makerere university firm characteristics, foreign exchange risk

... the related exposure management that a rises so as to benefit from exports. ...

... the related exposure management that a rises so as to benefit from exports. ...

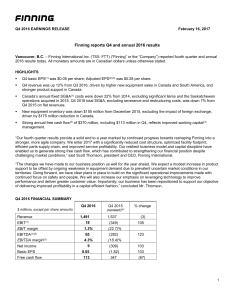

Q4 and Annual 2016 Results

... This report contains statements about the Company’s business outlook, objectives, plans, strategic priorities and other statements that are not historical facts. A statement Finning makes is forward-looking when it uses what the Company knows and expects today to make a statement about the future. F ...

... This report contains statements about the Company’s business outlook, objectives, plans, strategic priorities and other statements that are not historical facts. A statement Finning makes is forward-looking when it uses what the Company knows and expects today to make a statement about the future. F ...

Trying To Understand All-Equity Firms

... had zero outstanding debt, including both short and long-term debt, in their capital structure. In the same year, 49.8% or 1706 firms had negative debt, i.e. outstanding cash and short term investments was larger than total debt. Between 1987 and 2009, on average 14,1% of firms show no debt, 16.8% s ...

... had zero outstanding debt, including both short and long-term debt, in their capital structure. In the same year, 49.8% or 1706 firms had negative debt, i.e. outstanding cash and short term investments was larger than total debt. Between 1987 and 2009, on average 14,1% of firms show no debt, 16.8% s ...

SWP4: Corporate Bond Markets (Vol 1) - A global perspective

... 6.1 Changes to the global financial stock ........................................................................................ 63 6.2 Infrastructure and development financing ............................................................................... 68 6.3 The funding gap for small medium e ...

... 6.1 Changes to the global financial stock ........................................................................................ 63 6.2 Infrastructure and development financing ............................................................................... 68 6.3 The funding gap for small medium e ...

ECONOMICO 2013 ENG.indd

... • During 2013 the subsidiary T-Solar Global, S.A., manufacturing solar photovoltaic panels, was declared in to be involved in bankruptcy proceedings, with its subsequent liquidation and dissolution. The powers of administration and disposal of its assets were therefore suspended and a bankruptcy adm ...

... • During 2013 the subsidiary T-Solar Global, S.A., manufacturing solar photovoltaic panels, was declared in to be involved in bankruptcy proceedings, with its subsequent liquidation and dissolution. The powers of administration and disposal of its assets were therefore suspended and a bankruptcy adm ...

Corporate Bond Markets: A Global Perspective

... 6.1 Changes to the global financial stock ........................................................................................ 63 6.2 Infrastructure and development financing ............................................................................... 68 6.3 The funding gap for small medium e ...

... 6.1 Changes to the global financial stock ........................................................................................ 63 6.2 Infrastructure and development financing ............................................................................... 68 6.3 The funding gap for small medium e ...

Market Settlements Virtual and Financial Schedules (VF 201)

... • Represents daily allocation to AOs of any energy dollars that result from the MISO BA Net Inadvertent for an Operating Day • On an hourly basis each LBA is tasked with balancing their energy generation supply, load, and Net Scheduled Interchange (NSI) • The difference between the NAI and the NSI i ...

... • Represents daily allocation to AOs of any energy dollars that result from the MISO BA Net Inadvertent for an Operating Day • On an hourly basis each LBA is tasked with balancing their energy generation supply, load, and Net Scheduled Interchange (NSI) • The difference between the NAI and the NSI i ...

implications of EMU for global macroeconomic and financial stability

... ties to the EU. In particular, it could provide a useful exchange rate anchor for stabilisation in countries with strong trade and monetary links with the EU and weak institutional frameworks. Also, EU accession prospects or geographical and political proximity could confer on certain countries a so ...

... ties to the EU. In particular, it could provide a useful exchange rate anchor for stabilisation in countries with strong trade and monetary links with the EU and weak institutional frameworks. Also, EU accession prospects or geographical and political proximity could confer on certain countries a so ...

stock market overreaction and trading volume

... good past performance (winner stocks). In other words, winner and loser stock returns tend to reverse over time. De Bondt and Thaler (1985) suggested that investor's overreactions to good and bad news were the cause of this phenomenon. The authors postulated the overreaction hypothesis based on the ...

... good past performance (winner stocks). In other words, winner and loser stock returns tend to reverse over time. De Bondt and Thaler (1985) suggested that investor's overreactions to good and bad news were the cause of this phenomenon. The authors postulated the overreaction hypothesis based on the ...

Sample

... A) the corporate bonds are indirect securities and the life insurance policies are direct securities. B) the corporate bonds are indirect securities and the life insurance policies are indirect securities. C) the corporate bonds are direct securities and the life insurance policies are indirect secu ...

... A) the corporate bonds are indirect securities and the life insurance policies are direct securities. B) the corporate bonds are indirect securities and the life insurance policies are indirect securities. C) the corporate bonds are direct securities and the life insurance policies are indirect secu ...

In Short Supply: Short‐Sellers and Stock Returns

... this problem across a wide cross‐section of stocks. In this paper, we exploit a rich equity lending data set from Markit Data Explorer (DXL) to examine the role of loan market supply constraints in equity price formation. We also evaluate the role of accounting characteristics in establishing ...

