* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download L20 AggregateSupplyW..

Non-monetary economy wikipedia , lookup

Nominal rigidity wikipedia , lookup

Ragnar Nurkse's balanced growth theory wikipedia , lookup

Monetary policy wikipedia , lookup

Money supply wikipedia , lookup

Phillips curve wikipedia , lookup

Fei–Ranis model of economic growth wikipedia , lookup

Full employment wikipedia , lookup

Lecture 20: Aggregate Supply -Price level P, Inflation π, & Wages W

Aggregate Demand (AD)

& Aggregate Supply (AS)

1.

2.

3.

4.

5.

6.

Ultra-Keynesian A.S. case

Neoclassical A.S. case

Intermediate A.S. curve

Expectations-augmented A.S. curve

Rational-expectations A.S.

Real Business Cycle models (RBC)

Appendices -- 7. Labor market rigidities.

Aggregate Demand curve slopes down.

Why?

p

Say P ↑ (e.g., because W↑)

=> M1 / P ↓ (“real balance effect”)

=> LM shifts left

=> Y ↓

AD

y

ITF220 - Prof.J.Frankel

A monetary expansion shifts AD to the right.

By how much?

By the answer to IS-LM.

Or it shifts AD up.

p

By how ●

much?

{

In proportion to Δ M1.

Equilibrium outcome

(Y vs. P) depends on AS.

●

●

●

AD′

AD

y

ITF220 - Prof.J.Frankel

The notion of Aggregate Supply

• If demand rises too rapidly, it shows up

in the price level, not output.

• In practice, the path of potential output 𝒀

is often measured by the point beyond which

inflation begins to accelerate;

• and the natural rate of unemployment ū

is measured as the rate below which

inflation begins to accelerate.

ITF220 - Prof.J.Frankel

US output fell sharply below potential in 2008-09.

𝒀

𝒀

Brad deLong, Jan. 2014

http://delong.typepad.com/delong_long_form/2014/01/the-relative-efficacy-of-fiscal-and-monetary-policy-at-the-zero-lower-bound-where-are-the-goalposts-anyway-the-honest-bro.html

Inflation fell in the 2008-09 global recession.

WORLD ECONOMIC OUTLOOK (WEO)

Uneven Growth: Short- and Long-Term Factors

April 2015

IMF

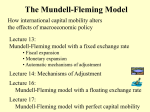

ALTERNATIVE SUPPLY RELATIONSHIPS

All-purpose supply function: 𝑌/𝑌 = (ω 𝑃/𝑊)σ

where:

𝑌 ≡ potential output

W ≡ nominal wage

W/P ≡ real wage

ω ≡ “warranted real wage”

σ ≡ elasticity of aggregate supply .

Can readily be derived from aggregation of supply decisions

by individual firms that maximize profits and

operate in competitive goods & labor markets.

Then ω ≡ MP of Labor at full employment.

(See graphs in Appendix I.)

ITF220 - Prof.J.Frankel

Two polar extreme cases

1) Ultra-Keynesian case:

AS flat, at 𝑃

=> AD expansion goes entirely into Y.

AD'

p

AS

Realistic in Very Short Run.

y

2) Classical case

AS vertical at 𝑌

=> AD expansion goes entirely into P.

AS

p

Realistic in Long Run.

Only AS shocks move Y ,

e.g., productivity shocks.

API-120 - Prof. J. Frankel, Harvard University

AD'

𝑦

y

AGGREGATE SUPPLY (continued)

● 3) Intermediate case:

W = 𝑊 => AS has some slope, even in the SR.

SR supply relationship:

𝑌

𝑌

=

ω𝑃

σ

𝑊

AS

p

●

AD'

y

Implication:

Demand expansion goes partly into P, partly into Y.

Monetary expansion raises AD in the SR.

A rise in the current level of M shifts LM curve out,

because M/P , in the SR.

Alternatively, a rise in expected future growth rate of M shifts IS out,

because e

AS long run

=> r

=> A .

Either way,

IS-LM shifts right

=> AD shifts right:

p

AS short run

●

pe

AD expanded

Result is higher Y

and higher P.

AD initial

y

ITF220 - Prof.J.Frankel

AGGREGATE SUPPLY (continued)

SR supply relationship:

𝑌

𝑌

=

ω𝑃

σ

𝑊

● 4) Friedman-Phelps supply curve:

W is set in line with Pe,

which adjusts over time.

Yearly wage contract 𝑊 = ω 𝑃𝑒.

𝑌

or in logs,

𝑌

=

𝑃

𝑃𝑒

σ

Milton Friedman

y - 𝑦 = σ (π − π𝑒 )

where π ≡ p – p-1

and πe ≡ pe – p-1 .

But over time πe adjusts to actual π, so Y = 𝑌. In LR, AS is vertical.

SR: Point B in Figure 26.4.

MR: Point C.

LR: Point D.

26.4

●

●●

●

Initially –

Point A.

Then monetary

expansion.

SR -- Point B:

before W has had

time to adjust.

MR -- Point C: Pe adjusts

partway => W does too.

