* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download From Structuralism to the New Institutional Economics

Economic democracy wikipedia , lookup

Business cycle wikipedia , lookup

Ragnar Nurkse's balanced growth theory wikipedia , lookup

Economics of fascism wikipedia , lookup

Economic growth wikipedia , lookup

Transformation in economics wikipedia , lookup

Uneven and combined development wikipedia , lookup

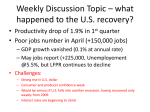

From Structuralism to the New Institutional Economics By Ryan Forslund The political Economy of Latin American Development Albert O. Hirschman LES TRENT GLORIEUSES Debt crisis of 1982 lead to fall in raw material prices, reduction in imports, public expenditures, and private investments There has been uneven growth in the region since the crisis There was growth before this yet it was not acknowledged. This shows the trend to recognize the good only in a time of recession so it can be contrasted. One reason is the fact that much of the good went hand in hand with the bad: social tension, poverty from urbanization, urban and rural divide, so on From 1945-1980 serious improvements were made in Latin America Increase in population, GDP, higher life expectancy, better health care, education, lower infant mortality, smaller families, better sex ed Important to note with the growth in population the living standards did increase, and more educated on how to control population growth Can be seen that improvements in all these areas have even taken place in the poorest regions The improvement is largely due to education, even in times of downturn or recession the lessons they have learned have not been forgotten: despite developmental fluctuations the social advances will remain There are things to fear however: oil prices, debt in the region, and so on People in Latin America feel they must stop looking in the past for answers and try to find something completely new Industrialization and deindustrialization in Argentina and Chile Divide between the countries of the Rio de la Plata and the tropical countries Raul Prebisch said all of Latin America must join together in coming out of the role of supplier of raw material to the world economy: to do so must industrialize Yet the tropical, previously poorer countries, have now surpassed the growth of the others (Brazil and Mexico) These countries were more populous and focused in on the domestic market due to the ISI system: the share of national income on the continent by Brazil and Mexico was at 61.3% in 1981 Two criticisms made by those that did not develop: industrialization catered to higher classes and “inward-oriented” causing misallocation of resources, balance-of-payments problems, and rent-seeking Failed to see problems with ISI as ‘growing pain’ that could be fixed by incremental policy making There were instances were the growing pain theory was applied and ISI shifted somewhat to substantial exports of manufactured goods due to policy Yet military regimes would have a profound effect on economies Had no problem eliminating hundreds of industries causing massive unemployment, even though some industries were corrupt Monetarist policies enacted in Argentina and Chile: overvaluation of domestic currency and high domestic interest rates This lead to many large companies to borrow foreign money at a much lower rate yet when exchange rate ultimately devalued interest rates shot up cause the loans to be to great to handle Government had to step in: originally said economic mission was to make economy more privatized yet ended up controlling central bank and many private industries Desubstitution of Imports and a Curious Convergence in Mexico The Mexican oil boom and the aftermath Relatively steady growth in Mexico until oil was found By 1975 it became major producer and exporter of oil PEMEX brought in ¼ of the countries total revenue There was a large increase in the demand for imports to match their exports and this would lead to the eventual downturn Though it did not deindustrialize it did go through something called ‘import desubstitution’ Imports soared and domestic prices rose and government refused to do anything to slow the flow of imports: this lead to the debt crisis Mexico thought this oil boom could help development yet they did not keep the imports and capital flight under control “Forced-March Industrialization” in Brazil As stated earlier Brazil was one of the continents economic powers: despite having no oil and depending on its import, this was blessing is disguise Despite having largest debt (1 of every 3 $ from exports goes to debt) Yet have been growing due to expansion of exports and cuts in imports, reviving domestic economic activity This has been possible because of brand new changes being made and importantly military to civilian rule (Geisel Administration did however enact helpful developmental plans) Despite oil shock in 1973 Brazil handled it different then others: instead of restrictive economic policies they moved investments away form cars, focus on final stage of ISI: capital goods (chemical and metallurgical industries) O’Donnell says final stage of ISI makes it difficult for democratic government in Latin America this is why successes only acknowledged