EXTERNAL STABILITY External stability or external balance

... ation where external indicators such as the balance of payment, foreign liabilities and the exchange rate are at a sustainable level, that is, a level where they can remain in the longer term without negative economic consequences. The past two decades saw the sweep in of globalisation, what was als ...

... ation where external indicators such as the balance of payment, foreign liabilities and the exchange rate are at a sustainable level, that is, a level where they can remain in the longer term without negative economic consequences. The past two decades saw the sweep in of globalisation, what was als ...

Investment Policy - OutServe-SLDN

... OS/SLDN’s Board of Directors is responsible for making daily short-term investment decisions. The Board of Directors and our donors expect the assets to be invested with care, skill, prudence, and diligence under the circumstances prevailing from time to time that a prudent expert acting in a like c ...

... OS/SLDN’s Board of Directors is responsible for making daily short-term investment decisions. The Board of Directors and our donors expect the assets to be invested with care, skill, prudence, and diligence under the circumstances prevailing from time to time that a prudent expert acting in a like c ...

Is it 1931, 1937, or 1939? - McGuire Performance Solutions

... If we successfully avoid a replay of 1931, is the U.S. economy then on the road to a real recovery? Unfortunately, I am not quite so optimistic on that score. The U.S. economy bottomed out during the Depression in 1933 with an unemployment rate exceeding 20 percent. While the unemployment remained m ...

... If we successfully avoid a replay of 1931, is the U.S. economy then on the road to a real recovery? Unfortunately, I am not quite so optimistic on that score. The U.S. economy bottomed out during the Depression in 1933 with an unemployment rate exceeding 20 percent. While the unemployment remained m ...

Managing cash in your portfolio

... assets such as stocks and bonds, and should be invested in the vehicle that best matches the need. Investors must also be careful to evaluate other considerations for investing cash. First, the investor should be aware of any fees associated with the cash investment, such as fund management fees or ...

... assets such as stocks and bonds, and should be invested in the vehicle that best matches the need. Investors must also be careful to evaluate other considerations for investing cash. First, the investor should be aware of any fees associated with the cash investment, such as fund management fees or ...

Thailand 10 years after the crisis: Beyond finance, the exhaustion of

... but how without industrial policy and protectionism? • Incentive is not enough: Automobile versus electronics. ...

... but how without industrial policy and protectionism? • Incentive is not enough: Automobile versus electronics. ...

Advanced Practicum in Investment Management (FBE453a and

... portfolio theory and practice, as well as behavioral finance. You will get to learn the analytical framework for the valuation of stocks and bonds, risk management, portfolio optimization, and performance attribution. You will be a real money manager and produce industry reports, company research re ...

... portfolio theory and practice, as well as behavioral finance. You will get to learn the analytical framework for the valuation of stocks and bonds, risk management, portfolio optimization, and performance attribution. You will be a real money manager and produce industry reports, company research re ...

N1DM01 - The University of Nottingham

... (i) The investment relates to the acquisition of a 10% stake in the equity share capital in another construction company. The investment was made many years ago. At present the investment is carried at original cost. The current market value of this stake – the shares are quoted – is £50million. (ii ...

... (i) The investment relates to the acquisition of a 10% stake in the equity share capital in another construction company. The investment was made many years ago. At present the investment is carried at original cost. The current market value of this stake – the shares are quoted – is £50million. (ii ...

High-level Regional Policy Dialogue on

... The current account deficit in India was a concern in recent years. But, it improved to 2.6% in 2010-11 from 2.8 in 2009-10 (see Table 5). This improvement came about by cyclical upswing in global trade and turn around in invisibles. Export growth was 37.4% in 2010-11 and 46% in the first quarter of ...

... The current account deficit in India was a concern in recent years. But, it improved to 2.6% in 2010-11 from 2.8 in 2009-10 (see Table 5). This improvement came about by cyclical upswing in global trade and turn around in invisibles. Export growth was 37.4% in 2010-11 and 46% in the first quarter of ...

Speech to UCLA Symposium at UC Berkeley Berkeley, California

... of a job. In a market in which house prices have been declining, a borrower with a recent mortgage secured with little or no down payment does not have the flexibility to tap into the equity in the house to weather these problems or may be unable to refinance or sell the house for enough to cover th ...

... of a job. In a market in which house prices have been declining, a borrower with a recent mortgage secured with little or no down payment does not have the flexibility to tap into the equity in the house to weather these problems or may be unable to refinance or sell the house for enough to cover th ...

Financial Engineering is BACK!

... The CURRAN RISK to defense is that equity markets can climb higher into 2015-2016 because of unprecedented global ZIRP and global QE policies. This is especially true in the EU which is just getting started with its asset inflation policies. This is the one market where I am willing to take some ris ...

... The CURRAN RISK to defense is that equity markets can climb higher into 2015-2016 because of unprecedented global ZIRP and global QE policies. This is especially true in the EU which is just getting started with its asset inflation policies. This is the one market where I am willing to take some ris ...

Week 4 assignment

... bring along you PC with the budget model software. They are worried about your finding in Part 1. They have obviously been arguing over certain assumptions you were given. a. Mr. Wayne thinks that the gross margin may shrink to 27.5 percent because of higher purchase prices. He is concerned about wh ...

... bring along you PC with the budget model software. They are worried about your finding in Part 1. They have obviously been arguing over certain assumptions you were given. a. Mr. Wayne thinks that the gross margin may shrink to 27.5 percent because of higher purchase prices. He is concerned about wh ...