LR -- Point D:

Pe, and so W, have

fully adjusted.

ITF220 - Prof.J.Frankel

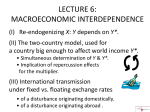

OVERVIEW OF AGGREGATE SUPPLY (continued)

● 5) Lucas supply relationship

𝑌

or in logs,

𝑌

=

𝑃

𝑃𝑒

σ

y - 𝑦 = σ (π − π𝑒 )

Robert Lucas

= σ ε,

where ε is the forecast error.

Rational expectations => ε is unforecastable.

Implications: An unpredictable demand expansion

goes partly into P, party into Y in the short run;

but predictable demand expansions have no effect on Y.

Committing monetary policy to a nominal anchor

would reduce inflation at little cost in terms of output.

If monetary policy cannot have a systematic effect on output anyway,

the central bank might as well give up, and attain the only goal it can:

price stability.

But only if it“ties its hands”

will its commitment not to inflate be credible.

Odysseus

tied to

the mast

Alternative Nominal Anchors

Money supply targets

(e.g., monetarism in 1980s.)

Pegged price of gold

(e.g., classical gold standard)

Price level target

(e.g., Inflation Targeting)

Fixed exchange rate

(e.g., currency board)

ITF220 - Prof.J.Frankel

6. Real business cycle (RBC) theory

• Y= Y

• N= N .

• According to this theory,

all fluctuations are due to real (supply)

factors:

– technology shocks &

– shifts in preferences for work vs. leisure.

– Not monetary policy.

ITF220 - Prof.J.Frankel

Appendix I:

Derivation of general AS relationship

Appendix II: Another AS relationship

• 7. Indexed wages

– Application: real wage rigidity in Europe, vs. US.

Appendix III: Measures of output gap

Appendix IV:

An example of rational expectations

ITF220 - Prof.J.Frankel

Appendix I

If a firm’s Marginal Product of Labor

> W/P => hire more N.

If M P of Labor

< W/P => cut N.

●

Employment determines output,

via the production function.

And the real wage

determines employment,

via the demand for labor.

Sum labor

demand

across all

firms.

●

Then set

equal to

supply of

labor.

Determines w.

ITF220 - Prof.J.Frankel

An alternative approach:

The New Keynesian Phillips curve

allows firms to be imperfectly competitive,

with a profit mark-up over cost,

but still has Y↑ => P ↑

via firms’ demand for labor & marginal cost.

ITF220 - Prof.J.Frankel

Appendix II: Labor market rigidities

Explicit wage indexation:

Examples in 1970s-80s -• US: Cost of Living

Adjustment clauses

• Italy: scala mobile

• Argentina: complete

indexation of everything

7.

Implicit real

wage rigidity:

Example -- thought to

characterize Europe.

ITF220 - Prof.J.Frankel

If actual real wage w > warranted real wage ω,

• Y < Y permanently .

• Growth in demand will not

show up in increased employment.

– because it is “classical unemployment,”

not Keynesian unemployment.

• E.g., comparison of US vs. Europe:

– In the 1970s the upward trend of warranted w slowed sharply

• <= productivity slowdown <= oil shocks.

– In the US, employment continued to rise, but real w did not;

– in Europe, real w continued to rise, but employment did not.

ITF220 - Prof.J.Frankel

In the 1970s & 80s, the upward trend of warranted w slowed

sharply,employment rose in US,

while real wage contracts rose in Europe.

ITF220 - Prof.J.Frankel

One view: Europeans prefer job security; Americans prefer job growth.

The Netherlands may have found a “middle way.”

ITF220 - Prof.J.Frankel

“Labor market

rigidities” in Europe

go beyond

sticky real wages;

Employment Protection Legislation

often does not raise overall employment.

If anything, the reverse.

They include also,

e.g., laws against

laying off workers,

which discourage hiring.

One view of the divergence

Between Germany & Greece:

Labor market reforms enacted

by Gerhard Schröder 2003-05

improved labor market efficiency.

source: Giuseppe Bertola (2001)

ITF220 - Prof.J.Frankel

Appendix III: Measures of output gap

Three measures of

excess supply tend

to move together.

Source: IMF,

World Economic Outlook.

.

ITF220 - Prof.J.Frankel

Inflation turned negative in 1930-33,

along with the output gap,

and again in 1938-39

ITF220 - Prof.J.Frankel

Jobs vary with GDP

though usually less-than-proportionately , in practice.

Data: OECD Quarterly National

Accounts Database; OECD Labour

Force Statistics Database, Eurostat,

Annual national accounts for the

European countries, ILO, ILOSTAT

Database and results from national

labour force surveys for Argentina and

India.

”G20 labour markets: outlook, key challenges and policy responses,” Sept. 2014, ILO, OECD, World Bank Group,

Report prepared for the G20 Labour and Employment Ministerial Meeting, Melbourne, Australia,

Appendix IV

An example

of rational

expectations:

Mexican

sexenio

From 1976

through 1994,

inflation would

shoot up and/or

the peso would

devalue, every 6th

year (presidential

election years).

ITF220 - Prof.J.Frankel