preface - JustAnswer

... political risk such as government’s policies regarding technological sectors as well as data regulations.Internatioal politics also effects apple’s business because apple operates worldwide which means that changes in laws and regulation of any country would impact apple inc sales. Economic: Economi ...

... political risk such as government’s policies regarding technological sectors as well as data regulations.Internatioal politics also effects apple’s business because apple operates worldwide which means that changes in laws and regulation of any country would impact apple inc sales. Economic: Economi ...

NBER WORKING PAPER SERIES FINANCE AND INEQUALITY: THEORY AND EVIDENCE Asli Demirguc-Kunt

... and endogenous evolution of finance, growth, and inequality. Specifically, the three notions of inequality are distinct and potentially contradictory. For example, financial innovations that equalize opportunities could widen the distribution of income as the economy rewards those with the most ski ...

... and endogenous evolution of finance, growth, and inequality. Specifically, the three notions of inequality are distinct and potentially contradictory. For example, financial innovations that equalize opportunities could widen the distribution of income as the economy rewards those with the most ski ...

Fiscal 2017 Second Quarter Consolidated - corporate

... Net sales of $1.17 billion in the second quarter of fiscal 2017 decreased 3.3 percent compared to $1.21 billion in fiscal 2016. Excluding the negative impact of $9.7 million of foreign exchange, organic net sales declined 2.5 percent. Gross profit and gross profit margin in the second quarter of fis ...

... Net sales of $1.17 billion in the second quarter of fiscal 2017 decreased 3.3 percent compared to $1.21 billion in fiscal 2016. Excluding the negative impact of $9.7 million of foreign exchange, organic net sales declined 2.5 percent. Gross profit and gross profit margin in the second quarter of fis ...

Essays on information asymmetry and the firm

... firms. The intuition is as follows. Given asymmetric information can lead to misvaluation, and recognizing that undervalued (but not overvalued) firms will conduct OMRs renders the empirical prediction that the shareholder wealth effect to OMR announcements should increase in the degree of a firm’s ...

... firms. The intuition is as follows. Given asymmetric information can lead to misvaluation, and recognizing that undervalued (but not overvalued) firms will conduct OMRs renders the empirical prediction that the shareholder wealth effect to OMR announcements should increase in the degree of a firm’s ...

unisys corporation

... contracts and obtaining additional outsourcing customers. The company quarterly compares the carrying value of the outsourcing assets with the undiscounted future cash flows expected to be generated by the outsourcing assets to determine if there is an impairment. If impaired, the outsourcing asset ...

... contracts and obtaining additional outsourcing customers. The company quarterly compares the carrying value of the outsourcing assets with the undiscounted future cash flows expected to be generated by the outsourcing assets to determine if there is an impairment. If impaired, the outsourcing asset ...

This PDF is a selection from an out-of-print volume from... Bureau of Economic Research

... This theoretical literature and the insight it provides may help to explain why neoclassical investment theory has so far failed to provide good empirical models of investment behavior and has led to overly optimistic forecasts of the effectiveness of interest rate and tax policies in stimulating in ...

... This theoretical literature and the insight it provides may help to explain why neoclassical investment theory has so far failed to provide good empirical models of investment behavior and has led to overly optimistic forecasts of the effectiveness of interest rate and tax policies in stimulating in ...

IFRS 9 Financial Instruments

... IAS 32 deals with the presentation of financial instruments and especially their classification as debt or equity whilst IAS 39 deals with recognition, derecognition, measurement and hedge accounting. IFRS 7 Financial Instruments: Disclosures is the subject of a separate workbook. These three standa ...

... IAS 32 deals with the presentation of financial instruments and especially their classification as debt or equity whilst IAS 39 deals with recognition, derecognition, measurement and hedge accounting. IFRS 7 Financial Instruments: Disclosures is the subject of a separate workbook. These three standa ...

More of the same? In Focus: Markets as we see them

... Global trade, the spread of the internet, and wider technological advances are the three that we tackle here. ...

... Global trade, the spread of the internet, and wider technological advances are the three that we tackle here. ...

S0700130_en.pdf

... comprised of a very diverse set of economies which makes generalizations hazardous, but the strong performance was remarkably widespread. Favourable external conditions, such as low international interest rates, high prices for export commodities and strong tourism demand as well as increased public ...

... comprised of a very diverse set of economies which makes generalizations hazardous, but the strong performance was remarkably widespread. Favourable external conditions, such as low international interest rates, high prices for export commodities and strong tourism demand as well as increased public ...

British Airways Plc Year ended 31 December 2015

... will target a return on capital of at least 15 per cent with an operating margin in the range of 12-15 per-cent. Improving the customer experience will be a key feature of this business plan with plans to either replace or refurbish 99 per cent of wide-body aircraft by 2020. Our customer’s will bene ...

... will target a return on capital of at least 15 per cent with an operating margin in the range of 12-15 per-cent. Improving the customer experience will be a key feature of this business plan with plans to either replace or refurbish 99 per cent of wide-body aircraft by 2020. Our customer’s will bene ...

The Role of Private International Financial Capital Flows in Support

... organizations have sought to coordinate global monetary actions, while others have sought to institute unilateral tools to “protect” from the volatility of flows on domestic markets. For instance, the recent economic crisis has seen a rise in prominence for emerging market countries within global po ...

... organizations have sought to coordinate global monetary actions, while others have sought to institute unilateral tools to “protect” from the volatility of flows on domestic markets. For instance, the recent economic crisis has seen a rise in prominence for emerging market countries within global po ...

Returns to Venture Capital - University of Colorado Boulder

... Existing funds accelerate their investment flows and earn higher returns when investment opportunities improve and the demand for capital increases. Increases in supply lead to tougher competition for deal flow and private equity fund managers respond by cutting their investment spending. The smalle ...

