![TR 1H 14 presentation results 4 [Modo de compatibilidad]](http://s1.studyres.com/store/data/024465526_1-33e98d67fcc5575ed742aed31c4183f0-300x300.png)

15 The Financial Crisis and the Great Recession

... in the form of mortgages. During the mid-1990s, U.S. households borrowed an annual average of approximately $200 billion in the form of mortgages for home purchases. The figure rose abruptly to $500 billion for the period 1998–2002 and to $1 trillion from 2003 to 2006. While widespread access to cre ...

... in the form of mortgages. During the mid-1990s, U.S. households borrowed an annual average of approximately $200 billion in the form of mortgages for home purchases. The figure rose abruptly to $500 billion for the period 1998–2002 and to $1 trillion from 2003 to 2006. While widespread access to cre ...

stance of monetary policy

... about 2.4%. Oddly, in this period, the 10-year treasury yield stopped tracking changes in stock prices. More often than not, interest rates will go up when stock prices rise, and vice versa, however in 2012 they seemed to move independently on most trading days. Stocks trended straight up, while yie ...

... about 2.4%. Oddly, in this period, the 10-year treasury yield stopped tracking changes in stock prices. More often than not, interest rates will go up when stock prices rise, and vice versa, however in 2012 they seemed to move independently on most trading days. Stocks trended straight up, while yie ...

How does a monetary policy affect the economy

... can issue equity easily and buy extra assets and thus invest. However, when Ms is reduced, public spends less on stock-markets, thus equity prices and q falls and firms are reluctant to invest, they rather buy up existing firms. Keynesians also argue that interest rate rise makes bonds more attracti ...

... can issue equity easily and buy extra assets and thus invest. However, when Ms is reduced, public spends less on stock-markets, thus equity prices and q falls and firms are reluctant to invest, they rather buy up existing firms. Keynesians also argue that interest rate rise makes bonds more attracti ...

3rd Quarter 2016 - Bellwether Consulting

... outlook in September. On September 8, the ECB, again, left its €1.7 trillion stimulus plan unchanged even in the face of forecasts showing the bank will miss its inflation target now and into the forseeable future. President Draghi’s concern is focused on persistent low inflation in the zone which h ...

... outlook in September. On September 8, the ECB, again, left its €1.7 trillion stimulus plan unchanged even in the face of forecasts showing the bank will miss its inflation target now and into the forseeable future. President Draghi’s concern is focused on persistent low inflation in the zone which h ...

Highlights of Colombia 2010 Financial analysis and

... compared to the previous year. This trend was more apparent between May and September, when the exchange rate reached its minimum in two years ($1,800). Revaluation continues to be the regional trend, but the Colombian peso shows one of the most significant appreciations. The above results from incr ...

... compared to the previous year. This trend was more apparent between May and September, when the exchange rate reached its minimum in two years ($1,800). Revaluation continues to be the regional trend, but the Colombian peso shows one of the most significant appreciations. The above results from incr ...

Review Questions for SOL CE 11 - Augusta County Public Schools

... A. taxes from individuals only B. taxes from businesses only C. taxes from both individuals and businesses 16. Which of the following is NOT a type of financial institution commonly found in this country? A. banks B. business institutions C. credit unions D. S&L’s 17. How is the type of financial in ...

... A. taxes from individuals only B. taxes from businesses only C. taxes from both individuals and businesses 16. Which of the following is NOT a type of financial institution commonly found in this country? A. banks B. business institutions C. credit unions D. S&L’s 17. How is the type of financial in ...

Financial Institutions

... Two primary ways insurance companies make money: Selling insurance policies and selling investment products ...

... Two primary ways insurance companies make money: Selling insurance policies and selling investment products ...

Securitisation

... • Innovations in mortgage loans will be reflected on the funding side. • Investors who buy the issued bonds do not incur any default risk in practice (almost all bonds are Aaa rated). It is a secure product that has never led to credit losses. • It has a stabilizing effect on the Danish economy and ...

... • Innovations in mortgage loans will be reflected on the funding side. • Investors who buy the issued bonds do not incur any default risk in practice (almost all bonds are Aaa rated). It is a secure product that has never led to credit losses. • It has a stabilizing effect on the Danish economy and ...

Geren. Con.SU.J:t1nlil

... As a small business owner, I feel it's necessary to contact you regarding stock options. As you can imagine, when the economy is shaky it is an uphill struggle for many companies to attract talented people to come to work for them. Frankly, it would be all but impossible to attract those people with ...

... As a small business owner, I feel it's necessary to contact you regarding stock options. As you can imagine, when the economy is shaky it is an uphill struggle for many companies to attract talented people to come to work for them. Frankly, it would be all but impossible to attract those people with ...

