DOC - Europa EU

... interest on the loan. If the debtor goes bankrupt, the creditor simply cancels the obligation to sell back the collateral and sets off its value against the remaining debt (known as “netting”). This instrument has been developed in order to avoid cumbersome procedures or uncertainties involved in pl ...

... interest on the loan. If the debtor goes bankrupt, the creditor simply cancels the obligation to sell back the collateral and sets off its value against the remaining debt (known as “netting”). This instrument has been developed in order to avoid cumbersome procedures or uncertainties involved in pl ...

FL BlackRock Long Term (Aquila C) IE/XE

... G - Derivatives: Where a fund uses derivatives for investment purposes, there may be an increase in the risk and volatility of the fund. Some derivative investments also expose investors to counterparty or default risk where another party is unable to meets its obligations and pay what is due, which ...

... G - Derivatives: Where a fund uses derivatives for investment purposes, there may be an increase in the risk and volatility of the fund. Some derivative investments also expose investors to counterparty or default risk where another party is unable to meets its obligations and pay what is due, which ...

0.1 Front matter.PM

... much detail beyond that. Many critics denounce “speculation” as a waste of social resources, without making any connections between it and the supposedly more fundamental world of “production.” Sociologists who study power structures write portentously of “the banks,” but their evidence is often vag ...

... much detail beyond that. Many critics denounce “speculation” as a waste of social resources, without making any connections between it and the supposedly more fundamental world of “production.” Sociologists who study power structures write portentously of “the banks,” but their evidence is often vag ...

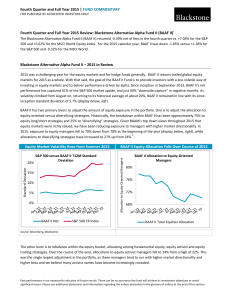

Fourth Quarter and Full Year 2015

... All returns include dividend and capital gain distributions. All investors should consider the investment objectives, risks, charges and expenses of the Fund carefully before investing. The prospectus contains this and other information about the Fund. Investors can obtain a prospectus from your fi ...

... All returns include dividend and capital gain distributions. All investors should consider the investment objectives, risks, charges and expenses of the Fund carefully before investing. The prospectus contains this and other information about the Fund. Investors can obtain a prospectus from your fi ...

Present Value of an Ordinary Annuity

... (FIND PERIODIC PAYMENTS) Sinking fund –a financial arrangement that sets aside regular periodic payments of a particular amount of money. Compound interest accumulates on these payments to a specific sum at a predetermined future date. Corporations use sinking funds to: discharge bonded inde ...

... (FIND PERIODIC PAYMENTS) Sinking fund –a financial arrangement that sets aside regular periodic payments of a particular amount of money. Compound interest accumulates on these payments to a specific sum at a predetermined future date. Corporations use sinking funds to: discharge bonded inde ...

The Transmission of Financial Stress and Monetary Policy

... of monetary policy to the real economy. I rely on the impulse response functions from the SVAR model developed in Tng (2013) to address these issues. The methodologies applied in this paper are premised on the use of Financial Stress Indices (FSIs) as a synthetic measure of financial stability. Usin ...

... of monetary policy to the real economy. I rely on the impulse response functions from the SVAR model developed in Tng (2013) to address these issues. The methodologies applied in this paper are premised on the use of Financial Stress Indices (FSIs) as a synthetic measure of financial stability. Usin ...

Calculate - LessonPaths

... This lesson will help you refresh your skills using exponents. Many financial equations rely on exponents to show compounding and growth. 1. A business acquaintance promises to deliver a $20 bill to you one year from today. How much should you be willing to pay today for this promise? 2. What is the ...

... This lesson will help you refresh your skills using exponents. Many financial equations rely on exponents to show compounding and growth. 1. A business acquaintance promises to deliver a $20 bill to you one year from today. How much should you be willing to pay today for this promise? 2. What is the ...

Equity Valuation Using Sales Multiples

... popular press as summary statistics for comparison of the market valuation of fundamental financial variables among a set of comparable firms. In practice, these multiples are widely used as a preliminary screening device to rank stocks. In cases where firm-specific detailed projections are difficul ...

... popular press as summary statistics for comparison of the market valuation of fundamental financial variables among a set of comparable firms. In practice, these multiples are widely used as a preliminary screening device to rank stocks. In cases where firm-specific detailed projections are difficul ...

Stock Exchange Markets for New Ventures

... According to Cassar (2004), how business start-ups are financed is one of the most fundamental questions of enterprise research. Conventional equity financing of new ventures is generally provided by specialized investors through informal and formal VC networks.2 Furthermore, these investors are ass ...

... According to Cassar (2004), how business start-ups are financed is one of the most fundamental questions of enterprise research. Conventional equity financing of new ventures is generally provided by specialized investors through informal and formal VC networks.2 Furthermore, these investors are ass ...

The Good, the Bad, and the Ugly: An inquiry into the causes and

... creating a boom and leading to an improvement in borrower net worth. During a boom, with an improved net worth, the agents are now able to finance the Bad projects. The credit is now redirected from the Good to the Bad. This change in the composition of credit and of investment at the peak of the bo ...

