* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download File

Economic bubble wikipedia , lookup

Economic democracy wikipedia , lookup

Full employment wikipedia , lookup

Fiscal multiplier wikipedia , lookup

Ragnar Nurkse's balanced growth theory wikipedia , lookup

Business cycle wikipedia , lookup

Early 1980s recession wikipedia , lookup

2000s commodities boom wikipedia , lookup

Monetary policy wikipedia , lookup

Economic calculation problem wikipedia , lookup

Inflation targeting wikipedia , lookup

Money supply wikipedia , lookup

Nominal rigidity wikipedia , lookup

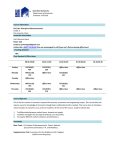

QUESTION BANK PART – A (TWO MARK QUESTIONS) 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. 21. 22. 23. 24. 25. 26. 27. 28. 29. 30. 31. 32. 33. 34. 35. 36. 37. 38. 39. 40. 41. 42. 43. 44. 45. What is economics? Define utility? What are the forms of utility? What are the various forms of wealth? What does production possibility curve shows? What is meant by marginal rate of transformation? What is meant by micro economics? What is known as macro economics? What is meant by globalization? What does Kuznet’s curve suggests? Write a note on Phillip’s curve What are the intermediate variables? What is monetary policy? What is meant by fiscal policy? What is meant by Invisible Hand? What is the meaning of demand? State the law of demand. What is market demand? What is income effect? State the law of supply. Why does supply curve slope upwards? What is meant by equilibrium price? What is meant by equilibrium amount? What is meant by demand-pull inflation? Define Elasticity of demand. What is meant by Elasticity of demand? What are the types of elasticity? What is zero elasticity? What is meant by point elasticity? Define Elasticity of supply. Define Marginal Rate of Substitution? What is consumer equilibrium? Write a definition of substitution and complements. What is income effect? Define production function. What is meant by market? Define perfect competition. What is meant by oligopoly? What is the meaning of ‘Land’? What is meant by Personal Income (PI)? What is national income? How could it be measured? What are the different kinds of Unemployment? Define inflation. Define Precautionary Demand. What is meant by cost-push inflation? 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. 21. 22. 23. 24. 25. PART – B (SIXTEEN MARK QUESTIONS) What are the three fundamental problems in the economy? What are the factors determining for goods? What are the factors determining supply? Explain in detail five cases of elasticity? What is the relationship between price elasticity average revenue and marginal revenue? What are properties of indifference curve? How do you criticize indifference approach? What is the superiority of indifference curve technique? What are the types of production function? What are the advantages and disadvantages of large scale production? What are the conditions of a perfect marker? What are the factors affecting productivity of land? What are the factors determining real wages? What are the properties of general equilibrium? What are the benefits of minimum wages? What are the factors determining National Income? Explain in details, importance and leakages of Multiplier? Explain the limitations of Acceleration principle. Explain the types of Macro Economics. Explain about Macro Economics Indicators. Explain the various measures of money supply. What are the factors determining money supply? Explain Monetary Policy. Explain various types of inflation. What is meant by non-accelerating inflation rate of unemployment or NAIRU? Question Bank with key PART – A (TWO MARK QUESTIONS KEY) 1. What is economics? Economics is the science which studies human behavior as a relationship between ends and scarce means which have alternative uses. 2. Define utility. The want satisfying power of a commodity is called utility. It is a quality possessed by a commodity or service to satisfy human wants. Utility can also be defined as value-in-use of a commodity because the satisfaction which we get from the consumption of a commodity is its value-in-use. 3. What are the forms of utility? The forms of utility are (i) Form Utility (ii) Place Utility (iii) Time utility (iv) Service Utility (v) Possession Utility (vi) Knowledge Utility (vii) Natural Utility 4. What are the various forms of wealth? Wealth may be of the following types, (i) Individual Wealth (ii) Social Wealth (iii) National or Real Wealth (iv) International wealth (v) Financial wealth 5. What does production possibility curve shows? The production possibility curve shows the maximum output of any one commodity that the economy can produce together with the prescribed quantities of other commodities produce and the resources utilized. 6. What is meant by marginal rate of transformation? In order to produce more X, we must sacrifice some Y, i.e., Y’s can be transformed into X’s. The rate at which one product is transformed into another is called marginal rate of transformation. 