* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download chapter summary

Economic planning wikipedia , lookup

Nouriel Roubini wikipedia , lookup

Nominal rigidity wikipedia , lookup

Fiscal multiplier wikipedia , lookup

Economy of Italy under fascism wikipedia , lookup

Ragnar Nurkse's balanced growth theory wikipedia , lookup

Post–World War II economic expansion wikipedia , lookup

Steady-state economy wikipedia , lookup

Circular economy wikipedia , lookup

Transformation in economics wikipedia , lookup

Long Depression wikipedia , lookup

Stagflation wikipedia , lookup

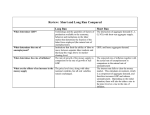

CHAPTER 5 INTRODUCTION TO MACROECONOMICS In this chapter, you will find: Learning Outcomes Chapter Outline with PowerPoint Script Chapter Summary Teaching Points (as on Prep Card) Solutions to Problems Appendix Experiential Assignments INTRODUCTION To introduce students to macroeconomics in a natural and familiar way, the economy is compared to the human body and parallels are drawn. The history of the U.S. economy is traced, using aggregate supply and demand, and both demand-side economics and supply-side economics are discussed. The chapter also conveys the difficulty of testing macroeconomic theories and includes a brief discussion of the twin deficits. LEARNING OUTCOMES 5-1 Explain what's special about a national economy compared to regional, state, or local economies. The national economy has its own currency, its own system of government, its own laws, regulations, customs, manners, and ways of doing business within its borders and across borders. Regional, state, and local economies operate within the larger, national economy. 5-2 Describe the phases of the business cycle. The economy fluctuates between two phases: periods of expansion and periods of contraction. See the figures below for details. No two business cycles are the same. Before 1945, expansions averaged 29 months and contractions 21 months. Since 1945, expansions have averaged 57 months and contractions 11 months. Despite the Great Depression and later recessions, the economy’s output has grown more than fourteenfold since 1929 and jobs have grown faster than the population. 5-3 Explain the shapes of the aggregate demand curve and the aggregate supply curve, and how they interact to determine real GDP and the price level for a nation. The aggregate demand curve slopes downward, reflecting a negative, or inverse, relationship between the price level and real GDP demanded. The aggregate supply curve slopes upward, reflecting a positive, or direct, relationship between the price level and real GDP supplied. The intersection of the two curves determines the economy’s real GDP and price level. See the figures below. 5-4 Identify the five eras of the U.S economy, and describe briefly what went on during each. 1) The Great Depression and Before: The Great Depression and earlier depressions prompted John Maynard Keynes to argue that the economy is unstable, largely because business investment is erratic. Keynes did not believe that contractions were self- correcting. 2) The Age of Keynes: His demand-side policies of increased government spending and decreased taxes dominated macro economic thinking between World War II and the late 1960s. (3) Stagflation: During the 1970s, higher oil prices and global crop failures reduced aggregate supply. The result was stagflation, the © 2015 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. Chapter 5 Introduction to Macroeconomics 68 troublesome combination of declining real GDP and rising inflation. 4) Relatively Normal Times of 1980 until 2007: Output and employment also grew nicely during this era. The expanding economy increased federal revenues enough to create a federal budget surplus by the end of the 1990s. But after the longest expansion on record, the economy experienced an eight-month recession in 2001. The economy started growing again, and that expansion lasted until the end of 2007. 5) The Great Recession of 2007 to 2009 and Beyond: After peaking in December 2007, the economy entered a recession because of falling home prices and rising foreclosure rates. The collapse of a Wall Street bank in September 2008 panicked financial markets around the world, cutting investment and consumption. Job losses during this Great Recession were the highest since the Great Depression. Massive federal programs aimed at stabilizing the economy resulted in gigantic federal deficits. Economic growth returned in the second half of 2009, but the unemployment rate remained stubbornly high for years. CHAPTER OUTLINE WITH POWERPOINT SCRIPT USE POWERPOINT SLIDES 2-8 FOR THE FOLLOWING SECTION The National Economy: Economy: the structure of economic life, or economic activity, in a community, a region, a country, a group of countries, or the world. GDP (gross domestic product): The market value of all final goods and services produced in the U.S. during a given period, usually a year. What’s Special about the National Economy? Each country has its own “rules of the game” (laws, regulations, customs, manners, and conventions). The Human Body and the Economy: The economy, like the body: (1) consists of many parts, each performing particular functions yet linked, (2) is continually renewing itself, and (3) involves circular flow through the system. Flow and Stock Variables Flow: A variable that measures an amount per unit of time. Stock: Amount measured at particular point in time. Testing New Theories: There is no laboratory in which macroeconomic theories can be tested. Therefore, economists examine historical and