... Existing funds accelerate their investment flows and earn higher returns when investment opportunities improve and the demand for capital increases. Increases in supply lead to tougher competition for deal flow and private equity fund managers respond by cutting their investment spending. The smalle ...

6 GUIDELINES TO EMPOWER FINANCIAL DECISION

... case of leasing, accounts receivable play an important role, but the lending decision relies on the value of the physical assets, as the financier takes the assets onto its own balance sheet. Note that securing funding by underwriting is more common for debt financing (i.e. loans) than equity financ ...

... case of leasing, accounts receivable play an important role, but the lending decision relies on the value of the physical assets, as the financier takes the assets onto its own balance sheet. Note that securing funding by underwriting is more common for debt financing (i.e. loans) than equity financ ...

Foreign Investment and Sustainable Development in Argentina

... In the view of the reformers, FDI was to play a significant role in the needed restructuring of Argentina’s economy. At the macroeconomic level, FDI was to help finance current-account deficits. Since TNCs often follow long-term investment strategies and, once installed in a host country, have large ...

... In the view of the reformers, FDI was to play a significant role in the needed restructuring of Argentina’s economy. At the macroeconomic level, FDI was to help finance current-account deficits. Since TNCs often follow long-term investment strategies and, once installed in a host country, have large ...

NBER WORKING PAPER SERIES MACROECONOMIC EFFECTS OF CORPORATE DEFAULT CRISES: Kay Giesecke

... the past 150 years. A number of these shocks were much more severe than even those during the Great Depression. For example, more than 50 percent of all outstanding bonds in the U.S. defaulted during the 1871–1879 period as many railroads found themselves overextended in the wake of their rapid expa ...

... the past 150 years. A number of these shocks were much more severe than even those during the Great Depression. For example, more than 50 percent of all outstanding bonds in the U.S. defaulted during the 1871–1879 period as many railroads found themselves overextended in the wake of their rapid expa ...

Download attachment

... suceed in supporting economic growth. Even so, conditions don’t have to get dramatically better for equity markets to rally. Another reason for some optimism is the unprecedented value that is now on offer in equity markets, following the substantial falls of recent months. Over the past 60 years, t ...

... suceed in supporting economic growth. Even so, conditions don’t have to get dramatically better for equity markets to rally. Another reason for some optimism is the unprecedented value that is now on offer in equity markets, following the substantial falls of recent months. Over the past 60 years, t ...

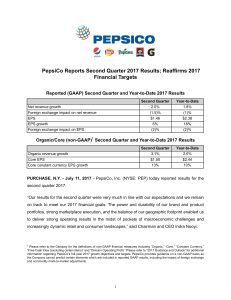

Reaffirms 2017 Financial Targets

... Division operating profit growth (a non-GAAP measure that excludes corporate unallocated costs) increased by 11 percent in the year and was positively impacted by items affecting comparability (8 percentage points) and negatively impacted by foreign exchange translation (1.5 percentage points). Core ...

... Division operating profit growth (a non-GAAP measure that excludes corporate unallocated costs) increased by 11 percent in the year and was positively impacted by items affecting comparability (8 percentage points) and negatively impacted by foreign exchange translation (1.5 percentage points). Core ...

Revenue-generating projects

... case of decreasing costs the funding gap is smaller and the managing authorities are encouraged to take care that projects are not over-financed and programme resources are wherever possible made available for allocation to additional projects. ...

... case of decreasing costs the funding gap is smaller and the managing authorities are encouraged to take care that projects are not over-financed and programme resources are wherever possible made available for allocation to additional projects. ...

Word - The Open University

... If the organisation is large enough, you should seek to fund it from a number of markets rather than just a single market. (Similarly, a large organisation should have relationships, and borrowing facilities, with a number of banks rather than just one or two.) For example, larger organisations will ...

... If the organisation is large enough, you should seek to fund it from a number of markets rather than just a single market. (Similarly, a large organisation should have relationships, and borrowing facilities, with a number of banks rather than just one or two.) For example, larger organisations will ...

Our greatest resOurce can be

... As you review the financial statements in this report, you will see that the Company’s financial position has continued to strengthen. Total equity to total capitalization improved from 42 percent at December 31, 2007 to 45 percent at December 31, 2008. In addition, the Company continued to fund mos ...

... As you review the financial statements in this report, you will see that the Company’s financial position has continued to strengthen. Total equity to total capitalization improved from 42 percent at December 31, 2007 to 45 percent at December 31, 2008. In addition, the Company continued to fund mos ...

First half year 2016 results

... Bekaert achieved an operating result before non-recurring items (REBIT) of € 157.3 million, up 40% from the same period last year. This equates to a REBIT margin on sales of 8.6%. REBITDA was € 259 million (14.3% margin) compared with € 219 million (11.5% margin) for the same period last year. Non-r ...

... Bekaert achieved an operating result before non-recurring items (REBIT) of € 157.3 million, up 40% from the same period last year. This equates to a REBIT margin on sales of 8.6%. REBITDA was € 259 million (14.3% margin) compared with € 219 million (11.5% margin) for the same period last year. Non-r ...

Comments on “When Do TIPS Prices Adjust to

... 2. They probably do not need more earnings to maintain their low growth perspective and can afford to increase the payout [see Grullon et al. (2002)]. 3. The higher risk may involve higher cost of capital and make free cash flow problem worse for low growth firms. => For free cash flow concerns, low ...

... 2. They probably do not need more earnings to maintain their low growth perspective and can afford to increase the payout [see Grullon et al. (2002)]. 3. The higher risk may involve higher cost of capital and make free cash flow problem worse for low growth firms. => For free cash flow concerns, low ...