Mobile Financial Apps - Society for Financial Education and

... …lets me enter purchases and rate/track how happy they do or don't make me over time, so I can adjust my spending accordingly. …calculates the return on investment for college, based on expected net cost of tuition at specific colleges and anticipated salary by major. ...

... …lets me enter purchases and rate/track how happy they do or don't make me over time, so I can adjust my spending accordingly. …calculates the return on investment for college, based on expected net cost of tuition at specific colleges and anticipated salary by major. ...

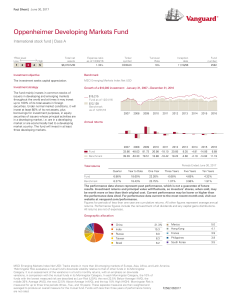

Oppenheimer Developing Markets Fund - Vanguard

... social, regulatory, and political risks of that region, as well as the Chinese government’s significant level of control over China’s economy and currency. A disruption of relations between China and its neighbors or trading partners could severely impact China’s export-based economy. Small Cap: Con ...

... social, regulatory, and political risks of that region, as well as the Chinese government’s significant level of control over China’s economy and currency. A disruption of relations between China and its neighbors or trading partners could severely impact China’s export-based economy. Small Cap: Con ...

The Fourth Dimension: Derivatives and Financial Dominance

... empirical studies have shown that prices are first formed in derivatives markets (a process called price discovery) and are transmitted back to cash markets, while others have found that this process occurs more or less simultaneously.” 5The Chicago stock market, for example, negotiates weather futu ...

... empirical studies have shown that prices are first formed in derivatives markets (a process called price discovery) and are transmitted back to cash markets, while others have found that this process occurs more or less simultaneously.” 5The Chicago stock market, for example, negotiates weather futu ...

Low Interest Rates and Financial Stability

... pension assets will lose out. (Of course, many people will have positions in all three categories.) Nonfinancial corporations will benefit (and so, indirectly, will those who own these corporations) while governments will also benefit, implying an indirect benefit for taxpayers throughout the econom ...

... pension assets will lose out. (Of course, many people will have positions in all three categories.) Nonfinancial corporations will benefit (and so, indirectly, will those who own these corporations) while governments will also benefit, implying an indirect benefit for taxpayers throughout the econom ...

C3 Guidelines - University of California | Office of The President

... obligated to utilize the full amount; however, the full amount will be counted against a given Participant’s debt capacity until actual utilization is known. Hence, approval of the authorization is subject to debt financing feasibility metrics. 5. Loan Characteristics. Minimum amortization is three ...

... obligated to utilize the full amount; however, the full amount will be counted against a given Participant’s debt capacity until actual utilization is known. Hence, approval of the authorization is subject to debt financing feasibility metrics. 5. Loan Characteristics. Minimum amortization is three ...

How Dodd-Frank and Other New U

... Likewise, the Act amends Section 4s of the CEA to make it “unlawful for any person to act as a swap dealer unless … registered … with the Commission” and “unlawful … to act as a major swap participant unless … registered … with the Commission.” However, it is unclear how these prohibitions apply to ...

... Likewise, the Act amends Section 4s of the CEA to make it “unlawful for any person to act as a swap dealer unless … registered … with the Commission” and “unlawful … to act as a major swap participant unless … registered … with the Commission.” However, it is unclear how these prohibitions apply to ...

Lecture 02

... They look at the use of derivatives, the activities of the market-makers, the organization of the markets and the logic of the pricing models and try to make sense of everything. © 2013 Pearson Education, Inc., publishing as Prentice Hall. All rights reserved. ...

... They look at the use of derivatives, the activities of the market-makers, the organization of the markets and the logic of the pricing models and try to make sense of everything. © 2013 Pearson Education, Inc., publishing as Prentice Hall. All rights reserved. ...

Global circumstances US, UK and Europe, Japan in

... business investment will be in second half of 09 (and thereafter), by which time government investment will to some extent offset the decline Reasonable chance of a turnaround in home building in second half Given that consumption was so weak to September, reasonable chance that with lower inter ...

... business investment will be in second half of 09 (and thereafter), by which time government investment will to some extent offset the decline Reasonable chance of a turnaround in home building in second half Given that consumption was so weak to September, reasonable chance that with lower inter ...

Speculation and Sovereign Debt – An Insidious Interaction

... trading a derivative to reduce artificially the ‘riskiness’ of securities and thereby bypass prudential regulatory requirements. Some economists, including Paul Volcker, have questioned the social value of many financial innovations. Crotty and Epstein (2009) use previous studies to calculate the n ...

... trading a derivative to reduce artificially the ‘riskiness’ of securities and thereby bypass prudential regulatory requirements. Some economists, including Paul Volcker, have questioned the social value of many financial innovations. Crotty and Epstein (2009) use previous studies to calculate the n ...