7. What is meant by micro economics? Micro economics deals with the analysis of small individual units of an economy such as individual, consumers, individual industries and market. 8. What is known as macroeconomics? Macroeconomics studies how the large aggregate such as total employment, national product or national income of an economy and the general price level are determined. Macroeconomics is therefore a study of aggregates. 9. What is meant by globalization? With globalization, interdependence is on the increase and it is now well known that international trade and investments have goodies to offer to all participating countries, provided they are carried out on mutually reasonable terms. 10. What does Kuznet’s Curve suggests? The Kuznet’s curve outlines the inverted U-shaped relationship between the degree of income inequality and the level of percapita, income which implies that the goals of equality and high percapita income conflict in poor countries while they go hand in rich countries. 11. Write a note on Phillip’s Curve. The Phillips curve describes a non-linear negative relationship between the rate of inflation and unemployment, and thus suggests that the goals of price stability and full employment (high level of output) are incompatible. 12. What are the intermediate variables? The intermediate variables include variables like money supply, interest rate, wage rate, savings, investments, bank credit, foreign exchange rate, imports, exports, foreign investments and others. They are so called because they fall between the instruments and target variables and the former influences the latter through these. 13. What is monetary policy? Monetary policy refers to the policies regarding growth of money supply, availability of credit and interest or cost of credit. It is an important tool of controlling inflation in the economy. 14. What is meant by fiscal policy? The fiscal policy refers to taxation and expenditure decisions of the government. Before Keynes it was believed that the government budget should preferably be balanced, that is revenue collected through taxes should be equal to the expenditure made by the government. 15. What is meant by Invisible Hand? Invisible hand is the self-adjusting, self-correcting mechanism that regulates the economic activity and brings about automatic adaptability. A factor of production is the best possible alternatives. 16. What is the meaning of demand? The demand for a commodity is essentially consumer’s attitude towards a commodity. This consumer’s attitude gives rise to actions in purchasing units of a commodity at various given prices. Demand in economics implies both the desire to purchase and the ability to pay for a good. 17. State the law of demand. The law of demand expresses the functional relationship between price and quantity demanded. According to the law of demand, other things being equal if price of a commodity falls, the quantity demanded of it will rise, and if the price of the commodity rises, its quantity demanded will decline. 18. What is market demand? The market demand is the sum total of demands of all consumers in the market for a commodity at various prices. Therefore, we can derive market demand for a commodity by adding up the quantities demanded of the commodity at various prices by all the consumers that buy the commodity in a period of time. 19. What is income effect? When price of a commodity falls, the consumer can buy more quantity of the commodity with his given income or if he chooses to buy same amount of the commodity as before, some money will be left with him because he has to spend less on the commodity due to its lower price. 20. State the law of supply. Supply has functional relationship with price, “other things remaining the same, as the price of a commodity rises its supply is extended, and as the price falls its supply its contacted”. The quantity offered for sale varies directly with prices i.e., the higher the price the larger is the supply and vice versa. 21. Why does supply curve slope upward? Price of a product and quantity supplied of it by firms, producing it are positively related to each other, that is, at a higher price more is supplied and vice versa. 22. What is meant by equilibrium price? The price at which quantity demanded equals quantity supplied is called the equilibrium price, for at this price the two forces of demand and supply exactly balance each other. 23. What is meant by equilibrium amount? The quantity of the good which is purchased and sold at this equilibrium price is called equilibrium amount. 24. What is meant by demand-pull inflation? Increase in demand is the most important factor causing inflation, that is, rise in prices is generally described as demand-pull inflation. Though the term inflation is used in the context of a rise in general price level, but it has roots at the micro level. 