* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download 14 - The Citadel

Exchange rate wikipedia , lookup

Nominal rigidity wikipedia , lookup

Monetary policy wikipedia , lookup

Business cycle wikipedia , lookup

Virtual economy wikipedia , lookup

Phillips curve wikipedia , lookup

Long Depression wikipedia , lookup

Modern Monetary Theory wikipedia , lookup

Helicopter money wikipedia , lookup

Real bills doctrine wikipedia , lookup

Ragnar Nurkse's balanced growth theory wikipedia , lookup

Money supply wikipedia , lookup

Stagflation wikipedia , lookup

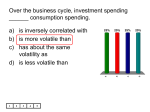

37 14. Aggregate Demand and IS-LM Analysis Question: 34. Be able to describe the short run effects of an increase or a decrease in consumption, saving, investment, government spending, taxes, budget deficit, trade deficit, base money, money supply or demand shocks, price level and illustrate with an IS-LM diagram. (these are the effects on the real market interest rate and real income. These effects must be shown!) Aggregate Demand Aggregate Demand is the real volume of final goods and services that households, firms, and government choose to buy. That is, the planned purchases of consumer goods and services by households are added to the planned purchases of capital goods by firms. That is private expenditure. That is added to purchases of goods and services by the government. This total amount of nominal expenditure is then corrected for changes in the price level. The result is aggregate demand. IS-LM Analysis IS-LM analysis is a method of understanding the relationships between money supply and demand, interest rates and aggregate demand. It allows us to develop of theory of aggregate demand, but it is based on the implicit assumption that firms will always produce whatever they can sell at a given price level. (This is a very incomplete theory of the macroeconomy--but aggregate supply will be added later.) Changes in the LM curve Changes in money supply, money demand shocks, or the price level are analyzed using shifts in the LM curve. An increase in the LM curve is a shift to the right. A decrease in the LM curve is a shift to the left. Factor Base Money Supply Money Multiplier Money Supply Shock (βt) Money Demand Shock ( αt ) Price Level Relationship to LM Positive Positive Positive Negative Negative The explanation is simple. An increase in the money supply tends to lower interest rates, given money demand. That means that the real interest rate consistent with a given level of real income is lower--the LM curve shifts to the right. If people just choose to hold more money or else the higher price level causes people to hold more money, the result is a shift of the money demand curve to the right. The nominal and real interest rates that go with a given level of income are higher. The LM curve has shifted to the left. IS Relationship An increase in income causes an increase in savings. The interest rate at which saving and investment are equal is lower. This relationship is represented by the IS curve. I stands for investment. S stands for saving. The IS curve shows combinations of income and interest rates consistent with saving and investment being equal in the short run. An alternative approach looks at the relationship between the real interest rate and total real expenditure--consumption plus investment plus government spending. A lower real interest rate tends to stimulate consumption and investment spending. The increase in total spending, tends to cause firms to sell more. Assuming they expand their production, output and income rise. A log linear function representing the is function would be: 38 lnyt = co - c1tt - c2r bt + c3 lngt+ c4 lnxt - c5 lnnt + γt where: co, c1, c2, c3, c4, c5 are positive coefficients, and γt is a real expenditure shocks. t is the tax rate, rbt is the real interest rate on bonds, x is exports and n is imports. Permanent changes in consumption or investment would be represented by a change in c0 in the same direction. Temporary increases in investment and consumption or decreases in saving are positive real expenditure shocks. Temporary decreases in investment or consumption or increases in saving are negative real expenditure shocks. The IS curve is the graph of this relationship. IS and LM Together: Equilibrium Real Income and Interest Rate The IS curve and LM curve together seem to show the equilibrium interest rate and real income in the short run. It is the level of the interest rate and real income consistent with the supply of money being equal to the demand for money and the supply of saving being equal to the demand for investment. An alternative statement is that given the equilibrium level of real income, the money demand and money supply are consistent with the equilibrium real interest rate and given the equilibrium interest rate, sufficient spending is generated to purchase just the amount output equal to the equilibrium income. But always remember--this income in IS-LM is actually real spending on final goods and services. There is enough spending to buy that amount of output. There is no guarantee that firms can produce that much output or that they are willing to sell that amount. 39 By solving the real expenditure (IS) function and the LM function, real income and the real interest rate can be found. Start with the LM and the IS relationships: . rbt = 1/b2(1-b3)*(lnPt + bo + b1lnyt - lnBt - lnmt + βt - αt) - Pet lnyt = co - c1tt - c2r bt + c3 lngt+ c4 lnxt - c5 lnnt + γt Solve the IS relationship for the real bond interest rate: rbt = 1/c2 (c0 - c1 + c3 lngt + c4 lnxt - c5 lnt - lnyt) Set them equal and solve for real income: lnyt = b2(1-b3)/(b1c2+b2(1-b3)) * (co-c1tt+c3lngt+c4lnxt-c5lnnt+γt) + c2/(b1c2+b2(1-b3)) *(lnBt+lnmt-lnPt -bo -βt+αt) . + c2b2(1-b3)/(b1c2+b2(1-b3)) * Pet Substitute this solution for real income into the IS relationship above, and that gives the solution for the real bond interest rate. Changes in the LM curve Changes in money supply, money demand shocks, or the price level are analyzed using shifts in the LM curve. An increase in the LM curve is a shift to the right. A decrease in the LM curve is a shift to the left. Factor Base Money Supply Money Multiplier Money Supply Shock (βt) Money Demand Shock ( αt ) Price Level Relationship to LM Positive Positive Positive Negative Negative Short Run Effects of Increase in Base Money Other things being equal, an increase in base money increases the money supply. Assuming money demand is unchanged, that tends to create a surplus of money. The excess money is spent and at least some of it is spent on bonds. Bond prices rise and the nominal and real interest rate falls. The lower real interest