The Post-2008 Economic Soft Depression and Your Portfolio

... • Global risk assets will grow more volatile as earnings shift lower in the US but accelerate overseas. Both Europe and Japan are primed for sizable gains at a time when US profits will slow, mainly due to a strong dollar; • We still think most emerging markets should be avoided; previous USD surges ...

... • Global risk assets will grow more volatile as earnings shift lower in the US but accelerate overseas. Both Europe and Japan are primed for sizable gains at a time when US profits will slow, mainly due to a strong dollar; • We still think most emerging markets should be avoided; previous USD surges ...

What is wine - UNT College of Arts and Sciences

... Theoretically, they could depreciate their currencies to avoid recession ...

... Theoretically, they could depreciate their currencies to avoid recession ...

MIDLANDS STATE UNIVERSITY FACULTY OF COMMERCE

... Course Outline: Financial Risk Management (BF410) ...

... Course Outline: Financial Risk Management (BF410) ...

Directors` Guide to Credit - Federal Reserve Bank of Atlanta

... Lease and rental expense + current portion of long-term debt (CPLTD) Measurement of a firm’s ability to satisfy fixed financing expenses, such as interest and leases. A ratio over 1.0 indicates that the company is able to pay its fixed charges without incurring additional debt. Interest coverage ...

... Lease and rental expense + current portion of long-term debt (CPLTD) Measurement of a firm’s ability to satisfy fixed financing expenses, such as interest and leases. A ratio over 1.0 indicates that the company is able to pay its fixed charges without incurring additional debt. Interest coverage ...

Fair value - fek.zcu.cz

... the present discounted value of the future net cash inflows that the item is expected to generate in the normal course of business. Liabilities are carried at the present discounted value of the future net cash outflows that are expected to be required to settle the liabilities in the normal course ...

... the present discounted value of the future net cash inflows that the item is expected to generate in the normal course of business. Liabilities are carried at the present discounted value of the future net cash outflows that are expected to be required to settle the liabilities in the normal course ...

We need to solve the mortgage problem before interest rates rise

... looking at mechanisms for leaving the housing market altogether. In order to address the more specific potential mortgage prisoner problem, two steps are required: releasing prisoners where possible (by providing a choice of other options, such as a fixed rate deal that would prevent monthly repayme ...

... looking at mechanisms for leaving the housing market altogether. In order to address the more specific potential mortgage prisoner problem, two steps are required: releasing prisoners where possible (by providing a choice of other options, such as a fixed rate deal that would prevent monthly repayme ...

IFC Russia Capitalization Fund

... No doubt that distressed assets / NPLs will continue to grow • Peaking in 2010? • “Peak” NPLs: a measure of nominal risk, not losses – “Average temperature at the hospital” not a good indicator • True NPLs: uncertain repayment profiles (“restructuring”) – “Extend and pretend” “Bad bank” solution ...

... No doubt that distressed assets / NPLs will continue to grow • Peaking in 2010? • “Peak” NPLs: a measure of nominal risk, not losses – “Average temperature at the hospital” not a good indicator • True NPLs: uncertain repayment profiles (“restructuring”) – “Extend and pretend” “Bad bank” solution ...

27 January 2017 Global developments Government bond yields, the

... Q3, compared to the 2.2% consensus forecast. Growth was held back be the strongest drag from trade since Q2 2010 while non-residential fixed investment was at a 5-quarter high. The early 2017 US growth indicators were strong however, with Markit Services PMI in January rising to 55.1 against consens ...

... Q3, compared to the 2.2% consensus forecast. Growth was held back be the strongest drag from trade since Q2 2010 while non-residential fixed investment was at a 5-quarter high. The early 2017 US growth indicators were strong however, with Markit Services PMI in January rising to 55.1 against consens ...

Summary of Chapter

... In order to achieve a competitive advantage, a company needs to pursue strategies that build on its existing resources and capabilities and formulate strategies that build additional resources and capabilities (develop new competencies). ...

... In order to achieve a competitive advantage, a company needs to pursue strategies that build on its existing resources and capabilities and formulate strategies that build additional resources and capabilities (develop new competencies). ...

Santander Brasil

... Sizable asset management industry controlled basically by the big retail banks: USD 1,031 billion (the 4 largest banks ...

... Sizable asset management industry controlled basically by the big retail banks: USD 1,031 billion (the 4 largest banks ...

Financialization

Financialization is a term sometimes used in discussions of the financial capitalism that has developed over the decades between 1980 and 2010, in which financial leverage tended to override capital (equity), and financial markets tended to dominate over the traditional industrial economy and agricultural economics.Financialization describes an economic system or process that attempts to reduce all value that is exchanged (whether tangible or intangible, future or present promises, etc.) into a financial instrument. The intent of financialization is to be able to reduce any work product or service to an exchangeable financial instrument, like currency, and thus make it easier for people to trade these financial instruments.Workers, through a financial instrument such as a mortgage, may trade their promise of future work or wages for a home. The financialization of risk sharing is what makes possible all insurance. The financialization of a government's promises (e.g., US government bonds) is what makes possible all government deficit spending. Financialization also makes economic rents possible.