25. Define Elasticity of demand. According to Mrs. Joan Robinson, “The elasticity of demand, at any output, is the proportional change of amount purchased in response to a small change in price, divided by the proportional change of price”, 26. What is meant by Elasticity of demand? ‘The elasticity of demand is a measure of the relative change in amount purchased in response to a relative change in price on a given demand curve’. 27. What are the types of elasticity? There are three types of elasticity viz. price elasticity, income elasticity and cross elasticity. 28. What is zero elasticity? When people must continue to buy exactly the same quantity whatever the price, elasticity is zero. It means that they cannot do without this quantity, however high the price or they cannot be include to buy any more however low the prices. The demand is absolutely inelastic. 29. What is meant by point elasticity? This method tells us how to measure elasticity of demand at any point on a demand curve. The demand curve is the straight line demand curve. Elasticity is represented by the fraction, distance from D to a point on the curve divided by the distance from the other end to that point. 30. Define Elasticity of supply. According to Meyers,” we may define supply as s schedule of the amount of a good that would be offered for sale at all possible prices at any one instant of time, or during any one period of time, for ex: a day, a week and so on, in which the condition of supply remain the same”. 31. Define Marginal Rate of Substitution. Hicks define “Marginal rate of substitution of X for Y as the quantity of Y which would just compensate the consumer for the loss of the marginal unit of X”. 32. What is consumer equilibrium? The consumer is in equilibrium when he obtains the maximum possible satisfaction from his purchase given the prices in the market and the amount of money he has for making purchases. 33. Write a definition of substitutes and complements. Professor Hicks defines the substitutes and complements thus; “I shall say Y is a substitute of X if a fall in the price of X leads to a fall in the consumption of Y; Y is a component of X if a fall in the price of X leads to a rise in the consumption of Y; a compensating variation in income being made of course in each case”, 34. What is income effect? Income effect is the effect on the quantity demand exclusively as a result of change in money income, all prices remaining constant. As a result of change in income, consumer satisfaction will either increase or diminish; now he has a large or smaller income to spend. The result of this type of change is described in technical language as income effect. 35. Define production function? According to Stigler “the production function is name given to the relationship between the rates of input of productive services and the rate of output of product. It is the economist’s summary of technological knowledge”. 36. What is meant by market? In common language “market” refers to a place or locality where a commodity or commodities are bought and sold. In economics market does not refer to a place but to a commodity and also to buyers and sellers of that commodity who are in competition with one another. 37. Define perfect competition Mr. John Robinson writes, “Perfect competition prevails when the demand for the output of each producer is perfectly elastic. This entails, first, that the number of sellers is large, so that the output of any seller is negligibly small proportion of the total output of the commodity, the second that buyers are all alike in respect of their choice between rival sellers, so that the market is perfect”. 38. What is meant by oligopoly? The second sub-category of imperfect competition is oligopoly without product differentiation which is also known as pure oligopoly. The third sub-category of imperfect competition is oligopoly with product differentiation which is also called differentiated oligopoly. 39. What is the meaning of ‘Land’? The term “Land” in economics is often used in a wider sense. It does not mean only the surface of the soil, but it also includes all those natural resources which are the free gifts of nature include the rivers, forests, mountains and oceans, the heat of sun, climate, weather, rainfall etc, which are above the surface of land, and the minerals under the surface of the earth such as iron, coal, copper, water, etc. 40. What is meant by Personal Income (PI)? Personal Income (PI) is the actual income received by the individuals or households in the country during the year. Personal Income = National Income-corporate Income Taxes-Undistributed corporate profits-Social Contributions-Transfer Payments 41. What is national income? How could it be measured? This is the total of all income payments received by the factors of production, viz., land, labor, capital and organization. It is also known as National Income at Factor cost. It can be derived from the NNP in the following manner. National Income=NNP – Indirect Taxes + Subsidies. 