* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download AD Question

Edmund Phelps wikipedia , lookup

Full employment wikipedia , lookup

Pensions crisis wikipedia , lookup

Exchange rate wikipedia , lookup

Okishio's theorem wikipedia , lookup

Money supply wikipedia , lookup

Fear of floating wikipedia , lookup

Business cycle wikipedia , lookup

Inflation targeting wikipedia , lookup

Monetary policy wikipedia , lookup

Stagflation wikipedia , lookup

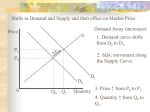

Early 1980s Review: Aggregate Demand/Aggregate Supply Model AD Question: How many final goods and services would be purchased if the inflation rate () were _______ percent, given that all other factors relevant to demand remained the same? (%) AS AD G&S Aggregate Demand (AD) curve is downward sloping AS Question: How many final goods and services would be produced if the inflation rate () were _______ percent, given that all other factors relevant to supply remained the same? Aggregate Supply (AS) curve is upward sloping Equilibrium Goods and services (G&S) purchased AD C + I + G = = = Goods and services (G&S) produced AS GDP Shifts in the Aggregate Demand (AD) Curve Fiscal Policy: President and Congress Government Purchases Decrease Increase Contractionary Expansionary AD curve shifts left AD curve shifts right Long Run Aggregate Supply (LRAS) Curve Taxes Increase Decrease Contractionary AD curve shifts left Expansionary AD curve shifts right Vertical: A placeholder for potential GDP, GDPP. Intersects the AS curve at the expected inflation rate, E. Shifts in the Aggregate Supply (AS) Curve Supply Shocks Negative Shock Positive Shock AS curve shifts left AS curve shifts right Changes in the expected inflation rate (E) Decrease in E Increase in E AS curve shifts up AS curve shifts down (%) LRAS AS AS AS E E E GDPP G&S Reagan Tax Cut Unemp Year Rate (%) 1980 1981 7.6 1982 9.7 1983 9.6 1984 7.5 Real GDP Actual Infl Rate (%) 9.0 9.3 6.2 3.9 3.5 6,610 6,485 6,785 7,275 Expected Infl Rate (%) Govt Purch Real Interest Rate (%) 9.0 9.3 6.2 3.9 1,630 1,660 1,720 1,785 4.8 7.6 8.1 9.2 (%) Adaptive Expectations: The expected inflation rate depends on the actual inflation rate in the recent past. AS1981,82 10.0 1981 1981-1982 1982-1983 1983-1984 AS1983 Expected inflation raterate about decreases the same AS curve shifts stationary down 8.0 6.0 1982 AS1984 4.0 AS and LRAS curves intersect at the expected inflation rate. AS Curve 1983 1984 2.0 GDP 6,500 6,750 7,000 7,250 7,500 Year 1980 1981 1982 1983 1984 Unemp Rate (%) Real GDP 7.6 9.7 9.6 7.5 6,610 6,485 6,785 7,275 Actual Infl Rate (%) 9.0 9.3 6.2 3.9 3.5 Fiscal Policy: President and Congress Government Purchases Taxes Increase Decrease Expansionary Expansionary AD curve shifts AD curve shifts right right Expected Infl Rate (%) Govt Purch Real Interest Rate (%) 9.0 9.3 6.2 3.9 1,630 1,660 1,720 1,785 4.8 7.6 8.1 9.2 AD Curve (%) AS1981,82 10.0 5 percent in 1982 10 percent in 1983 10 percent in 1984 1981 8.0 6.0 Reagan Tax Cut In August 1981, the President and Congress enacted a 25 percent reduction phased in over the next three years: AD1981 1982 Question: Did the aggregate demand (AD) curve have to shift? 