slides - Harvard University

... 7th Policy Roundtable of the European Central Bank The international role of the euro: past, present and prospects ...

... 7th Policy Roundtable of the European Central Bank The international role of the euro: past, present and prospects ...

Global currency trends through the financial crisis

... the increased risk factors associated with trading over this ...

... the increased risk factors associated with trading over this ...

REPUBLIC OF TURKEY PRIME MINISTRY Ref: B. 02.1.HZN.0.08.02.00/500/18999

... pressure on headline inflation. However, these adjustments will also support lower inflation in the medium term as they contribute to a prudent fiscal stance and facilitate an expansion of the domestic energy supply. Meanwhile, the continued easing of core inflation since early 2007 allowed a gradua ...

... pressure on headline inflation. However, these adjustments will also support lower inflation in the medium term as they contribute to a prudent fiscal stance and facilitate an expansion of the domestic energy supply. Meanwhile, the continued easing of core inflation since early 2007 allowed a gradua ...

Answers to PS 3

... autonomy to enter into cooperative agreements with other countries to reduce the risk of beggar-thyneighbor policies. All of these benefits must be weighed against the cost of losing monetary autonomy. If a nation fixes its exchange rate to a country with which it has a highly coordinated business c ...

... autonomy to enter into cooperative agreements with other countries to reduce the risk of beggar-thyneighbor policies. All of these benefits must be weighed against the cost of losing monetary autonomy. If a nation fixes its exchange rate to a country with which it has a highly coordinated business c ...

The neglected side of banking union: reshaping Europe`s financial

... is the high exposure to risk relative to the loss-absorbing capital and debt in the banking system. This translated into increasing demands for bail-outs and numerous public assistance programmes. The third problem is the contrast between the high degree of (wholesale) banking market integration tha ...

... is the high exposure to risk relative to the loss-absorbing capital and debt in the banking system. This translated into increasing demands for bail-outs and numerous public assistance programmes. The third problem is the contrast between the high degree of (wholesale) banking market integration tha ...

Handout on the U.S. Federal Reserve and the mechanics of

... The Federal Reserve: The Mechanics of Monetary Policy To manage the money supply, the Federal Reserve uses the tools of monetary policy to influence the quantity of reserves in the banking system. Increasing (decreasing) reserves tends to expand (contract) a bank’s ability to make loans. Thus, reser ...

... The Federal Reserve: The Mechanics of Monetary Policy To manage the money supply, the Federal Reserve uses the tools of monetary policy to influence the quantity of reserves in the banking system. Increasing (decreasing) reserves tends to expand (contract) a bank’s ability to make loans. Thus, reser ...

PDF Download

... and highlight the lessons that can be learnt from current and past crises. Whereas many European countries may envy Sweden's fiscal discipline, recent economic policies in Hungary seem to bode ill for the country's future. Finally, Chapter 6 looks at the longterm crisis of climate change and argues ...

... and highlight the lessons that can be learnt from current and past crises. Whereas many European countries may envy Sweden's fiscal discipline, recent economic policies in Hungary seem to bode ill for the country's future. Finally, Chapter 6 looks at the longterm crisis of climate change and argues ...

Default and Debt Swap in Argentina: Kirchner`s fair Hair-cut

... (5) Will the Argentinean example affect the honouring of emerging market debt? An incentive to purchase emerging market bonds results from the higher interest rate. These coupons are not only designed to this purpose, since capital is most needed in emerging countries due to strong growth, but also ...

... (5) Will the Argentinean example affect the honouring of emerging market debt? An incentive to purchase emerging market bonds results from the higher interest rate. These coupons are not only designed to this purpose, since capital is most needed in emerging countries due to strong growth, but also ...

History of cooperation in East Africa cont`d..

... Gross foreign exchange reserves equivalent to at least 6 months of imports in the medium term. ...

... Gross foreign exchange reserves equivalent to at least 6 months of imports in the medium term. ...

PROMOTING JAPANESE RECOVERY by

... long duration, an unanticipated decline in inflation or deflation leads to a decrease in the net worth of firms. Debt contracts with long duration have interest payments fixed in nominal terms for a substantial period of time, with the fixed interest rate allowing for expected inflation. When infla ...

... long duration, an unanticipated decline in inflation or deflation leads to a decrease in the net worth of firms. Debt contracts with long duration have interest payments fixed in nominal terms for a substantial period of time, with the fixed interest rate allowing for expected inflation. When infla ...

Department of Economics

... balance sheet of chartered/commercial banks and balance sheet of Bank of Canada demand versus time deposits cash reserves of chartered banks [accounts receivable from the Bank of Canada and Canadian currency held by banks – Canadian coin and Bank of Canada notes] cash reserve ratio [no longer requir ...

... balance sheet of chartered/commercial banks and balance sheet of Bank of Canada demand versus time deposits cash reserves of chartered banks [accounts receivable from the Bank of Canada and Canadian currency held by banks – Canadian coin and Bank of Canada notes] cash reserve ratio [no longer requir ...

The Seductive Myth of Canada`s Overvalued Dollar

... prices it is usually changing in response to various economic forces, domestic and foreign. As occurs whenever relative prices change, some people are made better off and others worse off. But in a setting of freely floating currencies, it makes little sense to claim that today’s exchange rate is ei ...