42. What are the different kinds of Unemployment? There are three kinds of unemployment. They are (i) Fractional Unemployment (ii) Structural Unemployment (iii) Cyclical Unemployment 43. Define inflation. According to A.C.Pigou. “Inflation exists when money income is expanding more than in proportion to increase in earning activity”. 44. Define precautionary Demand. According to J.M.Keynes, all money holdings in order to meet contingent liabilities are the result of man’s instinct to guard against future uncertainties. It is for this reason in his opinion, this sort of demand for money may be called as the precautionary demand. 45. What is meant by cost-push inflation? Inflation resulting from rising costs during periods of high unemployment and slack resource utilization is called cost-push inflation. PART – B (SIXTEEN MARK QUESTIONS KEY) 1. What are the three fundamental problems in the economy? The following fundamental problems which an economy has to tackle What to produce Hoe to produce For whom to produce Are the Resources Economically used Problem of Full employment Problem of growth 2. What are the factors determining demand for goods? Tastes and Preferences of the Consumers Income of the People Changes in the Prices of the related Goods The number of consumers in the Market Consumers Expectations Income Distribution. 3. What are the factors determining supply? The important factors determining supply of a commodity are The price of the commodity The price of inputs (i.e., resources) used for the production of the commodity. The state of technology The number of firms producing and selling the commodity The price of related goods produced Future expectations regarding prices. The factors other than price which determine supply are the following: Production technology Price of inputs Price of related products Number of producers (or firms) Future price expectations Taxes and subsidies 4. Explain in detail five cases of elasticity? Perfectly elastic or Infinite elasticity Perfectly inelastic or zero elasticity Relatively elastic Unit elasticity. 5. What is the relationship between price elasticity average revenue and marginal revenue? There is a close relationship between price elasticity, average revenue and marginal revenue. This relationship enables us to understand and compare the conditions of equilibrium under different market conditions. The formula is; Price or AR = MR [e / (e-1)] or AR = MC [e / (e-1)] Since in equilibrium MR = MC Price discrimination Measuring Degree of Monopoly Power Substitutes and complements Boundary between industries Market Forms Incidence of Taxes Theory of Distribution 6. What are properties of indifference curve? There are three characteristics of indifference curves: Downward sloping to the right Non intersecting Convex to the origin 7. How do you criticize indifference curve approach? Old wine in New Bottle Importance of Marshallian Base Unrealistic Absurd Only two goods Cannot Explain Uncertainty Introspective Constancy of Tastes Continuity Ignore Demonstration Effect Transitivity objected Limited Empirical Nature 8. What is the superiority of indifference curve technique? The indifference curve technique is superior to the Marshallian utility analysis in several respects. More realistic Measurement of Utility No Assumption of Constancy of Marginal Utility of Money Analyses Multi-goods Models Less Restrictive More General Theory of Demand 9. What are the types of production function? Production function may take several forms. It can be fixed – proportions production function. It can be a variable – proportion – proportions production function. 10. What are the advantages and disadvantages of large scale production? Advantages of large scale production: 1. Internal Economies, 2.External Economies, 3. Division of Labor, 4. Use of Machines, 5. More Production, 6. Economies of Organization, 7. Low Cost of Production, 8. Cheap and Easy Loans, 9. Ancillary Industries, 10. Standard good, 11. Advertisement and Salesmanship, 12. Research, 13. Economy of Buying and Selling, 14. Economies of Indivisibility Disadvantages of Large Scale Production: 1. Evils of Factory System 2. Danger of Over Production 3. Less Supervision 4. Monopoly 5. Class Struggle 6. Depend on Foreign Markets 7. Possibility of war 8. Lack of Adaptability 9. Individual Tastes Ignored 10. Unequal Distribution of wealth 11. What are the conditions of a perfect market? For a market to be perfect the following conditions are essential: Large number of Buyers and Sellers Homogeneous Product Free Entry or Exit Cheap and Efficient Transport and Communication Wide Extent Perfect Knowledge Perfect combicity of the factors of production 12. What are the factors affecting productivity of land? The following factors affect our productivity of land in a country Qualities of land Means of Irrigation Situation of Land Proper use of land Improvements of Land Trained Labor Ownership of Land Government Policy 13. What are the factors determining real wages? Real wages depend upon the following factors: Price level Money Wages Regularity of Work Nature of Work Future Prospects Extra Benefits