the Treasury Management Strategy Statement 2017/18

... England could set its Bank Rate at or below zero, which is likely to feed through to negative interest rates on all low risk, short-term investment options. This situation already exists in many other European countries. In this situation the Council will have met its requirement to give priority to ...

... England could set its Bank Rate at or below zero, which is likely to feed through to negative interest rates on all low risk, short-term investment options. This situation already exists in many other European countries. In this situation the Council will have met its requirement to give priority to ...

the wizard of bubbleland

... the interest rate were such that the demand for lendable funds was not equal to the supply of it, then we would also not have investment equal to savings. Thus the Fed interest-rate policy is responsible for over- or underinvestment in the US economy. Foreign countries with dollar trade surpluses fr ...

... the interest rate were such that the demand for lendable funds was not equal to the supply of it, then we would also not have investment equal to savings. Thus the Fed interest-rate policy is responsible for over- or underinvestment in the US economy. Foreign countries with dollar trade surpluses fr ...

CHAPTER 1

... a. A person or firm that spends less than the income received b. A unit of measure used by the Federal Reserve c. The department in a bank that makes loans d. Persons or firms that spend more than the income they receive ANSWER: a 58. Why is financial intermediation important in an economy? a. Becau ...

... a. A person or firm that spends less than the income received b. A unit of measure used by the Federal Reserve c. The department in a bank that makes loans d. Persons or firms that spend more than the income they receive ANSWER: a 58. Why is financial intermediation important in an economy? a. Becau ...

A quantitative take on recent market volatility

... little bit less clear but at the very least the government needs to take additional steps to reach their 2% inflation target from where they are right now. Within the AsiaPacific region, we are most constructive on Japan right now. However, we think if China continues to take steps in terms of stimu ...

... little bit less clear but at the very least the government needs to take additional steps to reach their 2% inflation target from where they are right now. Within the AsiaPacific region, we are most constructive on Japan right now. However, we think if China continues to take steps in terms of stimu ...

The Revolving Door

... 3. Promotions: the presence of internal promotions (members of governing bodies of Central Banks who came from the CB itself, number of those remaining at the Central Bank after a ...

... 3. Promotions: the presence of internal promotions (members of governing bodies of Central Banks who came from the CB itself, number of those remaining at the Central Bank after a ...

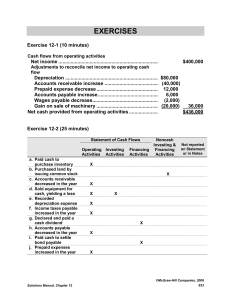

higher audit risk

... An otherwise financing (Case 1) or investing (Case 1(a)) cash inflows are classified as operating cash inflows, thereby inflating OCF ...

... An otherwise financing (Case 1) or investing (Case 1(a)) cash inflows are classified as operating cash inflows, thereby inflating OCF ...

The Forecasting and Policy System: an introduction Executive summary

... live an uncertain length of time and must plan their consumption and savings accordingly. In doing so, they must balance the desire for consumption today with the need to sustain consumption levels later in life. They accomplish this goal by accumulating financial assets that provide income over and ...

... live an uncertain length of time and must plan their consumption and savings accordingly. In doing so, they must balance the desire for consumption today with the need to sustain consumption levels later in life. They accomplish this goal by accumulating financial assets that provide income over and ...

Janet L Yellen: Improving the oversight of large financial institutions

... the lead-up to the crisis, many large institutions had become heavily reliant on very shortterm borrowing, at relatively low rates, to fund lending and other operations providing higher returns. While this approach may have appeared to be an easy source of profit, it had the disadvantage of leaving ...

... the lead-up to the crisis, many large institutions had become heavily reliant on very shortterm borrowing, at relatively low rates, to fund lending and other operations providing higher returns. While this approach may have appeared to be an easy source of profit, it had the disadvantage of leaving ...

Cash flows from operating activities

... Plus decrease in wages payable ................................................................... Less decrease in prepaid expenses ............................................................. Cash paid for other operating expenses ...................................................... ...

... Plus decrease in wages payable ................................................................... Less decrease in prepaid expenses ............................................................. Cash paid for other operating expenses ...................................................... ...

1 Hong Kong / Singapore, 19 August 2014 SOCIETE GENERALE

... conducting due diligence. The bank also played a critical role in structuring the deal. The transaction achieved financial close in May 2014. Several factors contributed to the success of this project. For one, the project sponsor group – which includes Itochu Corporation, Kyushu Electric Power Comp ...

... conducting due diligence. The bank also played a critical role in structuring the deal. The transaction achieved financial close in May 2014. Several factors contributed to the success of this project. For one, the project sponsor group – which includes Itochu Corporation, Kyushu Electric Power Comp ...

Financial (in)stability low interest rates and (un)conventional monetary policy

... Outright purchases can in principle help resolve the apparent time inconsistency of a commitment to an announced policy path by changing the central bank’s incentives through its balance sheet. A central bank that purchases a sizable quantity of, e.g., long bonds when long rates are low will see the ...