... prices it is usually changing in response to various economic forces, domestic and foreign. As occurs whenever relative prices change, some people are made better off and others worse off. But in a setting of freely floating currencies, it makes little sense to claim that today’s exchange rate is ei ...

Three Lectures in Economics by Kenneth Creamer

... such a way as to promote access and social development – Ensure that issues such as social justice, equality and the war on poverty dominate state policy making ...

... such a way as to promote access and social development – Ensure that issues such as social justice, equality and the war on poverty dominate state policy making ...

The Classical Model and Macroeconomic Policy

... So far so good, but now we need to look at the implications this has for policy makers confronted with a deepening depression in the US in the 1930s. The fundamental question facing those policy makers is: does the market system have an adequate self-correction mechanism that produces a level of out ...

... So far so good, but now we need to look at the implications this has for policy makers confronted with a deepening depression in the US in the 1930s. The fundamental question facing those policy makers is: does the market system have an adequate self-correction mechanism that produces a level of out ...

Financial Crises in Emerging Market Economies

... Crises in advanced economies can be triggered by a number of factors. But in emerging market countries, financial crises develop along two basic paths—either the mismanagement of financial liberalization and globalization or severe fiscal imbalances. The first path of mismanagement of financial libe ...

... Crises in advanced economies can be triggered by a number of factors. But in emerging market countries, financial crises develop along two basic paths—either the mismanagement of financial liberalization and globalization or severe fiscal imbalances. The first path of mismanagement of financial libe ...

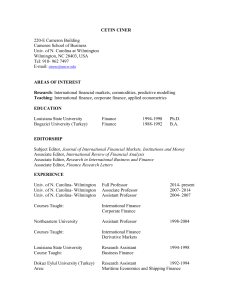

cetin ciner - University of North Carolina Wilmington

... Maritime Economics and Shipping Finance ...

... Maritime Economics and Shipping Finance ...

Diapositiva 1

... Direct policy tools, e.g., tariff taxes, import controls, periodic exchange rate devaluation can control balance of payments Monetary policy enhances growth ...

... Direct policy tools, e.g., tariff taxes, import controls, periodic exchange rate devaluation can control balance of payments Monetary policy enhances growth ...

The Promise and Challenges of Bank Capital Reform

... banks are regulated is through capital requirements. A financial institution’s capital is its net worth: the difference between the values of its assets and liabilities. A bank’s typical assets would include loans to businesses and households, and securities such as municipal bonds or mortgage-backe ...

... banks are regulated is through capital requirements. A financial institution’s capital is its net worth: the difference between the values of its assets and liabilities. A bank’s typical assets would include loans to businesses and households, and securities such as municipal bonds or mortgage-backe ...

Global financial system

The global financial system is the worldwide framework of legal agreements, institutions, and both formal and informal economic actors that together facilitate international flows of financial capital for purposes of investment and trade financing. Since emerging in the late 19th century during the first modern wave of economic globalization, its evolution is marked by the establishment of central banks, multilateral treaties, and intergovernmental organizations aimed at improving the transparency, regulation, and effectiveness of international markets. In the late 1800s, world migration and communication technology facilitated unprecedented growth in international trade and investment. At the onset of World War I, trade contracted as foreign exchange markets became paralyzed by money market illiquidity. Countries sought to defend against external shocks with protectionist policies and trade virtually halted by 1933, worsening the effects of the global Great Depression until a series of reciprocal trade agreements slowly reduced tariffs worldwide. Efforts to revamp the international monetary system after World War II improved exchange rate stability, fostering record growth in global finance.A series of currency devaluations and oil crises in the 1970s led most countries to float their currencies. The world economy became increasingly financially integrated in the 1980s and 1990s due to capital account liberalization and financial deregulation. A series of financial crises in Europe, Asia, and Latin America followed with contagious effects due to greater exposure to volatile capital flows. The global financial crisis, which originated in the United States in 2007, quickly propagated among other nations and is recognized as the catalyst for the worldwide Great Recession. A market adjustment to Greece's noncompliance with its monetary union in 2009 ignited a sovereign debt crisis among European nations known as the Eurozone crisis.A country's decision to operate an open economy and globalize its financial capital carries monetary implications captured by the balance of payments. It also renders exposure to risks in international finance, such as political deterioration, regulatory changes, foreign exchange controls, and legal uncertainties for property rights and investments. Both individuals and groups may participate in the global financial system. Consumers and international businesses undertake consumption, production, and investment. Governments and intergovernmental bodies act as purveyors of international trade, economic development, and crisis management. Regulatory bodies establish financial regulations and legal procedures, while independent bodies facilitate industry supervision. Research institutes and other associations analyze data, publish reports and policy briefs, and host public discourse on global financial affairs.While the global financial system is edging toward greater stability, governments must deal with differing regional or national needs. Some nations are trying to orderly discontinue unconventional monetary policies installed to cultivate recovery, while others are expanding their scope and scale. Emerging market policymakers face a challenge of precision as they must carefully institute sustainable macroeconomic policies during extraordinary market sensitivity without provoking investors to retreat their capital to stronger markets. Nations' inability to align interests and achieve international consensus on matters such as banking regulation has perpetuated the risk of future global financial catastrophes.