2014 Outlook: Financial Services

... One of the key sources of risk for the financial sector in 2014 will come from potential changes in the Federal Reserve’s (Fed’s) monetary policy. The unprecedented volume of asset purchases by the Fed during the past few years (i.e., quantitative easing, or QE)2 was designed to provide liquidity to ...

... One of the key sources of risk for the financial sector in 2014 will come from potential changes in the Federal Reserve’s (Fed’s) monetary policy. The unprecedented volume of asset purchases by the Fed during the past few years (i.e., quantitative easing, or QE)2 was designed to provide liquidity to ...

SRR - CBSL

... The shortage of liquid dollar balances in international financial markets arising from the ongoing global financial crisis and the higher demand for domestic funds have caused a prolonged liquidity shortfall in the domestic financial markets. The Central Bank has closely monitored these market devel ...

... The shortage of liquid dollar balances in international financial markets arising from the ongoing global financial crisis and the higher demand for domestic funds have caused a prolonged liquidity shortfall in the domestic financial markets. The Central Bank has closely monitored these market devel ...

Ingen bildrubrik

... interests • Market pricing of bad debt • Immediate credibility among foreign investors and creditors ...

... interests • Market pricing of bad debt • Immediate credibility among foreign investors and creditors ...

Policy Innovations - Decouple the World from the Dollar

... Until recently, some economists believed that this economic crisis would end when investors returned to the stock market and recapitalized banks. But investors lacked confidence, thinking that they would be throwing good money after bad. The dubious assets buried deep in bank balance sheets still ha ...

... Until recently, some economists believed that this economic crisis would end when investors returned to the stock market and recapitalized banks. But investors lacked confidence, thinking that they would be throwing good money after bad. The dubious assets buried deep in bank balance sheets still ha ...

YORK UNIVERSITY

... o Reduces credibility of commitment to fixed exchange rate o Limits the sue of monetary policy for domestic purposes o Opens the currency to speculative attacks, especially when the country lacks adequate foreign reserves Fixed exchange rate requires holding of foreign reserves – usually low yieldin ...

... o Reduces credibility of commitment to fixed exchange rate o Limits the sue of monetary policy for domestic purposes o Opens the currency to speculative attacks, especially when the country lacks adequate foreign reserves Fixed exchange rate requires holding of foreign reserves – usually low yieldin ...

Financial supervision and crisis management in the EU

... • Seventh, to secure effective macro-risk management financial regulation must escape from its present focus on the nature of institutions – commercial banks are regulated differently from investment banks, hedge funds are not regulated at all – and concentrate instead on function. – Targeting regul ...

... • Seventh, to secure effective macro-risk management financial regulation must escape from its present focus on the nature of institutions – commercial banks are regulated differently from investment banks, hedge funds are not regulated at all – and concentrate instead on function. – Targeting regul ...

background

... Fiscal policy Fiscal policy is tightened to limit the need for inflows of capital from overseas. As it became apparent that the economic impact of the Asian Crisis was deeper than had been expected, fiscal targets in Asian countries were relaxed to take account of falling government tax revenues. Mo ...

... Fiscal policy Fiscal policy is tightened to limit the need for inflows of capital from overseas. As it became apparent that the economic impact of the Asian Crisis was deeper than had been expected, fiscal targets in Asian countries were relaxed to take account of falling government tax revenues. Mo ...

World Trade Organization (WTO)

... countries such as Brazil, China, India, Indonesia, and Russia. More trade expected in emerging markets, regional trade areas, and the established markets in Europe, Japan, Saudi Arabia and U.S. Companies need to be more efficient, improve productivity, expand global reach, and respond quickly. Great ...

... countries such as Brazil, China, India, Indonesia, and Russia. More trade expected in emerging markets, regional trade areas, and the established markets in Europe, Japan, Saudi Arabia and U.S. Companies need to be more efficient, improve productivity, expand global reach, and respond quickly. Great ...

Sustainability News 1 - UNIMAK - the University of Makeni, Sierra

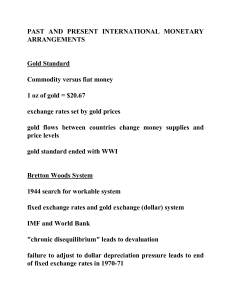

... We need to consider how economic policy came to be what it is in 2015. So, we need a brief Economic History discussion. Our journey starts in the US at Bretton Woods in 1944, yes that long ago. It was at this conference that the norms regulating post Second World War international trade and trade wh ...

