Chapter 03 PowerPoint

... Ratio analysis • Allows for better comparison over time or between companies • Used both internally and externally • For each ratio, several questions arise: – How is it computed ? – What is the ratio trying to measure and why is that information important? – What is the unit of measurement? – What ...

... Ratio analysis • Allows for better comparison over time or between companies • Used both internally and externally • For each ratio, several questions arise: – How is it computed ? – What is the ratio trying to measure and why is that information important? – What is the unit of measurement? – What ...

05Rates

... pressures can lead to variation of rate between loci and over time, as evidenced by differential rates of the three codon positions [9,10], the slower evolutionary rate of highly expressed genes [11], and the effect of tertiary structure on patterns of sequence conservation [12]. Selection also affects ...

... pressures can lead to variation of rate between loci and over time, as evidenced by differential rates of the three codon positions [9,10], the slower evolutionary rate of highly expressed genes [11], and the effect of tertiary structure on patterns of sequence conservation [12]. Selection also affects ...

law, share price accuracy and economic performance: the

... Mandatory disclosure’s effect on efficiency has also been a matter of intense debate among the economics oriented members of the legal academy. As the discussion below indicates, the two questions addressed empirically in this Article – whether an increase in share price accuracy enhances the perfor ...

... Mandatory disclosure’s effect on efficiency has also been a matter of intense debate among the economics oriented members of the legal academy. As the discussion below indicates, the two questions addressed empirically in this Article – whether an increase in share price accuracy enhances the perfor ...

A Causal Framework for Credit Default Theory

... Our definition of credit default for a secured loan is consistent with Moody’s definition19 mentioned above, as it includes the notion of an expected loss. In this definition, neither delinquency nor insolvency alone is sufficient to cause a credit default. Both delinquency and insolvency are neces ...

... Our definition of credit default for a secured loan is consistent with Moody’s definition19 mentioned above, as it includes the notion of an expected loss. In this definition, neither delinquency nor insolvency alone is sufficient to cause a credit default. Both delinquency and insolvency are neces ...

Volume 74 No. 4, December 2011 Contents

... of wealth (and consumption possibilities) than on the overall level. The relatively old, who might have been about to downsize, benefit from the windfall, and can spend more than otherwise over the rest of their lives. But the relatively young, coming into the housing market, have to pay the higher ...

... of wealth (and consumption possibilities) than on the overall level. The relatively old, who might have been about to downsize, benefit from the windfall, and can spend more than otherwise over the rest of their lives. But the relatively young, coming into the housing market, have to pay the higher ...

Competition In the Swedish Food Retail Industry

... over 85 percent of the national market in 2010 8 . Among these three, ICA is undisputedly largest with a market share of almost 50 percent in Sweden as well as substantial market shares in Norway and the Baltic countries. ICA and Axfood organize their stores according to franchising models, thus eac ...

... over 85 percent of the national market in 2010 8 . Among these three, ICA is undisputedly largest with a market share of almost 50 percent in Sweden as well as substantial market shares in Norway and the Baltic countries. ICA and Axfood organize their stores according to franchising models, thus eac ...

Lally - The dividend growth model

... over the next 10 years (8.98%) by rerunning the example shown above with the AER’s market cost of equity for the next 10 years of 8.98% and use the DGM to estimate the market cost of equity capital in the subsequent years (CEG, 2012b, paras 152-160). In addition, CEG uses an expected nominal dividen ...

... over the next 10 years (8.98%) by rerunning the example shown above with the AER’s market cost of equity for the next 10 years of 8.98% and use the DGM to estimate the market cost of equity capital in the subsequent years (CEG, 2012b, paras 152-160). In addition, CEG uses an expected nominal dividen ...

A Policy Model to Analyze Macroprudential Regulations and Monetary Policy 2014-6

... closely linked, there is also a better appreciation that monetary, …scal and macroprudential policies may need to be used jointly to ensure both macroeconomic and …nancial stability. As a result, there is a need to better understand how these di¤erent policies interact, what trade-o¤s they give rise ...

... closely linked, there is also a better appreciation that monetary, …scal and macroprudential policies may need to be used jointly to ensure both macroeconomic and …nancial stability. As a result, there is a need to better understand how these di¤erent policies interact, what trade-o¤s they give rise ...

Market-specific and Currency-specific Risk during the

... euro, Japanese yen, New Zealand dollar, Pound sterling, Swedish krona, Swiss franc, and US dollar. The following analysis uses LIBOR denominated either in the US dollar or the Japanese yen. Because the US dollar traded on the offshore market is referred to as the "Eurodollar” and the Japanese Yen tr ...

... euro, Japanese yen, New Zealand dollar, Pound sterling, Swedish krona, Swiss franc, and US dollar. The following analysis uses LIBOR denominated either in the US dollar or the Japanese yen. Because the US dollar traded on the offshore market is referred to as the "Eurodollar” and the Japanese Yen tr ...

Maximizing shareholder value: a new ideology for corporate

... enable them to dispense with shop- oor skills so that ‘hourly’ production workers could not exercise control over the conditions of work and pay. US companies also tended to favour suppliers and distributors who would provide goods and services at the lowest price today, even if it meant that they ...

