* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Primary Money Creation Channels under Instability

Survey

Document related concepts

Transcript

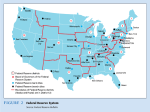

Prof.dr.sc. Ivan Lovrinović1 Dr.sc. Tomislav Ćorić Martina Nakić, dipl.oec. Primary Money Creation Channels under Instability JEL classification: E51, E58 Key words: monetary base, balance sheet of central bank, instability, channels of money creation. Abstract: Aims and channels of primary money creation are among most challenging questions of monetary economics and policy. The relevance is even greater under unstable circumstances for the financial markets in particular and economies in general. Primary money creation is not determined only by deposit multiplication within the banking system of a country through its credit activity. Changes in quantities of primary money influence all other economic variables, e.g. the interest rate, inflation, employment, GDP growth rates, liquidity. It is well known that primary money is an input in a secondary money supply through credits of banks offered to non-monetary entities. Primary money creation channels, visible in assets of a central bank balance sheet, differ among countries. According to primary money creation channels the degree of (in)dependence of a monetary system, domestic currency credibility, development of domestic financial system, state of public finances, interdependence of real and monetary economy, etc. may be determined. Furthermore, it is possible to identify monetary policy instruments used by a respective country. Under unstable conditions, in this case financial crisis and recession that started in 2007, our goal is to investigate the choice of primary money creation channels made by selected countries and its effects on liquidity management both on financial and real sectors of economies. Furthermore, we answer the question of primary money channel choice which yields best results in terms of GDP growth and faster recession recovery. It is our understanding that determination of a specific primary 1 Prof.dr.sc. Ivan Lovrinović is Full Professor at the Department of Finance at Faculty of Economics and Business, University of Zagreb. Dr.sc. Tomislav Ćorić is assistant researcher and lecturer at the Department of Finance at Faculty of Economics and Business, University of Zagreb. Martina Nakić, dipl.oec. is assistant researcher and lecturer at the Department of Finance at Faculty of Economics and Business, University of Zagreb. 1 money creation channel underpins philosophy behind economic policy which takes speed of the process into consideration both for the interest rate and expectations as main pro-cyclical measures. 1. Endogenous and exogenous money Money creation today differs from the era of commodity money. Commodity money had value of a commodity and it was not possible to increase supply without increasing production. With time, a monetary system based on gold, due to its limited supply, was not able to keep up with economic growth, thus stipulating pro-recession and deflationary characteristics. Due to these and other reasons, during the time of the gold standard, surrogate money started to evolve. Most of all, the banknote was used as a certificate of deposited gold with a bank. In the third phase of the gold standard, gold was pushed out and served only as a foundation for the trust in banknotes. The banknote developed from a surrogate to currency which did not have intrinsic value but carried a mark of value (gold). This is the genesis of a modern currency. During the gold standard era, however, two money supply peinciples evolved stipulated by growing industrial development and supply of goods and services relative to supples of gold and limited gold production capabilities. Currency principle and banking principle made division in theory which is the source of all current dispositions on primary money creation. It is known that the banking principle prevailed which comes down to the fact that money supply may be greater in banknotes compared to the stock of gold, as during the time of the gold standard. Thus, the idea of additional money supply of surrogate money in the form of banknotes was born. It further reflected Aristotle’s thesis that the money is consequence of the law, i.e. the money will be what a government decided it to be. Thus, the physical shape and form is less important, and today even unimportant. Therefore, during the age of the gold standard, gold was an exogenous factor of money supply (banknotes), supplied by all banks depending on quantities of gold in their vaults. Paper money, at the time, was created by private banks in form of the banknotes as surrogate money. Nonetheless, prevailing banking principle opened space for endogenous money creation within a banking system with primary money as a base. Basic principle was that a deposit created credit, i.e. creadit created a deposit. Today, primary money, and secondary money, supply rests on liability, i.e. debt by the issuer which may lead to great problems both for national and global economy. Poor monetary 2 policy management and irresponsible increase of primary money supply may deter economic system and create financial crisis. Exogenous money creation, backed by monetarists, from 1975 is based on a premise that a central bank determines supply of primary, and thus, supply of transaction money. Monetarists argue that the ration of primary money to money supply is stable and their relation determined through the monetary multiplier. Open market operations in this system are a corrective instrument. In such a model money creation is technical in essence and monetary multiplier is responsible for relation between primary money and money stock. According to known fact of stability between currency and deposits, i.e. primary money and deposits, it turns out that there is nothing to explore further. However, it is a fact that a central bank from a monetarist point of view does not have a full autonomy in creation, i.e. supply of primary money. It also depends on non-monetary sector behavior. Monetarists have made the model of exogenous primary money creation, and overall supply of money, stronger by Friedman’s research results which showed demand for money in a long time series for the US to be stabile. Thus, continues growth rule of three to five percent of money supply should be followed. Fisher’s quantitative money demand function (MV=PY) illustrates the dilemma on endogenous and exogenous money creation. Some economists read causality from left to right (exogenous), while others do so in the opposite direction (endogenous). However, Fisher’s equation represents foremost identity and a sound analytical framework for investigating causality of money, prices and income. It does not, however, answer the key question: does the change in size of money influence income or other way around? However, the equation starting point is the assumption of exogenous money creation, due to the conclusion that the price level is determined by the money stock determined by the central bank. Furthermore, assumption is that the velocity of money and production are constant. Both cases are obviously possible but the term structure is important. Post-Keynesians seriously challenge the monetarist foundations of exogenous primary money creation and total supply of money, arguing that in the past thirty years things have considerably changed. Based on this fact, they argue that most textbook interpret the IS-LM model wrongly. It is suggested that the changes of the LM curve explain changes of money stock as a lead indirect goal of a monetary policy. On the other hand, it is argued that most major central banks in the world do not use supply of money as an indirect goal but the 3 interest rate. Furthermore, as argued by post-Keynesianists, if a central bank uses the interest rate instead of supply of money, i.e. respective monetary aggregate, it means that cration of money is endogenous in nature. This is especially true if the discount rate is used frequently. However, one question remains unanswered: why a central bank increases or decreases supply of primary money and thus the supply of money? Post-Keynesians argue that demand for credit is the key factor influencing money supply, and thus supply of primary money. Demand for money by companies depends on their expectations of an uncertain future. This in turn influences their demand for bank credit, i.e. demand for central bank money. According to post-Keynesians, bank credit flows and total money supply is pro-cyclical and endogenous, and driven by Keynes’s “animal spirits.” Therefore, with withdrawal from the gold standard in 1973, which was a gold-dollar standard in essence, the only thing that remained was the banknote which was no longer a surrogate but the real and only currency. Gold was demonetized and henceforth was not linked to money. This represents the case of transformation from intrinsic value money to money without intrinsic value and affirmation of the banking principle to its extremes, where gold is unnecessary. With the breakdown of the gold standard, foundation for increased supply of currency was fiat money. From this point on, issuing currency is based solely on trust, i.e. the law. The modern money stands on trust in power, potential and efficiency of respective country’s economy. The fiat money starts to be a foundation for issuing credit money by banks. Thus, issue of primary money in modern conditions is the key test for central banks and economic policies. Today’s money is dematerialized, in case of cash and deposit money alike, because both forms represent only symbols of value and posses no intrinsic value. Commodity money represent asset for its owner without liability. On the other hand, today’s paper money represents liability to the issuer, i.e. a central bank which is not backed by supply of goods. Liability of the central bank is, therefore, a debt which an owner of the paper money cannot call in. Creation of money during the days of commodity money was determined by the size of materials, especially in the gold standard. Today there is no limit to creation of primary money, thus creation of primary money may theoretically be limitless. This fact reflects the basic difference between two money issuance systems valid in the time of commodity money and today’s paper money. Limitations do exist, but this will be explored later. 