Personal Finance Economics

... – Banks lend saved funds and charge a higher interest rate on loans that they do on savings. ...

... – Banks lend saved funds and charge a higher interest rate on loans that they do on savings. ...

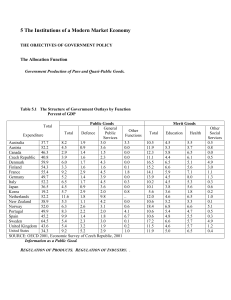

In chapter 1 we discussed in broad outline some of the institutions

... trade enhances both world welfare and the aggregate welfare of countries that engage in it. However, within a country there are costs to particular groups. In general we may say that the broad consuming public benefits from liberalization because it provides access to lower cost imports. However, th ...

... trade enhances both world welfare and the aggregate welfare of countries that engage in it. However, within a country there are costs to particular groups. In general we may say that the broad consuming public benefits from liberalization because it provides access to lower cost imports. However, th ...

Mr. Greenspan`s testimony before the Joint Economic Committee of

... balanced external accounts and relatively robust financial systems, have experienced severe pressures in recent days. One can debate whether the recent turbulence in Latin American asset values reflect contagion effects from Asia, the influence of developments in U.S. financial markets, or home-grow ...

... balanced external accounts and relatively robust financial systems, have experienced severe pressures in recent days. One can debate whether the recent turbulence in Latin American asset values reflect contagion effects from Asia, the influence of developments in U.S. financial markets, or home-grow ...

The Current Financial Environment 1 The Current Financial

... how much is borrowed. Credit Unions are great to borrow money from because they are not imposed by the growth of their shareholders dividends in the stock market. Credit Unions present competitive pricing in every area and the prices are not affected by how much is borrowed. In conclusion, the gover ...

... how much is borrowed. Credit Unions are great to borrow money from because they are not imposed by the growth of their shareholders dividends in the stock market. Credit Unions present competitive pricing in every area and the prices are not affected by how much is borrowed. In conclusion, the gover ...

Proposal title

... and local GAAP ► Experienced in loan portfolio reviews and internal control assessments. ...

... and local GAAP ► Experienced in loan portfolio reviews and internal control assessments. ...

Presentation - Stephany Griffiths-Jones

... instruments, where positions have grown exponentially (see below) Risks could be via abrupt financing of the US current account deficit a. b. ...

... instruments, where positions have grown exponentially (see below) Risks could be via abrupt financing of the US current account deficit a. b. ...

Economic Evolution

... The economic crisis has developed gradually from a mortgage and credit problem in industrial countries into a systemic financial crisis and a generalized collapse of confidence which has affected the world economy. ...

... The economic crisis has developed gradually from a mortgage and credit problem in industrial countries into a systemic financial crisis and a generalized collapse of confidence which has affected the world economy. ...

Suspected Illegal Money Deals Increase 2.5-Fold

... They deposit Korean won in brokers’ bank accounts here and receive the equivalent in foreign currency when they travel abroad. Some owners of domestic firms attempt to use company funds for private purposes by inflating business expenses and subsequently launder the fund through a series of banking ...

... They deposit Korean won in brokers’ bank accounts here and receive the equivalent in foreign currency when they travel abroad. Some owners of domestic firms attempt to use company funds for private purposes by inflating business expenses and subsequently launder the fund through a series of banking ...

exchange raate management in the face of global crisis

... The recent economic crisis initially started as a financial crisis arising from low interest rates and high world economic growth. low interest rates prompted investors around the world to search for yield further down the credit quality curve, and high growth/low volatility led them to overoptimist ...

... The recent economic crisis initially started as a financial crisis arising from low interest rates and high world economic growth. low interest rates prompted investors around the world to search for yield further down the credit quality curve, and high growth/low volatility led them to overoptimist ...

To view this press release as a file

... Chinese economy, from the continued decline in commodity prices, and from the emerging markets with high foreign currency debt, have come into sharper relief. A series of examinations presented in the report leads to the conclusion that a possible crisis due to the gyrations being experienced by the ...

... Chinese economy, from the continued decline in commodity prices, and from the emerging markets with high foreign currency debt, have come into sharper relief. A series of examinations presented in the report leads to the conclusion that a possible crisis due to the gyrations being experienced by the ...

NATIONAL CHENGCHI UNIVERSITY

... of financial statements and diagnose a business organization. Furthermore, students will be trained to come up with solutions to make improvement for a business. The course will also cover investment subjects. Fundamental analysis will be taught in the class and stock picking techniques will be demo ...

... of financial statements and diagnose a business organization. Furthermore, students will be trained to come up with solutions to make improvement for a business. The course will also cover investment subjects. Fundamental analysis will be taught in the class and stock picking techniques will be demo ...

Shock Therapy Economic Subordination Sham Stablization

... and manufactured products due to inability to compete with foreign producers Imported goods increased by 50% between ...

... and manufactured products due to inability to compete with foreign producers Imported goods increased by 50% between ...

Global Macro Investment For Presentation at Yale U. October 22

... • Liquidity (FX market >> Bond >> Stocks) Low transaction costs; • Liquidity if you get it right and do it in size, you become billionaire; • You work for yourself Personal Freedom; • Real-time profit or loss Instant Gratification; • FX market functions around the clock Ideal job for worka ...

... • Liquidity (FX market >> Bond >> Stocks) Low transaction costs; • Liquidity if you get it right and do it in size, you become billionaire; • You work for yourself Personal Freedom; • Real-time profit or loss Instant Gratification; • FX market functions around the clock Ideal job for worka ...

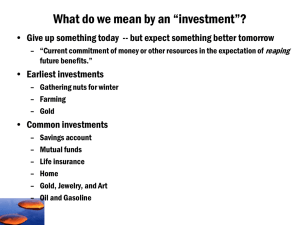

principles of finance

... Below is a list of reference publications that were either used as a reference to create the exam, or were used as textbooks in college courses of the same or similar title at the time the test was developed. You may reference either the current edition of these titles or textbooks currently used at ...

... Below is a list of reference publications that were either used as a reference to create the exam, or were used as textbooks in college courses of the same or similar title at the time the test was developed. You may reference either the current edition of these titles or textbooks currently used at ...

Chapter 1

... sought to maximize the value of the keiretsu-a family of firms to which the individual firms belongs- through increased market share ...

... sought to maximize the value of the keiretsu-a family of firms to which the individual firms belongs- through increased market share ...

Chap001_overview

... • All financial assets (owner of the claim) are offset by a financial liability (issuer of the claim). • When we aggregate over all balance sheets, only real assets remain. • Hence the net wealth of an economy is the sum of its real assets. ...

... • All financial assets (owner of the claim) are offset by a financial liability (issuer of the claim). • When we aggregate over all balance sheets, only real assets remain. • Hence the net wealth of an economy is the sum of its real assets. ...

Financialization

Financialization is a term sometimes used in discussions of the financial capitalism that has developed over the decades between 1980 and 2010, in which financial leverage tended to override capital (equity), and financial markets tended to dominate over the traditional industrial economy and agricultural economics.Financialization describes an economic system or process that attempts to reduce all value that is exchanged (whether tangible or intangible, future or present promises, etc.) into a financial instrument. The intent of financialization is to be able to reduce any work product or service to an exchangeable financial instrument, like currency, and thus make it easier for people to trade these financial instruments.Workers, through a financial instrument such as a mortgage, may trade their promise of future work or wages for a home. The financialization of risk sharing is what makes possible all insurance. The financialization of a government's promises (e.g., US government bonds) is what makes possible all government deficit spending. Financialization also makes economic rents possible.