Whither Delaware? Limited Commitment and the Financial Value of

... to the board’s greater insulation from disciplining market forces. Nevertheless, the positive effect on firm value we document in the time series for firms reincorporating into a Managerial State seems to indicate that such an increase in moral hazard is more than compensated by the benefits accruin ...

... to the board’s greater insulation from disciplining market forces. Nevertheless, the positive effect on firm value we document in the time series for firms reincorporating into a Managerial State seems to indicate that such an increase in moral hazard is more than compensated by the benefits accruin ...

prospectus

... materially from our expectations. Accordingly, you should not place undue reliance on the forward-looking statements contained or incorporated by reference in this prospectus. Such forward-looking statements speak only as of the date on which the statements were made. We undertake no obligation to u ...

... materially from our expectations. Accordingly, you should not place undue reliance on the forward-looking statements contained or incorporated by reference in this prospectus. Such forward-looking statements speak only as of the date on which the statements were made. We undertake no obligation to u ...

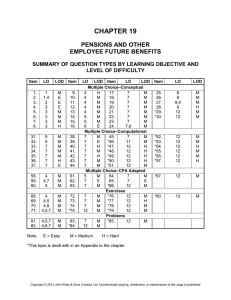

chapter study objectives

... obligation, and prepare a continuity schedule of transactions and events that change its balance. The employer’s benefit obligation is the actuarial present value of the benefits that have been earned by employees for services they have provided up to the date of the statement of financial position. ...

... obligation, and prepare a continuity schedule of transactions and events that change its balance. The employer’s benefit obligation is the actuarial present value of the benefits that have been earned by employees for services they have provided up to the date of the statement of financial position. ...

Risky Value

... that controlling for ex post realizations of country level earnings growth subsumes the ability of B/P to explain country level returns, as would be expected if B/P is capturing unbiased expectations of future earnings growth (see e.g., Fama, 1990). Expected returns are attributable to expectations ...

... that controlling for ex post realizations of country level earnings growth subsumes the ability of B/P to explain country level returns, as would be expected if B/P is capturing unbiased expectations of future earnings growth (see e.g., Fama, 1990). Expected returns are attributable to expectations ...

citigroup`s 2008 annual report on form 10-k

... Citigroup expenses increased $1.1 billion, or 9%, year-overyear to $12.9 billion. Excluding the impact of the UK bonus tax of approximately $400 million in the second quarter of 2010, expenses increased by nearly $1.5 billion, or 13%, yearover-year. Approximately one-third of this 13% increase resul ...

... Citigroup expenses increased $1.1 billion, or 9%, year-overyear to $12.9 billion. Excluding the impact of the UK bonus tax of approximately $400 million in the second quarter of 2010, expenses increased by nearly $1.5 billion, or 13%, yearover-year. Approximately one-third of this 13% increase resul ...

UNITED STATES SECURITIES AND EXCHANGE

... Our audited consolidated financial statements as of and for the years ended December 31, 2016, 2015 and 2014 and the corresponding notes, which are included under "Item 18. Financial Statements" of this annual report, were prepared in accordance with International Financial Reporting Standards (IFRS ...

... Our audited consolidated financial statements as of and for the years ended December 31, 2016, 2015 and 2014 and the corresponding notes, which are included under "Item 18. Financial Statements" of this annual report, were prepared in accordance with International Financial Reporting Standards (IFRS ...

Form 8-K CURRENT REPORT Pursuant to Section 13 or 15(d)

... We are a fully integrated, self-managed real estate investment trust specializing in the acquisition, ownership, management, development, and disposition of primarily high-quality Class A office buildings located in major U.S. office markets and leased primarily to high-credit-quality tenants. We op ...

... We are a fully integrated, self-managed real estate investment trust specializing in the acquisition, ownership, management, development, and disposition of primarily high-quality Class A office buildings located in major U.S. office markets and leased primarily to high-credit-quality tenants. We op ...

Moving from private to public ownership: Selling out to

... and the resulting trade-offs. In an IPO, owners sell off a portion of their stake in the private firm. The dilution effects of an IPO are relatively minimal since the average IPO in our sample leaves the original owners with approximately half of the post-transaction ownership of the firm. However, ...

... and the resulting trade-offs. In an IPO, owners sell off a portion of their stake in the private firm. The dilution effects of an IPO are relatively minimal since the average IPO in our sample leaves the original owners with approximately half of the post-transaction ownership of the firm. However, ...

united states securities and exchange commission ally

... For consumers, we provide retail automotive financing for new and used vehicles and leasing for new vehicles. In the United States, retail financing for the purchase of vehicles takes the form of installment sales financing. During 2013, we originated a total of 1.4 million automotive loans and leas ...

... For consumers, we provide retail automotive financing for new and used vehicles and leasing for new vehicles. In the United States, retail financing for the purchase of vehicles takes the form of installment sales financing. During 2013, we originated a total of 1.4 million automotive loans and leas ...

Key words: Consumption, investment, growth

... equations (11) to (14); scenarios I and II compare role of depreciation, scenarios I-IV demonstrate the role of productivity of capital. The scenarios IV-VI illustrate distortions due to intermediation costs as presented in equations (19) to (22) and scenarios VII to IX show impact of technical prog ...

... equations (11) to (14); scenarios I and II compare role of depreciation, scenarios I-IV demonstrate the role of productivity of capital. The scenarios IV-VI illustrate distortions due to intermediation costs as presented in equations (19) to (22) and scenarios VII to IX show impact of technical prog ...

