Voter Guide 2014: Debt and Deficit

... How Do We Reduce Federal Debt? A long-term high national debt could be problematic because it means fewer savings and income in future years; a limited ability for Congress to respond to unexpected events, like recessions; and investors may begin to doubt the U.S.’s ability to pay back its loans. In ...

... How Do We Reduce Federal Debt? A long-term high national debt could be problematic because it means fewer savings and income in future years; a limited ability for Congress to respond to unexpected events, like recessions; and investors may begin to doubt the U.S.’s ability to pay back its loans. In ...

Key messages

... Remittances (World Bank estimates decline of 58 percent in 2009) FDI inflows (tripled in past 5 years: could drop this year by at least 20 percent) ...

... Remittances (World Bank estimates decline of 58 percent in 2009) FDI inflows (tripled in past 5 years: could drop this year by at least 20 percent) ...

Trinidad_and_Tobago_en.pdf

... credit to the private sector meanwhile slowed from 20.3% in 2007 to 14.0% in 2008, revealing a more prudent stance on the part of domestic financial institutions owing to the increased uncertainty that had been brought about by the deterioration of conditions in the world economy. In 2009, the centr ...

... credit to the private sector meanwhile slowed from 20.3% in 2007 to 14.0% in 2008, revealing a more prudent stance on the part of domestic financial institutions owing to the increased uncertainty that had been brought about by the deterioration of conditions in the world economy. In 2009, the centr ...

Malaysia`s 2016 Budget: Pursuing Fiscal Consolidation while

... demand is not the main culprit for the position of the current account. First, Malaysia’s export growth had been slowing down even before the Global Financial Crisis (GFC), suggesting that structural, instead of cyclical factors, are at play. Second, supply-side factors are found to contribute to th ...

... demand is not the main culprit for the position of the current account. First, Malaysia’s export growth had been slowing down even before the Global Financial Crisis (GFC), suggesting that structural, instead of cyclical factors, are at play. Second, supply-side factors are found to contribute to th ...

Debt, Growth and the Austerity Debate

... debt spell was 23 years. In 23 of the 26 cases, average growth was slower during the high-debt period than in periods of lower debt levels. Indeed, economies grew at an average annual rate of roughly 3.5 percent, when the ratio was under 90 percent, but at only a 2.3 percent rate, on average, at hi ...

... debt spell was 23 years. In 23 of the 26 cases, average growth was slower during the high-debt period than in periods of lower debt levels. Indeed, economies grew at an average annual rate of roughly 3.5 percent, when the ratio was under 90 percent, but at only a 2.3 percent rate, on average, at hi ...

The Greek Economy under Reform - Konrad-Adenauer

... do not happen overnight and actual results may take more time to occur. The magnitude of the reforms taking place in Greece is huge. This means that it is not realistic to expect reform designing, implementation and actual results on GDP or employment at the same quarter or even at the same year! Mo ...

... do not happen overnight and actual results may take more time to occur. The magnitude of the reforms taking place in Greece is huge. This means that it is not realistic to expect reform designing, implementation and actual results on GDP or employment at the same quarter or even at the same year! Mo ...

Tutorial 8 - Peter Foldvari

... private savings would remain unchanged (if we believe that individuals would reduce their consumption as a result if increase in interest rate, then private savings would increase). As a result national savings and investments would reduce. ...

... private savings would remain unchanged (if we believe that individuals would reduce their consumption as a result if increase in interest rate, then private savings would increase). As a result national savings and investments would reduce. ...

2015 Quarter 1 GHANAIAN SNAPSHOT

... address the large fiscal deficit. In turn, Ghana’s weak fiscal finances contributed to a widening current account deficit, a depreciating currency, increasing levels of inflation, high interest rates, and an increase in tax rates. Ghana’s economy will face several headwinds this year. Authorities ac ...

... address the large fiscal deficit. In turn, Ghana’s weak fiscal finances contributed to a widening current account deficit, a depreciating currency, increasing levels of inflation, high interest rates, and an increase in tax rates. Ghana’s economy will face several headwinds this year. Authorities ac ...

Fiscal Policy

... who opposed Keynes' call in the 1930s for fiscal stimulus. The same general argument has been repeated by some neoclassical economists up to the present. In the classical view, the expansionary fiscal policy also decreases net exports, which has a mitigating effect on national output and income. Wh ...

... who opposed Keynes' call in the 1930s for fiscal stimulus. The same general argument has been repeated by some neoclassical economists up to the present. In the classical view, the expansionary fiscal policy also decreases net exports, which has a mitigating effect on national output and income. Wh ...

High-level Regional Policy Dialogue on

... Inflation and Economic Growth There is a debate in India on the instruments needed for controlling inflation. According to some, Monetary policy may not be the right one. Fiscal policy and supply side are important. Due to monetary tightening, investment demand got affected although consumption dema ...

... Inflation and Economic Growth There is a debate in India on the instruments needed for controlling inflation. According to some, Monetary policy may not be the right one. Fiscal policy and supply side are important. Due to monetary tightening, investment demand got affected although consumption dema ...

Ecuador_en.pdf

... public investment. From the third to the fourth quarter of 2008, petroleum revenue fell by an amount equivalent to 1.8% of GDP, with a larger decrease expected in 2009. It is thus very likely that capital formation by the State will decline sharply in 2009, with the consequent detrimental effects fo ...

... public investment. From the third to the fourth quarter of 2008, petroleum revenue fell by an amount equivalent to 1.8% of GDP, with a larger decrease expected in 2009. It is thus very likely that capital formation by the State will decline sharply in 2009, with the consequent detrimental effects fo ...

