2017 Stock Market Outlook

... directly. Past performance is no guarantee of future results. The PE ratio (price-to-earnings ratio) is a measure of the price paid for a share relative to the annual net income or profit earned by the firm per share. It is a financial ratio used for valuation: a higher PE ratio means that investors ...

... directly. Past performance is no guarantee of future results. The PE ratio (price-to-earnings ratio) is a measure of the price paid for a share relative to the annual net income or profit earned by the firm per share. It is a financial ratio used for valuation: a higher PE ratio means that investors ...

Section 11 - Loss of Lot Market Value

... owners whose lots are terminated. A valuation is conducted and the market value of the 7 lots terminated is assessed at $14m. From this amount, the 7 lots’ share of the Section 1 agreed value payout (7/15 x $20m = $9.3m) and the land value (7/15 x $800k = $0.373m) would be deducted, and the balance ...

... owners whose lots are terminated. A valuation is conducted and the market value of the 7 lots terminated is assessed at $14m. From this amount, the 7 lots’ share of the Section 1 agreed value payout (7/15 x $20m = $9.3m) and the land value (7/15 x $800k = $0.373m) would be deducted, and the balance ...

FUTURE // noun [C, usually pl

... the options exchange/market 3 (Finance) [C] the right to buy sth or more of sth in the future: We have an option on the land and will purchase it soon. The airline has bought 100 planes with an option for another 50. OPTION TO PURCHASE to have/exercise/take (up) an option call option (also call) n ...

... the options exchange/market 3 (Finance) [C] the right to buy sth or more of sth in the future: We have an option on the land and will purchase it soon. The airline has bought 100 planes with an option for another 50. OPTION TO PURCHASE to have/exercise/take (up) an option call option (also call) n ...

Weekly Commentary 12-07

... subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones. * Yahoo! Finance is the source for any reference to the performance of an index between two specific periods. * Opinions expressed are subject to change without notice and are not intended as investment advic ...

... subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones. * Yahoo! Finance is the source for any reference to the performance of an index between two specific periods. * Opinions expressed are subject to change without notice and are not intended as investment advic ...

Ohio Deferred Compensation Investment Performance Report—As

... Bond Funds—Bonds are loans or debt instruments issued by governments or corporations that need to raise money. Bond funds have the same interest rate, inflation, and credit risks associated with the underlying bonds owned by the fund. Bonds are generally a more conservative form of investment than s ...

... Bond Funds—Bonds are loans or debt instruments issued by governments or corporations that need to raise money. Bond funds have the same interest rate, inflation, and credit risks associated with the underlying bonds owned by the fund. Bonds are generally a more conservative form of investment than s ...

REITs and Rising Interest Rates

... to shareholders as dividends, and do not pay income taxes themselves. REITs allow small investors to more easily invest in professionally managed, large commercial properties. REITs are financed by common stock and preferred stock and/or debt, and own a wide array of property types including shoppin ...

... to shareholders as dividends, and do not pay income taxes themselves. REITs allow small investors to more easily invest in professionally managed, large commercial properties. REITs are financed by common stock and preferred stock and/or debt, and own a wide array of property types including shoppin ...

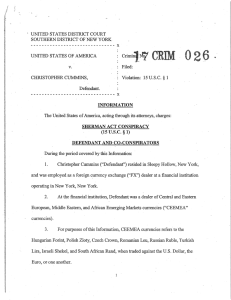

` UNITED STATES DISTRICT COURT SOUTHERN DISTRICT OF

... of Defendant and his co-conspirators that are the subject of this Information were within the flow of, and substantially affected, interstate and U.S. import trade and commerce. Defendant and his co-conspirators filled substantial quantities of CEEMEA customer orders, and traded substantial quantiti ...

... of Defendant and his co-conspirators that are the subject of this Information were within the flow of, and substantially affected, interstate and U.S. import trade and commerce. Defendant and his co-conspirators filled substantial quantities of CEEMEA customer orders, and traded substantial quantiti ...

Estimating the Expected Marginal Rate of Substitution

... (MRS), used to discount income accruing in period t+1 (also known as the stochastic discount factor, marginal utility growth, or pricing kernel), and xtj+1 is income received at t+1 by owners of asset j at time t (the future value of the asset plus any dividends or other income). We adopt the standa ...

... (MRS), used to discount income accruing in period t+1 (also known as the stochastic discount factor, marginal utility growth, or pricing kernel), and xtj+1 is income received at t+1 by owners of asset j at time t (the future value of the asset plus any dividends or other income). We adopt the standa ...

(as for FX options).

... • Derivative defined: – An executory contract (to be executed or performed later by both parties), the value of which depends on the changes in another measure of value (often referred to as the “underlying” item). ...

... • Derivative defined: – An executory contract (to be executed or performed later by both parties), the value of which depends on the changes in another measure of value (often referred to as the “underlying” item). ...

Illusions of Precision, Completeness and Control

... concentrating on what I call “conventional” investing that emphasizes portfolios that are simple, transparent and focused. This approach includes limiting investment to asset classes such as global equities and investment grade fixed income (with an addition of some private investments such as real ...

