III. Unsustainable international relations of the financial - Pekea-fr

... Nevertheless, it must be added that the payment of this debt becomes extremely onerous indeed for the developing countries due to the inequality of international monetary relations. Since, when the developed countries and specially the United States lends to developing countries, these funds come fr ...

... Nevertheless, it must be added that the payment of this debt becomes extremely onerous indeed for the developing countries due to the inequality of international monetary relations. Since, when the developed countries and specially the United States lends to developing countries, these funds come fr ...

Money Matters with Climate Change The Thesis in Brief

... ‘climate killer’ banks that finance private sector fossil fuel extraction. Investment and lending activities were targeted because they facilitate the emission of greenhouse gases around the world. ...

... ‘climate killer’ banks that finance private sector fossil fuel extraction. Investment and lending activities were targeted because they facilitate the emission of greenhouse gases around the world. ...

(Nedlac) (2013) (part 1). - Lecture Notes

... • The 1990’s saw an attempt to control public debt leading to rapidly rising inequality, as a result of weakened trade-unionism, cuts in social spending (as Clinton heralded the end to ‘welfare as we know it” and reduced growth due to austere fiscal policy • Private debt replaced public debt as the ...

... • The 1990’s saw an attempt to control public debt leading to rapidly rising inequality, as a result of weakened trade-unionism, cuts in social spending (as Clinton heralded the end to ‘welfare as we know it” and reduced growth due to austere fiscal policy • Private debt replaced public debt as the ...

No Slide Title

... Slovenia, Spain, Sweden, the Netherlands, United Kingdom Population: 460.1 million Total GDP: $11.7 trillion ...

... Slovenia, Spain, Sweden, the Netherlands, United Kingdom Population: 460.1 million Total GDP: $11.7 trillion ...

B01.2303 Global Business Environment Sample Questions for the Proficiency Exam

... (b) investors are expecting a depreciation of the Dollar relative to the Euro. (c) inflation in the US is lower than in Europe, (d) the dollar will usually appreciate relative to the euro. 4. Under fixed exchange rates, domestic interest rates will be above foreign ones: (a) if the peg is perfectly ...

... (b) investors are expecting a depreciation of the Dollar relative to the Euro. (c) inflation in the US is lower than in Europe, (d) the dollar will usually appreciate relative to the euro. 4. Under fixed exchange rates, domestic interest rates will be above foreign ones: (a) if the peg is perfectly ...

Accrual of Interest Costs - Homepage

... period usually a year, in economic activities and transactions on a significant scale. The one-year period is suggested only as a guideline and not as an inflexible rule. However, the armed forces deployed out of the economic territory, students, patients, ...

... period usually a year, in economic activities and transactions on a significant scale. The one-year period is suggested only as a guideline and not as an inflexible rule. However, the armed forces deployed out of the economic territory, students, patients, ...

Y Regulating Ele ctronic Money •

... the near future that issuers of electronic payment obligations, such as stored-value cards or "digital cash," set up specialized issuing corporations with strong balance sheets and public credit ratings. Such structures have been common in other areas, for example, in the derivatives and commercial ...

... the near future that issuers of electronic payment obligations, such as stored-value cards or "digital cash," set up specialized issuing corporations with strong balance sheets and public credit ratings. Such structures have been common in other areas, for example, in the derivatives and commercial ...

An Overview of the Great Depression

... • U.S. mortgage rates peaked at 18% in 1982 • From late 2002 through most of 2005 mortgage rate are below 6% ...

... • U.S. mortgage rates peaked at 18% in 1982 • From late 2002 through most of 2005 mortgage rate are below 6% ...

March - Crossbridge Capital

... Crimea, the Peninsula on the Black Sea, has held a pivotal place in world history. The Crimean War (185356) pitted the French and the British against Tsarist Russia and its plan to expand eastwards by occupying provinces of the weakened Ottoman Empire. This would have allowed the Russian navy direct ...

... Crimea, the Peninsula on the Black Sea, has held a pivotal place in world history. The Crimean War (185356) pitted the French and the British against Tsarist Russia and its plan to expand eastwards by occupying provinces of the weakened Ottoman Empire. This would have allowed the Russian navy direct ...

Abstract - Covenant University Repository

... The legal, regulatory and prudential framework discussed in the preceding section is essential for fostering financial market functions and promoting and anchoring its institutional framework. The ultimate function of financial markets, as earlier indicated, is to mobilize and allocate resources thr ...

... The legal, regulatory and prudential framework discussed in the preceding section is essential for fostering financial market functions and promoting and anchoring its institutional framework. The ultimate function of financial markets, as earlier indicated, is to mobilize and allocate resources thr ...

Diversification

... it was created in 1965 ($19/share), you would have about $53,163,160 today $101,010 Sept. 29, 2009). The S&P stock index for the same amount and length of time you would only have $500,000. ...

... it was created in 1965 ($19/share), you would have about $53,163,160 today $101,010 Sept. 29, 2009). The S&P stock index for the same amount and length of time you would only have $500,000. ...

