HD VIEW 360 INC.

... The Company follows the provisions of ASC 740-10, Accounting for Uncertain Income Tax Positions. When tax returns are filed, it is highly certain that some positions taken would be sustained upon examination by the taxing authorities, while others are subject to uncertainty about the merits of the p ...

... The Company follows the provisions of ASC 740-10, Accounting for Uncertain Income Tax Positions. When tax returns are filed, it is highly certain that some positions taken would be sustained upon examination by the taxing authorities, while others are subject to uncertainty about the merits of the p ...

Predicting The Financial Failure Of Retail Companies In The United

... sample that did not involve pair-matching, and he found that the four statistically significant factors for identifying the probability of failure are the size of the company, measures of financial structure, measures of performance, and measures of current liquidity. Ohlson’s paper appears to have ...

... sample that did not involve pair-matching, and he found that the four statistically significant factors for identifying the probability of failure are the size of the company, measures of financial structure, measures of performance, and measures of current liquidity. Ohlson’s paper appears to have ...

Liquidity Crises - Business Review, Second Quarter 2008

... In this example, prices are below their fair value because of binding collateral constraints. However, another reason that prices may fall in a crisis is that one side of the market has more information than the other, and thus, asset sales may be interpreted as negative information about fundamenta ...

... In this example, prices are below their fair value because of binding collateral constraints. However, another reason that prices may fall in a crisis is that one side of the market has more information than the other, and thus, asset sales may be interpreted as negative information about fundamenta ...

Wednesday, July 26, 2006

... as one of the easier ways for retail investors to build market positions on the cheap. And as hedge-fund assets ballooned after 2000, ETFs increasingly were used by these opportunistic pros to buy or short the market on the quick. Yet, as the ETF market has matured, these funds' impact has nowhere b ...

... as one of the easier ways for retail investors to build market positions on the cheap. And as hedge-fund assets ballooned after 2000, ETFs increasingly were used by these opportunistic pros to buy or short the market on the quick. Yet, as the ETF market has matured, these funds' impact has nowhere b ...

Why Do Investment Banks Continue To Fail? By: Caroline Gieryn

... were flooding bond markets. The large demand for these war bonds, caused by an outpouring of patriotism, forced up yields on all other forms of bonds including municipal bonds. In other words, the popularity of war bonds came at the expense of other bonds, meaning Caldwell entered the municipal mark ...

... were flooding bond markets. The large demand for these war bonds, caused by an outpouring of patriotism, forced up yields on all other forms of bonds including municipal bonds. In other words, the popularity of war bonds came at the expense of other bonds, meaning Caldwell entered the municipal mark ...

An Empirical Assessment of Models of the Value Premium*

... B/M) tend to earn higher subsequent returns than stocks with low B/M. However, researchers disagree on the economic forces behind the value premium. In earlier studies, the debate focuses on whether this value premium reflects compensation for systematic risk or mispricing based on cognitive biases. ...

... B/M) tend to earn higher subsequent returns than stocks with low B/M. However, researchers disagree on the economic forces behind the value premium. In earlier studies, the debate focuses on whether this value premium reflects compensation for systematic risk or mispricing based on cognitive biases. ...

OSFI`s approach can be defined as: Reliance based

... • Regulation: enhances the financial system’s safety and soundness by evaluating system-wide risks and promoting sound business and financial practices through guidelines, policy and recommendations. • Supervision: identifies institution-specific and systemic risks and trends, and intervenes in a ti ...

... • Regulation: enhances the financial system’s safety and soundness by evaluating system-wide risks and promoting sound business and financial practices through guidelines, policy and recommendations. • Supervision: identifies institution-specific and systemic risks and trends, and intervenes in a ti ...

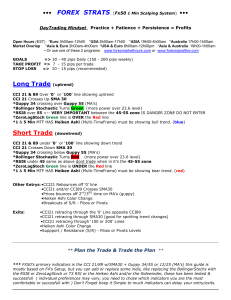

Long Trade (uptrend) Short Trade (downtrend)

... *** FX50’s primary indicators is the CCI 21/89 w/SMA30 + Guppy 34/55 or 12/25 (MA’s) this guide is mostly based on F4’s Setup, but you can add or replace some indis, like replacing the BollingerStochs with the RSI8 or ZeroLagStoch or T3 RSI or the Heiken Ashi and/or the Sidewinder, these has been te ...

... *** FX50’s primary indicators is the CCI 21/89 w/SMA30 + Guppy 34/55 or 12/25 (MA’s) this guide is mostly based on F4’s Setup, but you can add or replace some indis, like replacing the BollingerStochs with the RSI8 or ZeroLagStoch or T3 RSI or the Heiken Ashi and/or the Sidewinder, these has been te ...

Interest Rates in Mexico The Role of Exchange Rate Expectations

... for expectations of exchange rate changes are linked (through a "g" function) to the implicit yield from the secondary market of Mexico's external debt. That is, it is postulated that domestic interest rates in Mexico are closely associated to the international perception of Mexico's creditworthines ...

