Business Surveys: Uses And Abuses

... Bond yields have been very low in recent years and took another sharp dip in 2010. Yields have been rising in recent months but they are still very low by historical standards (see middle chart) and low relative to global bond yields. If global yields keep rising and Swedish short-term rates increas ...

... Bond yields have been very low in recent years and took another sharp dip in 2010. Yields have been rising in recent months but they are still very low by historical standards (see middle chart) and low relative to global bond yields. If global yields keep rising and Swedish short-term rates increas ...

Tutorial 2 - City University of Hong Kong

... manufacturing plants and investment from HK to Southern China. The lower cost in Mainland serves as a “pulling” force while the higher cost in HK serves as the “pushing” force for the shifting of manufacturing production to Mainland China. ...

... manufacturing plants and investment from HK to Southern China. The lower cost in Mainland serves as a “pulling” force while the higher cost in HK serves as the “pushing” force for the shifting of manufacturing production to Mainland China. ...

If you`ve got it, flaunt it

... performance problems in 2006: a dramatic change in the business fundamentals of commodity-related companies—a change that has made this stock market unlike any other in the past 30 years. “Commodity prices generally are at all-time highs, with the Commodity Research Bureau Metals Sub-Index up more t ...

... performance problems in 2006: a dramatic change in the business fundamentals of commodity-related companies—a change that has made this stock market unlike any other in the past 30 years. “Commodity prices generally are at all-time highs, with the Commodity Research Bureau Metals Sub-Index up more t ...

Mexican and Asian Currency Crisis

... restore stability to the peso, and control wage increases. In addition, the United States should insist on continuing Mexican government deregulation and privatization of its economy. If these conditions are not rigorously drawn and enforced, there will be more trouble later. Mexico also will be ...

... restore stability to the peso, and control wage increases. In addition, the United States should insist on continuing Mexican government deregulation and privatization of its economy. If these conditions are not rigorously drawn and enforced, there will be more trouble later. Mexico also will be ...

Banking, Finance and Insurance

... Trade conditions in South Africa surged above the neutral level last month for the first time in two years, backing hopes that the economy is emerging from the recession, a business survey showed yesterday. But another survey showed that consumer vulnerability deepened during the third quarter of th ...

... Trade conditions in South Africa surged above the neutral level last month for the first time in two years, backing hopes that the economy is emerging from the recession, a business survey showed yesterday. But another survey showed that consumer vulnerability deepened during the third quarter of th ...

Transmission mechanism of monetary policy

... Changes in the exchange rate can affect inflation directly, insofar as imported goods are directly used in consumption, but they may also work through other channels. Affects saving and investment decisions Changes in interest rates affect saving and investment decisions of households and firms. For ...

... Changes in the exchange rate can affect inflation directly, insofar as imported goods are directly used in consumption, but they may also work through other channels. Affects saving and investment decisions Changes in interest rates affect saving and investment decisions of households and firms. For ...

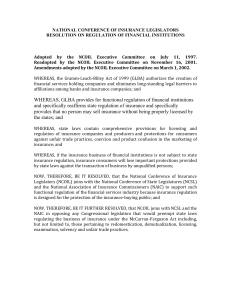

On Regulation of Financial Institutions – 07/11/97

... WHEREAS, state laws contain comprehensive provisions for licensing and regulation of insurance companies and producers and protections for consumers against unfair trade practices, coercion and product confusion in the marketing of insurance; and WHEREAS, if the insurance business of financial insti ...

... WHEREAS, state laws contain comprehensive provisions for licensing and regulation of insurance companies and producers and protections for consumers against unfair trade practices, coercion and product confusion in the marketing of insurance; and WHEREAS, if the insurance business of financial insti ...

Chapter 2 Notes

... trade in merchandise and services, private gifts, and public aid between countries • trade deficit • trade surplus – Capital account – record of all long-term direct investment, portfolio investment, and capital flows ...

... trade in merchandise and services, private gifts, and public aid between countries • trade deficit • trade surplus – Capital account – record of all long-term direct investment, portfolio investment, and capital flows ...

July 8, 2016

... In the markets: U.S. stocks ended the holiday-shortened week on an up note, thanks to a very strong rally on Friday. Indices were negative for the week going into Friday, but ripped higher on the stronger-than-expected jobs report (more on that below). The benchmark S&P 500 LargeCap index ended the ...

