Annual Report - Wilson Asset Management

... the 2016 financial year. I would also like to welcome each of the 3,072 new shareholders who have joined us during the year. In 2016, the Company achieved strong growth, increasing pre-tax profit by 85.7% to $132.3 million. Over the 12 month period, the Company’s gross assets grew by $105.4 million ...

... the 2016 financial year. I would also like to welcome each of the 3,072 new shareholders who have joined us during the year. In 2016, the Company achieved strong growth, increasing pre-tax profit by 85.7% to $132.3 million. Over the 12 month period, the Company’s gross assets grew by $105.4 million ...

Will China Escape the Middle-income Trap? A Politico

... such a model offers three very attractive features: less pronounced recessions, focus on long-term investing and producing world champions. These considerations make him optimistic about the sustainability of China’s future growth, and even about the possibility that China can become a role model fo ...

... such a model offers three very attractive features: less pronounced recessions, focus on long-term investing and producing world champions. These considerations make him optimistic about the sustainability of China’s future growth, and even about the possibility that China can become a role model fo ...

Download attachment

... international transactions. One may argue that the KAOPEN index measures the extensity of capital controls because it may not directly refer to the stringency of restrictions on cross-border transactions, but to the existence of different types of restrictions. However, measuring the extensity of ca ...

... international transactions. One may argue that the KAOPEN index measures the extensity of capital controls because it may not directly refer to the stringency of restrictions on cross-border transactions, but to the existence of different types of restrictions. However, measuring the extensity of ca ...

The Financial, Economic, Social, and Political

... there remain concerns about structural issues, the lack of full recovery in some credit markets to stimulate investment, and deflationary pressures; ...

... there remain concerns about structural issues, the lack of full recovery in some credit markets to stimulate investment, and deflationary pressures; ...

"What is more important: agglomeration, firm

... a certain country. Such studies have been done for Italy by Basile (2002) and Bronzini (2004), for France by Crozet et al (2002), for Turkey by Erdal and Tatoglu (2002), for China by Campos and Kinoshita (2003) and Cheng (2006), for Germany by Buch (2003), for Japan by Head and Mayer (2004), for Rom ...

... a certain country. Such studies have been done for Italy by Basile (2002) and Bronzini (2004), for France by Crozet et al (2002), for Turkey by Erdal and Tatoglu (2002), for China by Campos and Kinoshita (2003) and Cheng (2006), for Germany by Buch (2003), for Japan by Head and Mayer (2004), for Rom ...

Where Did All The Borrowing Go? Philip R. Lane

... gross scale of international balance sheets (Lane and Milesi-Ferretti 2001, 2007a). Second, the increased number, size, and complexity of financial instruments and market participants engaged in cross-country transactions complicates significantly the statisticians’ task of monitoring external accou ...

... gross scale of international balance sheets (Lane and Milesi-Ferretti 2001, 2007a). Second, the increased number, size, and complexity of financial instruments and market participants engaged in cross-country transactions complicates significantly the statisticians’ task of monitoring external accou ...

Finding Your Way Around the Book`s Web Site

... in the long term, have performed better historically than bonds. In the U.S., stocks have yielded an average annual return of about 13 percent since 1926, compared to 6.1 percent for corporate bonds, 5.6 percent for long-term government bonds, and 3.5 percent for short-term T-bills. But, more likely ...

... in the long term, have performed better historically than bonds. In the U.S., stocks have yielded an average annual return of about 13 percent since 1926, compared to 6.1 percent for corporate bonds, 5.6 percent for long-term government bonds, and 3.5 percent for short-term T-bills. But, more likely ...

NRCS Pastureland Ecology - Agricultural and Resource Economics

... ensure you have certain mount of cash – a lump sum – to cover necessary expenses The MPP program quotes margins and premiums in per cwt terms Your IOFC margin will not be the ...

... ensure you have certain mount of cash – a lump sum – to cover necessary expenses The MPP program quotes margins and premiums in per cwt terms Your IOFC margin will not be the ...

View/Open

... cotton yarn and cotton cloth (cumulatively down by 9.86% as compared to last year) dragged overall exports as absence of China's stock piling policy and higher production of cotton in India kept Pakistani exports subdued due limiting its market. Receipt of GSP+ status provided slight support to valu ...

... cotton yarn and cotton cloth (cumulatively down by 9.86% as compared to last year) dragged overall exports as absence of China's stock piling policy and higher production of cotton in India kept Pakistani exports subdued due limiting its market. Receipt of GSP+ status provided slight support to valu ...

International Capital Flows and U.S. Interest Rates Francis E. Warnock

... estimates in our regressions, but because the flows are smaller, the overall impact is more muted. For example, had foreign official flows been zero over the last twelve months, long rates would currently be 60 basis points higher.5 Our results are robust to many alternative specifications. In robu ...

... estimates in our regressions, but because the flows are smaller, the overall impact is more muted. For example, had foreign official flows been zero over the last twelve months, long rates would currently be 60 basis points higher.5 Our results are robust to many alternative specifications. In robu ...

AEGON withstands market turmoil with continued capital

... increased pension and variable annuity deposits in the United States and continued strong third-party asset management inflows. Value of new business Compared with the third quarter 2010, the value of new business declined considerably to EUR 58 million, reflecting current market circumstances of lo ...

... increased pension and variable annuity deposits in the United States and continued strong third-party asset management inflows. Value of new business Compared with the third quarter 2010, the value of new business declined considerably to EUR 58 million, reflecting current market circumstances of lo ...

