Barry Eichengreen - Banco Central de Chile

... global financial crisis in 80 years. The reason is clear: delicate political relations make it hard for Asian countries to demand policy adjustments of their neighbors, and in the absence of such adjustments they are reluctant to put money on the barrelhead. To finesse this problem, disbursing credi ...

... global financial crisis in 80 years. The reason is clear: delicate political relations make it hard for Asian countries to demand policy adjustments of their neighbors, and in the absence of such adjustments they are reluctant to put money on the barrelhead. To finesse this problem, disbursing credi ...

PDF

... and further international borrowing appeared unlikely, the government turned to the domestic capital market as potential source of capital. The available potential for further development of the capital market was a condition for the government to try and test the market to secure additional funds w ...

... and further international borrowing appeared unlikely, the government turned to the domestic capital market as potential source of capital. The available potential for further development of the capital market was a condition for the government to try and test the market to secure additional funds w ...

New Financial Regulator Seen to Target Chaebol

... Yoon also said market confidence is the most important factor concerning the revamping of the nation’s regulatory system. ``It should be revised so people find financial services more efficient.’’ Choosing between a civil-servant-based regulatory agency and a private regulator depends on each natio ...

... Yoon also said market confidence is the most important factor concerning the revamping of the nation’s regulatory system. ``It should be revised so people find financial services more efficient.’’ Choosing between a civil-servant-based regulatory agency and a private regulator depends on each natio ...

Risk Management Objectives

... How Financial Markets Can Magnify Crises If no apparent event can cause such destruction of value, think of what can happen if the markets end up on the wrong side of a real event. ...

... How Financial Markets Can Magnify Crises If no apparent event can cause such destruction of value, think of what can happen if the markets end up on the wrong side of a real event. ...

EMERGING MARKETS: Business Opportunities for Kansas SME’s

... Paved road density Internet hosts (per million people) Population (per retail outlet) Television sets (per capita) ...

... Paved road density Internet hosts (per million people) Population (per retail outlet) Television sets (per capita) ...

Discussion: Financial Crises, Bank Risk Exposure and Government Financial Policy by

... • The popular discussion in the press seems to put tremendous weight on this factor: – If only banks would lend more then the economy would recover and we would be back to a normal world again… • But as always with lower bank lending, there is the question of which direction causality goes, are ...

... • The popular discussion in the press seems to put tremendous weight on this factor: – If only banks would lend more then the economy would recover and we would be back to a normal world again… • But as always with lower bank lending, there is the question of which direction causality goes, are ...

2015 Global Financial Markets Forum Concludes

... the dollar was also seen as a positive factor from the UAE side. The world economy is expected to grow by about 3.5% this year which was seen as positive but pointed that the growth scene has changed and become more country specific. Panelists welcomed the US economy’s recovery and China’s good long ...

... the dollar was also seen as a positive factor from the UAE side. The world economy is expected to grow by about 3.5% this year which was seen as positive but pointed that the growth scene has changed and become more country specific. Panelists welcomed the US economy’s recovery and China’s good long ...

COPY FOR `MINT`

... instruments created a bubble. We are also in it. When it was pricked, overextended institutions liquidated investments at fractions of face values. Indian financial institutions have also created such a bubble which might be pricked any day. The American economy must learn to live within its means. ...

... instruments created a bubble. We are also in it. When it was pricked, overextended institutions liquidated investments at fractions of face values. Indian financial institutions have also created such a bubble which might be pricked any day. The American economy must learn to live within its means. ...

Word Version

... implemented. “The market had a significant rally post-election, and what it was pricing in was the best-case scenario for all of these pro-growth policies occurring,” Spika said. “To the extent that they don’t and they don’t occur as timely as the market would expect, there’s likely to be some volat ...

... implemented. “The market had a significant rally post-election, and what it was pricing in was the best-case scenario for all of these pro-growth policies occurring,” Spika said. “To the extent that they don’t and they don’t occur as timely as the market would expect, there’s likely to be some volat ...

