* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download ECONOMIC ENVIRO NMENT answers.d oc

Survey

Document related concepts

Fear of floating wikipedia , lookup

Economic democracy wikipedia , lookup

Full employment wikipedia , lookup

Non-monetary economy wikipedia , lookup

Steady-state economy wikipedia , lookup

Fiscal multiplier wikipedia , lookup

Ragnar Nurkse's balanced growth theory wikipedia , lookup

Phillips curve wikipedia , lookup

Business cycle wikipedia , lookup

Economic growth wikipedia , lookup

Rostow's stages of growth wikipedia , lookup

Interest rate wikipedia , lookup

Transcript

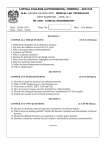

INSTITUTE OF BANKERS IN MALAWI DIPLOMA IN BANKING EXAMINATION SUBJECT: ECONOMIC ENVIRONMENT (IOBM – D211) Date: Friday, 9th May 2014 Time Allocated: 3 hours (08:00 – 11:00 am) INSTRUCTIONS TO CANDIDATES 1 This paper consists of TWO Sections, A and B. 2 Section A consists of 4 questions, each question carries 15 marks. Answer ALL questions. 3 Section B consists of 4 questions, each question carries 20 marks. Answer ANY TWO questions. 4 You will be allowed 10 minutes to go through the paper before the start of the examination, you may write on this paper but not in the answer book. 5 Begin each answer on a new page. 6 Please write your examination number on each answer book used. Answer books without examination numbers will not be marked. 7 All persons writing examinations without payment will risk expulsion from the Institute 8 DO NOT open this question paper until instructed to do so. SECTION A (60 MARKS) Answer ALL questions from this section. QUESTION 1 a) Explain three interactive parts of economic methodology and how they relate to each other? (10 marks) a. Collecting data whereby the data consists of measurable values of price and changes in price, for measurable commodities b. Formulation of models of economic relationships i.e. relationship between the genera level of prices and the general level of employment. c. Production of economic statistics; this takes data collected in the first stage and applies the model in step (b) to produce representation of economic activity d. Lastly, reasoning within economic models which sometimes involve advanced mathematics. b) Briefly explain any two economic systems? (2 marks) a. Traditional or subsistence economies; this is where there is little specialisation and trade within the economy and with other countries. People are to a greater extent self-sufficient. b. Free market economies; this is where economic decisions are made through the free market mechanism with minimal government intervention. c. Command economies; this is where all key economic decisions are made by the government. Thus the government is involved in a great deal of planning. d. Mixed economies; mixture of a pure free enterprise market economy and a command economy. The economy is characterised by the presence of a public and private sector. c) Mention any three unique features of the labour market? 3 marks (Total 15 marks) a. Labour services are embodied in the persons concerned and are not transferable. b. Labour is always rented rather than sold c. Considerations other than material advantage enter the relationship between suppliers and demanders-thus the market is affected by a wide range of noneconomic considerations. d. Labour is not traded at the best price on daily basis but rather by means of long-term contracts. e. Labour is heterogeneous and it cannot be classified or standardised. f. There are a variety of labour markets, each with its own feature, thus it is a segmented market. A qualification examined by the Institute of Bankers in Malawi 2 g. Remuneration of labour does not consist only of its price, non-wage benefits (such as housing, medical, pension, travel and holiday benefits) h. Remuneration of labour is affected by a number of factors which are not directly related to labour market conditions e.g. taxation and views on what constitutes a lignin wage or a reasonable standard of living. QUESTION 2 a) Mention three objectives of macroeconomic policy? I. Full employment II. Price stability III. A high and sustainable rate of economic growth IV. Keeping the balance of payments in equilibrium (3 marks) b) With the aid of a diagram, illustrate how an increase in the prime lending rate will affect the consumption function? (12 marks) a. Candidates are expected to reproduce a graph on page 131 of the module which should exclude C2 as it doesn’t apply to this question.. i. An increase in the prime lending rate raises the household’s debt service and consequently its wealth and thus consumption declines as well; graphically the Consumption function will shift down from C1 to C3. (Total 15 marks) QUESTION 3 Using the GDP equation under the aggregate demand approach, explain how any three of these factors have affected Malawi’s GDP growth in the past two years? GDP= C+I+G+(X-M) (15 marks) I. Consumption; high