4 Since creation of money is a decision made by a central bank as a monetary authority, the key question are the reasons for creation of additional supply of primary money and how to secure its value, i.e. purchasing power. In the globalized world and liberalized capital accounts, question of exogenous primary supply of money is even greater. Foreign currency transactions in some countries, foremost developing countries, are becoming key determinant for issue of domestic currency by the respective central banks. The grater the commitment of local currency issues to foreign currency transactions the lower monetary sovereignty. Such monetary system determines the shape of economic relations, thus countries become more dependent on imports with trade balance deficits and growing foreign debt. Such system reflects a down side of the gold standard which lies in pro-recession mechanism. This is due to shrinking supply of foreign currency initiated by increasing foreign debt worsened by the fact that almost fixed exchange rate must be maintained in order to preserve stability of prices. This is the case in Croatia with more rigid monetary system that the classical currency board. 2. Primary money creation flows Primary money issued by central banks today represent “modern gold” because it reflects secondary emission of money performed by banks through credit activity. Based on trust in money supplied by a central bank, multiplication may result in increase or decrease of trust in the central bank and its money, i.e. towards government and the law backing it. In this sense, it is important to question further primary money creation and its credibility. In today’s conditions we speak of flows or channels of primary money creation. According to existing literature and practice, main flows of primary money creation are: a) credit to banks by central banks, b) buying securities (mostly issued by governments), c) foreign exchange operations, d) gold and other precious metals transactions, e) selective credit to companies. Flow of primary money creation dominant in a country, speaks of the type of an economy, and the size of emission speaks of problems a country is facing in short or longer run. If the credit to banks as monetary institutions in a two layer monetary system is the key channel of primary money creation than a security used as collateral is important. Basically, these are discounted credits based on bills of exchange in the beginning. A central bank, in this case, discounts the bill of exchange already discounted to companies. This way production of goods and services performed in the market through bills of exchange end up in creation of 5 appropriate amount of primary money. It represents a logical circular flow between monetary and real economies. We will not get into details of supply and demand for primary money because we are interested primarily for reasons and flows of primary money creation. Discounting already discounted bills of exchange represents a base of central bank refinancing policy. A central bank, by using discount rate policy, balances goods and financial flows. If a central bank’s assets are predominantly made of discounted credit, it is obvious that it takes care of development of a domestic economy. This is the way dominantly used by the Bundesbank prior to introduction of the Euro. Furthermore, this is also the practice used by the European Central Bank and some other central banks in the world. Approval of the discounted credit by a central bank means that the foundations of primary money emission is based on goods and services involving actual work. We speak of credit part of the overall primary money created by a central bank. By selling produced goods and services in the market issuer of a bill of exchange is able to pay it out. The bank is paid by the central bank thus canceling previously created amount of primary money. In case that the bill of exchange cannot be paid out, other asset forms would be recorded in the bank’s and central bank’s balance sheets which the issuer of the bill of exchange owns. Thus, the central bank and a bank as monetary institutions should prefer primary and secondary money emission tied to a real economy and creation of new value. If former flow of primary money creation dominates, we can say that the independent and balanced monetary system exists which takes care of a domestic economy creating money out of real production. For a case where a central bank buys government bonds as a main flow of primary money creation, i.e. its non-credit portion, we can develop few scenarios. If we assume government is issuing bonds only, the question is why it is being done, i.e. is it due to investments or nonproduction spending. If the central bank buys government bonds to help the real economy, as was the case in the US during 2008-2009, creation of money is connected to production. Thus, we speak of earmarking public debt and emission of primary money which is know in literature as monetization of public debt. In this case the primary money emission was guaranteed by the US Treasury. If foreign currency transactions are dominant flow of primary money creation, structure should be laid out first, i.e. sources of the foreign currency. If the foreign currency is based on exports of goods and services, than the sale of foreign currency to banks and finally to the central bank can be realistic base for primary money creation. In this case we have 6 transformation of purchasing power from abroad in foreign currency to domestic purchasing power in the domestic market. This means that the primary money will be created when central bank purchases foreign currency. Such creation of primary money is a non-credit portion of primary money. If foreign exchange transactions are consequence of borrowing from abroad dedicated for non production purposes, primary money creation will through transmission mechanism create inflation pressures or increase trade balance deficit. In this case monetary effects of foreign exchange transactions would mostly be negative for an economy and further signal foreign dependence. 3. Influence of instability to primary money creation In unstable conditions created by financial markets or real economy, flows of primary money creation would change, and its relevance is different among countries. Why are the flows of primary money different, what are the reasons for choosing a specific primary money creation channel and why channels may be changed in short and long run? These questions will be answered in the following text. We will use experiences of selected central banks in unstable period (2007-2010), and 2002-2007 will be used as mostly stabile period. Federal Reserve of the US was the first one to face huge consequence of the recent financial crisis which generated from the mortgage market. In a very short period of time FED lowered interest rates to historically low levels which led to liquidity effect. Supply of primary money was more than doubled in a very short time. Real estate crisis was so deep and wide spread to other financial institutions that governors of central banks were unaware of the real threats for overall economic system and financial stability at the beginning. Lower interest rates showed to be the key measure against looming illiquidity, panic and meltdown. The interest rate channel (fixed) was the only efficient measure to put recession as a continuation of the financial crises, to an end. No one knew how much primary money should be pumped into the system so the boundaries of borrowing from central banks were not set. Due to this reason, primary money emission was enormous and nobody wanted to limit quantity due to multitude of problems and negative expectations. However, it was important to maximally lower the interest rate and thus get the message across to the economy that the central bank is ready to supply enough money at such rate. Targeting the interest rate represented an advantage over monetary aggregate targeting in recent financial crises and recession. 7 The FED intervention was performed in several phases, which speaks of adjusted measures and instruments in order to achieve set goals. Intervention programs created by economic policy, described below, were the foundation for primary money emission. 