Balance of Trade

... 1975, the United States ran a trade surplus. Since then, however, the country has run large annual trade deficits, peaking at $753 billion — 5.6 percent of GDP — in 2006. Falling imports brought the deficit to a nineyear low of $381 billion during the 2007-09 recession, but the gap widened to $560 b ...

... 1975, the United States ran a trade surplus. Since then, however, the country has run large annual trade deficits, peaking at $753 billion — 5.6 percent of GDP — in 2006. Falling imports brought the deficit to a nineyear low of $381 billion during the 2007-09 recession, but the gap widened to $560 b ...

What Hazard? - Inter-American Development Bank

... CURRENT FINANCIAL TURMOIL: Some key issues Guillermo A. Calvo ...

... CURRENT FINANCIAL TURMOIL: Some key issues Guillermo A. Calvo ...

The Global Crisis Jomo K. Sundaram 13 March 2009, Mumbai TISS & IDEAs

... Financial Impacts • Financial markets crisis Æ emerging markets collapse greater • Reversal of capital flows • FDI down • Borrowing costs, margins much higher • Financial positions of many developing countries much stronger than during financial crises in Asia + LA, due to strong foreign reserves, ...

... Financial Impacts • Financial markets crisis Æ emerging markets collapse greater • Reversal of capital flows • FDI down • Borrowing costs, margins much higher • Financial positions of many developing countries much stronger than during financial crises in Asia + LA, due to strong foreign reserves, ...

Policy Actions to Mitigate Bank

... gains and socializing losses. Participants in no other industry get as self-righteously angry when public officials – particularly, central bankers – fail to come at once to their rescue when they get into (well-deserved) trouble.” (Martin Wolf, Financial Times, Jan 15, 2008). ...

... gains and socializing losses. Participants in no other industry get as self-righteously angry when public officials – particularly, central bankers – fail to come at once to their rescue when they get into (well-deserved) trouble.” (Martin Wolf, Financial Times, Jan 15, 2008). ...

Historical Monetary Overview

... 14. The U.S., the U.K., and others reinstated the gold standard 15. But the rules were persistently broken and the U.K. in decline 16. The Great Depression made many countries float their currencies ...

... 14. The U.S., the U.K., and others reinstated the gold standard 15. But the rules were persistently broken and the U.K. in decline 16. The Great Depression made many countries float their currencies ...

NSE boss pledges to sustain capital market reforms

... Oscar Onyema, yesterday pledged to sustain the on going reforms in the market as part of strategies to accelerate Nigeria and Africa’s economic development. In his presentation to the House of Representative Committee on Capital Market and Institutions, Onyema said that it was unfortunate that the m ...

... Oscar Onyema, yesterday pledged to sustain the on going reforms in the market as part of strategies to accelerate Nigeria and Africa’s economic development. In his presentation to the House of Representative Committee on Capital Market and Institutions, Onyema said that it was unfortunate that the m ...

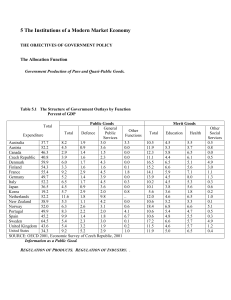

In chapter 1 we discussed in broad outline some of the institutions

... trade enhances both world welfare and the aggregate welfare of countries that engage in it. However, within a country there are costs to particular groups. In general we may say that the broad consuming public benefits from liberalization because it provides access to lower cost imports. However, th ...

... trade enhances both world welfare and the aggregate welfare of countries that engage in it. However, within a country there are costs to particular groups. In general we may say that the broad consuming public benefits from liberalization because it provides access to lower cost imports. However, th ...

Chapter 1

... and assets of the corporation • Issuing stock and selling it to the public is a way for corporations to raise funds to finance their activities • Stock Market is a place where people can get rich—or poor—quickly. ...

... and assets of the corporation • Issuing stock and selling it to the public is a way for corporations to raise funds to finance their activities • Stock Market is a place where people can get rich—or poor—quickly. ...

