Stocks Are Not The New Bonds

... bonds, to their investment portfolios. Pools of investment-grade ...

... bonds, to their investment portfolios. Pools of investment-grade ...

2nd Homework - Samuel Moon Jung

... A) expectations influence the behavior of participants in the economy and thus have a major impact on economic activity. B) expectations influence only a few individuals, have little impact on the overall economy, but can have important effects on a few markets. C) expectations influence many indiv ...

... A) expectations influence the behavior of participants in the economy and thus have a major impact on economic activity. B) expectations influence only a few individuals, have little impact on the overall economy, but can have important effects on a few markets. C) expectations influence many indiv ...

Question and Problem Answers Chapter 5

... return for postponing consumption. This return is the intercept of the SML and represents investments with no systematic risk. In other words, all investments must earn at least this minimum return, otherwise investors will consume their income rather than investing it. Stocks with an "average" amou ...

... return for postponing consumption. This return is the intercept of the SML and represents investments with no systematic risk. In other words, all investments must earn at least this minimum return, otherwise investors will consume their income rather than investing it. Stocks with an "average" amou ...

Slide 1

... • Clarity re: who pays • Clarity re: where the revenues go • Clarity re: who makes decisions and how • Rigorous ...

... • Clarity re: who pays • Clarity re: where the revenues go • Clarity re: who makes decisions and how • Rigorous ...

CHAPTER 10

... beta (sensitivity) relative to the broadly based market portfolio. Arbitrage Price Theory (APT) takes a different approach: it is not much concerned about investor preferences, and it assumes that returns are generated by a multi-factor model. APT reflects the fact that several major (systematic) ec ...

... beta (sensitivity) relative to the broadly based market portfolio. Arbitrage Price Theory (APT) takes a different approach: it is not much concerned about investor preferences, and it assumes that returns are generated by a multi-factor model. APT reflects the fact that several major (systematic) ec ...

ECONOMICS IS NOT ALWAYS ECONOMICAL

... starting valuation of these assets versus their future 10 year returns. The current valuations are now expecting a negative long term return from the U.S. stock market, which lay the framework for a stock market bubble. ...

... starting valuation of these assets versus their future 10 year returns. The current valuations are now expecting a negative long term return from the U.S. stock market, which lay the framework for a stock market bubble. ...

The Financial Crisis and the Systemic Failure of Academic Economics

... 2. Models (or the Use of Models) as a Source of Risk The economic textbook models applied for allocation of scarce resources are predominantly of the Robinson Crusoe (representative agent) type. Financial market models are obtained by letting Robinson manage his financial affairs as a sideline to hi ...

... 2. Models (or the Use of Models) as a Source of Risk The economic textbook models applied for allocation of scarce resources are predominantly of the Robinson Crusoe (representative agent) type. Financial market models are obtained by letting Robinson manage his financial affairs as a sideline to hi ...

The Point - Fieldpoint Private

... judgments of such sources or represent reasonable estimates. Any pricing or valuation of securities or other assets contained in this material is as of the date provided as prices fluctuate on a daily basis. Past performance is not a guarantee of future results. Asset allocation models are based on ...

... judgments of such sources or represent reasonable estimates. Any pricing or valuation of securities or other assets contained in this material is as of the date provided as prices fluctuate on a daily basis. Past performance is not a guarantee of future results. Asset allocation models are based on ...

the full document

... their allocation to a particular emerging market on relative market capitalisation, not GDP. It is likely that other emerging markets will, over time, see a proportional increase in their market capitalisation in line with their relative GDP, thereby reducing South Africa’s relative market capitalis ...

... their allocation to a particular emerging market on relative market capitalisation, not GDP. It is likely that other emerging markets will, over time, see a proportional increase in their market capitalisation in line with their relative GDP, thereby reducing South Africa’s relative market capitalis ...

Future Rate Hikes and Market Volatility

... believe this rate hike will occur in December believing that the Fed does not want to be a part of the election dialogue, but this is just speculation. One thing is for certain, we will continue to see market volatility and uncertainty between now and the end of the year. As I mentioned before, we h ...

... believe this rate hike will occur in December believing that the Fed does not want to be a part of the election dialogue, but this is just speculation. One thing is for certain, we will continue to see market volatility and uncertainty between now and the end of the year. As I mentioned before, we h ...