1) Liquidity Programs for Financial Firms was FED’s first form of intervention with the goal of achieving short run liquidity (90 days) for healthy institutions with acceptable investment security. Some $860 billion (45% of FED assets) was approved, predominantly to banks, primary dealers and for foreign exchange swaps with other central banks. 2) Direct Lending to Borrowers and Investors represents a second phase of intervention by the FED with the key segments in stabilizing securitization of financial instruments market through TALF (Term Asset-Backed Securities Loan Facility). The other segment was tied to CPFF (Commercial Paper Funding Facility). The goal was to improve functioning of the credit market with direct credit approval to major entities. The FED approved $255 billion for the activities (1/8 of its assets). 3) Purchases of High-Quality Assets was related to actions of buying high quality government bonds and government agencies bonds for which the FED issued primary money in the amount of $780 billion (3/8 of FED assets). Out of $780 billion, $490 billion went for government bonds. The FED influenced returns stability in the long run and lowering of interest rates and credit risks. 4) Support for Specific Institutions was the fourth intervention program by the FED which related to direct financing of important institutions with minor support of the US Treasury and the US Congress. Speed of the effects was crucial for take-over of Bear Stearns from JP Morgan Chase & Co. Furthermore, AIG insurance company was bailed out. These operations amounted to 5% of FED’s assets. “Hard choice for the FED, but there was no other solution.” (Bernanke, 2009.) Above mentioned operations by the FED and the ways of policy creation tells that the selective policy became the most important instrument of the FED in solving financial crises and subsequent recession. For improvement of liquidity in the first phase credit flow to banks was used. For stabilizing long run interest rates and expectations in this phase purchase of long term government bonds was used. In this context, Bernanke stated in September 2009 that the FED balance sheet was the key instrument of the monetary policy in solving the financial crisis and recession. The 8 balance sheet of the FED at the time is a clear illustration of the gravity of situation where for the first time companies were clients. The FED at the time was more than ever the lender of last resort for banks, insurance companies, real estate agencies, companies, and for the government. For the first time the FED assumed the role of a commercial bank. The quest for most efficient way for counter cyclical actions with transmission mechanism was the excuse for extending the clientele base of the FED. In conducting new measures and instruments of monetary policy, better known as credit easing, the FED was guided by the following principles: a) tight cooperation with the US Treasury, b) in credit operations, risk taking was avoided, and credits were allocated to predefined industries, c) initiated resolution on its role for bailing out non-monetary institutions. For decades the balance sheet of the FED relied on government bonds. At the end of 2007 the share was shrinking with growing share of other financial assets. In this sense the balance sheet of the FED can be divided into following three segments: a) short run credit for liquidity of financial institutions e.g. deposit institutions, broker/dealer firms and MMMFs, b) assets related to programs focused on widening credit conditions, and c) high quality securities, especially government bonds and asset backed securities. By the end of 2007, FED established TAF (Term Auction Facility) as an innovation related to “discount window” as a classical instrument of the monetary policy. This was a solution for an unpopular “stigma problem” because it relied on an anonymous auction which was announced and liquidated in three days. For example, on April 1, 2009, out of $525 billion devoted to the “discount window”, $470 billion was allocated through the auction, and the rest through regular channels (Bernanke, 2009.). For liquidity of foreign banks abroad the FED signed cooperation agreements with 14 central banks which relate to currency swaps dispensing $310 billion and foreign central banks committed to counter value in local currencies. In this operation also significant amount of the primary money in the US was created. In March 2008, the FED, under the pressure of the crisis, introduced a new program of assistance called Primary Dealer Credit Facility (PDCF) where $105 billion in credit was dispensed. 9 The third form of FED assets relate to high quality securities, especially MBS (mortgage backed securities), in total amount of $780 billion, out of which $490 billion was assigned for government bonds. The main goal of the program was to lower costs and increase availability of credit to households and businesses. CPFF program was very important because commercial papers market represents the key part of the short run money market in the US. Companies found harder to issue commercial papers so the FED decided to buy out papers of financial and non-financial companies with different insurance premiums and up to three months. The TALF program had the goal to restore securitization market which almost died out (car loans, student loans, credit cards). Beside afore mentioned programs of fast and strong FED intervention, “Support for Specific Institutions” as a program of aid to especially important financial institutions was acknowledgement of change in behavior of the central bank. The case was aid of the FED to JP Morgan Chase & Co. for take-over of Bear Sterns and bail out of AIG. The model of aid in these cases was different than the usual programs for liquidity which were dispensed by the central bank and are thus more risky. „…these operations have been extremely uncomfortable for the Federal Reserve to undertake and were carried out only because no reasonable alternative was available… we are working with the Administration and the Congress to develop a formal resolution regime for systemically critical nonbank financial institutions“ (Bernanke, 2009). In this case political decision, but also the fear of further destabilization of financial markets, overall economy and society, was the cause of an extra primary money emission in its credit form. This is acknowledgement to the thesis that unusual and serious circumstances also yield unusual solutions. Traditionally conservative central banking responded strong and with innovation, not only in the US but throughout the world. No one spoke of central bank autonomy any longer. The FED was not only satisfied with lowering interest rates as a classical monetary instrument because it would prove ineffective. The FED also combined low interest strategy with a new approach to credit access called “credit easing”. However, lowering interest rates only does not mean that transmission that should result in economic growth is automatic. Changes in FED policies toward banking and nonbanking institutions led to a boom in its balance sheet which increased dramatically. “In the United States, the Federal Reserve has done, and will continue to do, everything possible within the limits of its authority to assist in restoring our nation to financial stability and economic prosperity as quickly as possible“ (Bernanke, 2009). In this sense the FED had to loosen its crude demands tied to credit applications by banks which were an obstacle prior to 10 “credit easing”. Faster and easier access to FED credit with the low interest rate stabilized interbank market and put a stop to negative expectations regarding system liquidity. From 2002 to 2007, main flow of primary money creation in the US was purchases of government securities with the share in FED’s balance sheet of over 80% (see Figure 1 and Table 1 in attachment). Figure 1: FED asset structure (2002-2010, in $ millions) Source: Federal Reserve, www.federalreserve.gov We can conclude that the policy of government securities purchases dramatically changed with the crises in the mortgage market which culminated in 2008. Up until that time, the FED mostly purchased medium and long run government bonds (50-51% of its assets), treasury bills (26-31% of its assets), while purchases of other securities remained low. In 2008 purchases of government bonds were drastically lowered to mere 18.04%, and in 2009 and 2010 its share doubled compared to 2008 (38.30% in 2010). On the other hand, in 2009, purchases of mortgage securities dramatically increased. These securities were not purchased 11 by the FED at all up until that time, but amounted to 39.91% in 2009. This clearly shows the FED to focus on the source of the problem – mortgage market, i.e. the real estate market which threatened to collapse entire financial market and real sector too. The FED realized that bailing out real estate market would be too complicated but turned to direct purchases of mortgage securities from their owners. The monetary policy in 2010 wanted to stabilize long run yield curve. In 2008 FED assumed the role of principle buyer of mortgage securities posing as a primary dealer, under condition of