New Financial Regulator Seen to Target Chaebol

... accurate and timely information for investors. There is also further scope for improvement which we hope Korea will look into.’’ ...

... accurate and timely information for investors. There is also further scope for improvement which we hope Korea will look into.’’ ...

Financial reforms in China

... China has been implementing financial reforms since 1978. And by some measure it’s probably been half-way through the process Financial reform in China has been strong in building institutions and growing volumes but weak in liberalizing markets and improving governance The impact of financial repre ...

... China has been implementing financial reforms since 1978. And by some measure it’s probably been half-way through the process Financial reform in China has been strong in building institutions and growing volumes but weak in liberalizing markets and improving governance The impact of financial repre ...

Unit 1 Essential Questions

... How does the time value of money affect the future value of an investment? Why is it important to diversify your investments? How are liquidity and diversification related? How do you know which type of investment is best for you? In what ways does the stock market impact the personal wealth of an i ...

... How does the time value of money affect the future value of an investment? Why is it important to diversify your investments? How are liquidity and diversification related? How do you know which type of investment is best for you? In what ways does the stock market impact the personal wealth of an i ...

Bilateral Local Currency Swap Agreement with the Monetary

... The Bank of Japan has signed a bilateral local currency swap agreement with the Monetary Authority of Singapore, effective as of November 30, 2016. This agreement is designed to enhance the financial stability of the two countries, allowing for the exchange of local currencies between the two centra ...

... The Bank of Japan has signed a bilateral local currency swap agreement with the Monetary Authority of Singapore, effective as of November 30, 2016. This agreement is designed to enhance the financial stability of the two countries, allowing for the exchange of local currencies between the two centra ...

M09a_FinancialCrisis

... • Fixed exchange rate to maintain credibility and low inflation following a period of hyperinflation • Growing government debt • GDP began to decline in 1999 (by 4%) • Loss of confidence and capital flight led to a rise in interest payments that worsened the fiscal situation • Domestic run on banks ...

... • Fixed exchange rate to maintain credibility and low inflation following a period of hyperinflation • Growing government debt • GDP began to decline in 1999 (by 4%) • Loss of confidence and capital flight led to a rise in interest payments that worsened the fiscal situation • Domestic run on banks ...

U n d e r s t a n d... t o c h a n g i...

... management, bank regulation, payments and settlements, and currency management all under one roof. It also means we benefit from information from many sources. ...

... management, bank regulation, payments and settlements, and currency management all under one roof. It also means we benefit from information from many sources. ...

Understanding the Global Economic Crisis

... positions could increase transparency • Micro-prudential regulation has to be complemented by macro-prudential regulation • Need of an international dimension to financial regulation and institution to take into account systemic risk ...

... positions could increase transparency • Micro-prudential regulation has to be complemented by macro-prudential regulation • Need of an international dimension to financial regulation and institution to take into account systemic risk ...

Christo Viljoen

... ABSTRACT Agricultural commodity derivatives were first introduced in South Africa in 1996 after the deregulation of the former marketing system. In the context of its proposed functions, namely price discovery and risk management, the question arose as to whether the futures market developed over ti ...

... ABSTRACT Agricultural commodity derivatives were first introduced in South Africa in 1996 after the deregulation of the former marketing system. In the context of its proposed functions, namely price discovery and risk management, the question arose as to whether the futures market developed over ti ...

Capital Market Integration

... Facilities in the U.K. and Brazil, BMW’s plants in South Carolina, or Nissan’s China operations. •The term capital market integration means the liberalization of restrictions on foreign ownership of financial assets ...

... Facilities in the U.K. and Brazil, BMW’s plants in South Carolina, or Nissan’s China operations. •The term capital market integration means the liberalization of restrictions on foreign ownership of financial assets ...

Derivatives-chapter1

... The widespread acceptance of exchange traded options is commonly regarded as one of the more significant and successful investment innovations of the 1970’s Today we have option exchanges around the world trading contracts on various financial instruments and commodities ...

... The widespread acceptance of exchange traded options is commonly regarded as one of the more significant and successful investment innovations of the 1970’s Today we have option exchanges around the world trading contracts on various financial instruments and commodities ...

Slide 1

... All levels of Government need cash, there will be tax and fee increases as well as reductions to tax credits and deductions The US consumer will be deleveraging and increasing their savings Unemployment will be higher than expected Real Estate prices will be softer, rents will decline US F ...