after the military regime was gone From Import-Substitution to Import-Preemption A country is considered to be economically maturing when they undermine the ISI system, whether it de intentional or not They can do this intentionally by choosing an industry and enacting policy to ensure their domestic market produces it better then the imports This is known as ‘import-preempting industrialization Brazil used this idea with regard to the info-tech industry, minicomputers: using Reserva de Mercado the spur their domestic market to start producing in a certain amount of time Conditions for this to work in Brazil: strong potential domestic market, helps national defense, pick an important industry Again a certain amount of time is given to the domestic company foe it to ‘grow up’ It must have a strong balance between using previous knowledge on producing the product as well as a reinvent spirit to make it their own Must be easily profitably even captured by LCDs cheaper labor The “Heterodox Shock” Therapy This was to bring down inflation in Argentina and Brazil (Plan Austral and Plan Cruzado) Each country had three digit inflation for years and were running very close to hyperinflation They needed to find a way to try and make inflation tolerable Structuralists saw ‘fundamental’ inflationary pressures from domestic social structures (land tenure) and the ‘propagation’ phenomena (wage-price spiral) All other options were unappealing to solving the problem and conceived the formula know as the ‘heterodox shock’ 1st the old currency is replaced with a new one, 2nd prices and wages are temporarily frozen, 3rd indexation of wages, salaries, and monetary instruments abolished, 4th government cuts its borrowing from the central bank, 5th prereform contracts involving future payments are assumed to have made provisions for future inflation This also tried to end the tug-of-war between the social groups for income shares Eventually this failed but must be noted why: this was during new democratic governemnts that had to deal with what the military left behind and hyperinflation would have be devasting to these new governments and a cycle back to military regimes could take place This however did not happen because the people were happy to be ride of the military regime and despite its failure they were willing to try Conclusion One of the main problems between North and South America was the lack of communication, especially with regard to the huge debt between the two Latin America is seen by most as a region of borrowers, despite the economic notion that deals involving multiple parties are made for mutual benefit As noted some countries were able to face the many hardships better then others (Brazil and Colombia) From Structuralism to the New Institutional Economics Jonathan C. Brown Structuralism arose out of the depression and its antithesis came out of the failure of this: the wreckage of ISI thought to bring about hyperinflation, debt, social unrest, rebellions, and ultimately military regimes This discredited structuralism and brought on neoclassical economics Structuralists argue there must be state lead development and states ownership of means of production Institutionalists look for the promoters of growth in the institutional arrangements: the ‘rules of the game’ Structures, Endowments, and Institutions in the Economic History of Latin America John H. Coatsworth Despite some growth after the WW2 ear, many are now worried yet again about the long run in the region, specifically structures, endowments, and institutions on growth With looking for ways to estimate long term effects of growth they have been able better look at historical trends, potentially answering old questions and posing new ones Latin America’s development and growth can be looked at from pre-colonial to colonial times, up to independence It is now accepted while under Spanish or Portuguese control the region had per capita rates at least equal to those of western Europe Following the independence movements starting in 1810 very little growth occurred Following 1870 the big eight economies had a larger growth rate then many advanced countries With the move to ISI yet another downturn was faced, inward-oriented growth strategies have not proven to work well at all, despite ISIs failure no alternative has been found As with the economic peaks and valleys living standards too rose and fell: stagnation till the late 19th century when there has been slow but steady increases since A notable difference between Latin Americas growth and the west is living standards and economic growth rose together in L.A. and in the west living standards came much later after development Two post WW2 trends for inequality were: state-led ISI which increased wage inequality (protecting certain industries and higher wages for state employees) and cold war politics promoting elites to be friendly to the US Two affects from inequality: slowed improvements in living standards and it kept poverty rates exceptionally high Three important things have been learned about the structuralists and the cepalinos (worked for CEPAL, the UN Economic Commission for Latin America) 1st the created ambitious programs of economic research and data collection, 2nd the indorsed