Market Insights - Quarterly outlook

... Second, policy divergence between the USA and the rest of the developed world is likely to persist. The Federal ...

... Second, policy divergence between the USA and the rest of the developed world is likely to persist. The Federal ...

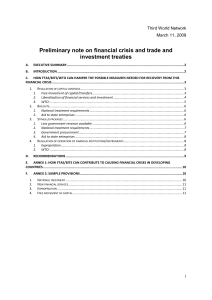

Third World Network

... b. There are multiple, conflicting, complicated services classification systems which was one of the causes for the U.S. mistake in the Antigua gambling case. c. Services are notoriously difficult to measure. Even developed countries and the United Nations Conference on Trade and Development have ha ...

... b. There are multiple, conflicting, complicated services classification systems which was one of the causes for the U.S. mistake in the Antigua gambling case. c. Services are notoriously difficult to measure. Even developed countries and the United Nations Conference on Trade and Development have ha ...

Development of capital markets forum

... specific factors or events will be taken into consideration The company should have qualified auditor’s report for the preceding 3 years ...

... specific factors or events will be taken into consideration The company should have qualified auditor’s report for the preceding 3 years ...

Exercises on Chapter 2

... Presented below are the assumptions, principles and constraints used in this chapter. 1. Economic entity assumption 2. Going concern assumption 3. Monetary assumption 4. Periodicity assumption 5. Historical cost principle 6. Matching principle 7. Full disclosure principle 8. Cost-benefit relationshi ...

... Presented below are the assumptions, principles and constraints used in this chapter. 1. Economic entity assumption 2. Going concern assumption 3. Monetary assumption 4. Periodicity assumption 5. Historical cost principle 6. Matching principle 7. Full disclosure principle 8. Cost-benefit relationshi ...

The Fundamental Structure of the International Monetary System

... prices and exchange rates—the current account, which excludes nonproduced income such as capital gains, will provide an increasingly distorted picture of the change in a country’s external position.5 Consider next the question of external adjustment. The United States still faces a very different pr ...

... prices and exchange rates—the current account, which excludes nonproduced income such as capital gains, will provide an increasingly distorted picture of the change in a country’s external position.5 Consider next the question of external adjustment. The United States still faces a very different pr ...

USCrisis

... Mortgage Bonds: Losses 4.4%, when these loans go bad, mortgagebacked securities fall too, but since these bonds are one step removed from loans, they have lost less then 5% of their worth. CDO No. 1: Losses 14%, The loss grows because these bonds are stacked, so the lowest rated bonds take the first ...

... Mortgage Bonds: Losses 4.4%, when these loans go bad, mortgagebacked securities fall too, but since these bonds are one step removed from loans, they have lost less then 5% of their worth. CDO No. 1: Losses 14%, The loss grows because these bonds are stacked, so the lowest rated bonds take the first ...

Practical Special Purpose Vehicles

... The Workshop will go through reviews of actual deal structures such as for major deals such as Bougyues, Enron, Cibinong as well as for more everyday deals. ...

... The Workshop will go through reviews of actual deal structures such as for major deals such as Bougyues, Enron, Cibinong as well as for more everyday deals. ...

How to Predict the Next Fiasco

... A telltale sign of trouble is negative cash flow from operations while the company's socalled Ebitda (earnings before interest, taxes, depreciation and amortization) is positive. Short sellers note that in such a case, a company could be using accounting gimmickry to make its business look healthie ...

... A telltale sign of trouble is negative cash flow from operations while the company's socalled Ebitda (earnings before interest, taxes, depreciation and amortization) is positive. Short sellers note that in such a case, a company could be using accounting gimmickry to make its business look healthie ...

FDI Glossary - Office for National Statistics

... of 10% or more- and are called fellow enterprises. It should be noted, however, that for FDI statistics, only cross-border transactions and positions between FDI related enterprises should be recorded. Globalisation- the world wide movement towards economic, financial, trade and communications integ ...

... of 10% or more- and are called fellow enterprises. It should be noted, however, that for FDI statistics, only cross-border transactions and positions between FDI related enterprises should be recorded. Globalisation- the world wide movement towards economic, financial, trade and communications integ ...

Defensive or offensive?

... is a ‘positive expected return’ and will, if done consistently over a period long enough to let the law of large numbers rule, produce the profit (being the difference between expected returns and payoff on event, or $10,000-$5,000 = $5,000 every 50 years, on average). But tail-risk insurance should ...

... is a ‘positive expected return’ and will, if done consistently over a period long enough to let the law of large numbers rule, produce the profit (being the difference between expected returns and payoff on event, or $10,000-$5,000 = $5,000 every 50 years, on average). But tail-risk insurance should ...

Financial Management ( ocw.mit.edu) Lecture Notes - edu,

... Introduction to Risk and Return (PDF) ...

