Country coverage: Based on absolute prices, this investigation covers eight countries for which data were available (France, United Kingdom, Germany, Austria, Denmark, Czech Republic, Slovenia and Lithuania). Main objective: study the presence of price transmission from the producers to the consumers: measure its magnitude, speed and potential asymmetry. 18 Price transmission analysis based on absolute prices methodology Data: Producer prices: monthly farm-gate milk and pig meat prices available in absolute levels Retail prices: absolute prices were received for most dairy and pork products from eight countries: France, United Kingdom, Germany, Austria, Denmark, Czech Republic, Slovenia and Lithuania. (all prices have been deflated and taken to the log) Causality test: verify the causality link between producer and consumer prices through the Granger causality test. Price transmission analysis: simple and/or multiple regression analysis has been carried out retail price = f ( producer prices ) for relevant lags 19 Price transmission in the pig meat sector main findings 20 Developments of producer and consumer price indices in the EU pig meat sector, 1997-2011 (Jan 1997=100) 190 180 Feed wheat, ex-wholesale 170 160 consumer price meats 150 140 130 120 110 100 90 80 70 slaughter pig, free-slaughterhouse Jan-11 Jul-10 Jan-10 Jul-09 Jan-09 Jul-08 Jan-08 Jul-07 Jan-07 Jul-06 Jan-06 Jul-05 Jan-05 Jul-04 Jan-04 Jul-03 Jan-03 Jul-02 Jan-02 Jul-01 Jan-01 Jul-00 Jan-00 Jul-99 Jan-99 Jul-98 Jan-98 Jul-97 Jan-97 60 Source: EUROSTAT, DG AGRI 21 Price transmission in the pig meat sector: main findings 1) Casuality: - 2009 Communication: Low or even null causality for around 40% of the observed pork products - updated analysis for SI, UK, FR: low level of causality in UK and SI, but strong causality in selected products in FR 2) Price transmission: - 2009 Communication: only approximately 10% exhibited a substantial price transmission, 45% showed moderate price transmission while slightly more than 45% of the products indicated a low degree of price transmission between producer and consumer prices. - updated analysis for SI, UK, FR: selected products for FR had low price transmission, higher level of price transmission in UK, while it was hard to detect in SI (however some indication of low level of price transmission) 22 Frequency of substantial, moderate, low price transmission results for the pig meat sector 60% 50% 40% 30% 20% 10% 0% All selected EU27 countries EU15 (FR, UK, DE, DK, AT) substantial moderate EU12 (CZ, SI, LT) low 23 Price transmission in the pig meat sector: main findings 3) Speed of price transmission: - EU-27 average price response at consumer level takes place with a delay of around one month. - higher delay in price response in the EU-12 than in the EU-15. - rapid transmission only concerns pork products whose price developments were found closely linked to pig meat producer prices. Much slower speed (at least a 12 month-delay) when examining the whole spectrum of pork products. - the statistical analysis indicates that some price transmission has taken place after a given number of months, but does not provide information concerning its completeness. - very different speed across product chains and countries depending on the competitive structure of the supply chain and the production/marketing strategies put in place. 24 Price transmission in the pig meat sector: main findings 4) Price asymmetry and price transmission over time: the statistical analysis does not enable to draw firm conclusions regarding the strengthening of the price transmission pattern over the most recent months (as was observed for the dairy sector and at aggregated agricultural level) as well as the existence of asymmetric behaviour. Price change between April 2009 and May 2007 for pig meat at the farm gate and for selected pork products at retail level (in national currency) Germany France Farm gate price Retail prices Cutlets Tenderloin Roasted pork Shoulder, neck Chopped pork Minced pork Pork loins Pork belly Bacon, back Bacon, gammon Ham Sausage 2% 8% 4% -8% 4% United Czech Denmark Austria Slovenia Lithuania Kingdom Republic 37% 6% 3% 3% 18% 19% 9% -3% 41% 20% 18% 4% 10% 8% 39% 19% -5% 7% 36% 13% 10% 5% 18% 7% 18% 8% 5% 37% 9% 25 Price transmission in the pig meat sector: main findings Overall conclusion: rather low price transmission between the agricultural producer stage and the consumer stage. Only a limited part of the changes in pork retail prices was generated by price changes at the farm gate. However it may be linked to several factors: - price transmission may be stronger from the retail and/or processing stage to the producer level (depending on the country, the net trade position and/or the relative strength of the downstream sectors). - steadily declining share of pig meat raw materials into retail price of pork products, - potential inefficiencies in the market structure of the chain (linked to imbalances in bargaining power and/or anti-competitive practices), - specific adjustments constraints and costs (e.g. long-term contracts between economic actors), - pricing/marketing strategies in the downstream sectors. - the importance of producer organisations in the pig meat sector in some countries may mask some developments in the analysis of price transmission along the pig supply chain (as producers may receive dividends and/or price bonuses in addition to the observed price of pig meat) 26 Summary of the main results of the statistical analysis of price transmission: pig meat sector, United Kingdom Correlation R 2 Pork sausage 1999-2006 Pork ham 0.0306 0.0073 0.0008 0.0272 Pork bacon, back Pork bacon, gammon 0.386 2007-2011 0.227 0.287 0.505 0.538 0.872 Pork bacon, back Pork loin 0.357 0.258 Pork ham Pork shoulder boneless 0.128 0.374 Pork sausage Pork bacon, gammon 0.354 0.23 Pork shoulder boneless Pork loin Price transmission coefficient 0.462 0.286 0.017 0.046 0.817 0.676 0.897 0.308 27 Thank you 28