lending rates have to a greater extent impacted household wealth negatively with the likely effect of reducing aggregate demand II. Investments; intermittent power supply and possible lengthy processes that an investor goes through to register an investment in the country has also affected the contribution of I to the aggregate demand equation. III. X-M is in negative for Malawi which creates a BOP imbalance and has a negative effect of aggregate demand as the country tends to prefer externally produced goods to local ones. (Total 15 marks) QUESTION 4 A qualification examined by the Institute of Bankers in Malawi 3 a) Explain the term ‘double coincidence of wants? (4 marks) a. This relates to the barter economy whereby a supplier of good X wants good Z and the supplier of good Z wants good X. b) Why should governments be worried with deflation? (5 marks) a. Yes as it slows down economic performance; its more worrisome in cases where this is not a deliberate government policy. c) Mention any two major conflicts between macroeconomic objectives? (6 marks) a. Healthy growth and low inflation-steps taken to keep inflation rate low such as relatively high interest rates can often restrict growth via reduced consumer spending and investment-thus it is difficult to achieve both. b. Healthy growth and a BOP equilibrium-As the economy grows at a faster pace, consumers prefer to buy more things from abroad which for countries with narrow export base like money tends to worsen the BOP position for the country. In cases like this, the exchange rate depreciates, or government imposes import controls or even deflating the economy which slows down economic growth. c. Low unemployment(or full employment) and low inflation-if a government tries to reduce unemployment trough reflationary measures , such as lower interest rates or increased public spending, then the resulting reduction in unemployment will push wages and then prices higher. On the other hand when government tries to control high inflation with high interest rates and reduced spending, the resulting reduced consumer spending will result in job losses. (Total 15 marks) SECTION B (40 MARKS) Answer ANY TWO questions from this section QUESTION 5 Malawi’s inflation rate is currently one of the highest in the Southern Africa Development Community (SADC) region. Mention any three drivers of this (high inflation rate) and the effect it is having on the economy. (20 marks) Drivers of Malawi’s inflation; I. demand pull caused type of inflation; this is mostly captured by food inflation , where demand of food in particular maize and the available supply A qualification examined by the Institute of Bankers in Malawi 4 II. III. plays a key role in determining the national inflation rate-this is quite so due the fact that food has the largest share in the food basket. Cost push-type of inflation- the size of the economy and the limited production avenues entails that the country relies heavily on imports for most of its needs and any change in the importation costs impacts the countries inflation rate. Monetarist type of inflation- relates to the effect on inflation due to high growth in Moneys supply relative to real growth in output. Effect of inflation rate on the economy; a. Effect on competitiveness; if Malawi’s inflation rate is higher than that of the rest of the world, it loses on competitiveness in international markets assuming a given exchange rate. b. Reduction in real value of savings especially where real interest rates are negative. c. Penalizes consumers and businesses who run on fixed income i.e. pensioners d. Inflation leads to a higher nominal interest rate which should have a deflationary effect on GDP e. High inflation rate disrupts business planning due to the high degree of uncertainty that a high inflation rate environment poses. (Total 20 marks) QUESTION 6 (a) Explain why the individual labour supply curve is back-ward bending? (8 marks) a. There are two explanations for this pattern; substitution and income effects i. Substitution effect; this is where an increase in the wage rate encourages workers for more hours by sacrificing leisure to obtain higher income. Thus increases in wage rate raises the opportunity cost of leisure and probably entices most workers to sacrifice leisure and to work longer. ii. Income effect; this is where an increase in workers expenditure on goods and services, leads to a decrease in the marginal utility of consumption and given that leisure is a normal good, the demand for leisure also increases with the increasing wage rate-backward bending portion. A qualification examined by the Institute of Bankers in Malawi 5 (b) You have been appointed the Minister of Finance in Malawi and your main task is to see the Malawi economy attaining growth rates of above 6.5% over the next four years? What initiatives would you put in place to boost aggregate demand for the country? (12 marks ) a. Reducing tax rate (could be VAT and PAYE just to mention a few) b. Encouraging investments by creating a conducing environment for investors which will create employment thereby translating into more income to spend for the economy as a whole. c. Increasing government investment with the same effect as the point above. (Total 20 marks) QUESTION 7 (a) With the aid of a well-labelled diagram, explain the deadweight loss concept in the context of taxation. (8 marks ) a. Candidate should reproduce a graph on page 93 of the module. b. This is a cost to society imposed by marginal taxes and it’s in a form of a loss in social surplus. It particularly occurs because potential trades are not executed due to a tax which is levied on a marrow tax base (taxing a particular good heavily. In other words the tax constricts supply of the supplied good. (b) Briefly explain any two types of taxes? (2 marks) a. Income tax is levelled on income and it is typically structured to be progressive tax. b. Retirement tax; this tax is levied on specific sources of income, generally wages and salary which is used to fund social security systems. c. Capital gain tax-which is levied on profit realised upon the sale of an asset d. Cooperation tax –which is levied on corporate earnings and often includes capital gains. e. Poll tax-it levies a set amount per individual f. Excise tax-these are based on quantity of product purchased g. Other taxes on pages 89 to 102 of the module. (c) Explain the Human Poverty and Human Development indices and their interpretation? (10 marks) A qualification examined by the Institute of Bankers in Malawi 6 a. HD I is constructed as an aggregate index of three components; education, income, and life expectancy at birth scaled to lie within 0 to 1 interval. It focuses on the escape from poverty which is defined as an HDI of less than 0.5. b. Human poverty index provides a multidimensional measure of poverty and it focuses on four basic dimensions of human life-longevity, knowledge, economic provisioning and social inclusion. A score of 1 signifies a highest standard of living and moving towards zero implies deterioration in living conditions. (Total 20 marks) QUESTION 8 a) Explain the curvature of the Phillips curve? (12 marks) a. Explaining it with a graph is the most ideal (page 162 and 163 of the module) i. The curve cuts through zero on the inflation rate axis which captures the fact that deflation can happen although it will normally be associated with high unemployment. ii. The curve rises quite sharply as unemployment gets very low which means that prices can begin to rise very fast in an overheated economy. iii. The curve gets flatter at very high unemployment levels for the reason that further increases in unemployment, may have little effect on inflation. b) Malawi Government recently announced the sale of Malawi Savings Bank. Provide four concise arguments for OR against this decision? (8marks) 2 marks for each correct answer a. Any four Arguments provided for and against privatization on pages 107111 of the module should apply as the sale is a form privatization QUESTION 9 a) Explain how the Solow’s growth model differs from and the endogenous growth model? (10 marks) 5 marks for any of the answers , thus two points are enough. I. Solow’s growth model assumes that countries use their resources efficiently and that there are diminishing returns to scale whereas the A qualification examined by the Institute of Bankers in Malawi 7 endogenous growth model assumes that overall there are constant returns to scale. II. It predicts that increasing capital relative to human labor creates economic growth, since people can be more productive given more capital. The endogenous model on the other hand, believes that human capital has increasing rate of return unlike physical capital. III. The Solow’s growth model further predicts that poor countries with less capital per person will grow faster because each investment in capital will produce a higher return than rich countries with ample capital. On the contrary, the endogenous growth model asserts that growth does not slow as capital accumulates, but that the rate of growth is dependent on the types of capital a country invests in. b) Briefly explain three main methods of privatization? (6 marks) a. Share issue privatization; involves selling of share on the stock market 2 b. Asset sale privatization-involves selling the entire firm to an investor, usually by auction 2 c. Voucher auction-shares of ownership are distributed to all citizens, usually for free or at very low price. 2 c) Mention four ways used by Governments to fund expenditures? (4 marks) a. Taxation of the population 1 b. Seignorage, the benefit from printing money 1 c. Borrowing money from the population 1 d. Borrowing from other multilateral/bilateral partners 1 (Total 20 marks) END OF EXAMINATION PAPER A qualification examined by the Institute of Bankers in Malawi 8