... for expectations of exchange rate changes are linked (through a "g" function) to the implicit yield from the secondary market of Mexico's external debt. That is, it is postulated that domestic interest rates in Mexico are closely associated to the international perception of Mexico's creditworthines ...

Foreign Exchange Risk Management

... list is not exhaustive and is for guidance purposes only: a) Exchange rate risk (open position) This is the risk that the bank may suffer losses as a result of adverse exchange rate movements during a period in which it has an open position in a currency. Where the value of asset/inflow exposures in ...

... list is not exhaustive and is for guidance purposes only: a) Exchange rate risk (open position) This is the risk that the bank may suffer losses as a result of adverse exchange rate movements during a period in which it has an open position in a currency. Where the value of asset/inflow exposures in ...

T Has the Stock Market Become Too Narrow?

... confirm that the disparity of valuations reflected a similar dispersion of forecasts of companies’ earnings (Figure 5). When high price-earnings ratios reflect forecasts of rapidly growing earnings, and when low priceearnings ratios correspond to forecasts of earnings that grow more slowly, the dist ...

... confirm that the disparity of valuations reflected a similar dispersion of forecasts of companies’ earnings (Figure 5). When high price-earnings ratios reflect forecasts of rapidly growing earnings, and when low priceearnings ratios correspond to forecasts of earnings that grow more slowly, the dist ...

APRA Prudential Standard APS 330 Capital and Credit Risk

... Table 2: Main features of Regulatory Capital instruments Tier 1 ...

... Table 2: Main features of Regulatory Capital instruments Tier 1 ...

The determinants of government bond yield spreads in

... With the European Monetary Union (EMU), EU policymakers seemed to have achieved their goal of creating a standardized European public debt market. Indeed, euro-area governments have witnessed a considerable narrowing in their borrowing costs following the introduction of the single currency. However ...

... With the European Monetary Union (EMU), EU policymakers seemed to have achieved their goal of creating a standardized European public debt market. Indeed, euro-area governments have witnessed a considerable narrowing in their borrowing costs following the introduction of the single currency. However ...

Number Slumber Understanding Rating Agency Evals 8

... reflects a somewhat more conservative perspective taken by Fitch than in the past with respect to concentration risk as a monoline insurer. Given the reliance on a single market and low frequency/high severity nature of lawyers’ liability claims, Fitch ...

... reflects a somewhat more conservative perspective taken by Fitch than in the past with respect to concentration risk as a monoline insurer. Given the reliance on a single market and low frequency/high severity nature of lawyers’ liability claims, Fitch ...

Table of Contents - Duke University`s Fuqua School of Business

... because housing has not had as big a drag on economy as initially expected the increase in fuel prices and the housing market have not created a significant problem for businesses/consumers that is yet evident in the jobs data Goldilock effect is wearing off. Recovery from February 27 drop. Record M ...

... because housing has not had as big a drag on economy as initially expected the increase in fuel prices and the housing market have not created a significant problem for businesses/consumers that is yet evident in the jobs data Goldilock effect is wearing off. Recovery from February 27 drop. Record M ...

Striking the Right Balance? - Oxford Institute for Energy Studies

... Any combination of these factors can lead to a slowdown in the pace of reforms or even to their reversal, as indeed has been the case in many countries around the world. 3 An additional complexity is that policy decisions often cannot be entirely depoliticized, as they form part of the implicit soci ...

... Any combination of these factors can lead to a slowdown in the pace of reforms or even to their reversal, as indeed has been the case in many countries around the world. 3 An additional complexity is that policy decisions often cannot be entirely depoliticized, as they form part of the implicit soci ...

Moneysupermarket has a forecast dividend yield of over

... Moneysupermarket is on a forecast P/E ratio of 15X for 2014 which falls to 13.8X in 2015. For both years the forecast dividend yield is 4.2% and 4.7% respectively with the payouts covered 1.6X by earnings. The group is relatively diversified but can see fluctuating demand in its key business lines w ...

... Moneysupermarket is on a forecast P/E ratio of 15X for 2014 which falls to 13.8X in 2015. For both years the forecast dividend yield is 4.2% and 4.7% respectively with the payouts covered 1.6X by earnings. The group is relatively diversified but can see fluctuating demand in its key business lines w ...

i. the stable growth ddm: gordon growth model

... (Note: Since the costs of equity change each year, the present value has to be calculated using the cumulated cost of equity. Thus, in year 7, the present value of dividends is PV of year 7 dividend = $3.11 /{(1.1630)5 (1.1564) (1.1498)} = $1.10 The terminal price at the end of year 10 can be calcul ...

... (Note: Since the costs of equity change each year, the present value has to be calculated using the cumulated cost of equity. Thus, in year 7, the present value of dividends is PV of year 7 dividend = $3.11 /{(1.1630)5 (1.1564) (1.1498)} = $1.10 The terminal price at the end of year 10 can be calcul ...