... creating a boom and leading to an improvement in borrower net worth. During a boom, with an improved net worth, the agents are now able to finance the Bad projects. The credit is now redirected from the Good to the Bad. This change in the composition of credit and of investment at the peak of the bo ...

NBER Reporter Economic Fluctuations and Growth Program Report

... income distribution to the forefront of economists’ and policymakers’ concerns. NBER researchers have explored a wide range of issues related to the sources and consequences of inequality at both the national and international levels. This research group is notable for its combination of empiricists ...

... income distribution to the forefront of economists’ and policymakers’ concerns. NBER researchers have explored a wide range of issues related to the sources and consequences of inequality at both the national and international levels. This research group is notable for its combination of empiricists ...

Dynamic Monitoring of Financial Intermediaries with Subordinated

... proceed in two stages. In the first stage, because we have information on the state of the stock and bond markets, we linearly filter the systematic component in equity and debt. The filtered series for equity and debt are proxies for the idiosyncratic component of each security. In the second stage ...

... proceed in two stages. In the first stage, because we have information on the state of the stock and bond markets, we linearly filter the systematic component in equity and debt. The filtered series for equity and debt are proxies for the idiosyncratic component of each security. In the second stage ...

Implied Market Price of Weather Risk - SFB 649

... get the explicite nature of non-arbitrage prices for temperature derivatives. In contrast to this work we find that Berlin Temperature is more normal in the sense that the driving stochastics are closer to a Wiener Process than their analysis for Stockholm. The estimate of the market price of weathe ...

... get the explicite nature of non-arbitrage prices for temperature derivatives. In contrast to this work we find that Berlin Temperature is more normal in the sense that the driving stochastics are closer to a Wiener Process than their analysis for Stockholm. The estimate of the market price of weathe ...

0000355811-15-000045 - Gentex Investor Relations

... Investments (continued) provide increased consistency in how fair value determinations are made under various existing accounting standards that permit, or in some cases, require estimates of fair-market value. This standard also expanded financial statement disclosure requirements about a company’s ...

... Investments (continued) provide increased consistency in how fair value determinations are made under various existing accounting standards that permit, or in some cases, require estimates of fair-market value. This standard also expanded financial statement disclosure requirements about a company’s ...

The Concept of Systemic Risk

... definitions by Eijffinger (2012) points out that systemic risk, regardless of in which form it materializes, causes a loss in confidence and increased uncertainty about the functioning of the financial system and its parts. The concept of systemic risk lies in the contagion effect and negative impa ...

... definitions by Eijffinger (2012) points out that systemic risk, regardless of in which form it materializes, causes a loss in confidence and increased uncertainty about the functioning of the financial system and its parts. The concept of systemic risk lies in the contagion effect and negative impa ...

Options on Fed funds futures and interst rate volatity

... by trading options. As a result, their model predicts that options introduction can attract more informed trading and increase informational efficiency of the primary market. This is also noted by Cao (1999) who shows that options listing leads to an increase in the amount of information collected o ...

... by trading options. As a result, their model predicts that options introduction can attract more informed trading and increase informational efficiency of the primary market. This is also noted by Cao (1999) who shows that options listing leads to an increase in the amount of information collected o ...

Determinant of Return on Assets and Return on Equity and Its

... relationship with share prices with 45.7% relationship. He also tried to identify the individual effect of RoA, RoE and RoI and succeeded in concluding that RoA and RoI has positive but low relationship with marketshare price but failed to get the relationship of RoE with market share price individu ...

... relationship with share prices with 45.7% relationship. He also tried to identify the individual effect of RoA, RoE and RoI and succeeded in concluding that RoA and RoI has positive but low relationship with marketshare price but failed to get the relationship of RoE with market share price individu ...

New Capital Rules for Community Banks

... Additional Tier 1 leverage ratios proposed (not adopted as part of final rule) for 8 largest US banking holding companies (considered as global systemically important banks by Basel), effective January 1, 2018 Minimum supplemental leverage ratio of 6 percent of Tier 1 capital for any insured ban ...

... Additional Tier 1 leverage ratios proposed (not adopted as part of final rule) for 8 largest US banking holding companies (considered as global systemically important banks by Basel), effective January 1, 2018 Minimum supplemental leverage ratio of 6 percent of Tier 1 capital for any insured ban ...

long-term portfolio guide - Responsible Investment Association

... unexpected? What can passive and active investment strategies deliver over the long term? How important is the initial asset allocation relative to investment selection and strategic shifts? How much diversification is “enough” in markets that are imperfect? Can we trace and profit from patterns in ...

... unexpected? What can passive and active investment strategies deliver over the long term? How important is the initial asset allocation relative to investment selection and strategic shifts? How much diversification is “enough” in markets that are imperfect? Can we trace and profit from patterns in ...

Consolidated financial statements

... 16.1 Income for the period – Equity holders of Air France-KLM per share ........................................ - 43 16.2 Non-dilutive instruments ................................................................................................................... - 43 16.3 Instruments issued after t ...

... 16.1 Income for the period – Equity holders of Air France-KLM per share ........................................ - 43 16.2 Non-dilutive instruments ................................................................................................................... - 43 16.3 Instruments issued after t ...