Statutory Instrument 57 of 1996 Foreign Exchange Risk

... "fixed forward contract" means a foreign exchange bought or sold forward in advance for delivery on a fixed value date longer than spot, at a pre-determined specified rate of exchange; "option forward contract" means a forward exchange contract which gives the counterparty the right to exercise the ...

... "fixed forward contract" means a foreign exchange bought or sold forward in advance for delivery on a fixed value date longer than spot, at a pre-determined specified rate of exchange; "option forward contract" means a forward exchange contract which gives the counterparty the right to exercise the ...

Inter-regional Financial Cooperation: Another Layer of Financial

... United States, Asia, and Latin America, respectively. Low fertility rates and population aging have been the main cause of prolonged low economic growth in Japan since 1990. This is also likely to become a big issue even for Korea and China in the not-so-distant future. Some Latin American countries ...

... United States, Asia, and Latin America, respectively. Low fertility rates and population aging have been the main cause of prolonged low economic growth in Japan since 1990. This is also likely to become a big issue even for Korea and China in the not-so-distant future. Some Latin American countries ...

Presentation to the Pasadena Business Community co-sponsored by

... All of the functions I’ve just described came into play in the most dramatic way during those dark days. ...

... All of the functions I’ve just described came into play in the most dramatic way during those dark days. ...

Ch 12: 1.1-4

... to repay the loans. In this sense, the repurchase agreement market is similar to traditional bank deposits. The run on Bear Stearns was an early sign that problems with mortgage-backed securities might spill over into the financial system as a whole. The run on Lehman Brothers forced it into bankrup ...

... to repay the loans. In this sense, the repurchase agreement market is similar to traditional bank deposits. The run on Bear Stearns was an early sign that problems with mortgage-backed securities might spill over into the financial system as a whole. The run on Lehman Brothers forced it into bankrup ...

5_Papanotniou_transcript

... driven by a self-fulfilling panic. The emerging negative feedback loop could easily drive up the cost of bank and government funding, leading to lower economic growth, while raising the risk of defaults, particularly if investors shun peripheral countries’ bonds on grounds that they are not risk-fre ...

... driven by a self-fulfilling panic. The emerging negative feedback loop could easily drive up the cost of bank and government funding, leading to lower economic growth, while raising the risk of defaults, particularly if investors shun peripheral countries’ bonds on grounds that they are not risk-fre ...

download soal

... 4. (Introductory) What is the regulatory impact of moving some loans to a new subsidiary? What is the impact on the financial statements? Why are these different? 5. (Advanced) What are the public relations issues involved with these kinds of actions? Should the banks be concerned? Why or why not? 6 ...

... 4. (Introductory) What is the regulatory impact of moving some loans to a new subsidiary? What is the impact on the financial statements? Why are these different? 5. (Advanced) What are the public relations issues involved with these kinds of actions? Should the banks be concerned? Why or why not? 6 ...

U.S. Monetary Policy Forum, February 29, 2008

... migration analysis that looks at historical trends of each vintage year and then adjusts the trends for falling home prices. The second extrapolates from the current pricing of mortgage-backed securities’ expected losses. The third uses foreclosure rates from previous regional periods of falling hou ...

... migration analysis that looks at historical trends of each vintage year and then adjusts the trends for falling home prices. The second extrapolates from the current pricing of mortgage-backed securities’ expected losses. The third uses foreclosure rates from previous regional periods of falling hou ...

Exam Preparation Assignment 4 Version 1: ANSWER KEY

... The higher the interest rate, the lower the resulting present value. This is because as i increases the discount factor increases and so the weights of future payments become smaller. 2. A “consol” promises to pay $500 each year, forever, starting next year. If the nominal interest rate is 10%, what ...

... The higher the interest rate, the lower the resulting present value. This is because as i increases the discount factor increases and so the weights of future payments become smaller. 2. A “consol” promises to pay $500 each year, forever, starting next year. If the nominal interest rate is 10%, what ...