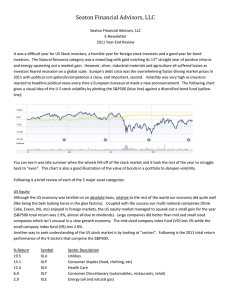

2011 - Seaton Financial Advisors, LLC

... Short term interest rates were kept artificially low by the Fed in order to assist banks in earning profits to shore up their balance sheets (the bailouts are never-ending). This resulted in interest rates on savings accounts, CDs and money market accounts being very close to zero. While these low r ...

... Short term interest rates were kept artificially low by the Fed in order to assist banks in earning profits to shore up their balance sheets (the bailouts are never-ending). This resulted in interest rates on savings accounts, CDs and money market accounts being very close to zero. While these low r ...

fixed income strategies for a rising interest rate environment

... insurance agent for final recommendations and before changing or implementing any financial, tax, or estate planning strategy. Sector and asset allocation recommendations should be considered in the context of an individual investor’s goals, time horizon and risk tolerance. Not all recommendations w ...

... insurance agent for final recommendations and before changing or implementing any financial, tax, or estate planning strategy. Sector and asset allocation recommendations should be considered in the context of an individual investor’s goals, time horizon and risk tolerance. Not all recommendations w ...

Introduction to Derivative Instruments

... • OTC product (adhoc payoff) • Built on investor’s needs that are not covered by standard products • Enable personal investors to take exposures they would usually have no access to ...

... • OTC product (adhoc payoff) • Built on investor’s needs that are not covered by standard products • Enable personal investors to take exposures they would usually have no access to ...

Comments by Saša Žiković

... imperfections in credit and loan markets. Credit market distortions destabilize the economy. The financial accelerator hypothesis is important because standard business cycle models require large, persistent disturbances to mimic the business cycles observed in the data. Because the financial accele ...

... imperfections in credit and loan markets. Credit market distortions destabilize the economy. The financial accelerator hypothesis is important because standard business cycle models require large, persistent disturbances to mimic the business cycles observed in the data. Because the financial accele ...

Summary of Chapter

... The distinctive competencies of an organization arise from its resources (its financial, physical, human, technological, and organizational assets) and capabilities (its skills at coordinating resources and putting them to productive use). ...

... The distinctive competencies of an organization arise from its resources (its financial, physical, human, technological, and organizational assets) and capabilities (its skills at coordinating resources and putting them to productive use). ...

Institute of Actuaries of India MARKING SCHEDULE October 2009 EXAMINATION

... From this we see that all values of q1 such that 0.2 < q 1 < 0.6 will result in a martingale measure, and therefore under the above martingale measure the stock price is free from arbitrage. ...

... From this we see that all values of q1 such that 0.2 < q 1 < 0.6 will result in a martingale measure, and therefore under the above martingale measure the stock price is free from arbitrage. ...

FRBSF E L CONOMIC ETTER

... few decades, the volatility of the financial structure of firms has increased.To explain this observation, they construct an economic model where business cycle fluctuations are driven by asset price shocks. Because of financial frictions, increases in asset prices affect firms’ ability to produce, ...

... few decades, the volatility of the financial structure of firms has increased.To explain this observation, they construct an economic model where business cycle fluctuations are driven by asset price shocks. Because of financial frictions, increases in asset prices affect firms’ ability to produce, ...

Chapter 5

... and the import substitute are worth the same to the economy in terms of the domestic currency (Rs. 8000 each) However, suppose that the price of the import substitute good is raised by an import duty on competing imports of 10% and that on average the domestic prices for all traded goods are 10% hig ...

... and the import substitute are worth the same to the economy in terms of the domestic currency (Rs. 8000 each) However, suppose that the price of the import substitute good is raised by an import duty on competing imports of 10% and that on average the domestic prices for all traded goods are 10% hig ...

slides

... government promises to collect taxes and provide liquidity (bailout) to the bank in case the bank faces financial distress ...

... government promises to collect taxes and provide liquidity (bailout) to the bank in case the bank faces financial distress ...

Personal Finance

... We have to ask ourselves why so many people have money problems? We will work this Semester/Quarter to provide you with information that will help you make wise financial decisions. ...

... We have to ask ourselves why so many people have money problems? We will work this Semester/Quarter to provide you with information that will help you make wise financial decisions. ...

Diversification

... Derivatives are instruments based on the future, and therefore uncertain, price of another security, such as a share of stock, a government bond, a currency, or a commodity. Mutual funds are portfolios of investments designed to achieve maximum diversification with minimal cost through economies of ...

... Derivatives are instruments based on the future, and therefore uncertain, price of another security, such as a share of stock, a government bond, a currency, or a commodity. Mutual funds are portfolios of investments designed to achieve maximum diversification with minimal cost through economies of ...