dropping prices, buys in order to reverse the trend, and stabilize prices in the market. The FED as a dealer with limitless liquidity was the only one able to do this and primary money emission was directed toward the mortgage market. It was never before seen selective credit policy of the FED. This was done decisively, quickly and in a large volume which was crucial for expectations of investors and other entities, both in the US and abroad. In other words, we can say without any doubt that the selective policy of the FED, not in a sense of credit approval, but in the way mortgage securities were purchased, the goal was reached. The model of selective policy was innovated but, more importantly, it was aimed at decontamination, stabilization and resurrection of the real estate market. During 2008 one more emission flow of M0 in the US was present and it related to swap operations of the FED and 14 other central banks. In 2007 these transactions amounted to $14 billion, i.e. 1.51% of its assets, and in 2008 the share grew to 24.33%. Such a strong growth of transactions by which the FED emitted $553 billion of primary money and exchanged it for other currencies in countries in a need of the dollar, aimed at stabilization of currencies of major countries. After 2008 this flow of primary money in the assets of the FED became insignificant and was down to zero. The other strong flow of creation of M0 in 2008 was through credit to banks by the FED (term auction credit) which represented innovated discounted credit amounting to 19.79% of the FED assets. We can conclude that foreign currency transactions in 2008 were the most significant flow of M0 creation in the US both in absolute and relative sense. 12 Figure 2: M0, M1 and monetary multiplier, rate of change (m=M1/M0)in the US (2001IX/2010, in %, year-to-year) Source: Federal Reserve, www.federalreserve.gov In Figure 2 we can see that the primary money emission during 2008 was extremely high. However, money stock growth did not follow which can be seen from the data on the monetary multiplier. 4. Peculiarities of primary money creation in the Eurozone In the discussion oo primary money emission under instability, the EU and the EMU have its peculiarities less known in the field or to the general public. These are best viewed through the ECB balance sheet and the Eurosystem balance sheet. The Eurosystem is made of the ECB and 17 national central banks which accepted the Euro. It is know that the flows of primary money creation are in the asset portion of the balance sheet. If we look at the ECB balance sheet only we cannot detect most significant flows of primary money creation in the Eurozone. In the assets of the ECB there is an entry “claims related to the allocation of Euro banknotes within the Eurosystem” which amounted to 50% of the ECB asset structure in 2009 (ECB Annual Report, 2009). This means that the assets of the ECB incorporate bills as a form of primary money. Primary money, i.e. currency in form of bills and coins is in the liabilities part of the Eurosystem balance sheet. If we look at the Eurosystem balance sheet we can see the total amount of currency which is in the assets of the ECB balance sheet and amounts to roughly 8% of currency in the Eurosystem, i.e. in 17 national central banks. Structure of 13 currency 8%: 92% in favor of national central banks, determined by the European Council in 2001. National central banks accordingly can create and cancel currency including the one in the ECB balance sheet. However, the ECB does not issue currency but 8% of currency emitted by national central banks is allocated in the ECB balance sheet which resembles the IMF system. Thus, the ECB balance sheet does not show the ways in which currency is created in its assets, i.e. we cannot see weather created money is allocated by central banks or is it its own creation of money. Currency in the ECB assets has a similar status to gold or foreign currency or reserve position with the IMF. The difference being that it is created “ex nihilo” and thus represents the demand toward 17 national central banks. Just this first pass reflects political economy of the primary money emission in the Eurozone telling us that the ECB phenomenon as a decentralized central bank, regardless of the prevailing understanding that the ECB is the only issuer of primary money. In this context, the ECB cannot be considered a lender of last resort in the classical sense. Acknowledgement of this statement can be found in the ECB balance sheet and the Eurosystem balance sheet. From the ECB balance sheet it can be seen that it creates primary money by purchasing gold and foreign currency and allocates a portion of currency to national central banks. If the ECB was a lender of last resort, the entry called credits to national central banks should be present on the asset side, and adequate liabilities to national central banks in the liabilities side of the balance sheet. There is no such entry so we can clearly conclude that the ECB in its operations does not operate as a monetary authority and a lender of last resort. In such a two layer system toward lender of last resort mechanism there is a flaw hidden in potential unwanted credit expansion and which national central banks could allow credit institutions, as a third pillar of the monetary system, conceived by the Delors plan (1988). This plan should have decommissioned the system based on the ECU and make strict competencies among the ECB, national central banks and credit institutions. Today the system is not fully operational which, due to lack of political foundations for the EMU in the form of a constitution for a single country, could not have been different than a mix of national monetary sovereignty headed by central banks. Division of decision powers at super national level was revived through the important role of the Governing Council of the ECB. 14 When analyzing the Greek central bank balance sheet we can see above described system. Greece succumbed under a heavy pressure of the crisis and explosion of its domestic public debt. In Greek central bank’s assets it is obvious that the main refinancing operations, as a main form of primary money creation, were modest in volume. When the financial and debt crises hit it was clear that the GCB acted as a lender of last resort for Greek banks. Furthermore, refinancing operations, as a main tool for liquidity management of the banking system, were enormous. The ECB assets do not yield any sign of this but it is visible in the balance sheet of the Eurosystem. One thing that may be distinguished is that the green light for such expansion was given to the GNB by the Governing Council of the ECB without any trace in the ECB balance sheet. Such decentralized system of operations of central banking in the Eurozone opens up the question of asymmetry of monetary policy operations. Keeping the key role of emission of primary money through credit to banks, i.e. refinancing operations leads to a conclusion that it is possible that a Eurozone member country may adjust monetary policy to a particular economy. This can be seen in the example of rates and structure of primary money emission in respective Eurosystem countries for the period 2007-2010 that follows. It is clear from the Euro system balance sheet that its assets contain evidence of main channels of primary money creation. These are credit to banks which, in the form of main and long term refinancing operations, by the end of 2009, consisted 40% of assets (ECB Annual Report, 2010). Refinancing operations are the key instrument for bank liquidity management which is in the hands of national banks. It should be pointed out that even though national central banks perform refinancing operations, the interest rate is set by the ECB. We can also speak of decentralization of the institute of a lender of last resort where unfavorable conditions may inflate moral hazard. Naturally, this is in order to say that at the top of the Eurosystem the ECB exists, and thus the decisions are made jointly, i.e. formally under the influence of the ECB. However, it is easy to point out that the Governing Council of the ECB is predominantly made of representatives of national central banks which in turn have dominant role. Such situation resembles the US in 1935 when 12 district banks were in operation, and seven members of the Board of Governors, where New York FED had the dominant role, even though there was no central monetary authority. The New York FED was the only one authorized for open market operations while other members could emit currency. However, 12 district banks, members of the FED, did not have its own balance sheets as today’s members of the Euro system, which makes a huge difference. Furthermore, we can 15 say that the ECB is the central bank of national central banks, but not a unique central bank with all attributes normally held in a national framework. Considering everything above, we could call the ECB main central bank of the Eurozone. Constant possibilities of depositing and taking out overnight loans from the ECB are also performed at the level of national central banks with the ECB setting the interest rate. If we could regard the ECB to be the main central bank of national central banks, it should truly be the main supplier and issuer of