The Research on Evaluation System of Financial Strength

... Switzerland Sankt Gallen University professor Simon said “they are in the way to increases trade protection, this trend is not hold up.” The International Trade Center warns that protectionist measures number is approximately expected 70 in the first half year. China is the most affected by the trad ...

... Switzerland Sankt Gallen University professor Simon said “they are in the way to increases trade protection, this trend is not hold up.” The International Trade Center warns that protectionist measures number is approximately expected 70 in the first half year. China is the most affected by the trad ...

Does PE Create Value.Apr 08

... the forward market – commits to a price today for delivery months into the future – ...

... the forward market – commits to a price today for delivery months into the future – ...

the structure of the spanish financial system

... Banks’ health and market consolidation place the Spanish financial system in a good position to face the challenges of financial globalisation ...

... Banks’ health and market consolidation place the Spanish financial system in a good position to face the challenges of financial globalisation ...

30 June 2007 Balance Nature strives for balance. In the wild, lions

... the remaining antelope until some of them starve ...

... the remaining antelope until some of them starve ...

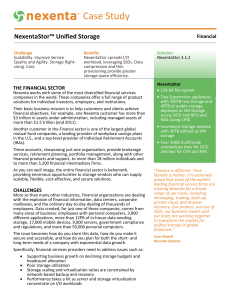

Case Study

... with the explosion of financial information, data centers, corporate mailboxes, and the ordinary day-to-day dealing of thousands of employees. Data created, for just one of these companies, comes from many areas of business: employees with personal computers, 3,000 different applications, more than ...

... with the explosion of financial information, data centers, corporate mailboxes, and the ordinary day-to-day dealing of thousands of employees. Data created, for just one of these companies, comes from many areas of business: employees with personal computers, 3,000 different applications, more than ...

Lecture 3 securitization

... packages the pool of collaterals into notes, with explicit priority of payments and sells them to investors. – Thus securitization is, first and foremost, a financing mechanism for the issuer of the collaterals. – The tranche structure makes securitization interesting, in terms of risk. ...

... packages the pool of collaterals into notes, with explicit priority of payments and sells them to investors. – Thus securitization is, first and foremost, a financing mechanism for the issuer of the collaterals. – The tranche structure makes securitization interesting, in terms of risk. ...

CHAPTER 1 An Overview of Financial Management

... intermediaries may not be able to assess whether the institutions holding their funds are sound or not, if they have doubts about the overall health of financial intermediaries, they may want to pull their funds out of both sound and unsound institutions, with the possible outcome of a financial pan ...

... intermediaries may not be able to assess whether the institutions holding their funds are sound or not, if they have doubts about the overall health of financial intermediaries, they may want to pull their funds out of both sound and unsound institutions, with the possible outcome of a financial pan ...

Economics 3403 - University of Colorado Boulder

... Asian governments would bail out banks and major companies, not allowing them to fail (default on foreign debts). More fundamentally, investors believed that the IMF and developed-country governments would also step in to cover creditor losses in the event of default. Most economists trace this conf ...

... Asian governments would bail out banks and major companies, not allowing them to fail (default on foreign debts). More fundamentally, investors believed that the IMF and developed-country governments would also step in to cover creditor losses in the event of default. Most economists trace this conf ...

Financialization

Financialization is a term sometimes used in discussions of the financial capitalism that has developed over the decades between 1980 and 2010, in which financial leverage tended to override capital (equity), and financial markets tended to dominate over the traditional industrial economy and agricultural economics.Financialization describes an economic system or process that attempts to reduce all value that is exchanged (whether tangible or intangible, future or present promises, etc.) into a financial instrument. The intent of financialization is to be able to reduce any work product or service to an exchangeable financial instrument, like currency, and thus make it easier for people to trade these financial instruments.Workers, through a financial instrument such as a mortgage, may trade their promise of future work or wages for a home. The financialization of risk sharing is what makes possible all insurance. The financialization of a government's promises (e.g., US government bonds) is what makes possible all government deficit spending. Financialization also makes economic rents possible.