International Political Economy

... A system reliant upon market forces was inadequate. What was required was a more publicly managed system. Similar to what necessitated the Keynesian New Deal approach but, with global political and economic stakes. To avoid economic nationalism free trade and international economic interaction w ...

... A system reliant upon market forces was inadequate. What was required was a more publicly managed system. Similar to what necessitated the Keynesian New Deal approach but, with global political and economic stakes. To avoid economic nationalism free trade and international economic interaction w ...

Recent International Financial Markets Turmoil is a Wakeup Call: Dr

... continuous widening of global economic imbalances now for almost five years whereby burgeoning US external current account deficit has also raised several questions. The SBP Governor said that in order to promote global economic stability and an orderly unwinding of these imbalances, the Internation ...

... continuous widening of global economic imbalances now for almost five years whereby burgeoning US external current account deficit has also raised several questions. The SBP Governor said that in order to promote global economic stability and an orderly unwinding of these imbalances, the Internation ...

Turkey Presentation - Wharton Finance Department

... State banks account for % 34 of the sector in Dec 2000. ...

... State banks account for % 34 of the sector in Dec 2000. ...

FRBSF E L CONOMIC ETTER

... capital markets, such as collateral constraints and trading costs, how can government policies address the problem? One proposed policy approach is to create explicit price-floor guarantees by international financial organizations for investments in emerging market economies. Mendoza and Durdu intro ...

... capital markets, such as collateral constraints and trading costs, how can government policies address the problem? One proposed policy approach is to create explicit price-floor guarantees by international financial organizations for investments in emerging market economies. Mendoza and Durdu intro ...

Global financial system

The global financial system is the worldwide framework of legal agreements, institutions, and both formal and informal economic actors that together facilitate international flows of financial capital for purposes of investment and trade financing. Since emerging in the late 19th century during the first modern wave of economic globalization, its evolution is marked by the establishment of central banks, multilateral treaties, and intergovernmental organizations aimed at improving the transparency, regulation, and effectiveness of international markets. In the late 1800s, world migration and communication technology facilitated unprecedented growth in international trade and investment. At the onset of World War I, trade contracted as foreign exchange markets became paralyzed by money market illiquidity. Countries sought to defend against external shocks with protectionist policies and trade virtually halted by 1933, worsening the effects of the global Great Depression until a series of reciprocal trade agreements slowly reduced tariffs worldwide. Efforts to revamp the international monetary system after World War II improved exchange rate stability, fostering record growth in global finance.A series of currency devaluations and oil crises in the 1970s led most countries to float their currencies. The world economy became increasingly financially integrated in the 1980s and 1990s due to capital account liberalization and financial deregulation. A series of financial crises in Europe, Asia, and Latin America followed with contagious effects due to greater exposure to volatile capital flows. The global financial crisis, which originated in the United States in 2007, quickly propagated among other nations and is recognized as the catalyst for the worldwide Great Recession. A market adjustment to Greece's noncompliance with its monetary union in 2009 ignited a sovereign debt crisis among European nations known as the Eurozone crisis.A country's decision to operate an open economy and globalize its financial capital carries monetary implications captured by the balance of payments. It also renders exposure to risks in international finance, such as political deterioration, regulatory changes, foreign exchange controls, and legal uncertainties for property rights and investments. Both individuals and groups may participate in the global financial system. Consumers and international businesses undertake consumption, production, and investment. Governments and intergovernmental bodies act as purveyors of international trade, economic development, and crisis management. Regulatory bodies establish financial regulations and legal procedures, while independent bodies facilitate industry supervision. Research institutes and other associations analyze data, publish reports and policy briefs, and host public discourse on global financial affairs.While the global financial system is edging toward greater stability, governments must deal with differing regional or national needs. Some nations are trying to orderly discontinue unconventional monetary policies installed to cultivate recovery, while others are expanding their scope and scale. Emerging market policymakers face a challenge of precision as they must carefully institute sustainable macroeconomic policies during extraordinary market sensitivity without provoking investors to retreat their capital to stronger markets. Nations' inability to align interests and achieve international consensus on matters such as banking regulation has perpetuated the risk of future global financial catastrophes.