... We need to consider how economic policy came to be what it is in 2015. So, we need a brief Economic History discussion. Our journey starts in the US at Bretton Woods in 1944, yes that long ago. It was at this conference that the norms regulating post Second World War international trade and trade wh ...

INTERNATIONAL MONETARY ECONOMICS IoBM, FEBRUARY

... income from abroad and interest payments abroad and grants such as foreign aid. The current account is commonly used to illustrate the trade balance.] b. The capital account records the net change in ownership of foreign assets. It includes reserve account (the international operations of a nation’s ...

... income from abroad and interest payments abroad and grants such as foreign aid. The current account is commonly used to illustrate the trade balance.] b. The capital account records the net change in ownership of foreign assets. It includes reserve account (the international operations of a nation’s ...

past and present international monetary

... Serve standard functions of money as unit of account, store of value, and medium of exchange Evolution from British pound to U.S. dollar and now to German mark and Japanese yen Why have Japan and Germany resisted currencies serving as world money? Seigniorage: the revenue from money creation is limi ...

... Serve standard functions of money as unit of account, store of value, and medium of exchange Evolution from British pound to U.S. dollar and now to German mark and Japanese yen Why have Japan and Germany resisted currencies serving as world money? Seigniorage: the revenue from money creation is limi ...

一、 解釋名詞,任選三小題作答

... Using the principles of double--entry bookkeeping, indicate how the following transactions are recorded in the balance of payments. Be sure to indicate whether a particular transaction enters as a credit or debit and identify the particular sub-account in which it is entered. a) An American buys a s ...

... Using the principles of double--entry bookkeeping, indicate how the following transactions are recorded in the balance of payments. Be sure to indicate whether a particular transaction enters as a credit or debit and identify the particular sub-account in which it is entered. a) An American buys a s ...

Slide

... best customer for its goods – both may see the advantages of a deal. China would admit that it has not already fixed its currency, and that domestic demand also needs to be increased. US would admit that it has a budget deficit problem, and that the trade deficit is not China’s fault. ...

... best customer for its goods – both may see the advantages of a deal. China would admit that it has not already fixed its currency, and that domestic demand also needs to be increased. US would admit that it has a budget deficit problem, and that the trade deficit is not China’s fault. ...

Microfinanças: quais os resultados dos programas?

... •GDP increasing for the second consecutive trimester; •Maintainance of pre-crisis levels of credit in the economy; •This level is manteined by both foreign and private banks. and is increased in estate owned commercial banks •Supervised MFIs virtually non-affected. •Coooperative system expanded cred ...

... •GDP increasing for the second consecutive trimester; •Maintainance of pre-crisis levels of credit in the economy; •This level is manteined by both foreign and private banks. and is increased in estate owned commercial banks •Supervised MFIs virtually non-affected. •Coooperative system expanded cred ...

presentation

... Per capita GDP $ 40,000 (PPP) – 6th in OECD Open in trade: ½ (imports + exports)/GDP = 38% Exceptionally open in finance: external assets 395% of GDP, external liabilities 517% of GDP (end-2006), significant carry trade Non-resident workforce of Icelandic companies approximately equals resident work ...

... Per capita GDP $ 40,000 (PPP) – 6th in OECD Open in trade: ½ (imports + exports)/GDP = 38% Exceptionally open in finance: external assets 395% of GDP, external liabilities 517% of GDP (end-2006), significant carry trade Non-resident workforce of Icelandic companies approximately equals resident work ...

Chapter 1 An Introduction to Money and the Financial System

... To pay for purchases and store wealth 2. Financial Instruments To transfer wealth from savers to investors and to transfer risk to those best equipped to bear it. ...

... To pay for purchases and store wealth 2. Financial Instruments To transfer wealth from savers to investors and to transfer risk to those best equipped to bear it. ...

Managing the Global Economy: Prospects for a

... Proper sequencing of reforms is needed in order to prevent future crises. This ensures that capital account liberalization does not result in the undermining of unprepared financial systems by unmanageable flows of hot money. Inter alia there must be more transparency, better financial regulation, d ...

