IOSR Journal of Economics and Finance (IOSR-JEF)

... companies should improve their resilience through decentralization, immense diversity and bymaintaining excess buffers. There is no such profession that could tolerate the conflicts of interest. Stressing on the financial industry to go with line of business and type of customers will resolve the co ...

... companies should improve their resilience through decentralization, immense diversity and bymaintaining excess buffers. There is no such profession that could tolerate the conflicts of interest. Stressing on the financial industry to go with line of business and type of customers will resolve the co ...

General Presentations Template - Texas Municipal Retirement System

... TMRS Asset Allocation Philosophy Current policy assists to ensure that the risk tolerance remains appropriate The Strategic Target Allocation will be reviewed at least annually to ensure that the longterm return objective and risk tolerance continues to be appropriate considering significant economi ...

... TMRS Asset Allocation Philosophy Current policy assists to ensure that the risk tolerance remains appropriate The Strategic Target Allocation will be reviewed at least annually to ensure that the longterm return objective and risk tolerance continues to be appropriate considering significant economi ...

Answers to Chapter 22 Questions

... interest income. If rates are about to fall the manger would like to set the repricing gap less than zero. As rates fall, interest income will decrease by less than interest expense, resulting in an increase in net interest income. 6. Book value accounting reports assets and liabilities at the origi ...

... interest income. If rates are about to fall the manger would like to set the repricing gap less than zero. As rates fall, interest income will decrease by less than interest expense, resulting in an increase in net interest income. 6. Book value accounting reports assets and liabilities at the origi ...

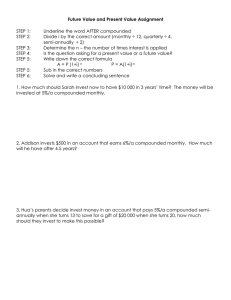

Future Value and Present Value Assignment

... 3. Hua’s parents decide invest money in an account that pays 5%/a compounded semiannually when she turns 13 to save for a gift of $20 000 when she turns 20, how much should they invest to make this possible? ...

... 3. Hua’s parents decide invest money in an account that pays 5%/a compounded semiannually when she turns 13 to save for a gift of $20 000 when she turns 20, how much should they invest to make this possible? ...

NCB Saudi Economic Perspectives 2014-2015

... whereby accommodative policies were adopted across the board. The International Monetary Fund (IMF) projects higher global growth in 2014 and 2015 at 3.6% and 3.9%,respectively, yet below the 5.1% registered in 2010. • Last year marked the slowest economic growth rate since 2009, and we do believe ...

... whereby accommodative policies were adopted across the board. The International Monetary Fund (IMF) projects higher global growth in 2014 and 2015 at 3.6% and 3.9%,respectively, yet below the 5.1% registered in 2010. • Last year marked the slowest economic growth rate since 2009, and we do believe ...

Statement of Cash Flows Revisited

... Evolution of the Statement of Cash Flows Early efforts to instill the standard of accrual accounting internationally suppressed the widespread practice of cash flow reporting. The statement of changes in financial position was the predecessor to the statement of cash flows. The increasingly widespre ...

... Evolution of the Statement of Cash Flows Early efforts to instill the standard of accrual accounting internationally suppressed the widespread practice of cash flow reporting. The statement of changes in financial position was the predecessor to the statement of cash flows. The increasingly widespre ...

Chapter 21: Financial Statement Analysis - McGraw

... Long-term debt + current liabilities Long-term debt + current liabilities – (liquid) current assets + equity ...

... Long-term debt + current liabilities Long-term debt + current liabilities – (liquid) current assets + equity ...

Higher Interest Rates Are on the Horizon

... which other short-term U.S. interest rates are based. The FOMC has left the Fed Funds rate at zero since early 2009. Why? The FOMC has been concerned about the persistently low inflation rate below its 2 percent target level, combined with its assessment of significant slack remaining in the labor f ...

... which other short-term U.S. interest rates are based. The FOMC has left the Fed Funds rate at zero since early 2009. Why? The FOMC has been concerned about the persistently low inflation rate below its 2 percent target level, combined with its assessment of significant slack remaining in the labor f ...