primary money for them, and thus serve as a lender of last resort, which clearly is not. However, it is puzzling that it is portrayed as such in the most significant documents of the EU, which may be confusing. In this context some authors consider national central banks as affiliates of the ECB and pose a question which is sovereign authority to which the ECB operations are subject to? “This new sovereignty would supposedly be a common conduction of its sovereignties delegated to it by national central banks. However, this constituted right legislator did not convey out of voting rights of European peoples. Relation of the ECB to democracy is, thus, not identical to relations situated with national central banks. There is no hierarchy of values at the European level in order for the ECB to be a subject to national sovereignty. While it commands monetary policy to whole of Europe, the ECB would have powers not included in democratic social system within a single territory. The problem is enormous because in this new organization sovereignties are added together but not articulated according to a hierarchical principle that should stand above it” (Aglietta, Orlean et. al., 2004: 48). Relating to the above statement there is the other possibility that the project of the Euro yields some kind of European political sovereignty. Without it the whole project is unsustainable. Other economists realize this fact and stress unsustainable voting practice within the Governing Council of the ECB. This is especially true if expansion process of the European economic and monetary union is to continue (De Grauwe, 2007). If we look at history of the FED we could say that the European economic and monetary union is not a single country with a single constitution, and thus simultaneous existence of the ECB and the Eurosystem is controversial. Is the ECB just a predecessor of a future single joint central bank in the Union or should it be an institution for performing e.g. open market operations, as the FED of New York did, within the new shared competencies of the Eurosystem? 16 5. Primary money creation in the EMU under instability Under unstable financial market conditions and subsequent recession, the ECB used different channels of primary money creation compared to the FED. Until July 8, 2007 changes in the ECB assets were minimal, and the size of assets remained mostly unchanged. When the financial crisis hit there was a dramatic change in the size of assets but it led to significant changes in structure too. Main refinancing operations before the financial crisis were the most significant channel of primary money creation and accounted for some one third of assets, only to fall to 3% in 2009. Its function were taken over by more long term refinancing operations which accumulate to 9% in 2005, but by 2009 the figure was up to 37% of assets. Significance of securities also grew, and the ECB lowered criteria for securities that served as collateral for credit approval. Securities amounted to 9% in 2005 but went up to 18% in 2009 of the ECB assets. The gravity of the financial crisis which came down on the EU and the EMU in mid 2007, resulted in unorthodox instruments and measures of monetary policy better known as “enhanced credit support” and “securities market program”. These policies were responsible for policy of primary money creation by the ECB. New, unorthodox measures of the ECB monetary policy aimed at the following: a) Introduction of so called “fixed rate full allotment” procedure of supply for all refinancing operations, where banks had unlimited access to liquidity with appropriate collateral and at the interest rate for major refinancing operations. This measure made possible for banks to solve short term illiquidity problem and prevented severance of ties in the credit market for companies and households. b) The list of acceptable securities as collateral for refinancing operations was considerably expanded. Even before the advent of the financial crisis, the ECB accepted as collateral private securities not only government ones. Besides, clientele base of the ECB expanded, thus e.g. fine tuning operations expanded from 140 to roughly 2000. In main refinancing operations the number of institutions expanded from 360 to 800 (ECB, 2010.). c) The ECB, after fully exploiting liquidity through main refinancing operations in May 2009, directed its policy toward long term refinancing operations with six months to one year maturities. Goal was to enhance liquidity of banks and stabilize the interest rate in the money market to a low level and avoid turbulences which reflected in the interest rate spread. More long term measure allowed banks to decrease the gap between assets and liabilities. 17 d) The ECB insured liquidity in the foreign exchange market by making arrangements with major central banks in the world. e) In May 2009, the ECB announced the covered bonds purchase program in the amount of 60 billion Euros in order to revive this segment of the financial market which almost died out. By the end of June 2010, the ECB purchased 422 different bonds using this program (CBPP – Covered Bonds Purchase Programme). Afore mentioned measures of the ECB, i.e. the Eurosystem, defined the reasons for creation of additional amount of primary money by carefully analyzing and choosing appropriate channels by which the set goals of primary emission would be acquired. In this sense it was important to change transmission mechanism of the ECB monetary policy. Outcome was actually favorable, and manifested in a drop of the interest rate in the money market and returns on the long term market whereby the most important goal was reached – stability of financial markets. Strong credit activities of the Eurosystem toward banks lead to diminishing role of the money market in that period. However, due to risk aversion, banks have redirected a significant portion of the primary money back to the Eurosystem using the deposit facility. Thus, a difference between the overnight interest rate (EONIA) and the deposit rate was lowered, a service rendered by the Eurosystem. Choice of primary money creation depends on structure of financing an economy. Nonfinancial institutions in the Euro zone realize some 70% of their needs for external financing through bank credit (Trichet, 2009). Quite a different situation exists in the US where companies issue securities and other non-banking instruments in order to facilitate external financing. This is the key for understanding why monetary policies were on opposite sides of the Atlantic so different. Therefore, the ECB focused on banks and shaped instruments of monetary policy targeting efficiency of transmission mechanism. The FED, on the other hand, chose securities as the most important primary money emission channel and transmission toward non-financial sector. The ECB thus shaped the anti crisis monetary policy better known as “enhanced credit support”. Trichet (2009) defined it as a collection of “the special and primarily bank-based measures that are being taken to enhance the flow of credit above and beyond what could be achieved through policy interest rate reductions alone.” The additional reasons for using different transmission mechanisms of monetary policies in the US and the Eurozone are best explained by Trichet (2009): “In the United States, for example, in normal times outright purchases and sales of treasury bonds with short maturities 18 belong to the routine toolkit of monetary policy implementation. Given that tradition, it may be a natural step, under non-standard circumstances, to adapt this procedure by significantly expanding the volume of purchases and focusing on governments bonds with longer maturities. The Eurosystem comes from a different tradition. For us, “reverse transactions” with banks – on the basis of repurchase agreements or collateralized loans – are the single most important – and in many respects exclusive – instrument in open market operations. Given that tradition, it has been a natural step to extend the maturity of our refinancing operations and make adjustments to the collateral requirements. In a limited empirical research which we conducted aiming to determine to what extent channels of primary money creation in three selected countries, Germany, Greece and Slovenia, correlate to channels of primary money creation in the Euro system (average). Germany was chosen as a strongest and largest economy in the EMU, Greece due to its public debt crisis, and Slovenia as a small stabile country.” Absolute values of assets of selected central banks for the period 2007-2010 show high correlation with movements of assets of the overall Eurosystem and the Bundesbank (88%). On the other hand, correlation coefficient for the Greek Central Bank and the Bank of Slovenia relative to the Eurosystem is considerably lower, 61.6% and 51.2% respectively. Differences in movements of individual sections of the monetary system speak in favor of different consequences of the crisis, i.e. asymmetric shock to real and financial sectors of selected countries. Sources of difference may be found in different power and structure of respective financial systems. According to third quarter of 2008 data, beginning of the crisis was marked with a change in strategy of national central banks within