... All levels of Government need cash, there will be tax and fee increases as well as reductions to tax credits and deductions The US consumer will be deleveraging and increasing their savings Unemployment will be higher than expected Real Estate prices will be softer, rents will decline US F ...

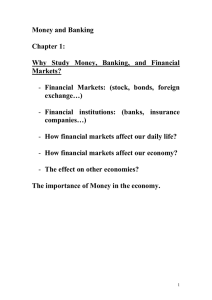

Lecture 1

... • How financial markets affect our daily life? • How financial markets affect our economy? • The effect on other economies? • The importance of Money in the economy. ...

... • How financial markets affect our daily life? • How financial markets affect our economy? • The effect on other economies? • The importance of Money in the economy. ...

Money and Banking

... - Financial Markets: (stock, bonds, foreign exchange…) - Financial institutions: (banks, insurance companies…) - How financial markets affect our daily life? - How financial markets affect our economy? - The effect on other economies? The importance of Money in the economy. ...

... - Financial Markets: (stock, bonds, foreign exchange…) - Financial institutions: (banks, insurance companies…) - How financial markets affect our daily life? - How financial markets affect our economy? - The effect on other economies? The importance of Money in the economy. ...

JICMI 2014 - Hizbut Tahrir

... Corrupt relationships in Government • Federal Reserve bank privately owned by banks • Too big to fail banks provide most senior government financial officers – executive and legal • Quantitative easing programme placing $85 billion monthly into markets including $40 billion of mortgage securities • ...

... Corrupt relationships in Government • Federal Reserve bank privately owned by banks • Too big to fail banks provide most senior government financial officers – executive and legal • Quantitative easing programme placing $85 billion monthly into markets including $40 billion of mortgage securities • ...

CHAPTER 4 The Financial Environment: Markets, Institutions, and

... groups are saving money and looking for a rate of return on their investment. Demanders or users of capital – individuals and institutions who need to raise funds to finance their investment opportunities. These groups are willing to pay a rate of return(interest) on the capital they borrow. ...

... groups are saving money and looking for a rate of return on their investment. Demanders or users of capital – individuals and institutions who need to raise funds to finance their investment opportunities. These groups are willing to pay a rate of return(interest) on the capital they borrow. ...

Financial Institutions

... The aim of the course is to enable students to understand the importance of financial institutions and their role in linking savings and investments between the lenders and borrowers at the national and international level, with emphasis on national legislation and international standards in this ar ...

... The aim of the course is to enable students to understand the importance of financial institutions and their role in linking savings and investments between the lenders and borrowers at the national and international level, with emphasis on national legislation and international standards in this ar ...

499Beaty10Presentation

... • Simon Johnson argues that increase in corporate pay compensation drove financiers to increase profits through risk • Lawrence H. White argues that it was govt. through low interest rates and encouraging unqualified barrowers for loans ...

... • Simon Johnson argues that increase in corporate pay compensation drove financiers to increase profits through risk • Lawrence H. White argues that it was govt. through low interest rates and encouraging unqualified barrowers for loans ...

Financial Globalization

... growth has slowed. – China’s growth is slowing as it shifts to an economy led by consumer demand and away from exports, which are depressed by weak demand from the U.S. and Europe. China has also vastly overbuilt its infrastructure. Vacant cities and other excess capacity could become considerable p ...

... growth has slowed. – China’s growth is slowing as it shifts to an economy led by consumer demand and away from exports, which are depressed by weak demand from the U.S. and Europe. China has also vastly overbuilt its infrastructure. Vacant cities and other excess capacity could become considerable p ...

Financialization

Financialization is a term sometimes used in discussions of the financial capitalism that has developed over the decades between 1980 and 2010, in which financial leverage tended to override capital (equity), and financial markets tended to dominate over the traditional industrial economy and agricultural economics.Financialization describes an economic system or process that attempts to reduce all value that is exchanged (whether tangible or intangible, future or present promises, etc.) into a financial instrument. The intent of financialization is to be able to reduce any work product or service to an exchangeable financial instrument, like currency, and thus make it easier for people to trade these financial instruments.Workers, through a financial instrument such as a mortgage, may trade their promise of future work or wages for a home. The financialization of risk sharing is what makes possible all insurance. The financialization of a government's promises (e.g., US government bonds) is what makes possible all government deficit spending. Financialization also makes economic rents possible.