Neither a Lender nor a Borrower Be

... The national debt is its own national institution. It is so ubiquitous that even the man on the street is likely to have formulated an opinion. Everyone seems to be in favor of eliminating it, but few have thought about the ancillary consequences of a debt free government. The national debt plays an ...

... The national debt is its own national institution. It is so ubiquitous that even the man on the street is likely to have formulated an opinion. Everyone seems to be in favor of eliminating it, but few have thought about the ancillary consequences of a debt free government. The national debt plays an ...

Growth Potentials of the Greek economy (ecosystems of dynamic

... Sector Debt 2011 (% of GDP) The private sector debt in Greece remains relatively low ...

... Sector Debt 2011 (% of GDP) The private sector debt in Greece remains relatively low ...

(current account deficit stood at 12.3% of GDP in 2008).

... Important indirect effects because Romania is highly dependent on the external funding (current account deficit stood at 12.3% of GDP in 2008). External debt and the debt of banking sector (% of GDP, 2008 Q2) ...

... Important indirect effects because Romania is highly dependent on the external funding (current account deficit stood at 12.3% of GDP in 2008). External debt and the debt of banking sector (% of GDP, 2008 Q2) ...

Austerity: The Answer to Europe`s Crisis

... were as intertwined as ever. If any one of them would default, it could cause a major collapse of other banks and institutions. If any one bank went bankrupt then this would prompt a government response, meaning increased government debt. Markets determined that a default by Spain would be much wors ...

... were as intertwined as ever. If any one of them would default, it could cause a major collapse of other banks and institutions. If any one bank went bankrupt then this would prompt a government response, meaning increased government debt. Markets determined that a default by Spain would be much wors ...

18-5-2012_Francesco_CONTESSO

... Main transmission mechanism of sovereign-debt crisis to the Western Balkan are lower exports and in particular more constrained access to (foreign) financing. This puts in question the Western Balkan growth model, which strongly relied on foreign sources. The region’s growth potential is impeded by ...

... Main transmission mechanism of sovereign-debt crisis to the Western Balkan are lower exports and in particular more constrained access to (foreign) financing. This puts in question the Western Balkan growth model, which strongly relied on foreign sources. The region’s growth potential is impeded by ...

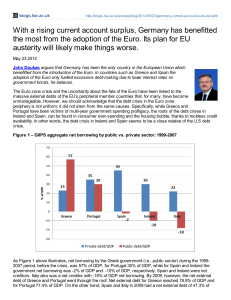

With a rising current account surplus, Germany has benefitted the

... which led to their external debt burden. Germany, on the other hand, with a rising current account surplus became a net creditor country. In brief, Germany is, perhaps, the only EU country that benefitted the most from the adoption of the Euro (i.e., a weaker currency relative to the German mark). E ...

... which led to their external debt burden. Germany, on the other hand, with a rising current account surplus became a net creditor country. In brief, Germany is, perhaps, the only EU country that benefitted the most from the adoption of the Euro (i.e., a weaker currency relative to the German mark). E ...

Recent Economic Developments

... • Indonesia's Q2-2010 balance of payments posted a significant surplus at US$5.4 billion (Q1-2010: US$6,6 billion surplus). Key to this surplus were positive contributions from the current account and the capital and financial account. • The current account in Q2-2010 posted a surplus of about US$1. ...

... • Indonesia's Q2-2010 balance of payments posted a significant surplus at US$5.4 billion (Q1-2010: US$6,6 billion surplus). Key to this surplus were positive contributions from the current account and the capital and financial account. • The current account in Q2-2010 posted a surplus of about US$1. ...

Strategies for Reinvigorating Global Economic Growth

... Reforming International Monetary System (IMS) ...

... Reforming International Monetary System (IMS) ...

Figure 3.4. Probability Distributions of One-Year-Ahead GDP

... Financial conditions improve the ability to predict future economic downturns. 1. 2006:Q2 ...

... Financial conditions improve the ability to predict future economic downturns. 1. 2006:Q2 ...

apropos… - ETHENEA

... In principal, nominal interest rates should be more or less in line with nominal GDP growth, which Abenomics aims to increase. If Japanese interest rates remain repressed, however, a significant share of GDP is redistributed from the households to the government. Unfortunately, the country has been ...

... In principal, nominal interest rates should be more or less in line with nominal GDP growth, which Abenomics aims to increase. If Japanese interest rates remain repressed, however, a significant share of GDP is redistributed from the households to the government. Unfortunately, the country has been ...

HIA – Jimmy Hixon Nov 10 - Houston Investors Association

... The only legitimate way out is to grow our way out by increasing wages through productivity increases, which cause tax revenues to increase without increasing tax rates. Low taxes help to do that. Why shouldn’t everyone pay some tax? Isn’t that what “fairness” is all about? I paid taxes all my life ...

... The only legitimate way out is to grow our way out by increasing wages through productivity increases, which cause tax revenues to increase without increasing tax rates. Low taxes help to do that. Why shouldn’t everyone pay some tax? Isn’t that what “fairness” is all about? I paid taxes all my life ...

Essay questions for Chapter 3

... countries increase or only those of a small group of EMU member countries? If interest rates of only a few countries increased, provide a list of these countries. State also the reasons that contributed to the increase in these countries’ interest rates. ...

... countries increase or only those of a small group of EMU member countries? If interest rates of only a few countries increased, provide a list of these countries. State also the reasons that contributed to the increase in these countries’ interest rates. ...

One of the fastest-growing economies in Europe

... Fiscal balance (% of GDP) - lhs Pubic debt (% of GDP) - rhs ...

... Fiscal balance (% of GDP) - lhs Pubic debt (% of GDP) - rhs ...