O Why High Yield Corporate Bonds Will Remain Attractive in 2012

... Not surprisingly, therefore, equity markets are pessimistic and reflect a negative view of world growth prospects. But the crucial difference between the corporate sector at the aggregate level and some of the other sectors in the economy is that firms have cut debt levels more deeply and profits ar ...

... Not surprisingly, therefore, equity markets are pessimistic and reflect a negative view of world growth prospects. But the crucial difference between the corporate sector at the aggregate level and some of the other sectors in the economy is that firms have cut debt levels more deeply and profits ar ...

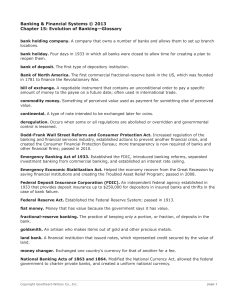

Chapter 15 Glossary - Banking and Financial Systems 2013

... bank of deposit. The first type of depository institution. Bank of North America. The first commercial fractional-reserve bank in the US, which was founded in 1781 to finance the Revolutionary War. bill of exchange. A negotiable instrument that contains an unconditional order to pay a specific amoun ...

... bank of deposit. The first type of depository institution. Bank of North America. The first commercial fractional-reserve bank in the US, which was founded in 1781 to finance the Revolutionary War. bill of exchange. A negotiable instrument that contains an unconditional order to pay a specific amoun ...

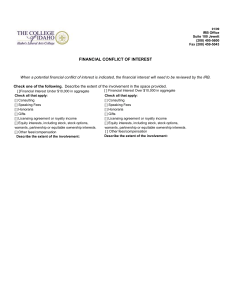

FinancialDisclosure

... When a potential financial conflict of interest is indicated, the financial interest will need to be reviewed by the IRB. Check one of the following. Describe the extent of the involvement in the space provided. [ ]Financial Interest Under $10,000 in aggregate Check all that apply: [ ] Consulting [ ...

... When a potential financial conflict of interest is indicated, the financial interest will need to be reviewed by the IRB. Check one of the following. Describe the extent of the involvement in the space provided. [ ]Financial Interest Under $10,000 in aggregate Check all that apply: [ ] Consulting [ ...

HOMs Conference on Central Asia

... Capital Account Convertibility (contd.) For an IFC, it may not be enough for the INR to be fully convertible on the capital account. The INR probably has to be an international reserve currency. With a Government bond market that is deep and liquid at long maturities which provides AAA instrume ...

... Capital Account Convertibility (contd.) For an IFC, it may not be enough for the INR to be fully convertible on the capital account. The INR probably has to be an international reserve currency. With a Government bond market that is deep and liquid at long maturities which provides AAA instrume ...

Our World at a Glance

... – Whether the investor expects to collect all amounts due according to the contractual terms of a security – If an adverse change in cash flows has occurred, the investment is other than temporarily impaired – The degree of decline in value, the time until anticipated recovery of value, and period o ...

... – Whether the investor expects to collect all amounts due according to the contractual terms of a security – If an adverse change in cash flows has occurred, the investment is other than temporarily impaired – The degree of decline in value, the time until anticipated recovery of value, and period o ...

Promoting a Better Functioning and Regulated Financial Market in

... Some features of Vietnam’s financial market prior to ...

... Some features of Vietnam’s financial market prior to ...

Document

... • There should be an adequate number of buyers and sellers such that all market participants are pricetakers • The primary market (for all issuance) should have a large number of participants • Valuations in the secondary market should be transparent and liquid enough to allow easy exit • The bid-as ...

... • There should be an adequate number of buyers and sellers such that all market participants are pricetakers • The primary market (for all issuance) should have a large number of participants • Valuations in the secondary market should be transparent and liquid enough to allow easy exit • The bid-as ...

The Current Financial Climate

... Response of Businesses • Look for creative micro and small business opportunities in sectors such as agriculture and tourism ...

... Response of Businesses • Look for creative micro and small business opportunities in sectors such as agriculture and tourism ...

August Again - Hong Kong Monetary Authority

... Whether we like it or not, Hong Kong, an international financial centre with open markets – one of a few in the region – will likely be tossed around in this environment. In fact, we may get an unfair share of volatility, for our openness means that we are a good candidate for conducting proxy hedgi ...

... Whether we like it or not, Hong Kong, an international financial centre with open markets – one of a few in the region – will likely be tossed around in this environment. In fact, we may get an unfair share of volatility, for our openness means that we are a good candidate for conducting proxy hedgi ...