international evidence for clues about how the economy works. Knowledge and Performance: We must know how a healthy economy works before we can consider whether anything can be done about it. USE POWERPOINT SLIDES 9-14 FOR THE FOLLOWING SECTION Economic Fluctuations and Growth Economic fluctuations (business cycles): The rise and fall of economic activity relative to the long-term growth trend of the economy. U.S. Economic Fluctuations: Two phases: periods of expansion and contraction Depression: A severe contraction or reduction in the nation’s total production lasting more than a year and accompanied by high unemployment. Recession: A mild contraction, a decline in total output lasting at least two consecutive quarters. Periods of expansion: Begin when economic activity starts to increase and continues until the economy reaches a peak. USE POWERPOINT SLIDE 15 FOR THE FOLLOWING SECTION Leading Economic Indicators: Foreshadow a turning point in economic activity © 2015 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. Chapter 5 Introduction to Macroeconomics 69 USE POWERPOINT SLIDES 16-17 FOR THE FOLLOWING SECTION Aggregate Demand and Aggregate Supply Aggregate Output and the Price Level Aggregate output: Total amount of final goods and services produced in the economy during a given period, real GDP. Price level: The average price of aggregate output (CPI or GDP price index.) USE POWERPOINT SLIDES 18-23 FOR THE FOLLOWING SECTION Aggregate Demand Curve: Shows the relationship between the economy’s price level and real GDP demanded Aggregate Supply Curve: Shows how much producers in an economy are willing and able to supply at each price level. Factors held constant along an aggregate supply curve: 1) Resource prices 2) State of technology 3) “Rules of the Game” that provide production incentives Equilibrium: Determined by the intersection of the aggregate supply and the aggregate demand curves. USE POWERPOINT SLIDES 24-28 FOR THE FOLLOWING SECTION A Short History of the U.S. Economy The Great Depression and Before: Due to the 1929 stock market crash, aggregate demand declined so severely that one of the deepest contractions of the economy was created. Prior to that time, macroeconomic policy was based on the “laissez-faire” philosophy of Adam Smith. USE POWERPOINT SLIDES 29-34 FOR THE FOLLOWING SECTION The Age of Keynes: After the Great Depression to the Early 1970s Demand-side economics: Focused on how changes in aggregate demand could promote full employment. USE POWERPOINT SLIDES 35-37 FOR THE FOLLOWING SECTION Stagflation: 1973 to 1980 Stagflation: A contraction in the economy’s aggregate output, along with inflation, or a rise in the economy’s price level. USE POWERPOINT SLIDES 38-42 FOR THE FOLLOWING SECTION Relatively Normal Times: 1980 to 2007 Supply-side economics: Theorizes that lowering federal tax rates would increase after-tax wages, which would provide an incentive to increase the supply of labor and other resources. Output and employment grew nicely during the 1990s. The expanding economy increased federal revenues enough to create a federal budget surplus by the end of the decade. After achieving the longest expansion on record, the U.S. economy slipped into recession aggravated by the terrorist attacks of September 2001. The subsequent expansion lasted until 2007. USE POWERPOINT SLIDES 43-49 FOR THE FOLLOWING SECTIONS The Recession of 2008-2009 and Beyond The economy went in recession in early 2008 because of falling home prices and rising foreclosure rates. The collapse of a Wall Street bank in September 2008 panicked financial markets around the world, cutting investment and consumption. Job losses were the worst since the Great Depression. © 2015 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. Chapter 5 Introduction to Macroeconomics 70 Massive federal programs aimed at stabilizing the economy resulted in gigantic federal deficits. Economic growth returned in the second half of 2009. USE POWERPOINT SLIDES 50-52 FOR THE FOLLOWING SECTION Eight Decades of Real GDP and Price Levels CHAPTER SUMMARY Macroeconomics focuses on the national economy. A standard measure of performance is the growth of real gross domestic product, or real GDP, the value of all final goods and services produced in the nation during the year. The economy has two phases: periods of expansion and periods of contraction. No two business cycles are the same. Before 1945, expansions averaged 29 months, and contractions 21 months. Since 1945, expansions have averaged 57 months and contractions 11 months. Despite the Great Depression and later recessions, the economy’s output has grown more than thirteenfold since 1929 and jobs have grown faster than the population. The aggregate demand curve slopes downward, reflecting a negative, or inverse, relationship between the price level and real GDP demanded. The aggregate supply curve slopes upward, reflecting a positive, or direct, relationship between the price level and real GDP supplied. The intersection of the two curves determines the economy’s real GDP and price level. The Great Depression and earlier depressions prompted John Maynard Keynes to argue that the economy is unstable, largely because business investment is erratic. Keynes did not believe that contractions were self-correcting. He argued that whenever aggregate demand sagged, the federal government should spend more or tax less to stimulate aggregate demand. His demand-side policies dominated macroeconomic thinking between World War II and the later 1960s. During the 1970s, higher oil prices and global crop failures