The Impact of Prices on Takeovers - Wharton Finance

... These results cast doubt on the received wisdom that market valuations create a takeover threat that forces managers to improve firm performance. We argue that there is a fundamental challenge to finding a relation between market prices and takeover activity in the data. While markets may exhibit a ...

... These results cast doubt on the received wisdom that market valuations create a takeover threat that forces managers to improve firm performance. We argue that there is a fundamental challenge to finding a relation between market prices and takeover activity in the data. While markets may exhibit a ...

In The Vanguard Core Edition Summer 2012

... or good. Bond prices would fall, but holders of money market funds and short-term bond funds would see their income go up fairly quickly, and yields of all bond funds would rise. If you’re a longer-term bond fund investor, the immediate pain may eventually subside if your time horizon matches or exc ...

... or good. Bond prices would fall, but holders of money market funds and short-term bond funds would see their income go up fairly quickly, and yields of all bond funds would rise. If you’re a longer-term bond fund investor, the immediate pain may eventually subside if your time horizon matches or exc ...

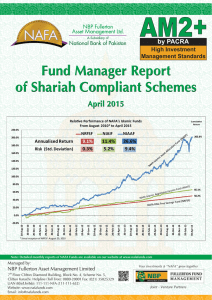

Islamic FMR- April 2015_(Complete)

... falling T-bill and PIB yields. More precisely, the money market is expecting a rate cut of 100 bps as reflected in around 70 to 80 bps fall in the long term T-bills and PIB yields. In the three T-Bills auctions during the month, MoF accepted Rs.498 billion (realized amount) against the target of Rs. ...

... falling T-bill and PIB yields. More precisely, the money market is expecting a rate cut of 100 bps as reflected in around 70 to 80 bps fall in the long term T-bills and PIB yields. In the three T-Bills auctions during the month, MoF accepted Rs.498 billion (realized amount) against the target of Rs. ...

International Interbank Borrowing During the Global Crisis

... information and creditors can reliably distinguish between sound and unsound banks. ...

... information and creditors can reliably distinguish between sound and unsound banks. ...

Chapter 4 "Foreign Exchange Markets and Rates of Return"

... The foreign exchange market (Forex) is not a market like the New York Stock Exchange, where daily trades of stock are conducted in a central location. Instead, the Forex refers to the activities of major international banks that engage in currency trading. These banks act as intermediaries between t ...

... The foreign exchange market (Forex) is not a market like the New York Stock Exchange, where daily trades of stock are conducted in a central location. Instead, the Forex refers to the activities of major international banks that engage in currency trading. These banks act as intermediaries between t ...

New York 2008

... is going through the most wrenching crises since World War II.” Soros had a similar comment and now of course in May (which I think is pretty close to April), they are tempering their views because recent economic data suggested that inflation might not be so bad, retail sales are okay, etc. Persona ...

... is going through the most wrenching crises since World War II.” Soros had a similar comment and now of course in May (which I think is pretty close to April), they are tempering their views because recent economic data suggested that inflation might not be so bad, retail sales are okay, etc. Persona ...

DOC - Investor Relations

... notes, the terms “Company,” “we,” “us,” or “our” refer to Gartner, Inc. and its consolidated subsidiaries. These interim condensed consolidated financial statements have been prepared in accordance with generally accepted accounting principles (“GAAP”) in the United States of America, as defined in ...

... notes, the terms “Company,” “we,” “us,” or “our” refer to Gartner, Inc. and its consolidated subsidiaries. These interim condensed consolidated financial statements have been prepared in accordance with generally accepted accounting principles (“GAAP”) in the United States of America, as defined in ...

On over Diversification in Operation Strategies

... competence [2]. Firstly, as the industry and the related products or services turn into the period of mature and recession gradually, the market become saturated and the profit margins begins to decline or even become negative, while the strategy of diversification is an important way to explore som ...

... competence [2]. Firstly, as the industry and the related products or services turn into the period of mature and recession gradually, the market become saturated and the profit margins begins to decline or even become negative, while the strategy of diversification is an important way to explore som ...

Does Housing Wealth Make Us Less Equal? The Role of

... Transaction costs induce an inaction region over which agents do not adjust their stock of the durable good in response to income shocks. The high frequency volatility of durable consumption, and the associated user cost of durables, declines. However, the low frequency movement of the durable good ...

... Transaction costs induce an inaction region over which agents do not adjust their stock of the durable good in response to income shocks. The high frequency volatility of durable consumption, and the associated user cost of durables, declines. However, the low frequency movement of the durable good ...

AVENTINE RENEWABLE ENERGY HOLDINGS INC

... shared in the earnings of the entity. The dilution from each of these instruments is calculated using the treasury stock method. Outstanding equity instruments that could potentially dilute basic loss per share in the future but were not included in the computation of diluted loss per share because ...

... shared in the earnings of the entity. The dilution from each of these instruments is calculated using the treasury stock method. Outstanding equity instruments that could potentially dilute basic loss per share in the future but were not included in the computation of diluted loss per share because ...

Three Types of Accounting Policies Reflected in Financial

... In our approach to demonstrate that a fact (in our case the image of the financial position) seen from different people looks different without being able to say that someone distorts the truth, we improvised three sets of accounting policies. First set of accounting policies will aim to maximize pr ...