4.0 2.0 Puzzle: What are we missing? Answer: Yes, to the left. 6,500 6,750 GDP Monetary Policy: Federal Reserve Board (Fed) FP Question: What would the AD Question: How many final goods real interest rate (r) equal, if the and services would be purchased, if the inflation rate () were _______ inflation rate () were _______ percent, percent, given that the Fed does given that all other factors relevant to not change its inflation policy? demand remained the same? (%) (%) Aggregate demand (AD) Taylor curve is downward sloping Principle FP as a consequence of the Taylor principle. AD G&S r (%) Inflation rate () increases Real interest Loans Households Fewer goods rate (r) become and firms and services increases more costly purchase less purchased Taylor principle (FP curve) Taylor Principle is reactive. C and I decrease AD = C + I + G decreases The Fed is reacting to a change in the inflation rate. Autonomous Monetary Policy: Shift of the Fed Policy (FP) curve – A Proactive Fed Autonomous Expansionary Monetary Policy Autonomous Contractionary Monetary Policy Fed becomes tougher on inflation Fed shifts the FP curve right At a given inflation rate (), the Fed increases the real interest rate (r). Fed becomes easier on inflation Fed shifts the FP curve right At a given inflation rate (), the Fed decreases the real interest rate (r). FP Question: What would the real interest rate (r) equal, if the inflation rate () were _______ percent, given that the Fed does not change its inflation policy? AD Question: How many final goods and services would be purchased, if the inflation rate () were _______ percent, given that all other factors relevant to demand remained the same? (%) (%) FP FP curve shifts right AD curve shifts left Contractionary Lab 10.1 AD FP At a given inflation rate () AD G&S r (%) Fed increases Loans Households Fewer goods Aggregate the real become more and firms and services demand (AD) interest rate (r) costly purchase less purchased curve shifts left The Fed and Autonomous Monetary Policies Question: Did the Fed pursue autonomous monetary policies in the early 1980s? Actual Infl Rate (%) 9.3% 6.2% 3.9% 3.5% Year 1981 1982 1983 1984 Real Interest Rate (%) 4.8% 7.6% 8.1% 9.2% The FP curve shifted right The Fed pursued an autonomous contractionary monetary policy The Fed shifted the AD curve left. (%) FP1981 FP1982 FP1983 10.0 1981 8.0 FP1984 1982 Question: When the FP curve shifts right, what happens to the AD curve? Answer: The AD curve shifts left. 6.0 1983 4.0 Taylor Principle: The Fed policy (FP) curve is upward sloping. 1984 2.0 4.0 6.0 8.0 10.0 r (%) Reagan Tax Cut Revisted Real Actual Infl Year GDP Rate (%) 1980 9.0 1981 6,610 9.3 1982 6,485 6.2 1983 6,785 3.9 1984 7,275 3.5 Govt Purch Fiscal Policy 1983-1984 1981-1982 1982-1983 Autonomous Monetary Policy Expansionary 1,630 1,660 1,720 1,785 Contractionary In Innet, net,AD ADcurve curveshifts shiftsright. left. Monetary Fiscal policy policy dominates. dominates. (%) AD1981 AS1981,82 Reagan Tax Cut 10.0 1982: 5 percent 1983: 10 percent 8.0 1984: 10 percent 6.0 1981 AS1983 AS1984 1982 4.0 1983 2.0 AD1982 6,500 6,750 1984 AD1983 7,000 AD1984 7,250 7,500 G&S Summary: Fiscal and Monetary Policies Fiscal Policy: Congress and the President Expansionary Contractionary G Up FP Curve AD Curve T Down G Down T Up FP Stationary AD Shifts Right AD Shifts Left FP Question: What would the real interest (%) rate (r) equal, if the inflation rate () were _______ percent, given that the Fed does not change its inflation policy? FP FP Autonomous Monetary Policy: The Fed Contractionary Expansionary Open Market Open Market Purchase Sale FP Shifts Left FP Shifts Right AD Shifts Right AD Shifts Left AD Question: How many final goods and (%) services would be purchased, if the inflation rate () were _______ percent, given that all other factors relevant to demand remained the same? FP AD AD r (%) AD G&S