the Eurosystem framework, foremost in the context of growing role of long term financing operations. In September 2008 these operations amounted to 29.54% of total assets of the Bundesbank (figure 2 in the appendix), in order to increase by the end of the year to 32.89%, i.e. 201 billion Euro. As the time passed tensions and philological effects of the crisis shrunk, the Bundesbank redirected most of its activities toward main refinancing operations, while during 2009 and 2010 long term operations kept coming down. The example of Bank of Slovenia (figure 3 in the appendix) shows a similar practice regarding the open market operations, with a time lag. Beginning of the crisis for most transition economies started later, so significant rise in long term refinancing operations share 19 was felt by the end of 2009. At this time these operations amounted to 21% of assets, compared to 2008 when these were 2.87%. During the whole observed period the most significant entries of the Bank of Slovenia assets were „Securities of euro area residents denominated in euro“ and „Intra Eurosystem claims“, which cumulatively, during 2007-2010 period, accumulated to 60% of the Bank of Slovenia assets. Structure of the Greek Central Bank assets (figure 1 in the appendix) shows the problem of illiquidity of the system which still has not been solved. Unlike other central banks, portion of long term refinancing operations in practice of the Greek Central Bank is constantly on the rise, and reached 58% of assets by the end of 2010. The data indicates banking system illiquidity as a consequence of economic collapse and the debt crisis which escalated during 2010. Based on the analysis of channels of primary money emission for three selected countries of the Eurosystem, it is clear that the national central banks played a crucial role regarding the choice of channels, size of emissions and effectiveness of transmission mechanisms, approved by the ECB. Credit to banks, as a choice of transmission mechanism in the Eurosystem, for primary money creation proved to be a good solution for the Eurozone, especially during the financial crisis of 2007-2010. Each approved credit to credit institutions by the Eurosystem had specific collateral which had a definite connection to the real economy, thus a real coverage. By doing this, production of goods and services was soundly completed by creation of primary money. On the other hand, most of the primary money created by the FED was based on buying government bonds. Such emission of primary money found its coverage in present and future revenues of the US Treasury based on the premise of eternal public debt. In both cases expansion boundaries of primary money had to have a realistic foundation, i.e. collateral which would be canceled in the next phase. Unlike the FED, the Eurosystem could not accept the concept of government bonds as a foundation for primary money emission due to a fact that 17 different fiscal policies exist, so there is no firm guarantee for stability of such a model. The FED primarily created money “ex nihilo”, with a promise from the government, i.e. the US Treasury, to repay. In the Eurosystem money was created “ex nihilo”, but had a real foundation in securities mostly from the private sector, being collateral of the real economy. This is a foundation for “covered bonds.” 20 Unorthodox measures of monetary policy in the Eurozone fostered more efficient liquidity management of banks through the concept of unlimited access within central banks of the Eurozone with historically low fixed interest rate. In this context, refinancing operations played the most significant role with an emphasis on lower criteria for collateral quality. Roughly 2200 credit institutions had access to Eurosystem credits through refinancing policy which speaks of the width of platform for efficient approach to liquidity. Greater portion of private sector securities relative to government securities should be stressed. Total value of collateral amounted to roughly 130% of GDP of the Eurozone (ECB, 2010). The third major action made by the ECB was to extend payment period for borrowing by banks. However, it became clear that the banks became a critical point of the monetary transmission mechanism. This was due to a fact that banks, to a greater extent, did not forward liquidity to non-financial sector but rather made deposits with the central banks. “…the expansion of the monetary base associated with the implementation of non-standard measures does not lead to an equi-proportional (or indeed any) expansion in broad money. This both illustrates the weakness of the money multiplier model – which would see such an expansion of broad money as key – and points to a need for further work to understand better the behaviour of the banking system and its interaction with the real economy.” (Giannone, Lenza, Pill and Reichlin, 2010.) However, different circumstances rendered the monetary multiplier model almost unusable. In this sense, extending payment period for credits to banks by the central banks of the Eurozone provided a solution to this problem due to extension of the time horizon yielding greater security. Currency swaps were also important in some stages of the crises as a channel of primary money creation. The ECB made agreements with major central banks in the world, especially the FED on ensuring liquidity in respective currency as to preserve international liquidity. In 2009, the Eurosystem started to introduce so called “covered bonds” which were issued by banks which had parts of assets as a foundation. Covered bonds in Germany are being issued for roughly 200 years “Pfandbriefe”. This segment of the market almost died out until the Eurosystem started to accept them as collateral on a larger scale for refinancing operations. Unlike the FED practice which bought government securities backed by the US taxpayers, covered bonds are backed by assets of a bank, which is a significant difference when talking about coverage of the primary money emission. In the case of FED, debt emission is a base for primary money emission backed by the US Treasury and with future tax revenues, as already mentioned, closes the circle of creation and canceling of primary money. In the case 21 of Eurosystem, political economy of primary money emission was considerably different and was based dominantly on specific forms of existing assets, though with varying prices due to market volatility. 6. Selected transition countries’ central bank assets as an indicator of independence and state of economy By analyzing assets of central banks balance sheets of selected transition economies of South East Europe we can see a large portion of foreign assets within the total assets for all countries (see figure 3). Presented data leads to a conclusion that main sources of primary money creation in selected countries are foreign exchange transactions. Monetary systems of Bulgaria and Bosnia and Herzegovina have currency boards. Basic characteristic of a currency board are fixed exchange rate according to a currency anchor, absolute convertibility of a local currency into the anchor currency and vice versa, and minimal 100% coverage of central bank’s liabilities (primary money) with foreign assets. This means that the only channel of creation/sterilization of primary money is buying/selling foreign currency. Figure 3: Structure of central banks’ assets for selected transition economies (2007-2009, in % of total assets) Source: National central banks 22 The larger the share of foreign exchange transaction the larger the assets in the central bank’s balance sheet, thus automatically increasing the degree of euroization of domestic monetary system. This makes creation of local currency more complicated along with overall monetary policy management. Dominance of foreign exchange transactions as a flow of primary money creation leads to a currency board as a monetary system where domestic monetary system entirely depends on a chosen foreign monetary system. In this case, primary money emission of local currency is exogenously determined by the size of foreign exchange transactions, fixed exchange rate, central bank does not provide facility of last resort lender, monetary sovereignty does not exist, and exiting local currency has only a psychological value. Depending on the proportion of foreign exchange transactions in primary money creation we can speak of “currency board” and “quasi currency board”. The “currency board” is the official monetary system of Bosnia and Herzegovina where primary money emission is 100% covered with the foreign exchange. On the other hand, Croatian monetary system is declared as independent, but the Croatian National Bank since introduction of Kuna based creation of 95-99% primary money on foreign exchange transactions. We can speak here of de facto “quasi currency board” where denial of de iure declared monetary system exists. Therefore, main flows of primary money creation uncover the type of monetary and economic system. Under the conditions of a currency board the only instrument of monetary policy for achieving economic objectives is the reserve requirement. The Central Bank of Bosnia and Herzegovina and Bulgaria by lowering the reserve requirement rate, i.e. calculation base, tried to increase liquidity of banking industry credit activity threatened by the financial crisis of 2007. In Bosnia and Herzegovina the reserve requirement rate at the end of 2008 was lowered from 18% to 14%, with all new credits to banks from abroad excluded from reserve requirement obligation. From January 2009, differentiated reserve requirement rate was put in use – for funds up to one year maturity 14%, and for longer maturities 10%. In May 2009, the reserve requirement rate for maturities of up to one year was lowered to 5%, where government deposits for development programs were excluded from the reserve requirement obligation. (Centralna banka Bosne i Hercegovine, www.cbbh.ba) Bulgarian central bank in October 2008 lowered minimal liquidity reserve for all funds from 12% to 10%. Furthermore, minimal liquidity reserve on foreign sources was lowered from 10% to 5%, where funds from local and central governments were excluded entirely (Bulgarian National Bank, www.bnb.bg). 