... Outright purchases can in principle help resolve the apparent time inconsistency of a commitment to an announced policy path by changing the central bank’s incentives through its balance sheet. A central bank that purchases a sizable quantity of, e.g., long bonds when long rates are low will see the ...

European Fixed Income: Challenges For Investors In A Low Yield

... corporate bonds is the reduction in duration (by over two years), while at the same time picking up incremental spread of 124bps. For investors whose primary aim is to remain in eurodenominated bonds and avoid negative interest rates, this may be a viable option. But for investors with a greater ris ...

... corporate bonds is the reduction in duration (by over two years), while at the same time picking up incremental spread of 124bps. For investors whose primary aim is to remain in eurodenominated bonds and avoid negative interest rates, this may be a viable option. But for investors with a greater ris ...

word

... The US economy enters 2014 with a good deal of momentum and upside growth potential. Steady job creation and a strong housing market, along with sharply rising stock prices have contributed to the highest year-end levels of consumer confidence since 2007. This, in turn, has spurred improvement in th ...

... The US economy enters 2014 with a good deal of momentum and upside growth potential. Steady job creation and a strong housing market, along with sharply rising stock prices have contributed to the highest year-end levels of consumer confidence since 2007. This, in turn, has spurred improvement in th ...

Is Sell in May Still in Play?

... This time, the bond sell-off began as investors realized the global economic recovery might finally be reaching “escape velocity.” The selling accelerated with talk of the Fed starting to scale back asset purchases as soon as this summer. Risky assets like stocks initially reacted positively to this ...

... This time, the bond sell-off began as investors realized the global economic recovery might finally be reaching “escape velocity.” The selling accelerated with talk of the Fed starting to scale back asset purchases as soon as this summer. Risky assets like stocks initially reacted positively to this ...

Construction Cartel - Amazon Web Services

... In terms of Regulation 28(10) of the cid Regulations, 2004 (as amended): If an organ of state, other than the cidb, undertakes an investigation and the finding of that organ of state indicates that a person acted contrary to or has omitted to act in terms of the code of conduct, that organ of state ...

... In terms of Regulation 28(10) of the cid Regulations, 2004 (as amended): If an organ of state, other than the cidb, undertakes an investigation and the finding of that organ of state indicates that a person acted contrary to or has omitted to act in terms of the code of conduct, that organ of state ...

Paper - Federal Reserve Bank of Kansas City

... Reis describes a model of how monetary policy works when central bank reserves are abundant. He uses that model to argue that going forward, it is not the quantity of reserves that will govern inflation but instead the interest rate paid on those reserves that matters. I will first reinterpret his ...

... Reis describes a model of how monetary policy works when central bank reserves are abundant. He uses that model to argue that going forward, it is not the quantity of reserves that will govern inflation but instead the interest rate paid on those reserves that matters. I will first reinterpret his ...

LECTURE 02

... corporation (MNC) and potential conflicts with that goal To describe the key theories that justify international business. ...

... corporation (MNC) and potential conflicts with that goal To describe the key theories that justify international business. ...

Higher rates after Trump win mean good things for bank loan yields

... Some bankers suggested that regulators have been wise to blow the whistle on CRE and encouraged others to proceed with caution. Banks reported in the Federal Reserve’s latest senior loan officer survey that standards had tightened on all types of CRE loans. Banks also reported strong demand for CRE ...

... Some bankers suggested that regulators have been wise to blow the whistle on CRE and encouraged others to proceed with caution. Banks reported in the Federal Reserve’s latest senior loan officer survey that standards had tightened on all types of CRE loans. Banks also reported strong demand for CRE ...

ACCOUNTANT STANDARDS ISSUED BY ICAI WITH REFERENCE

... Domestic sales are recognised at time of despatch to the customer, on the basis of invoice. Export sales are recognised on the basis of dates of bills of lading. Gross sales include excise duty but exclude custom duty ,education cess, sales tax, other recoveries set off against the respective expend ...

... Domestic sales are recognised at time of despatch to the customer, on the basis of invoice. Export sales are recognised on the basis of dates of bills of lading. Gross sales include excise duty but exclude custom duty ,education cess, sales tax, other recoveries set off against the respective expend ...

The Double Bottom Line: Investing in California`s Emerging Markets

... In the February 21st edition of U.S. News & World Report, James Lardner wrote: “Ask most economists about the forces that might ultimately undo the longest expansion in U.S. history, and they’ll talk about inflation, interest rate moves by the Federal Reserve, or a plunging stock market. The gap in ...

... In the February 21st edition of U.S. News & World Report, James Lardner wrote: “Ask most economists about the forces that might ultimately undo the longest expansion in U.S. history, and they’ll talk about inflation, interest rate moves by the Federal Reserve, or a plunging stock market. The gap in ...