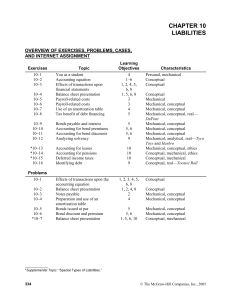

Internet Assignment

... investment horizon, should be concerned about the current relationships between the company’s liquid resources and its short-term obligations. 19. The return on assets represents the average return that a business earns from all of the capital. If this average rate is higher than the cost of borrowi ...

... investment horizon, should be concerned about the current relationships between the company’s liquid resources and its short-term obligations. 19. The return on assets represents the average return that a business earns from all of the capital. If this average rate is higher than the cost of borrowi ...

Free Full Text ( Final Version , 272kb )

... FDI are one of the the most significant phenomena in the era of globalization. Because of growing interdependence and fragmentation of economic activities, we may observe a boom in expanding production capacities all over the world as well as creation of firm networks which gradually lose their appe ...

... FDI are one of the the most significant phenomena in the era of globalization. Because of growing interdependence and fragmentation of economic activities, we may observe a boom in expanding production capacities all over the world as well as creation of firm networks which gradually lose their appe ...

This PDF is a selection from a published volume from... Bureau of Economic Research

... and liquidity crises arise when they become credit constrained themselves. In such liquidity crises, financial institutions’ ability to borrow against their securities plays a key role, as Bagehot points out. In the private markets, it can become virtually impossible to borrow against certain illiqu ...

... and liquidity crises arise when they become credit constrained themselves. In such liquidity crises, financial institutions’ ability to borrow against their securities plays a key role, as Bagehot points out. In the private markets, it can become virtually impossible to borrow against certain illiqu ...

GLOBAL PAYMENTS INC

... These unaudited consolidated financial statements include our accounts and those of our majority-owned subsidiaries, and all intercompany balances and transactions have been eliminated in consolidation. These unaudited consolidated financial statements have been prepared in accordance with accountin ...

... These unaudited consolidated financial statements include our accounts and those of our majority-owned subsidiaries, and all intercompany balances and transactions have been eliminated in consolidation. These unaudited consolidated financial statements have been prepared in accordance with accountin ...

Moving from private to public ownership: Selling out to

... and the resulting trade-offs. In an IPO, owners sell off a portion of their stake in the private firm. The dilution effects of an IPO are relatively minimal since the average IPO in our sample leaves the original owners with approximately half of the post-transaction ownership of the firm. However, ...

... and the resulting trade-offs. In an IPO, owners sell off a portion of their stake in the private firm. The dilution effects of an IPO are relatively minimal since the average IPO in our sample leaves the original owners with approximately half of the post-transaction ownership of the firm. However, ...

Blair, Theory of Firm

... To be sure, scholars have recognized and discussed the importance of firm-specific investments by employees for decades. Specialized knowledge and skills of employees are increasingly understood to be important factors that influence the structure and character of the employment relationship, and t ...

... To be sure, scholars have recognized and discussed the importance of firm-specific investments by employees for decades. Specialized knowledge and skills of employees are increasingly understood to be important factors that influence the structure and character of the employment relationship, and t ...

ACE HARDWARE CORPORATION 2015 Annual Report

... Receivables from retailers include amounts invoiced for the sale of merchandise, services and equipment used in the operation of retailers’ businesses. Notes Receivable The Company makes available to its retailers various lending programs whose terms exceed one year. The notes bear interest at vario ...

... Receivables from retailers include amounts invoiced for the sale of merchandise, services and equipment used in the operation of retailers’ businesses. Notes Receivable The Company makes available to its retailers various lending programs whose terms exceed one year. The notes bear interest at vario ...

global insight

... Despite a massive 50% reduction in exploration and development activity since autumn 2014, total U.S. oil production has continued to advance throughout much of this correction, with a leveling off appearing to take shape over the last five to six weeks. RBC Capital Markets forecasts U.S. oil produc ...

... Despite a massive 50% reduction in exploration and development activity since autumn 2014, total U.S. oil production has continued to advance throughout much of this correction, with a leveling off appearing to take shape over the last five to six weeks. RBC Capital Markets forecasts U.S. oil produc ...

Managing Interest Rate Risk: Duration GAP and Economic

... GAP examines various “time buckets” while Duration GAP represents the entire balance sheet. ...

... GAP examines various “time buckets” while Duration GAP represents the entire balance sheet. ...

State of the Economy and Prospects

... Transport and Communications, and its growth further declined in 2012-13. Activities in this sector, being forms of derived demand, tend to grow at a slower rate with the slowdown of economic activity in the industry and agriculture sectors. 1.5 Why has the economy slowed down so rapidly despite rec ...

... Transport and Communications, and its growth further declined in 2012-13. Activities in this sector, being forms of derived demand, tend to grow at a slower rate with the slowdown of economic activity in the industry and agriculture sectors. 1.5 Why has the economy slowed down so rapidly despite rec ...

pse09 van der Ploeg 9563581 en

... being paid for by borrowing ahead of the windfall and then by the interest from a SWF accumulated during the windfall. Section 3 analyses the best way to harness an anticipated windfall in capital-scarce developing countries which face an interest rate above the world interest rate. Full consumption ...

... being paid for by borrowing ahead of the windfall and then by the interest from a SWF accumulated during the windfall. Section 3 analyses the best way to harness an anticipated windfall in capital-scarce developing countries which face an interest rate above the world interest rate. Full consumption ...