23 The Czech Republic, Hungary and Poland are the members of the EU and are getting ready to introduce the Euro. By analyzing structures of their central banks assets, we can observe high portion of foreign assets. It should be noted that portion of credits to banks has risen to 5% in the Czech Republic in 2008 (from almost 0% a year earlier, except 2005). According to the data above on assets of selected central banks of transition economies in South East Europe which did not introduce the Euro, we can conclude that foreign exchange operations represent the key flow of primary money creation. The question emerges here: did the countries select mentioned flow or was this an outcome of objective circumstances? All mentioned countries are highly or moderately euroized, and the flow of FDI in recent time was significant. Besides, their banking systems are mostly in foreign ownership, i.e. owners are large banks from the EU. This fact should be especially stressed because it represents a significant flow of capital in Euros which increases credit potential of banks in SEE economies. However, by doing so the euroization spreads further, thus the appreciation pressures on local currencies. Figure 4: Monetary multiplier in selected transition countries (m=M1/M0, 2000-IX/2010) Source: National central banks We can observe the Czech Republic, Poland and Hungary to have significantly higher monetary multipliers than the rest of the countries even before the financial crisis, which developed in all observed countries during 2008 and 2009 (see figure 4). 24 Countries with foreign exchange as a main flow of primary money creation have so called monetary system surplus. This means that a precondition for creating local money is prior existence of foreign exchange. As mentioned earlier, this form of primary money emission is typical for a currency board as a form of dependent monetary system, where a central bank does not use its monetary sovereignty and currency, i.e. does not create links between a real economy and local money creation. Dominant foreign exchange transactions as a flow of money creation lead to complications for conducting monetary policy. In such conditions monetary policy is conducted through secondary currency and it is tied to monetary policy of a country which currency dominates in the structure of foreign exchange reserves. This dependence is more pronounced if a banking system is predominantly owned by foreign banks. Parent banks supply credit to its subsidiaries in transition countries and thus directly support euroization of these countries. Furthermore, channel of foreign exchange transactions in primary money creation is further exaggerated. Analyzed transition countries have thus formal monetary sovereignty, but de facto it is a case of pronounced dependence on European Monetary System. In analyzed transition countries, so called mono channel of primary money emission realized trough foreign exchange transactions is at work. In the case of Croatia, this is especially pronounced and it exhibits increased rigidity compared to classical currency board monetary system. As such, it carries seeds of recession which surface as soon as the real recession spreads in the EU and the region. Since Croatian National Bank did not change primary money emission channel, nor increase it, it had a pro recession effect, i.e. pro cyclical. Size of primary money increased due to a different reason. The reason lays in non-banking sector repaying previously approved loans which were thus withdrawn, and funds immobilized in central bank accounts. This can be seen in the example of the monetary multiplier which was lower than one, thus becoming monetary reducer. We can say that the monetary transmission mechanism of monetary policy operated, however, in the opposite direction, because the central bank did not react as a lender of last resort for banks which is visible through primary money emission channel. According to this fact, banks further increased risk aversion and laid path to growing illiquidity in the real economy. However, the ECB, as a model for the Croatian National Bank, temporarily disregarded price stability and turned to economic growth using heavily a pro cyclical monetary policy. Assets of a central bank’s balance sheet, as argued earlier, indicate the type of an economy and degree of dependence or sovereignty. If a country wishes to increase the degree of its 25 monetary sovereignty and make better connections between a real economy and primary money creation, it has to significantly change the structure of assets in a central bank’s balance sheet giving more space to local currency. In the case of Croatia where recession is present since 2008 and is present today, it is clear that the economy is in a state of self blockade. High money immobilization by the Croatian National Bank which is 30% of created primary money for years makes its way through various instruments of monetary policy. Consequences of such actions are high illiquidity of the economy, high interest rates and restrictive fiscal policy which cannot yield different results rather than prolong bottom of the recession. The public debt crisis in the EMU, problems in the banking industry etc., create necessity for greater use of a local currency in a monetary system of a transition country. Otherwise existing mono channel of primary money creation would manifest as a special form of the gold standard, i.e. the currency board with pro recession seeds. The example of primary money creation in China is very interesting one. In this case the model is more inherent to small transition and dependent countries described earlier, rather than second largest economy in the world. Increase of foreign exchange reserves from $125 billion in 2000 to $2.8 trillion by the end of 2010 will have significant and complicated consequences both on China and rest of the world. Chinese foreign exchange reserves resulted from growing surplus of the trade balance and strong inflow of investment. By creating deficits with countries that account for majority of its imports, the US by using position of the dollar as the most important currency in the world, in essence creates dependence of these monetary systems to the dollar. In the previous period China could not have done otherwise since it did not achieve necessary level of development and could not do without foreign currency, and for the fact that Yuan is not a world currency. The Chinese Central Bank in 2000 created 54% of its primary money by buying foreign currency, and in 2010 this channel made 80% of its assets. If we compare China to Japan, we can conclude that the Japanese Central Bank some 60% of its primary money creation bases on purchasing securities, roughly 30% by credits to banks, while foreign exchange transactions make 8% of total assets in 2010. This is an important example for China because Japan is second largest owner, after China, of foreign currency reserves in the world. Primary money creation phenomena based on the US dollar in the form of dollar reserves in China is one of the largest phenomena in modern international finances. After China eventually turns to internal markets primary money creation channels will have to change. 26 On the other hand, China, i.e. its central bank, will have to work on expanding use of Yuan in international transactions. Such a new Chinese monetary doctrine could significantly jeopardize present domination of the dollar and put China in the position where it would be able to create domestic currency “ex nihilo” for its development goals. Furthermore, such developments would go toward greater foreign investment and imports, i.e. the model that only the US could use in the world triangle of willingness to accept its monetary coercion. If that happens, world monetary system would be thoroughly shaken along with the constellation of overall economic and political relations. 