Stocks

... it was created in 1965 ($19/share), you would have about $53,163,160 today $101,010 Sept. 29, 2009). The S&P stock index for the same amount and length of time you would only have $500,000. ...

... it was created in 1965 ($19/share), you would have about $53,163,160 today $101,010 Sept. 29, 2009). The S&P stock index for the same amount and length of time you would only have $500,000. ...

Mexico_en.pdf

... The recovery of commercial bank lending to the private sector seen in 2010 continued, with a 14% nominal expansion (10.9% in real terms) in the first 10 months of 2011. Consumer lending was up by a considerable 21.4% in nominal terms in these 10 months. By sector, the largest rise occurred in financ ...

... The recovery of commercial bank lending to the private sector seen in 2010 continued, with a 14% nominal expansion (10.9% in real terms) in the first 10 months of 2011. Consumer lending was up by a considerable 21.4% in nominal terms in these 10 months. By sector, the largest rise occurred in financ ...

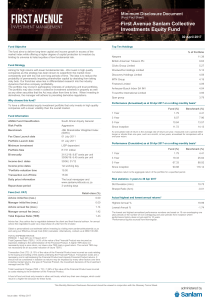

First Avenue Sanlam Collective Investments Equity Fund

... systematic or cyclical risk. It is a clear choice between arbitraging value rather than betting on the unwinding of macroeconomic risks. As systematic risk cannot be diversified away completely, we will benefit somewhat if macro risks recede or unwind. In contrast, low quality companies (e.g. constr ...

... systematic or cyclical risk. It is a clear choice between arbitraging value rather than betting on the unwinding of macroeconomic risks. As systematic risk cannot be diversified away completely, we will benefit somewhat if macro risks recede or unwind. In contrast, low quality companies (e.g. constr ...

Investing, Saving, Bonds, Stock

... In short, investment is the use of assets to earn income or profit. When people save or invest their money, their funds become available for businesses to use to expand and grow. In this way, investment promotes economic growth. ...

... In short, investment is the use of assets to earn income or profit. When people save or invest their money, their funds become available for businesses to use to expand and grow. In this way, investment promotes economic growth. ...

choices for financing fiscal and external deficits

... will double within 24 years. Although this period is still too long but higher growth rates will also result in pushing domestic savings rate higher, which, in turn, will further reduce this period of 24 years. So it becomes clear that mobilizing foreign resources is an activity which a poor country ...

... will double within 24 years. Although this period is still too long but higher growth rates will also result in pushing domestic savings rate higher, which, in turn, will further reduce this period of 24 years. So it becomes clear that mobilizing foreign resources is an activity which a poor country ...

When Banks Won`t Lend, There Are Alternatives, Though Often

... economy still struggling and new regulations meant to eliminate bad lending, bank loans continue to lag. “The days of yesteryear when you could go to your corner bank are over,” said Kenneth Walsleben, who teaches in the entrepreneurship and emerging enterprises department at the Whitman School of M ...

... economy still struggling and new regulations meant to eliminate bad lending, bank loans continue to lag. “The days of yesteryear when you could go to your corner bank are over,” said Kenneth Walsleben, who teaches in the entrepreneurship and emerging enterprises department at the Whitman School of M ...

China, the US, and Currency Issues

... The same with other major industrialized economies. A remarkable role-reversal: • Debt/GDP of the top 20 rich countries (≈ 80%) is already twice that of the top 20 emerging markets; • and rising rapidly. • By 2014 (at ≈ 120%), it could be triple. ...

... The same with other major industrialized economies. A remarkable role-reversal: • Debt/GDP of the top 20 rich countries (≈ 80%) is already twice that of the top 20 emerging markets; • and rising rapidly. • By 2014 (at ≈ 120%), it could be triple. ...

President`s letter

... in providing finance to the agri-food sector. Our objective is to become one of the largest banking institutions in Poland, with at least 5% market share. We currently have in excess of 1.65 million clients (and together with Sygma Bank Polska – about 2.6 million), with whom we are in close contact ...

... in providing finance to the agri-food sector. Our objective is to become one of the largest banking institutions in Poland, with at least 5% market share. We currently have in excess of 1.65 million clients (and together with Sygma Bank Polska – about 2.6 million), with whom we are in close contact ...

Financialization

Financialization is a term sometimes used in discussions of the financial capitalism that has developed over the decades between 1980 and 2010, in which financial leverage tended to override capital (equity), and financial markets tended to dominate over the traditional industrial economy and agricultural economics.Financialization describes an economic system or process that attempts to reduce all value that is exchanged (whether tangible or intangible, future or present promises, etc.) into a financial instrument. The intent of financialization is to be able to reduce any work product or service to an exchangeable financial instrument, like currency, and thus make it easier for people to trade these financial instruments.Workers, through a financial instrument such as a mortgage, may trade their promise of future work or wages for a home. The financialization of risk sharing is what makes possible all insurance. The financialization of a government's promises (e.g., US government bonds) is what makes possible all government deficit spending. Financialization also makes economic rents possible.