... In our approach to demonstrate that a fact (in our case the image of the financial position) seen from different people looks different without being able to say that someone distorts the truth, we improvised three sets of accounting policies. First set of accounting policies will aim to maximize pr ...

A Beginners Guide to Investing in the Share Market

... major share market around the world has its own index to help investors rate how the market is faring, plus a number of sub indices such as the industrial index, a gold index or a resources index, that measure particular sectors. ...

... major share market around the world has its own index to help investors rate how the market is faring, plus a number of sub indices such as the industrial index, a gold index or a resources index, that measure particular sectors. ...

Here`s a hint!

... problem is numerically different, but requires the same skills as the original bop to solve. This means that the duplicated bop must not fundamentally alter the scaffolding (or problem-solving steps, visual aids, and hints) of the original bop. • Changing the values in the final answer box. If it is ...

... problem is numerically different, but requires the same skills as the original bop to solve. This means that the duplicated bop must not fundamentally alter the scaffolding (or problem-solving steps, visual aids, and hints) of the original bop. • Changing the values in the final answer box. If it is ...

SM_Ch06

... In theory, the materiality decision (how much precision is required in the audit opinion) is independent of audit risk decision ( how much assurance is required in the audit opinion). It is helpful for an auditor to keep these two considerations separate since the materiality decision focuses on wha ...

... In theory, the materiality decision (how much precision is required in the audit opinion) is independent of audit risk decision ( how much assurance is required in the audit opinion). It is helpful for an auditor to keep these two considerations separate since the materiality decision focuses on wha ...

NBER WORKING PAPER SERIES ENDOGENOUS FINANCIAL OPENNESS: EFFICIENCY AND POLITICAL ECONOMY CONSIDERATIONS

... income from exporting a natural resource in the first period, and faces an uncertain future horizon. In these circumstances, his second period consumption would be partly determined by the income from first period savings, conveniently put offshore, beyond the control of the future regime. Second pe ...

... income from exporting a natural resource in the first period, and faces an uncertain future horizon. In these circumstances, his second period consumption would be partly determined by the income from first period savings, conveniently put offshore, beyond the control of the future regime. Second pe ...

CLAREMONT McKENNA COLLEGE STOCK MARKET SENTIMENT

... Investor sentiment in the context of this study will be defined as the investment preferences that prevail throughout the market. Investors can become overly-enthusiastic or pessimistic about a particular investment vehicle beyond what market fundamentals should dictate, which can eventually affect ...

... Investor sentiment in the context of this study will be defined as the investment preferences that prevail throughout the market. Investors can become overly-enthusiastic or pessimistic about a particular investment vehicle beyond what market fundamentals should dictate, which can eventually affect ...

Room to Move: International Financial Markets - UNC

... move their holdings to a different investment market. Cross-border investments are impossible or, at best, expensive. But with high capital mobility and high asset liquidity immediate exit (or increases in risk premiums) is a credible threat. The ‘‘possibility for potential ows’’ changes the tenor ...

... move their holdings to a different investment market. Cross-border investments are impossible or, at best, expensive. But with high capital mobility and high asset liquidity immediate exit (or increases in risk premiums) is a credible threat. The ‘‘possibility for potential ows’’ changes the tenor ...

Concepts of Equity Method

... significant influence is accounted for using the fair-value method. When ownership grows to the point where . . . all accounts are restated so that the significant influence is established . . . investor’s financial statements appear as if the equity method had been applied from the date of the fi ...

... significant influence is accounted for using the fair-value method. When ownership grows to the point where . . . all accounts are restated so that the significant influence is established . . . investor’s financial statements appear as if the equity method had been applied from the date of the fi ...

Overview of IFRS

... 1. A lease is an agreement whereby the lessor conveys to the lessee in return for a payment or series of payments the right to use an asset for an agreed period of time. 2. A finance lease is a lease that transfers substantially all the risks and rewards incident to ownership of an asset. 3. An oper ...

... 1. A lease is an agreement whereby the lessor conveys to the lessee in return for a payment or series of payments the right to use an asset for an agreed period of time. 2. A finance lease is a lease that transfers substantially all the risks and rewards incident to ownership of an asset. 3. An oper ...

Selling Time - CSInvesting

... distant point in the future – since it removes the need to save the loan value out of disposable income. Consequently, the accumulation of debt has a time function. Debt essentially “buys time”, so borrowers are literally “long” time and short the currency/credit which they must return to the lender ...

... distant point in the future – since it removes the need to save the loan value out of disposable income. Consequently, the accumulation of debt has a time function. Debt essentially “buys time”, so borrowers are literally “long” time and short the currency/credit which they must return to the lender ...

The Valuation Effect of Listing Requirements: An Analysis

... counterparts in the US, Canadian regulators and exchanges have set minimal listing requirements so low that almost any firm can list via an IPO, even without revenues or earnings. One of the main Canadian stock markets, the TSX Venture (TSXV), describes itself as a “public venture market”. New firms ...

... counterparts in the US, Canadian regulators and exchanges have set minimal listing requirements so low that almost any firm can list via an IPO, even without revenues or earnings. One of the main Canadian stock markets, the TSX Venture (TSXV), describes itself as a “public venture market”. New firms ...