... enable them to dispense with shop- oor skills so that ‘hourly’ production workers could not exercise control over the conditions of work and pay. US companies also tended to favour suppliers and distributors who would provide goods and services at the lowest price today, even if it meant that they ...

An Empirical Analysis of the Profitability of Technical Analysis

... TA has been put to extensive academic scrutiny and critique regarding TA and its principles has broadly been brought forth, not least by Eugene Fama, the man who coined the efficient market hypothesis. Not only do the principles contradict the EMH, but they also put the meanvariance framework into q ...

... TA has been put to extensive academic scrutiny and critique regarding TA and its principles has broadly been brought forth, not least by Eugene Fama, the man who coined the efficient market hypothesis. Not only do the principles contradict the EMH, but they also put the meanvariance framework into q ...

Thomson Learning - Higher Education

... Over time, short-run monopoly profits attract competition, and other firms enter the industry. This competitive aspect of monopolistic competition is seen most forcefully in the long run. As competitors emerge to offer close but imperfect substitutes, the market share and profits of the initial inno ...

... Over time, short-run monopoly profits attract competition, and other firms enter the industry. This competitive aspect of monopolistic competition is seen most forcefully in the long run. As competitors emerge to offer close but imperfect substitutes, the market share and profits of the initial inno ...

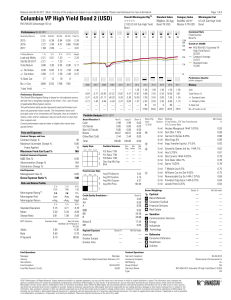

Columbia VP High Yield Bond 2 (USD)

... However, despite the fact that such a relationship may exist, the information displayed for those products will not be influenced as they are objective measures and/or are derived by quantitative driven formulas (i.e., Morningstar Rating). For more information on these Morningstar relationships, ple ...

... However, despite the fact that such a relationship may exist, the information displayed for those products will not be influenced as they are objective measures and/or are derived by quantitative driven formulas (i.e., Morningstar Rating). For more information on these Morningstar relationships, ple ...

Revenue Strategy - Shire of Esperance

... The Shire of Esperance commenced rating with two distinct systems of valuation on the 1 July 1994 with the introduction of the GRV system. Previous to that time all properties within the Shire were valued on the UV system. Since 1994 general rate increases have generally been applied equally to both ...

... The Shire of Esperance commenced rating with two distinct systems of valuation on the 1 July 1994 with the introduction of the GRV system. Previous to that time all properties within the Shire were valued on the UV system. Since 1994 general rate increases have generally been applied equally to both ...

LEYR rev2 - Law and Economics Yearly Review

... and difficult process that calls for specific skills. To devise a practical solution, information was gathered via a survey of 25 associated banks, their full collaboration being testimony to the concern this problem raises at the highest levels of management. The same survey was then implemented in ...

... and difficult process that calls for specific skills. To devise a practical solution, information was gathered via a survey of 25 associated banks, their full collaboration being testimony to the concern this problem raises at the highest levels of management. The same survey was then implemented in ...

This PDF is a selection from a published volume from... Economic Research

... these economies’ underdeveloped and closed financial markets are alleged to be insufficiently attractive enough to absorb the excess saving in the region, resulting in a “saving glut.” Clarida (2005a,b) argues that East Asian, particularly Chinese, financial markets are less sophisticated, deep, and o ...

... these economies’ underdeveloped and closed financial markets are alleged to be insufficiently attractive enough to absorb the excess saving in the region, resulting in a “saving glut.” Clarida (2005a,b) argues that East Asian, particularly Chinese, financial markets are less sophisticated, deep, and o ...

2014 Australian Financial Markets Report

... to rise, the experience on a market-bymarket basis has been disparate. Volumes in Overnight Index Swaps, for example, have increased nearly sixfold while we have seen turnover in the Bank Bill and Negotiable Certificates of Deposit markets halve. Figure 1 gives a summary of changes in turnover over ...

... to rise, the experience on a market-bymarket basis has been disparate. Volumes in Overnight Index Swaps, for example, have increased nearly sixfold while we have seen turnover in the Bank Bill and Negotiable Certificates of Deposit markets halve. Figure 1 gives a summary of changes in turnover over ...

a scandal or a scapegoat? - University of Nottingham

... and buy futures to protect against rising prices. If Ft+k > exp(Pt+k) then long hedgers are unlikely to hedge as they can buy in the spot market cheaper. As the Ft+k gets nearer to to exp(Pt+k) more long hedgers buy futures until they get to Ft+k ≤ exp(Pt+k). At this point there is ...

... and buy futures to protect against rising prices. If Ft+k > exp(Pt+k) then long hedgers are unlikely to hedge as they can buy in the spot market cheaper. As the Ft+k gets nearer to to exp(Pt+k) more long hedgers buy futures until they get to Ft+k ≤ exp(Pt+k). At this point there is ...

Technical Analysis in Financial Markets Griffioen, GAW

... As long as financial markets have existed, people have tried to forecast them, in the hope that good forecasts would bring them great fortunes. In financial practice it is not the question whether it is possible to forecast, but how the future path of a financial time series can be forecasted. In ac ...

... As long as financial markets have existed, people have tried to forecast them, in the hope that good forecasts would bring them great fortunes. In financial practice it is not the question whether it is possible to forecast, but how the future path of a financial time series can be forecasted. In ac ...