Document

... also focuses on financial stability progress in which Albania has undergone during the last two years (2012-2013). All statistical data and information are collected from both national and international sources, including Central Bank of Albania, Ministry of Finance, as well as IMF and World Bank. I ...

... also focuses on financial stability progress in which Albania has undergone during the last two years (2012-2013). All statistical data and information are collected from both national and international sources, including Central Bank of Albania, Ministry of Finance, as well as IMF and World Bank. I ...

Recent International Financial Markets Turmoil is a Wakeup Call: Dr

... have been concerns regarding its implications for inducing economic slowdown particularly in the U.S. markets where housing slowdown is estimated to have already chopped off close to half or quarter of US GDP growth. The SBP Governor said the Federal Reserve took the extraordinary step to reduce its ...

... have been concerns regarding its implications for inducing economic slowdown particularly in the U.S. markets where housing slowdown is estimated to have already chopped off close to half or quarter of US GDP growth. The SBP Governor said the Federal Reserve took the extraordinary step to reduce its ...

Q2 2008 Market Commentary (Excerpt)

... dramatic rallies in financial company stocks and airlines and equally astounding losses in Energy/Precious Metal and Agriculture stocks. The level of volatility that we are seeing now on a daily basis in individual stocks and economic sectors is absolutely unprecedented with some daily stock price m ...

... dramatic rallies in financial company stocks and airlines and equally astounding losses in Energy/Precious Metal and Agriculture stocks. The level of volatility that we are seeing now on a daily basis in individual stocks and economic sectors is absolutely unprecedented with some daily stock price m ...

The Great Recession vs. The Great Depression

... every bit as big as the Great Depression shock of 192930. Looking just at the US leads one to overlook how alarming the current situation is even in comparison with 1929-30.” • “The good news, of course, is that the policy response is very different. The question now is whether that ...

... every bit as big as the Great Depression shock of 192930. Looking just at the US leads one to overlook how alarming the current situation is even in comparison with 1929-30.” • “The good news, of course, is that the policy response is very different. The question now is whether that ...

THE USE OF STATISTICAL INFORMATION FOR FINANCIAL

... ABSTRACT: Although the Romanian agriculture has a significant share in GDP, during various steps taken to adapt Romanian accounting to market economy needs, specific references to agriculture have not been made. Providing generic information which is not specific to agriculture field alters the qual ...

... ABSTRACT: Although the Romanian agriculture has a significant share in GDP, during various steps taken to adapt Romanian accounting to market economy needs, specific references to agriculture have not been made. Providing generic information which is not specific to agriculture field alters the qual ...

ECB and EMU Exchange Rates

... which reflects the state of the economy. 2) Countries don’t have to use their foreign reserves to intervene on the international markets. 3) In the long rum, the balance on the current account in the balance of payments can be brought into equilibrium. ...

... which reflects the state of the economy. 2) Countries don’t have to use their foreign reserves to intervene on the international markets. 3) In the long rum, the balance on the current account in the balance of payments can be brought into equilibrium. ...

Document

... distribution, are nowhere to be found. With regard to global imbalances, much of the emphasis is on the overconsumption of the United States or low wages and an undervalued currency of ...

... distribution, are nowhere to be found. With regard to global imbalances, much of the emphasis is on the overconsumption of the United States or low wages and an undervalued currency of ...

Diapositive 1

... The financial cycle (17 countries) is driven by private sector credit but impinges heavily upon the public debt • LT <0 correlation between private and public debt, but in 1975-2000 shifting to >0 • The upward phase of the financial cycle (1996-2007) has been nurtured by the fastest expansion in Cr ...

... The financial cycle (17 countries) is driven by private sector credit but impinges heavily upon the public debt • LT <0 correlation between private and public debt, but in 1975-2000 shifting to >0 • The upward phase of the financial cycle (1996-2007) has been nurtured by the fastest expansion in Cr ...

Financialization

Financialization is a term sometimes used in discussions of the financial capitalism that has developed over the decades between 1980 and 2010, in which financial leverage tended to override capital (equity), and financial markets tended to dominate over the traditional industrial economy and agricultural economics.Financialization describes an economic system or process that attempts to reduce all value that is exchanged (whether tangible or intangible, future or present promises, etc.) into a financial instrument. The intent of financialization is to be able to reduce any work product or service to an exchangeable financial instrument, like currency, and thus make it easier for people to trade these financial instruments.Workers, through a financial instrument such as a mortgage, may trade their promise of future work or wages for a home. The financialization of risk sharing is what makes possible all insurance. The financialization of a government's promises (e.g., US government bonds) is what makes possible all government deficit spending. Financialization also makes economic rents possible.