reduced aggregate supply. The result was stagflation, the troublesome combination of declining real GDP and rising inflation. Demand-side policies appeared less effective in an economy suffering from a reduction in aggregate supply because stimulating aggregate demand would worsen inflation. Supply-side tax cuts in the early 1980s were aimed at increasing aggregate supply, thereby increasing output while dampening inflation. Some hoped that the added tax revenue from a stronger economy would offset the loss in tax revenue from cuts in tax rates. But federal spending increased faster than federal tax revenue, resulting in budget deficits that grew into the 1990s. Tax increases, a slower growth in government spending, and an expanding economy all helped erase budget deficits by 1998, creating a federal budget surplus. But after the longest expansion on record, the economy experienced an eightmonth recession. The recession ended in late 2001, but unemployment continued to rise into 2003. Tax cuts and a sluggish recovery boosted the federal deficit. Jobs began growing once again in late 2003, and by 2007 the economy added more than 8 million jobs. This growth cut the federal deficit to about $160 billion. After spikes in the price of oil and other commodities and the collapse of the housing market, the U.S. economy lost 2.5 million jobs in 2008. The federal budget deficit swelled to $450 billion in 2008. With lower tax revenues and increased stimulus spending, the deficit was sharply higher in 2012. © 2015 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. Chapter 5 Introduction to Macroeconomics 71 TEACHING POINTS 1. It may be useful to point out to students here that the reasons for the negative and positive slopes of the demand and supply curves of individual goods do not apply in dealing with the AS and AD curves. For example, holding “other prices” and “money income” constant is not appropriate in construction of the AD curve, and aggregate suppliers may be neither willing nor able to offer more output when the aggregate price level increases. 2. A short time series (projected roughly on the screen) will show that the U.S. economy did not really have a serious fall in income until 1931. The low point was reached in 1933 during a period of terrific monetary contraction. Many people mistakenly believe that the economy rose continually after that point in time (owing to FDR’s New Deal). However, the economy turned down again in 1938, although the drop was not as deep as the one that occurred in 1933. After 1938 the economy rose steadily as a result of the military spending required to fight World War II. 3.Some students may think that study of the Great Depression is akin to the study of dinosaurs. However, many have noted parallels between the Great Recession and the Great Depression, especially as they relate to the dramatic rises and falls in the stock market and the global recession of 2007–2009. 4. The purpose of introducing AS-AD in this chapter is to provide the student with a sense of the two sides to macroeconomics: supply and demand. It capsulizes national income determination and the determination of the price level in a heuristic way. Nevertheless, it can be troublesome explaining why a lower price level increases the quantity of aggregate output demanded. A drop in the price level, holding all else constant, makes money balances more valuable, thus giving rise to greater demand for output. A drop in the U.S. price level also makes domestic goods cheaper than foreign goods. 5. You may wish to ask the students how the AS and AD curves would shift in each of the following situations: (1) government spending increases, (2) consumer confidence improves, and (3) personal tax rates are cut. SOLUTIONS TO PROBLEMS APPENDIX 1. (The National Economy) Why do economists pay more attention to national economies (for example, the U.S. or Canadian economies) than to state or provincial economies (such as California or Ontario)? Each national economy has its own “rules of the game,” that is, its own laws, regulations, customs, and conventions for conducting economic activity. U.S. gross domestic product provides a measure of the performance of the national economy and of how it interacts with the rest of the world. 2. (Economic Fluctuations) Describe the various components of fluctuations in economy activity over time. Because economic activity fluctuates, how is long-term growth possible? The economy moves through periods of expansion and periods of contraction. Contractions include recessions in which total output and employment decline over a six-month period and more serious depressions in which sharp reductions occur in output and employment that last more than a year. The end of a contraction is marked by the trough, or lowest point. After the trough, the economy enters an expansion period in which total output increases until the © 2015 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. Chapter 5 Introduction to Macroeconomics 72 economy reaches its peak. The economy grows over time. This is possible because the growth during expansions more than offsets the decline during recessions. Economic fluctuations reflect movements around the long-term growth trend. 3. (Aggregate Demand and Supply) Review the information on demand and supply curves in Chapter 4. How do the aggregate demand and aggregate supply curves presented in this chapter differ from the market curves of Chapter 4? The demand and supply curves in Chapter 4 describe the relationship between the price of an individual product or product category, such as textbooks or food, and the quantities of that individual item demanded and supplied. Aggregate demand and aggregate supply describe the relationship between the average price level of all goods and services and the total quantities of goods and services demanded and supplied throughout the entire economy. 