... concentrating on what I call “conventional” investing that emphasizes portfolios that are simple, transparent and focused. This approach includes limiting investment to asset classes such as global equities and investment grade fixed income (with an addition of some private investments such as real ...

David Aranzabal

... Time flexibility is a great advantage for people with various schedules and allows for adaptation to everyone's day ...

... Time flexibility is a great advantage for people with various schedules and allows for adaptation to everyone's day ...

Economy tanking amidst Fed hot air prior to rate decision

... growth at a 30-month low, an intensifying recession signal (sources: BLS, BEA). Industrial production was down by 1.2% year-over-year in August and 1.3% below the pre-2007 recession peak; the US manufacturing sector has seen four consecutive quarters of contraction; this is unprecedented outside o ...

... growth at a 30-month low, an intensifying recession signal (sources: BLS, BEA). Industrial production was down by 1.2% year-over-year in August and 1.3% below the pre-2007 recession peak; the US manufacturing sector has seen four consecutive quarters of contraction; this is unprecedented outside o ...

CIS September 2011 Exam Diet Examination Paper 2.1:

... enterprise under conditions which are potentially unfavourable. B. Cash. C. A contractual right to exchange financial instruments with another company under conditions that are potentially favourable. D. A contractual right to receive cash or another financial instrument from another enterprise. ...

... enterprise under conditions which are potentially unfavourable. B. Cash. C. A contractual right to exchange financial instruments with another company under conditions that are potentially favourable. D. A contractual right to receive cash or another financial instrument from another enterprise. ...

Alternative ways of SME financing and a credit risk appropriate

... group companies bounded by mutual guarantees. Typical representative of this approach is European Association of Mutual Guarantee Societies (AECM). For example there are so called “Confidi” doing this business in Italy. Venture capital providing sources namely to fast growing innovative projects. Th ...

... group companies bounded by mutual guarantees. Typical representative of this approach is European Association of Mutual Guarantee Societies (AECM). For example there are so called “Confidi” doing this business in Italy. Venture capital providing sources namely to fast growing innovative projects. Th ...

FBLA PERSONAL FINANCE Competency - FBLA-PBL

... Evaluate how decisions made at one stage of your life can affect your options at other stages. Find and evaluate financial information from a variety of sources. Identify major consumer protection laws. Make financial decisions by systematically considering alternatives and consequences. Develop com ...

... Evaluate how decisions made at one stage of your life can affect your options at other stages. Find and evaluate financial information from a variety of sources. Identify major consumer protection laws. Make financial decisions by systematically considering alternatives and consequences. Develop com ...

COLOMBIA—CB Hikes 25bps As Tightening Cycle Continues

... domestic demand than expected. Net exports have subtracted from growth. On the supply side, industrial production showed a positive trend and indicators of offices and cement production suggest a favorable dynamics of construction…With this information and with the new data of economic activity in O ...

... domestic demand than expected. Net exports have subtracted from growth. On the supply side, industrial production showed a positive trend and indicators of offices and cement production suggest a favorable dynamics of construction…With this information and with the new data of economic activity in O ...

Money, Liquidity

... • The liquidity of an asset refers to how easy it is to trade it or convert it into money, by selling it, borrowing against it, etc. Liquid assets should have low transaction costs a predictable value, thick markets, and come in standard form. And it should be easy to buy or sell them without having ...

... • The liquidity of an asset refers to how easy it is to trade it or convert it into money, by selling it, borrowing against it, etc. Liquid assets should have low transaction costs a predictable value, thick markets, and come in standard form. And it should be easy to buy or sell them without having ...

Jeremy Siegel, Rob Arnott and Other Experts Forecast Equity Returns

... chicken – are underinvested in equities, if these ERP projections are to be believed. 5 These investors have over-weighted illiquid assets, hedge funds, and perhaps bonds because they have implicitly presumed that the horrible equity returns of the last decade will repeat themselves forever. An equi ...

... chicken – are underinvested in equities, if these ERP projections are to be believed. 5 These investors have over-weighted illiquid assets, hedge funds, and perhaps bonds because they have implicitly presumed that the horrible equity returns of the last decade will repeat themselves forever. An equi ...

The Relationship between Firm Sizes and Stock Returns of Service

... partially to the risk premium as big companies are safer for investment (Mossin, 1966). However, several assumptions have been made in this theory (e.g., every investor will include risk free and risky assets in their portfolio; costs of lending and borrowing are risk-free rates; all investors hold ...

... partially to the risk premium as big companies are safer for investment (Mossin, 1966). However, several assumptions have been made in this theory (e.g., every investor will include risk free and risky assets in their portfolio; costs of lending and borrowing are risk-free rates; all investors hold ...

The Invisible Hand and the Banking Trade

... namely by the use of probability distributions associated with extreme events -- fattailed distributions with ‘tail risk’, consistent with the very rare occurrence of disastrously bad returns. They show that, by using derivatives in a setting of asymmetric information, such downside risk in investme ...

... namely by the use of probability distributions associated with extreme events -- fattailed distributions with ‘tail risk’, consistent with the very rare occurrence of disastrously bad returns. They show that, by using derivatives in a setting of asymmetric information, such downside risk in investme ...