rate tends to stimulate investment and consumption spending. There is enough spending to buy more output. Assuming firms would actually produce that extra output, real income rises. The short run effects of an increase in base money are a lower real interest rate and higher level of real income (actually, aggregate demand.) This can be illustrated by a shift of the LM curve to the right. The analysis of an increase in the money multiplier, a positive shock to moeny supply, a decrease in the price level, or a negative shock to money demand are much the same. And a decrease in base money or the money multiplier, an increase in the price level and a negative shock to money supply or demand are just the opposite. Remember that both a money demand shock or an increase in the price level imply an increase in money demand. That leads to a shortage money, sales of bonds, etc.) 40 Changes in Real Expenditure: shifts of the IS curve Changes in real expenditure shocks are represented by shifts in the IS curve. Examples include changes in consumption, saving, investment, government spending, taxes, the budget deficit, and the trade deficit. In the short run, they cause changes in real income and the real interest rate. An increase in the IS curve is a shift to the right. A decrease in the IS curve is a shift to the left. (To remember the relationships, note that increases in spending tend to increase production and income in the short run. More consumption, more production, IS curve shifts right.) Factor Relationship to IS Consumption (c0) Positive Saving (negative c0) Negative Investment (c0) Positive Government Spending Positive Taxes (tax rate) Negative Budget Deficit (govt. spending - taxes) Positive Exports Positive Imports Negative Trade Deficit (imports -exports) Negative The explanation is simple. The increase in real expenditure implies that there is more spending at any given real income. That means enough spending so that more can be sold. Assuming, firms can produce and are willing to sell that extra output, income rises. A given real interest rate is consistent with higher real income--this IS curve shifts to the right. 41 Short Run Effects of an Increase in Government Spending Suppose government spending increases and everthing else remains unchanged. The increase in government spending leads to an increase in total spending. Assuming that firms adjust output to match the increased sales, then the increase in output implies a equal increase in real income. But people with higher income demand more money. The increase in money demand leads to a shortage of money. To obtain the needed funds, people sell bonds. Bond prices fall and the nominal and real interest rate on bonds rises. So the short run effect of an increase in government spending is to raise real income (actually aggregate demand) and raise the real interest rate. (This is illustrated by a shift of the IS curve to the right.) An increase in consumption, investment, or exports is analyzed in much the same way. A decreaes in taxes implies an increase in disposable income and consumption. A decrease in saving is an increase in consumption. A decrease in imports implies more domestic consumption or investment spending. An increase in the budget deficit implies more government spending or lower tax rates. A lower trade deficit implies higher exports or lower imports. The opposite analysis would apply to a decrease in consumption, increase in saving, decrease in government spending, increase in taxes, decrease in the budget deficit, decrease in exports, increase in imports, or an increase in the trade deficit. Dynamic IS-LM A growing supply of base money matched by a growing price level might leave the LM curve unchanged. But if real income is growing, steady-state equilibrium requires that both the IS and LM curves shift to the right at the same rate. Real consumption and investment expenditures tend to grow with capacity, so a dynamic IS relationship would be: . . . . . yt = c0 - c1 Δtt - c2 Δrbt + c3gt + c4 xt + c5 nt + γt For this kind of equilibrium to develop, the growing real expenditure and income must be matched by either an increasing money supply (say, growing base money) or else a decreasing price level. Of course, sufficiently rapid growth in base money would make this sort of equilibrium consistent with a rising price level. 42 The Aggregate Demand Function and Curve IS-LM analysis is a theory of aggregate demand. It shows the real volume of purchases, assuming that firms will actually produce the output. But when the real volume of sales change, firms will almost certainly adjust prices and well as output. But when prices change, so does the price level. The price level is negatively related to LM, which implies that a lower price level tends to raise real income. What that really means is that the lower price level tends to result in more spending, so that that firms could sell more output if they could produce the output and wanted to sell it. The equilibrium income from the IS-LM model is the aggregate demand relationship. Everything is given, except the price level. The negative relationship between the real income and the price level is highlighted. A d superscript is used to note that this is really a relationship between the price level and spending. lnydt = b2(1-b3)/(b1c2+b2(1-b3))*(co-c1tt+c3lngt+c4lnxt-c5lnnt+γt) + c2/(b1c2+b2(1-b3))*(lnBt+lnmt-lnPt -bo -βt+αt) . + c2b2(1-b3)/(b1c2+b2(1-b3)) * Pet The aggregate demand curve shows the relationship between the price level and real income, that is, the total amount households, firms, and the government is willing to buy. The lower the price level, the higher the amount of real income demanded and vice versa. All the factors that influence the IS or LM curves imply shifts in the aggregate demand curve in the same direction as the change in equilibrium real income. For example, IS-LM analysis suggests that real income increases when the money supply increases. That means that the aggregate demand curve increases--shifts to the right. Similarly, IS-LM analysis suggests that real income decreases when saving increases. That means the aggregate demand curve shifts to the left. Dynamic Aggregate Demand The growth rate of real expenditures can be found by taking the difference 43 between the log of aggregate demand in period t and period t-1. That gives: . . . . . ydt = b2(1-b3)/(b1c2+b2(1-b3))*(co-c1 Δt t+c3gt+c4xt-c5nt+γt) . . . + c2/(b1c2+b2(1-b3))*(Bt+mt-Pt -βt+αt) . + c2b2(1-b3)/(b1c2+b2(1-b3)) * ΔPet Notice that the growth rate of aggregate demand is negatively related to the inflation rate. (Dont get confused with the positive relationship to the change in the expected inflation rate.)