4. (Aggregate Demand and Supply) Determine whether each of the following would cause a shift of the aggregate demand curve, a shift of the aggregate supply curve, neither, or both. Which curve shifts, and in which direction? What happens to aggregate output and the price level in each case? a. The price level changes. b. Consumer confidence declines. c. The supply of resources increases. d. The wage rate increases. a. Neither curve would shift. A change in the price level would cause a movement along the curves. b. Aggregate Demand shifts left because less consumer confidence reduces the aggregate output demanded at each price level. Therefore, both aggregate output and the price level fall. c. Aggregate Supply shifts right. There is an increase in the aggregate output supplied at each price level. Therefore, aggregate output increases and the price level falls. d. Aggregate Supply shifts left as the costs of production have risen. Therefore, aggregate output falls and the price level rises. 5. (Five Eras of U.S. Economy) Identify the five eras of the U.S. economy beginning with the great Depression and before. 1) The Great Depression and Before: The Great Depression and earlier depressions prompted John Maynard Keynes to argue that the economy is unstable, largely because business investment is erratic. Keynes did not believe that contractions were self- correcting. 2) The Age of Keynes: His demand-side policies of increased government spending and decreased taxes dominated macro economic thinking between World War II and the late 1960s. (3) Stagflation: During the 1970s, higher oil prices and global crop failures reduced aggregate supply. The result was stagflation, the troublesome combination of declining real GDP and rising inflation. 4) Relatively Normal Times of 1980 until 2007: Output and employment also grew nicely during this era. The expanding economy increased federal revenues enough to create a federal budget surplus by the end of the 1990s. But after the longest expansion on record, the economy experienced an eight-month recession in 2001. © 2015 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. Chapter 5 Introduction to Macroeconomics 73 The economy started growing again, and that expansion lasted until the end of 2007. 5) The Great Recession of 2007 to 2009 and Beyond: After peaking in December 2007, the economy entered a recession because of falling home prices and rising foreclosure rates. The collapse of a Wall Street bank in September 2008 panicked financial markets around the world, cutting investment and consumption. Job losses during this Great Recession were the highest since the Great Depression. Massive federal programs aimed at stabilizing the economy resulted in gigantic federal deficits. Economic growth returned in the second half of 2009, but the unemployment rate remained stubbornly high for years. 6. (Supply-Side Economics) One supply-side measure introduced by the Reagan administration was a cut in income tax rates. Use an aggregate demand/aggregate supply diagram to show what effect was intended. What might happen if such a tax cut also shifted the aggregate demand curve? Lower tax rates were intended to increase after-tax earnings and thus increase incentives for resource owners to provide labor and capital. The resulting rightward shift in Aggregate Supply would increase aggregate output and lower the price level. The increase in after-tax earnings would also increase Aggregate Demand, which would increase aggregate output and raise the price level. The overall impact on the price level would depend on the relative sizes of the shifts in the aggregate supply and the aggregate demand. Experiential Assignments 1. The National Bureau of Economic Research maintains a Web page devoted to business cycle expansions and contractions at http://www.nber.org/cycles.html. Have students take a look at this page to see if they can determine how the business cycle has been changing in recent decades. Has the overall length of cycles been changing? Have recessions been getting longer or shorter? 2. Ask students to review the Summary of Commentary on Current Economic Conditions by Federal Reserve District (Beige Book), available through the Federal Reserve System at http://www.federalreserve.gov/monetarypolicy/beigebook/default.htm. Have them a. Summarize the national economic conditions for the most recent period covered in the report. Overall, is the economy healthy? If not, what problems is it experiencing? b. Go to the summary applicable to their district. Summarize the economic conditions for the last reporting period. Is the economy in their district healthy? If not, what problems is it experiencing? 3. This chapter introduced the tools of aggregate demand and supply. Test your students’ understanding by having them find an article in today’s Wall Street Journal describing an event that may affect the U.S. price level and real GDP. They can look under “Economy” or “International” in the first section of the newspaper. Students should then draw an initial set of AD and AS curves and determine which curve will be affected and in which direction it will shift. Ask them to predict what will happen to the price level and real GDP. © 2015 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.