Money

... S&L Crisis and junk bonds (mid-to-late 1980s) Oil industry (mid-1980s) Drysdale Securities and Penn Square Bank (1981-1982) the farm belt and LDC debt crisis (1980-1981) ...

... S&L Crisis and junk bonds (mid-to-late 1980s) Oil industry (mid-1980s) Drysdale Securities and Penn Square Bank (1981-1982) the farm belt and LDC debt crisis (1980-1981) ...

Euromarkets (Ch. 13)

... are made by bank syndicates. The bank originating the loan becomes the lead bank managing the syndicate, inviting one or two other banks to be co-managers of the loan. The borrower is charged a one-time syndication fee ranging from 0.25 % to 2 % of the loan value according to the size and type of th ...

... are made by bank syndicates. The bank originating the loan becomes the lead bank managing the syndicate, inviting one or two other banks to be co-managers of the loan. The borrower is charged a one-time syndication fee ranging from 0.25 % to 2 % of the loan value according to the size and type of th ...

Economic Survey of Brazil, 2001 Summary Brazil has made

... financial institutions has been instrumental in the process of bank re-structuring and privatisation, notably in the case of state level banks. Prudential supervision has been strengthened. These are positive developments, though the Brazilian banking sector still needs to increase its role in finan ...

... financial institutions has been instrumental in the process of bank re-structuring and privatisation, notably in the case of state level banks. Prudential supervision has been strengthened. These are positive developments, though the Brazilian banking sector still needs to increase its role in finan ...

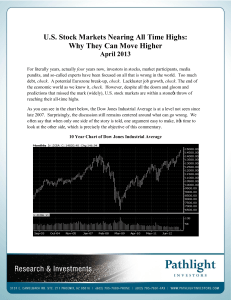

U.S. Stock Markets Nearing All Time Highs: Why They Can Move

... essence of credit markets, has returned. If you don’t believe us, look at the two-year chart of gold, which is often used as an insurance policy against catastrophic events. As seen in the chart below, the price of gold as measured by the SPDR Gold Trust ETF (symbol GLD) has been in a downward trend ...

... essence of credit markets, has returned. If you don’t believe us, look at the two-year chart of gold, which is often used as an insurance policy against catastrophic events. As seen in the chart below, the price of gold as measured by the SPDR Gold Trust ETF (symbol GLD) has been in a downward trend ...

Perú_en.pdf

... Almost two thirds of this increase stemmed from an 8.6% rise in general sales tax receipts on the back of expanding consumption. Personal income tax revenues were up by 11.9%, while those from corporate income tax fell by 2.2%. Central government non-financial expenditure jumped 11.9% to stand at 17 ...

... Almost two thirds of this increase stemmed from an 8.6% rise in general sales tax receipts on the back of expanding consumption. Personal income tax revenues were up by 11.9%, while those from corporate income tax fell by 2.2%. Central government non-financial expenditure jumped 11.9% to stand at 17 ...

characteristics of african economies

... marginalization increasing not diminishing in many areas. ...

... marginalization increasing not diminishing in many areas. ...

Maturity Mismatch Stretching: Banking Has Taken a Wrong Turn

... bank margins and hence leading to more risk-taking. World War II led to banks becoming stuffed with government debt, with loans to the private sector limited to large, mostly manufacturing companies, and with competition in this banking industry strictly restricted. Banks lived in a government-manag ...

... bank margins and hence leading to more risk-taking. World War II led to banks becoming stuffed with government debt, with loans to the private sector limited to large, mostly manufacturing companies, and with competition in this banking industry strictly restricted. Banks lived in a government-manag ...

handout1

... For this activity, you will be required to do some research. Your great spinster aunt is very concerned that you will not remember her when she is gone. However, she is also very frugal. She is willing to give you some money to open a savings account. Her condition in giving you this money is that y ...

... For this activity, you will be required to do some research. Your great spinster aunt is very concerned that you will not remember her when she is gone. However, she is also very frugal. She is willing to give you some money to open a savings account. Her condition in giving you this money is that y ...

Financialization

Financialization is a term sometimes used in discussions of the financial capitalism that has developed over the decades between 1980 and 2010, in which financial leverage tended to override capital (equity), and financial markets tended to dominate over the traditional industrial economy and agricultural economics.Financialization describes an economic system or process that attempts to reduce all value that is exchanged (whether tangible or intangible, future or present promises, etc.) into a financial instrument. The intent of financialization is to be able to reduce any work product or service to an exchangeable financial instrument, like currency, and thus make it easier for people to trade these financial instruments.Workers, through a financial instrument such as a mortgage, may trade their promise of future work or wages for a home. The financialization of risk sharing is what makes possible all insurance. The financialization of a government's promises (e.g., US government bonds) is what makes possible all government deficit spending. Financialization also makes economic rents possible.