... Proper sequencing of reforms is needed in order to prevent future crises. This ensures that capital account liberalization does not result in the undermining of unprepared financial systems by unmanageable flows of hot money. Inter alia there must be more transparency, better financial regulation, d ...

Laura R. Biddle Counsel, Washington, D.C. Laura Biddle`s practice

... formation and conversion, controlling and non-controlling private equity investments, Volcker Rule restrictions, reorganization, recapitalization and acquisitions of troubled banks through the FDIC’s receivership process, and compliance with margin lending regulations. Laura also has experience repr ...

... formation and conversion, controlling and non-controlling private equity investments, Volcker Rule restrictions, reorganization, recapitalization and acquisitions of troubled banks through the FDIC’s receivership process, and compliance with margin lending regulations. Laura also has experience repr ...

Globalization Globalization – Principle and Practice - Rose

... monetary value of all goods and services produced in a country in a given year. Gross National Product: Same as above, but takes into account foreign exchange (trade; foreign companies in the US; US companies producing abroad) ...

... monetary value of all goods and services produced in a country in a given year. Gross National Product: Same as above, but takes into account foreign exchange (trade; foreign companies in the US; US companies producing abroad) ...

William A. Niskanen CAPITAL MOBILITY, INFLATION, AND HARMONIZATION

... seem too small to merit the measures considered. In recent years, for example, Japan and Mexico have each experienced a severe financial problem with few effects in other countries other than on those who had purchased the securities of these countries. Although this observation seems to have been r ...

... seem too small to merit the measures considered. In recent years, for example, Japan and Mexico have each experienced a severe financial problem with few effects in other countries other than on those who had purchased the securities of these countries. Although this observation seems to have been r ...

Global financial system

The global financial system is the worldwide framework of legal agreements, institutions, and both formal and informal economic actors that together facilitate international flows of financial capital for purposes of investment and trade financing. Since emerging in the late 19th century during the first modern wave of economic globalization, its evolution is marked by the establishment of central banks, multilateral treaties, and intergovernmental organizations aimed at improving the transparency, regulation, and effectiveness of international markets. In the late 1800s, world migration and communication technology facilitated unprecedented growth in international trade and investment. At the onset of World War I, trade contracted as foreign exchange markets became paralyzed by money market illiquidity. Countries sought to defend against external shocks with protectionist policies and trade virtually halted by 1933, worsening the effects of the global Great Depression until a series of reciprocal trade agreements slowly reduced tariffs worldwide. Efforts to revamp the international monetary system after World War II improved exchange rate stability, fostering record growth in global finance.A series of currency devaluations and oil crises in the 1970s led most countries to float their currencies. The world economy became increasingly financially integrated in the 1980s and 1990s due to capital account liberalization and financial deregulation. A series of financial crises in Europe, Asia, and Latin America followed with contagious effects due to greater exposure to volatile capital flows. The global financial crisis, which originated in the United States in 2007, quickly propagated among other nations and is recognized as the catalyst for the worldwide Great Recession. A market adjustment to Greece's noncompliance with its monetary union in 2009 ignited a sovereign debt crisis among European nations known as the Eurozone crisis.A country's decision to operate an open economy and globalize its financial capital carries monetary implications captured by the balance of payments. It also renders exposure to risks in international finance, such as political deterioration, regulatory changes, foreign exchange controls, and legal uncertainties for property rights and investments. Both individuals and groups may participate in the global financial system. Consumers and international businesses undertake consumption, production, and investment. Governments and intergovernmental bodies act as purveyors of international trade, economic development, and crisis management. Regulatory bodies establish financial regulations and legal procedures, while independent bodies facilitate industry supervision. Research institutes and other associations analyze data, publish reports and policy briefs, and host public discourse on global financial affairs.While the global financial system is edging toward greater stability, governments must deal with differing regional or national needs. Some nations are trying to orderly discontinue unconventional monetary policies installed to cultivate recovery, while others are expanding their scope and scale. Emerging market policymakers face a challenge of precision as they must carefully institute sustainable macroeconomic policies during extraordinary market sensitivity without provoking investors to retreat their capital to stronger markets. Nations' inability to align interests and achieve international consensus on matters such as banking regulation has perpetuated the risk of future global financial catastrophes.