Traditional insurance products will not go out of vogue - Sa-Dhan

... the recent past. Call rates have also moved from the highs they touched in March 2007 on the back of improving liquidity scenario in the system. Most investors would tend to believe that Indian rate markets are close to the interest rate peak in the current monetary tightening cycle, with softer inf ...

... the recent past. Call rates have also moved from the highs they touched in March 2007 on the back of improving liquidity scenario in the system. Most investors would tend to believe that Indian rate markets are close to the interest rate peak in the current monetary tightening cycle, with softer inf ...

Macroeconomic Crises and the Open Economy

... current account deficit) • More foreign savings (foreign capital) flows into South Africa than flows out of South Africa (leading to a financial account surplus) • Inflow of foreign savings is useful as it tends to finance investment (e.g. higher shares prices and lower interest rates), but it poses ...

... current account deficit) • More foreign savings (foreign capital) flows into South Africa than flows out of South Africa (leading to a financial account surplus) • Inflow of foreign savings is useful as it tends to finance investment (e.g. higher shares prices and lower interest rates), but it poses ...

Economic Theory and the Current Economic Crisis

... Based on trickle down economics—throwing enough money at Wall Street will trickle down to rest of economy Like mass transfusion—while patient is dying from ...

... Based on trickle down economics—throwing enough money at Wall Street will trickle down to rest of economy Like mass transfusion—while patient is dying from ...

Speech to the Silicon Valley Chapter of Financial Executives International

... financial and economic developments, and to discuss the array of policy responses to them. As always, my comments represent my own views and do not necessarily reflect those of any of my colleagues in the Federal Reserve System. To preview my discussion, financial sector distress has led to a credi ...

... financial and economic developments, and to discuss the array of policy responses to them. As always, my comments represent my own views and do not necessarily reflect those of any of my colleagues in the Federal Reserve System. To preview my discussion, financial sector distress has led to a credi ...

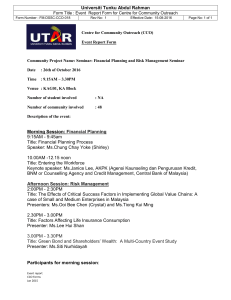

Financial Planning and Risk Management Seminar

... 4. Saving your money – cultivate saving habits, save money gradually, avoid non-essential spending, insured properly via health or medical insurance, life insurance, general insurance (motor, personal accidents, etc.); 5. Investing your money and constructing an investment portfolio – invest in shor ...

... 4. Saving your money – cultivate saving habits, save money gradually, avoid non-essential spending, insured properly via health or medical insurance, life insurance, general insurance (motor, personal accidents, etc.); 5. Investing your money and constructing an investment portfolio – invest in shor ...

course

... 70-20-10 Saving and Investing Rule: For any money earned, spend 70%, save 20%, and invest 10% Saving and Investing Plan: For those whose values or lifestyle make saving 30% unrealistic, start a saving and investing plan in order to continually save a fixed amount Rule of 72: Divide 72 by the r ...

... 70-20-10 Saving and Investing Rule: For any money earned, spend 70%, save 20%, and invest 10% Saving and Investing Plan: For those whose values or lifestyle make saving 30% unrealistic, start a saving and investing plan in order to continually save a fixed amount Rule of 72: Divide 72 by the r ...

Weekly Commentary 02-10-14 PAA

... and United States gained about $16 trillion in value during the period. Housing prices also may have benefitted as the cost of mortgage credit fell. British and American households weren’t the only ones affected by central bank policies. McKinsey found governments in both regions benefited to the tu ...

... and United States gained about $16 trillion in value during the period. Housing prices also may have benefitted as the cost of mortgage credit fell. British and American households weren’t the only ones affected by central bank policies. McKinsey found governments in both regions benefited to the tu ...

Farm Business Mng Part1 Test/Key

... 13. Which of the following would not be found on a cash flow statement? a. Total grain sales b. Loan payments c. Depreciation d. Family living expenses 14. A loan taken out for a piece of machinery to be paid back over five years is a(n): a. Current Liability b. Long Term Liability c. Intermediate ...

... 13. Which of the following would not be found on a cash flow statement? a. Total grain sales b. Loan payments c. Depreciation d. Family living expenses 14. A loan taken out for a piece of machinery to be paid back over five years is a(n): a. Current Liability b. Long Term Liability c. Intermediate ...

Here`s To Your Wealth - April 7, 2014

... So at this time we remain invested in the stock markets, and we remain invested in the bond markets. We believe the flight to cash or near cash, which yields near zero, is a mistake. And in recent years it has been a huge mistake despite how hard the holders of cash try to convince themselves. Marke ...

... So at this time we remain invested in the stock markets, and we remain invested in the bond markets. We believe the flight to cash or near cash, which yields near zero, is a mistake. And in recent years it has been a huge mistake despite how hard the holders of cash try to convince themselves. Marke ...

FRBSF E L CONOMIC ETTER

... addressing the problems plaguing the housing market directly, through increased aid to distressed homeowners to mitigate foreclosures or through broad-based incentives to boost the demand for housing. Such policies deserve consideration because they go to the heart of the problem, the fallout from t ...

... addressing the problems plaguing the housing market directly, through increased aid to distressed homeowners to mitigate foreclosures or through broad-based incentives to boost the demand for housing. Such policies deserve consideration because they go to the heart of the problem, the fallout from t ...