the ISI based on high tariff protection as dominate economic policy strategy, 3rd the US pressured the adoption of ISI for many LDCs Structuralists and dependency school writers saw institutions as the key to economic success of failure (one example give by Love is the concentration of land ownership) Economic growth needed to be carefully regulated by a powerful state (thought was aggressive state could manipulate external trade and capital flow in order to promote domestic industry They did have two good assumptions: 1st the less-developed world could not follow the path taken by the developed world, 2nd external dependence exacerbates economic inequality Brazil and Argentina did however show that some countries did need state-led management strategies After the failure of ISI much of Latin America Started opening up to more external trade and investments but it is important to note that economic reform is not enough by itself to ensure growth Institutions play a role and have two parts, politics and path dependence Engerman and Sokoloff say endowments lead to concentration of wealth (land ownership) elite power Yet many refute this, elites did not monopolize land ownership, while those in Europe did, they were ‘colonial’ and didn’t have much power While this trend did eventually happen, it was long after the colonial period and for different reasons: what they say hampered growth actually helped it because elites need to bring in capital and growth was its by product “Crony Capitalism” aka ‘vertical political integration’ (VPI) This was seen in Mexico after 50 years of hardship and was the best way for them to have some growth (protection for elites in politics, bankers, industrialists and foreign companies ) Some VPI government were aggressive but also they were considered ‘farsighted’ at times and they were even able to take on populists tones for temporary periods of time Conclusion It was found that the institutional deficiencies that hampered growth and development are not in the factor endowments but the political economy of conquest and enslavement Thanks to a export-led globalization there has been the opportunity for L.A. to shift away from their past institutions and try to find new paths Scholars in L.A. must look at development with a skeptical eye yet they must also be open to experimentation in order to bring a new better system to the region The Origins of Structuralism H.W. Arndt Main points: world as inflexible, many obstacles to change, little adaptation, resources being stuck, applied to LDCs: they look to manage change by administrative action The Doctrine of Market Failure: capitalism unjust, unstable, and prone to collapse Structuralist Theory of Inflation: Basic Inflationary Pressures (structural limitations, rigidity or inflexibility of the economic system) lack of movement of resources hence cannot adapt to rapid demand All this leads to rigid market structures, monopolies, immobile labor and capital, and inequalities in returns to labor and capital Government Failures in Development Anne Krueger The role of government is to provide infrastructure to facilitate economic development, should also be able to compensate for market failure Huge governmental failures lead to high cost public sector enterprises and on the other hand failure of transportation and communication facilities: this lead to large scale corruption What is the government? In LDCs was thought that government intervention was needed, this lead to protection of monopolies It is hard to find a government that is selfless, yet this is what is need to enact positive change Government activities should be done on a large scale, protection of laws, provision of information, and provision of public services It must be noted that actions taken by government are not costless, second is that large administrative action must be put into these actions, low-rent seeking policies must be adopted, and what is done must be transparent Import Substitution Industrialization Cardoso and Helwege Primary commodity markets are unstable Latin American terms of trade: dollar price of exports over dollar price of imports: this shows a deteriorating terms of trade L.A. can export goods that are natural resources and labor steps must be taken to shift countries in L.A. from capital poor to rich The goal of ISI was to promote new industries but this had problems: protection lead to overvalued exchange rates, exaggerated industrial growth, as taxes on exports failed to grow inflation occurred Criticisms of ISI: uneven protection, overcapacity, agriculture, budget deficits, interest rates, labor, foreign direct investment After it failed there were improvements within the countries, living stands especially yet economic growth was lacking After ISI how well a country would pull through was in large part due to how successful they were in the export markets Discussion 1. What do you think of the idea that the good accomplishments are only acknowledged in times of hardships? Do you believe this? 2. What do you think of Structuralism? Do you think it was a bad idea to adopt from the start or did any good come out of it? 3. If other countries handled the oil shock in the way Brazil did do you think they would have been better off ?