... this problem across a wide cross‐section of stocks. In this paper, we exploit a rich equity lending data set from Markit Data Explorer (DXL) to examine the role of loan market supply constraints in equity price formation. We also evaluate the role of accounting characteristics in establishing ...

Debt Refinancing and Equity Returns

... with leverage within each refinancing tertile. Furthermore, the difference in returns of highand low-leverage firms increases as the refinancing intensity increases (i.e. debt maturities become shorter). These findings are consistent with the notion that shareholders demand a premium for holding hi ...

... with leverage within each refinancing tertile. Furthermore, the difference in returns of highand low-leverage firms increases as the refinancing intensity increases (i.e. debt maturities become shorter). These findings are consistent with the notion that shareholders demand a premium for holding hi ...

Annual Report 2010

... and through acquisitions, and work on both options is intense. But once again, an ambition to become larger must not pressure us into making investments and acquisitions that do not fit in with our strategy. Our areas of focus are Fresh Foods, Food & Consumer Packaging, and Sack Solutions. I know th ...

... and through acquisitions, and work on both options is intense. But once again, an ambition to become larger must not pressure us into making investments and acquisitions that do not fit in with our strategy. Our areas of focus are Fresh Foods, Food & Consumer Packaging, and Sack Solutions. I know th ...

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

... hedging activities. The statement requires that certain derivative instruments be recorded in the balance sheet as either assets or liabilities measured at fair value, and that changes in the fair value be recognized currently in earnings, unless specific hedge accounting criteria are met. If the de ...

... hedging activities. The statement requires that certain derivative instruments be recorded in the balance sheet as either assets or liabilities measured at fair value, and that changes in the fair value be recognized currently in earnings, unless specific hedge accounting criteria are met. If the de ...

NORTH AMERICAN PALLADIUM LTD (Form: 40-F

... U.S. companies. In particular, and without limiting the generality of the foregoing, this Annual Report uses the terms “measured resources,” “indicated resources” and “inferred resources.” U.S. investors are advised that, while such terms are recognized and required by Canadian securities laws, the ...

... U.S. companies. In particular, and without limiting the generality of the foregoing, this Annual Report uses the terms “measured resources,” “indicated resources” and “inferred resources.” U.S. investors are advised that, while such terms are recognized and required by Canadian securities laws, the ...

Estimating the Gains from Trade in Limit

... The conditional trader arrival rates, the conditional distributions of the innovations in the common value, and the conditional distributions of the private values all depend on the exogenous state variables. The exogenous state variables therefore determine the intensity of trader arrivals, the dis ...

... The conditional trader arrival rates, the conditional distributions of the innovations in the common value, and the conditional distributions of the private values all depend on the exogenous state variables. The exogenous state variables therefore determine the intensity of trader arrivals, the dis ...

PDF, 1.9MB - Diploma PLC

... in the Healthcare businesses, initial dilution from acquired businesses and reduced operating leverage in a lower growth environment. The Group’s medium term target for operating margin, in an improved economic environment, remains 18–19%. Agility and responsiveness in the businesses ensure close ma ...

... in the Healthcare businesses, initial dilution from acquired businesses and reduced operating leverage in a lower growth environment. The Group’s medium term target for operating margin, in an improved economic environment, remains 18–19%. Agility and responsiveness in the businesses ensure close ma ...

Kenon Holdings Ltd.

... Shares are traded on the TASE, you are regarded as a beneficial holder of Kenon Shares and you may only vote your shares in one of the following ways: (a) sign and date a proxy card in the form filed by Kenon on MAGNA, the distribution site of the Israeli Securities Authority, at www.magna.isa.gov.i ...

... Shares are traded on the TASE, you are regarded as a beneficial holder of Kenon Shares and you may only vote your shares in one of the following ways: (a) sign and date a proxy card in the form filed by Kenon on MAGNA, the distribution site of the Israeli Securities Authority, at www.magna.isa.gov.i ...

Do Institutional Investors Alleviate Agency Problems

... Fama and French (2001) find in a study of U.S. firms that dividends are trending through time. They also find that firm profitability, size and growth opportunities are related to dividends. Therefore, I control for differences across firms using variables that control for these relationships. I use ...

... Fama and French (2001) find in a study of U.S. firms that dividends are trending through time. They also find that firm profitability, size and growth opportunities are related to dividends. Therefore, I control for differences across firms using variables that control for these relationships. I use ...

NCEA Level 2 Accounting (91177) 2012

... focussing on sales falling by 17% or $160,000, due to the sales volume of carpet dropping more than the increase in mark-up profit for year percentage / profit for year fell with a reason focussing on how poor expense management in administrative expenses offsetting any gains made in distribution co ...

... focussing on sales falling by 17% or $160,000, due to the sales volume of carpet dropping more than the increase in mark-up profit for year percentage / profit for year fell with a reason focussing on how poor expense management in administrative expenses offsetting any gains made in distribution co ...

Intangibles

... Research is defined as the planned search or critical investigation aimed at discovering new knowledge with the hope that the knowledge will be useful in developing a new product of service or a new process or technique or in significantly improving an existing product or process. Development is the ...

... Research is defined as the planned search or critical investigation aimed at discovering new knowledge with the hope that the knowledge will be useful in developing a new product of service or a new process or technique or in significantly improving an existing product or process. Development is the ...