... Introduction to Risk and Return (PDF) ...

The 4% Withdrawal Rule—Have Planners Been Wrong?

... Stories in the Journal of Financial Planning or Financial Planning Magazine suggest that use of the 4% rule is pervasive. Hardly a month goes by without an article about the 4% rule or some variant of it. But I wonder how often the 4% rule is actually used in day-to-day financial planning practice. ...

... Stories in the Journal of Financial Planning or Financial Planning Magazine suggest that use of the 4% rule is pervasive. Hardly a month goes by without an article about the 4% rule or some variant of it. But I wonder how often the 4% rule is actually used in day-to-day financial planning practice. ...

The cost of capital reflects the cost of funds

... 32. ________ ratios are a measure of the speed with which various accounts are converted into sales or cash. A) Activity B) Liquidity C) Debt D) Profitability 33. The ________ ratio measures the firm's ability to pay contractual interest payments. A) times interest earned B) fixed-payment coverage C ...

... 32. ________ ratios are a measure of the speed with which various accounts are converted into sales or cash. A) Activity B) Liquidity C) Debt D) Profitability 33. The ________ ratio measures the firm's ability to pay contractual interest payments. A) times interest earned B) fixed-payment coverage C ...

Asian Credit Daily

... prior written consent. This publication should not be construed as an offer or solicitation for the subscription, purchase or sale of the securities/instruments mentioned herein. Any forecast on the economy, stock market, bond market and economic trends of the markets provided is not necessarily ind ...

... prior written consent. This publication should not be construed as an offer or solicitation for the subscription, purchase or sale of the securities/instruments mentioned herein. Any forecast on the economy, stock market, bond market and economic trends of the markets provided is not necessarily ind ...

Fixed Income Opportunity

... economy. The reduction in demand will reduce earnings, with HY companies the most at risk ...

... economy. The reduction in demand will reduce earnings, with HY companies the most at risk ...

BM18_14TrusteeReport_Presentation_en

... Financial Crisis and the Global Fund’s Investments Presentation to the Global Fund Board November 7, 2008 Trustee, World Bank ...

... Financial Crisis and the Global Fund’s Investments Presentation to the Global Fund Board November 7, 2008 Trustee, World Bank ...

Pressure in Repo Market Spreads

... The volatility in Treasurys is reflected in interest rates and supply. Interest on Treasury bills out to three months is about 0% already, according to data from Tradeweb Markets LLC. On Tuesday, the bills set to mature out to April 16 briefly touched intraday lows below zero. In the Oct. 15 Treasur ...

... The volatility in Treasurys is reflected in interest rates and supply. Interest on Treasury bills out to three months is about 0% already, according to data from Tradeweb Markets LLC. On Tuesday, the bills set to mature out to April 16 briefly touched intraday lows below zero. In the Oct. 15 Treasur ...

Here are some of the services we can offer you.

... with even the most complex gift instruments such as CRTs and gifts of stock and life insurance. ...

... with even the most complex gift instruments such as CRTs and gifts of stock and life insurance. ...

Click to edit Master title style

... The European Union has mandated harmonization of accounting principles in its member countries By 2010, there could be only two major accounting bodies with substantial influence on global reporting – FASB in the United States and IASB elsewhere ...

... The European Union has mandated harmonization of accounting principles in its member countries By 2010, there could be only two major accounting bodies with substantial influence on global reporting – FASB in the United States and IASB elsewhere ...

PROBLE:v1S OF MONETARY MANAGEMENT IN NIGERIA WITH

... respective differentials with the discouct rate. If monetary authorities wish to reduce liquidity in the economy they may increase the discount rate thereby incr~asing the cost of borrowing and reducing investments. If monetary authorities intend to increasi: liquidity and increase production, they ...

... respective differentials with the discouct rate. If monetary authorities wish to reduce liquidity in the economy they may increase the discount rate thereby incr~asing the cost of borrowing and reducing investments. If monetary authorities intend to increasi: liquidity and increase production, they ...

Financialization

Financialization is a term sometimes used in discussions of the financial capitalism that has developed over the decades between 1980 and 2010, in which financial leverage tended to override capital (equity), and financial markets tended to dominate over the traditional industrial economy and agricultural economics.Financialization describes an economic system or process that attempts to reduce all value that is exchanged (whether tangible or intangible, future or present promises, etc.) into a financial instrument. The intent of financialization is to be able to reduce any work product or service to an exchangeable financial instrument, like currency, and thus make it easier for people to trade these financial instruments.Workers, through a financial instrument such as a mortgage, may trade their promise of future work or wages for a home. The financialization of risk sharing is what makes possible all insurance. The financialization of a government's promises (e.g., US government bonds) is what makes possible all government deficit spending. Financialization also makes economic rents possible.