Uncertainty and consumer durables adjustment

... on adjustment taking place, however, it is not expected to influence the size of durables stock adjustment, which should be based on forward-looking considerations and depends on uncertainty, adjustment costs and other characteristics, rather than on past history. Thus, an infrequent-adjustment pers ...

... on adjustment taking place, however, it is not expected to influence the size of durables stock adjustment, which should be based on forward-looking considerations and depends on uncertainty, adjustment costs and other characteristics, rather than on past history. Thus, an infrequent-adjustment pers ...

035_DP52 Risk Aversion, Financial Development and Economic

... Being risk averse, households value protection against risk. Because of that, households might decide to engage in financial transactions even when the return they get is lower than the expected return they would obtain under financial autarky, as long as by doing so they are able to reduce their expo ...

... Being risk averse, households value protection against risk. Because of that, households might decide to engage in financial transactions even when the return they get is lower than the expected return they would obtain under financial autarky, as long as by doing so they are able to reduce their expo ...

Are Dividend Changes a Sign of Firm Maturity?

... bound of 12.5% ensures that we include only economically significant dividend changes and the upper bound of 500% eliminates outliers. In addition, eliminating small dividend changes would also minimize problems arising from mis-specification in the model of expected dividends since large dividend c ...

... bound of 12.5% ensures that we include only economically significant dividend changes and the upper bound of 500% eliminates outliers. In addition, eliminating small dividend changes would also minimize problems arising from mis-specification in the model of expected dividends since large dividend c ...

sukuk structures

... however the lack of a globally unified approach means that certain Western-style debt products are more amenable to being considered Shariah compliant in certain parts of the Islamic world. Broadly, Islamic finance involves three key principles with which all sukuk must comply: I. ...

... however the lack of a globally unified approach means that certain Western-style debt products are more amenable to being considered Shariah compliant in certain parts of the Islamic world. Broadly, Islamic finance involves three key principles with which all sukuk must comply: I. ...

Annual Report 2014 - British American Tobacco

... Report contain forward-looking statements that are subject to risk factors associated with, among other things, the economic and business circumstances occurring from time to time in the countries and markets in which the Group operates. It is believed that the expectations reflected in these statem ...

... Report contain forward-looking statements that are subject to risk factors associated with, among other things, the economic and business circumstances occurring from time to time in the countries and markets in which the Group operates. It is believed that the expectations reflected in these statem ...

Rating Symbols and Definitions

... (sf ) to all structured finance ratings.3 The addition of (sf ) to structured finance ratings should eliminate any presumption that such ratings and fundamental ratings at the same letter grade level will behave the same. The (sf ) indicator for structured finance security ratings indicates that oth ...

... (sf ) to all structured finance ratings.3 The addition of (sf ) to structured finance ratings should eliminate any presumption that such ratings and fundamental ratings at the same letter grade level will behave the same. The (sf ) indicator for structured finance security ratings indicates that oth ...

ESRB 2014 - European Systemic Risk Board

... suggest that the CCB should be reduced or fully released. For one particular variable, the deviation of the ratio of credit to gross domestic product (GDP) from its long-term trend (credit-to-GDP gap), the analysis also focused on how to map specific levels of the credit-to-GDP gap into indicative s ...

... suggest that the CCB should be reduced or fully released. For one particular variable, the deviation of the ratio of credit to gross domestic product (GDP) from its long-term trend (credit-to-GDP gap), the analysis also focused on how to map specific levels of the credit-to-GDP gap into indicative s ...

ISE T7 Release 5.0 Market Model.

... In the trading model continuous trading with auctions members may act as Market Makers increasing a security’s liquidity by simultaneously offering to buy and sell, thereby improving the price quality of supported securities. Only traders using the M account can enter quotes. Quotes are entered as p ...

... In the trading model continuous trading with auctions members may act as Market Makers increasing a security’s liquidity by simultaneously offering to buy and sell, thereby improving the price quality of supported securities. Only traders using the M account can enter quotes. Quotes are entered as p ...

The Hazard Rates of First and Second Default

... compared with borrowers who did not experience a job loss during the first economic decline. This result would match a waiting-time interpretation: the chance of any one borrower experiencing a negative trigger event is a random variable which is a function of time since the last trigger event. The ...

... compared with borrowers who did not experience a job loss during the first economic decline. This result would match a waiting-time interpretation: the chance of any one borrower experiencing a negative trigger event is a random variable which is a function of time since the last trigger event. The ...

The Initial Public Offering Handbook

... An initial public offering is the realization of a dream for many entrepreneurs, executives, board members and stockholders, a singular achievement that demonstrates their success in building a strong business and creating value for owners, employees and customers. However, an initial public offerin ...

... An initial public offering is the realization of a dream for many entrepreneurs, executives, board members and stockholders, a singular achievement that demonstrates their success in building a strong business and creating value for owners, employees and customers. However, an initial public offerin ...

2000 Annual Report PDF Version

... two objectives; the first will require some luck. It’s appropriate here to thank two groups that made my job both easy and fun last year just as they do every year. First, our operating managers continue to run their businesses in splendid fashion, which allows me to spend my time allocating capit ...

... two objectives; the first will require some luck. It’s appropriate here to thank two groups that made my job both easy and fun last year just as they do every year. First, our operating managers continue to run their businesses in splendid fashion, which allows me to spend my time allocating capit ...