Financial literacy - Fairfield Public Schools

... List of basic services provided by financial institutions Differentiate among types of electronic monetary transactions (e.g. debit cards, ATM, and automatic deposits/payments) offered by various financial institutions. Evaluate services and related costs associated with financial institutions ...

... List of basic services provided by financial institutions Differentiate among types of electronic monetary transactions (e.g. debit cards, ATM, and automatic deposits/payments) offered by various financial institutions. Evaluate services and related costs associated with financial institutions ...

Financial integration in the four Basins: a quantitative comparison

... where FA (FL) denotes the stock of external assets (liabilities). This ratio is a volume-based measure of international financial integration. The indicator can also be expressed as a difference between gross foreign assets and foreign, as defined by the net external position, and GDP. Figure 2 plot ...

... where FA (FL) denotes the stock of external assets (liabilities). This ratio is a volume-based measure of international financial integration. The indicator can also be expressed as a difference between gross foreign assets and foreign, as defined by the net external position, and GDP. Figure 2 plot ...

LCbrsR222_en.pdf

... decrease of its trade surplus and a sharp reduction of portfolio investment, only partially compensated in 2009. The favorable results achieved in the mid-2000s are by and large the outcome of an extremely positive scenario, more than the result of specific policies. As a matter of fact an estimate ...

... decrease of its trade surplus and a sharp reduction of portfolio investment, only partially compensated in 2009. The favorable results achieved in the mid-2000s are by and large the outcome of an extremely positive scenario, more than the result of specific policies. As a matter of fact an estimate ...

Changing Interest Rates: The Impact on Your Portfolio

... Mutual fund investing involves risk. Some mutual funds have more risk than others. The investment return and principal value will fluctuate, and shares, when sold, may be worth more or less than the original cost, and it is possible to lose money. There is no guarantee a fund’s objectives will be ac ...

... Mutual fund investing involves risk. Some mutual funds have more risk than others. The investment return and principal value will fluctuate, and shares, when sold, may be worth more or less than the original cost, and it is possible to lose money. There is no guarantee a fund’s objectives will be ac ...

FRBSF L CONOMIC

... (LSAPs) of Treasury and mortgage-backed securities, followed by further purchase programs. These purchases have been designed to put downward pressure on longer-term interest rates. Unconventional monetary policy actions can only be successful in stimulating the economy if they lower the interest ra ...

... (LSAPs) of Treasury and mortgage-backed securities, followed by further purchase programs. These purchases have been designed to put downward pressure on longer-term interest rates. Unconventional monetary policy actions can only be successful in stimulating the economy if they lower the interest ra ...

FBLA ACCOUNTING II

... account should be debited when a purchase is made on account. 21. Source documents should be discarded at the end of the a. True fiscal year to make room for next year's documents. 22. Subsidiary ledgers are used to maintain accounts a. True receivable and accounts payable balances. 23. Partners are ...

... account should be debited when a purchase is made on account. 21. Source documents should be discarded at the end of the a. True fiscal year to make room for next year's documents. 22. Subsidiary ledgers are used to maintain accounts a. True receivable and accounts payable balances. 23. Partners are ...

Retirement Rules of Thumb - University of Wisconsin

... times annual spending. Of course spending more or less of your savings balance each year will result in relatively shorter or longer retirement periods. This simple rule is powerful and does provide a target for savings goals. However, future expenses can be challenging to estimate. Big ticket items ...

... times annual spending. Of course spending more or less of your savings balance each year will result in relatively shorter or longer retirement periods. This simple rule is powerful and does provide a target for savings goals. However, future expenses can be challenging to estimate. Big ticket items ...

Appendix A

... All the options are calculated based on net figures, recognizing that interest rate risk can be minimized by matching the maturity profiles of the borrowing and investment portfolios, so the interest rate risk of variable rate borrowing can be offset by holding variable rate investments. Options B a ...

... All the options are calculated based on net figures, recognizing that interest rate risk can be minimized by matching the maturity profiles of the borrowing and investment portfolios, so the interest rate risk of variable rate borrowing can be offset by holding variable rate investments. Options B a ...