Trade Expense Social Prestige Conditions of Work 14. What are the properties of general equilibrium? Basic Principles of a General Equilibrium The Basic Results of a General Equilibrium Detailed Analysis of General Equilibrium (i) Consumer Equilibrium (ii) Producer Equilibrium 15. What are the benefits of minimum wages? Increase in National Income For Industry Industrial Peace Remove Exploitation Profit Squeeze Price Rise Equitable Distribution 16. What are the factors determining National Income? There are number of influences which determine the size of the national income in a country. It is on account of these influences that one country may have a larger national income than the other. The three main influences are: Quality and Quantity of factors of production. The state of technical know-how Political Stability` 17. Explain in details, importance and leakages of Multiplier? Importance: Investment Trade Cycle Saving-Investment Equality Formation of Economic Policies (i) To achieve full employment (ii) To control trade cycle (iii) Deficit Financing (iv) Public Investment Leakages: Savings Strong Liquidity preference Purchase of old stocks and securities Debt Cancellation Price Inflation Net Imports Taxation Excess stocks of consumption goods Public Investment Programmes. 18. Explain the limitations of Acceleration principle. The successful operation of the accelerator depends on many conditions and assumptions Non-existence of excess capacity in consumer goods Industries. Existence of excess capacity in Investment goods Industries. Constant Capital Output Ratio Availability of Credit Availability of Resources Nature of Demand Fluidity Accelerator cannot work properly in the case of fall in demand beyond a certain level 19. Explain the types of Macro Economics. Macro Static It is an equilibrium point of macro-economic variables at a given point of time. It studies the final equilibrium as explained by the equation, Y = C+I+G. i.e., Income is equal to Consumption, Investment and Government Expenditure. Macro Comparative Static If a comparison of two macro static points at a given point of time is done, it is called macro comparative static analysis. Macro Dynamic This concept explains the process of change or path of change between initial equilibrium to the new equilibrium. It explains the forces which have been operative during the process of change. 20. Explain about Macro Economic Indicators. Macro economics is concerned with the study of issues and problems which are of vital importance for determining well-being of the people. Macro Economics for Accelerating Economic Growth Understanding Business Cycles Formulating Governments Macro Economic Policies Individual Decision – Making Importance in business decisions 21. Explain the various measures of money supply. Money supply M1 or Narrow Money M1 = C+DD+OD Money supply M2 M2 = M1+savings deposits with the post office savings bank. Money supply M3 or Broad Money Money supply M4 22. What are the factors determining money supply? RBI’s Analysis Bank Credit to the Government Bank Credit to the Commercial or Private Sector Changes in Net Foreign Exchange Assets Government’s Currency Liabilities to the Public. High Powered Money (H): H = Cp + R H = the amount of high-powered money Cp = Currency held by the public R = Cash Reserves of currency with the banks 23. Explain Monetary Policy. Definition: According to Harry G.Johnson, monetary policy is a “policy employing the central bank’s control of the supply of money as an instrument for achieving the objectives of general economic policy”. Objectives: The main objectives of monetary policy are Maximum feasible output High rate of growth Fuller employment Price stability Greater equality in the distribution of income and wealth Health balance in balance of payments. Instruments of monetary policy: Open market operations Bank rate policy Reserve requirement changes Selective Credit Controls Deficit Financing 24. Explain various types of inflation. “Inflation” is only a general term and there are different types in it. We shall make a brief study of the different types of inflation. On the Basis of Speed (i) Creeping Inflation (ii) Walking Inflation (iii) Running Inflation (iv) Galloping Inflation or Hyper-Inflation. On the Basis of Inducement (i) Deficit induced Inflation (ii) Wage-induced Inflation (iii) Profit-induced Inflation On the Basis of Time On the Basis of Extent of Coverage Other types of Inflation 25. What is meant by non-accelerating inflation rate of unemployment or NAIRU? The non-accelerating inflation rate of unemployment is that unemployment rate consistent with a constant inflation rate. At the NAIRU upward and downward forces on price and wage inflation are in balance, so there is no tendency for inflation to change. The NAIRU is the lower unemployment rate that can be sustained without upward pressure on inflation. Pulling this differently a stable inflation rate will occur when two conditions are met. No excess demand No supply Shocks.