7. Conclusion Primary money creation flows, as we have seen, speak a lot of economies of respective countries and the degree of monetary sovereignty. During the time of instability triggered in 2007 by the crises of the mortgage market in the US, spread quickly to the EU and other parts of the world. Furthermore, primary money creation flows, to be more exact, importance of respective flows, changed dramatically. In the examples of the FED and the ECB we have seen the historic dimension of respective channels of primary money creation which led to new questions of relations among money creation, real economy and physiological effect on market stability. Both mentioned central banks have used its monetary sovereignties to the limit using the fixed interest rate with readiness to infinitely supply liquidity. Size of the emission was not set in advance, thus did not exhibit endogenous characteristics. We could say that endogenous factor dominated primary money creation due to above mentioned central banks gauging its operations according to the state of the real economy, demands by banks and other financial institutions, in some cases even non-financial ones. In the example of the FED and the ECB, or better say Eurosystem, we could observe high flexibility in combining respective primary money emission channels, techniques of fine tuning and facilitating unobstructed flow of monetary policy transmission mechanism. We could generally say that the primary money creation mechanism was crucial source of faster recovery from the recession and higher growth rates. That was the key trigger used on time and aimed at counter cyclical effects. It was based on well known fact that for stopping recession crucial thing is the speed of actions which was only possible, within framework of economic policy, through monetary policy. 27 Within the Eurosystem, which actual emitted primary money in a decentralized way, even though the decisions were made on a super national level through the Governing Council of the ECB, it is interesting to point out that the channels of primary money creation were different among member countries. In financial crisis condition the EMU showed to be useful since it is a monetary system which is completely defined with a fact that it is not a single country. Primary money creation channels in this case were adjusted to specific countries in the Eurosystem and to its monetary policy transmission mechanisms. Even though the ECB is not a lender of last resort, joint decisions by the Governing Council were respected and decentralized system of primary money creation worked. However, a question remains: will this always be so and what would have happened in the case of individual monetary actions within the system? Selected transition countries even in the financial crisis kept its asset structures of national banks unchanged. This means that they failed to use their monetary sovereignty or creation of local currency in order to stop recession and through monetary factors start a counter cyclical economic policy. Money creation remained exogenously given by the volume of foreign exchange in assets of the national banks balance sheets. In the absence of monetary intervention their economies remained in a prolonged state of recession with an unknown time of recovery. In other words, they put their recovery in hands of the EU countries and the EMU because they tied their currencies of primary money creation to the Euro. This lead to the conclusion of a deeply dependent monetary system on periphery of the Eurosystem with all the negative consequences that stem out of failing to use monetary sovereignty. Historic size of primary money creation during the last financial crisis in the US and the EU points to notion of efficiency of monetary policy in the short run and its advantages compared to fiscal policy in speed of reaction and favorable effect on the interest rate. Primary money creation flows used in the crisis show the best ways to achieve favorable effects of monetary policy to the real economy through transmission mechanism tailored for respective economies 28 LITERATURE: 1. Aglietta M, Orlean A; Novac i suverenitet, Golden marketing-Tehnička knjiga, Zagreb 2004. 2. Bernanke, S.B.: Essays on the great Depression, Princeton University Press, New Jersey, 2004 3. Bernanke, S.B.: Federal Reserve Policies to Ease Credit and Their Implications for the Fed's Balance Sheet, At the National Press Club Luncheon, National Press Club, Washington, D.C., February 18, 2009 4. Bernanke, S.B.: The Federal Reserve's Balance Sheet, At the Federal Reserve Bank of Richmond 2009 Credit Markets Symposium, Charlotte, North Carolina, April 3, 2009 5. Bernanke, S.B.: Federal Reserve programs to strengthen credit markets and the economy, Before the Committee on Financial Services, U.S. House of Representatives, Washington, D.C., February 10, 2009 6. De Grauwe, P.: Economics of Monetary Union, Oxford University Press, Oxford, 2007 7. ECB Bulletin: The ECB s Response to the Financial Crisis, October 2010 8. Giannone, D., Lenza, M., Pill, H. i Reichlin, L.: Non-standard monetary policy measures and monetary developments, ECB, 2010 9. Trichet, J.-C.: Current challenges for the euro area, Speech by Jean-Claude Trichet, President of the ECB, “Lunchtime discussions” with the Spanish business community, Madrid, 27 October 2008 10. Trichet, J.-C.: Lessons from the financial crisis, Keynote address by Jean-Claude Trichet, President of the ECB, at the “Wirtschaftstag 2009” organised by the Volksbanken and Raiffeisenbanken, Frankfurt am Main, 15 October 2009 11. Trichet, J.-C.: The ECB’s enhanced credit support, Keynote address by Jean-Claude Trichet, President of the ECB, at the University of Munich, Munich, 13 July 2009 12. Web sites of national central banks 29 APPENDIX: Figure 1: Greek National Bank asset structure (in billion Euros, IX/2008-XI.2010) Source: Bank of Greece, www.bankofgreece.gr Figure 2: Bundesbank asset structure (in billion Euros, IX/2008-XI.2010) Source: Deutsche Bundesbank, www.bundesbank.de 30 Figure 3: Bank of Slovenia asset structure (in billion Euros, IX/2008-XI.2010) Source: Bank of Slovenia, www.bsi.si 31 Table 1: FED asset structure (ond of period, absolute amounts – in million US$, and as percentage of total assets) Assets (in mil.dollars) 12/2002 % 12/2005 % 12/2007 % 12/2008 % 12/2009 % 12/2010 % 1. Reserve Bank credit 708.457 93,67 830.165 94,34 876.551 94,41 2.223.537 97,72 2.216.732 97,41 2.403.419 97,57 1.1. Securities Held Outright 629.416 83,22 744.210 84,57 754.612 81,27 495.629 21,78 1.844.722 81,06 2.155.703 87,52 1.1.1. U.S. Treasury securities 629.406 83,22 744.210 84,57 754.612 81,27 475.921 20,92 776.587 34,13 1.016.102 41,25 1.1.1.1. Bills 226.682 29,97 271.270 30,83 241.856 26,05 18.423 0,81 18.423 0,81 18.423 0,75 1.1.1.2. Notes and bonds, nominal 389.219 51,46 449.595 51,09 470.984 50,73 410.491 18,04 707.649 31,10 943.377 38,30 1.1.1.3. Notes and bonds, inflation-indexed 12.242 1,62 19.983 2,27 36.911 3,98 41.071 1,80 44.643 1,96 48.125 1,95 1.1.1.4. Inflation compensation 1.263 0,17 3.362 0,38 4.862 0,52 5.936 0,26 5.873 0,26 6.178 0,25 1.1.2. Federal agency debt securities 10 0,00 0 0,00 0 0,00 19.708 0,87 159.879 7,03 147.460 5,99 1.1.3. Mortgage-backed securities 0 0,00 0 0,00 0 0,00 0 0,00 908.257 39,91 992.141 40,28 1.2. Other: Repurchase agreements 39.500 5,22 45.250 5,14 42.500 4,58 80.000 3,52 0 0,00 0 0,00 1.3. Term auction credit 0 0,00 0 0,00 20.000 2,15 450.219 19,79 75.918 3,34 0 0,00 1.4. Other loans 40 0,01 114 0,01 4.535 0,49 193.874 8,52 89.699 3,94 45.084 1,83 1.4.1. Primary credit 0 0,00 41 0,00 4.513 0,49 93.769 4,12 19.111 0,84 58 0,00 1.4.2. Secondary credit 0 0,00 0 0,00 0 0,00 15 0,00 980 0,04 17 0,00 1.4.3. Seasonal credit 31 0,00 73 0,01 22 0,00 7 0,00 44 0,00 23 0,00 1.4.4. Credit extended to American International Group, Inc., Net 0 0,00 0 0,00 0 0,00 38.914 1,71 22.033 0,97 20.282 0,82 1.4.5. Term Asset-Backed Securities Loan Facility 0 0,00 0 0,00 0 0,00 0 0,00 47.532 2,09 24.704 1,00 1.4.6. 0 0,00 0 0,00 0 0,00 37.404 1,64 0 0,00 0 0,00 1.4.7. Primary dealer and other broker-dealer credit Asset-backed commercial paper money market mutual fund liquidity facility 0 0,00 0 0,00 0 0,00 23.765 1,04 0 0,00 0 0,00 1.4.8. Other credit extensions 0 0,00 0 0,00 0 0,00 0 0,00 0 0,00 0 0,00 1.5. Net portfolio holdings of Commercial Paper Funding Facility LLC 0 0,00 0 0,00 0 0,00 334.102 14,68 14.072 0,62 NA NA 1.6. Net portfolio holdings of Maiden Lane LLC 0 0,00 0 0,00 0 0,00 27.023 1,19 26.667 1,17 26.974 1,10 1.7. Net portfolio holdings of Maiden Lane II LLC 0 0,00 0 0,00 0 0,00 20.117 0,88 15.697 0,69 16.197 0,66 1.8. 0 0,00 0 0,00 0 0,00 26.785 1,18 22.660 1,00 23.142 0,94 0 0,00 0 0,00 0 0,00 0 0,00 298 0,01 665 0,03 1.10. Net portfolio holdings of Maiden Lane III LLC Net Portfolio Holdings of TALF LLC: Net portfolio holdings of TALF LLC Preferred Interests: Preferred interests in AIA Aurora LLC and ALICO Holdings LLC 1.11. Float 1.12. Central bank liquidity swaps 1.13. Other Federal Reserve 2. Gold stock 3. Special drawing rights certificate account 4. Treasury currency outstanding 1.9. Total factors supplying reserve funds 0 0,00 0 0,00 0 0,00 0 0,00 25.000 1,10 26.057 1,06 812 0,11 1.047 0,12 -347 -0,04 -1.494 -0,07 -1.956 -0,09 -1.624 -0,07 0 0,00 0 0,00 14.000 1,51 553.728 24,33 10.272 0,45 75 0,00 38.689 5,12 39.544 4,49 41.251 4,44 43.553 1,91 93.683 4,12 111.147 4,51 11.043 1,46 11.041 1,25 11.041 1,19 11.041 0,49 11.041 0,49 11.041 0,45 2.200 0,29 2.200 0,25 2.200 0,24 2.200 0,10 5.200 0,23 5.200 0,21 34.597 4,57 36.540 4,15 38.682 4,17 38.674 1,70 42.690 1,88 43.549 756.297 100,00 879.946 100,00 928.473 100,00 2.275.452 100,00 2.275.664 100,00 2.463.209 1,77 100,00 Source: Federal Reserve, www.federalreserve.gov 32 33