MONEY MANAGER CAPITALISM AND THE GLOBAL FINANCIAL

... Management, the Russian default and Asian debt crises in the late 1990s; and so on. Until the current crisis, each of these was resolved (some more painfully than others—impacts were particularly severe and long-lasting in the developing world) with some combination of central bank or international ...

... Management, the Russian default and Asian debt crises in the late 1990s; and so on. Until the current crisis, each of these was resolved (some more painfully than others—impacts were particularly severe and long-lasting in the developing world) with some combination of central bank or international ...

Chapter 1

... anticipated yearly savings to be generated should be compared. When resources exceed needs, no other steps have to be made. ...

... anticipated yearly savings to be generated should be compared. When resources exceed needs, no other steps have to be made. ...

Paper - Saint Mary`s University

... the institution, the more exposed to risk it was. One may forgiven for, upon a cursory look at credit unions worldwide (WOCCU, 2009), espousing the superiority of the model. Or attributing the sole success of the credit union model to the fact that as member driven organizations, credit unions are n ...

... the institution, the more exposed to risk it was. One may forgiven for, upon a cursory look at credit unions worldwide (WOCCU, 2009), espousing the superiority of the model. Or attributing the sole success of the credit union model to the fact that as member driven organizations, credit unions are n ...

Hungary - CUTS International

... either the establishment of joint ventures, or privatization. Even some greenfield investments started in the privatization process. For example, GM purchased a workshop from the privatization agency to put up the Szentgotthárd Opel works. Privatization related FDI meant in most cases an interest of ...

... either the establishment of joint ventures, or privatization. Even some greenfield investments started in the privatization process. For example, GM purchased a workshop from the privatization agency to put up the Szentgotthárd Opel works. Privatization related FDI meant in most cases an interest of ...

Konzept Issue 04 - FT Alphaville

... requirements is that it hinders the market’s ability to enforce discipline on banks, especially in their riskiest areas. If everything is considered to be a risk factor, then nothing really is. While much smaller than today’s effort, that 2006 annual report for UBS still came to 256 pages, yet post- ...

... requirements is that it hinders the market’s ability to enforce discipline on banks, especially in their riskiest areas. If everything is considered to be a risk factor, then nothing really is. While much smaller than today’s effort, that 2006 annual report for UBS still came to 256 pages, yet post- ...

International Monetary and Financial Committee

... downside risks. Addressing sovereign debt challenges and putting public finances back on a sustainable path must remain the top priority. The continued uncertainties in the financial markets and the underlying economic and financial vulnerabilities, in particular in advanced countries, clearly demon ...

... downside risks. Addressing sovereign debt challenges and putting public finances back on a sustainable path must remain the top priority. The continued uncertainties in the financial markets and the underlying economic and financial vulnerabilities, in particular in advanced countries, clearly demon ...

Chapter 6

... New markets in which to buy and sell Wider variety of goods and services Less expensive goods and services New jobs New money management tools Easy access to information continued ...

... New markets in which to buy and sell Wider variety of goods and services Less expensive goods and services New jobs New money management tools Easy access to information continued ...

Sample Questions - C..

... proposed project. Which of the following items should the CFO include in the analysis when estimating the project's net present value (NPV)? a. The new store is expected to take away sales from two of the firm's existing stores located in the same town. b. The company owns the land that is being con ...

... proposed project. Which of the following items should the CFO include in the analysis when estimating the project's net present value (NPV)? a. The new store is expected to take away sales from two of the firm's existing stores located in the same town. b. The company owns the land that is being con ...

the Treasury Management Strategy Statement 2017/18

... England could set its Bank Rate at or below zero, which is likely to feed through to negative interest rates on all low risk, short-term investment options. This situation already exists in many other European countries. In this situation the Council will have met its requirement to give priority to ...

... England could set its Bank Rate at or below zero, which is likely to feed through to negative interest rates on all low risk, short-term investment options. This situation already exists in many other European countries. In this situation the Council will have met its requirement to give priority to ...