... In the markets: U.S. stocks ended the holiday-shortened week on an up note, thanks to a very strong rally on Friday. Indices were negative for the week going into Friday, but ripped higher on the stronger-than-expected jobs report (more on that below). The benchmark S&P 500 LargeCap index ended the ...

presentation PPT

... Loans and deposits are the predominant instruments in the balance sheets of domestic banks The banks are relying heavily on domestic deposits for their credit activity Domestic financial markets are very shallow, with CG paper and CB Bills being the main types of securities in the assets of domestic ...

... Loans and deposits are the predominant instruments in the balance sheets of domestic banks The banks are relying heavily on domestic deposits for their credit activity Domestic financial markets are very shallow, with CG paper and CB Bills being the main types of securities in the assets of domestic ...

386-387 Financial Maintenance

... during the course of the application/recertification process, the local district has the responsibility of evaluating these facts against the program income/resource levels and against each other. Although the A/R may appear to be eligible on the basis of the comparison of his/her available assets a ...

... during the course of the application/recertification process, the local district has the responsibility of evaluating these facts against the program income/resource levels and against each other. Although the A/R may appear to be eligible on the basis of the comparison of his/her available assets a ...

Available here

... The targeted date of the signature of the grant agreement is set to nine months from the cut-off date(s) of the call (14 July and 30 November respectively). The applicants' attention is however drawn to the fact that due to its complexity and the time needed to comply with specific procedures of the ...

... The targeted date of the signature of the grant agreement is set to nine months from the cut-off date(s) of the call (14 July and 30 November respectively). The applicants' attention is however drawn to the fact that due to its complexity and the time needed to comply with specific procedures of the ...

Banking on resilience - Overseas Development Institute

... weather events (World Bank, 2012). In the absence of formal insurance mechanisms for disasters, the poor are forced to self-insure, often depleting their savings when disaster strikes (Lopez, 2009; Fernandez, 2009). Weather index insurance presents a promising alternative to traditional agricultural ...

... weather events (World Bank, 2012). In the absence of formal insurance mechanisms for disasters, the poor are forced to self-insure, often depleting their savings when disaster strikes (Lopez, 2009; Fernandez, 2009). Weather index insurance presents a promising alternative to traditional agricultural ...

title goes here - Franklin Templeton

... regain interest in China’s A-share market among domestic investors. The goal of these efforts is to make China’s capital markets much more diverse, structured and transparent. This is very important, in our view, as there is a large amount of private savings in China that could be invested. Such cap ...

... regain interest in China’s A-share market among domestic investors. The goal of these efforts is to make China’s capital markets much more diverse, structured and transparent. This is very important, in our view, as there is a large amount of private savings in China that could be invested. Such cap ...

Chapter 18

... Rule from sinking below zero if inflation is low and economic activity is weak. In practice, however, central banks cannot target a negative interest rate. The reason is that banks and individuals can always hold cash (with a zero rate), so they would not lend to others at an interest rate less than ...

... Rule from sinking below zero if inflation is low and economic activity is weak. In practice, however, central banks cannot target a negative interest rate. The reason is that banks and individuals can always hold cash (with a zero rate), so they would not lend to others at an interest rate less than ...

International Derivatives Brochure

... Notice how, during the contract period, the futures price moved a total of R70 higher. This represented a total profit to the buyer of R70.00 and a total loss to the seller of R70. The margining system is effective in ensuring that both buyer and seller are constantly upto-date in their profits and ...

... Notice how, during the contract period, the futures price moved a total of R70 higher. This represented a total profit to the buyer of R70.00 and a total loss to the seller of R70. The margining system is effective in ensuring that both buyer and seller are constantly upto-date in their profits and ...

Financialization

Financialization is a term sometimes used in discussions of the financial capitalism that has developed over the decades between 1980 and 2010, in which financial leverage tended to override capital (equity), and financial markets tended to dominate over the traditional industrial economy and agricultural economics.Financialization describes an economic system or process that attempts to reduce all value that is exchanged (whether tangible or intangible, future or present promises, etc.) into a financial instrument. The intent of financialization is to be able to reduce any work product or service to an exchangeable financial instrument, like currency, and thus make it easier for people to trade these financial instruments.Workers, through a financial instrument such as a mortgage, may trade their promise of future work or wages for a home. The financialization of risk sharing is what makes possible all insurance. The financialization of a government's promises (e.g., US government bonds) is what makes possible all government deficit spending. Financialization also makes economic rents possible.