Housing Markets in Europe Is the worst over?

... Nature of crisis Oversupply of new and existing homes Low transaction levels New build consumers badly affected by unemployment & credit constraints – E.g. first-time buyers ...

... Nature of crisis Oversupply of new and existing homes Low transaction levels New build consumers badly affected by unemployment & credit constraints – E.g. first-time buyers ...

Interview given by BNB Governor Mr. Svetoslav Gavriiski to Welt

... already negative. We succeeded in six months to stabilise the situation. Since then the stabilisation is a real fact and we managed in making this process sustainable. Now we expect to see a growth in GDP. We expected growth of about 4% in 1999 but you know regional events hit the Bulgarian economy, ...

... already negative. We succeeded in six months to stabilise the situation. Since then the stabilisation is a real fact and we managed in making this process sustainable. Now we expect to see a growth in GDP. We expected growth of about 4% in 1999 but you know regional events hit the Bulgarian economy, ...

Abstract. The Euro area has been challenged by numerous range of

... Equity indexes in Italy and Spain lifted by nearly +9%, while bank equity prices went up by around +14%. Also in wealthy Euro area countries, simultaneously equity indexes and bank equity prices went up, while this increase not such accelerated as in Italy and Spain. Nominal euro exchange rate has a ...

... Equity indexes in Italy and Spain lifted by nearly +9%, while bank equity prices went up by around +14%. Also in wealthy Euro area countries, simultaneously equity indexes and bank equity prices went up, while this increase not such accelerated as in Italy and Spain. Nominal euro exchange rate has a ...

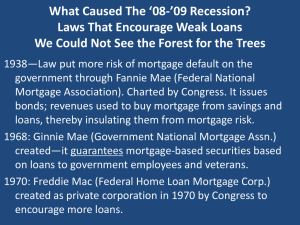

What Caused This Mess? Bad Laws Built Up Over Time

... 2. Sell bonds. Market cannot absorb $1 trillion plus year after year. Chinese government used to buy half of federal debt, but too big now for them or anyone else. If government borrows private savings, then little left for private sector, which again makes capital scarce, so hard to grow. ...

... 2. Sell bonds. Market cannot absorb $1 trillion plus year after year. Chinese government used to buy half of federal debt, but too big now for them or anyone else. If government borrows private savings, then little left for private sector, which again makes capital scarce, so hard to grow. ...

Currency Press release

... At 23 December 2016, the stock of currency was $100.1 billion, representing an increase of 15.9 per cent, relative to 23 December 2015. When the forecasted change in the consumer price index for December is taken into account, the real growth in currency for the period was 13.8 per cent, which is mu ...

... At 23 December 2016, the stock of currency was $100.1 billion, representing an increase of 15.9 per cent, relative to 23 December 2015. When the forecasted change in the consumer price index for December is taken into account, the real growth in currency for the period was 13.8 per cent, which is mu ...

A Framework for Assessing International Risk to the Financial System

... Canada’s case , the work is undertaken within several different departments. The Monetary and Fina ncial Analysis Department (MFA) examines the financial stability of Canadian banks, households and corporations. The Financial Markets Department analyses financial market developments both within Cana ...

... Canada’s case , the work is undertaken within several different departments. The Monetary and Fina ncial Analysis Department (MFA) examines the financial stability of Canadian banks, households and corporations. The Financial Markets Department analyses financial market developments both within Cana ...

(DOC file) No 177/2006 amending Rules No 530/2004

... minimum CAR shall generally be higher than 8% but not higher than 16%. The business plans of the undertaking should be taken into consideration as well as risk assessment results as stated in Articles 2 and 3 above. If an undertaking is rated at 2.25 or lower for three consecutive six-month calculat ...

... minimum CAR shall generally be higher than 8% but not higher than 16%. The business plans of the undertaking should be taken into consideration as well as risk assessment results as stated in Articles 2 and 3 above. If an undertaking is rated at 2.25 or lower for three consecutive six-month calculat ...

Ratio Analysis, PowerPoint Show

... then becoming more profitable. So becoming (more/less) profitable? ...

... then becoming more profitable. So becoming (more/less) profitable? ...

Emerging equity markets and commodities: joined at the hip?

... This document is for Professional Clients only and is not for consumer use. The value of investments and any income will fluctuate (this may partly be the result of exchange-rate fluctuations) and investors may not get back the full amount invested. Where Dean Newman, Head of Emerging Markets Equity ...

... This document is for Professional Clients only and is not for consumer use. The value of investments and any income will fluctuate (this may partly be the result of exchange-rate fluctuations) and investors may not get back the full amount invested. Where Dean Newman, Head of Emerging Markets Equity ...

FIN303 - CSUN.edu

... To find the value of an equity claim upon the company (share of stock), we must subtract out the market value of debt and preferred stock. This firm happens to be entirely equity funded, and this step is unnecessary. Hence, to find the value of a share of stock, we divide equity value (or in this ca ...

... To find the value of an equity claim upon the company (share of stock), we must subtract out the market value of debt and preferred stock. This firm happens to be entirely equity funded, and this step is unnecessary. Hence, to find the value of a share of stock, we divide equity value (or in this ca ...

Paper - Saint Mary`s University

... or state structures. This paper examines the potential role of co-operative legislation in dealing with the financial crises and the potential co-operatives have for mitigating such crises. It argues there are systemic reasons unique to the co-operative difference why credit unions, for instance, ar ...

... or state structures. This paper examines the potential role of co-operative legislation in dealing with the financial crises and the potential co-operatives have for mitigating such crises. It argues there are systemic reasons unique to the co-operative difference why credit unions, for instance, ar ...

Fall 2016 - Plimoth Investment Advisors

... U.S. products. At the same time, global demand has remained relatively steady, leading to a decline in foreign purchase of U.S. goods. On a positive note, inventory levels have declined, suggesting an eventual need for manufacturers to replenish inventory in the coming months. Finally, housing activ ...

... U.S. products. At the same time, global demand has remained relatively steady, leading to a decline in foreign purchase of U.S. goods. On a positive note, inventory levels have declined, suggesting an eventual need for manufacturers to replenish inventory in the coming months. Finally, housing activ ...

Euro Strengthens With European Economy

... euro zone’s retailing industry by NTC Economics reached its highest level since January 2004, when the poll began. For much of 2004, the dollar was buoyant as the Federal Reserve lifted interest rates far above European borrowing costs, drawing money from around the world into dollar-denominated ass ...

... euro zone’s retailing industry by NTC Economics reached its highest level since January 2004, when the poll began. For much of 2004, the dollar was buoyant as the Federal Reserve lifted interest rates far above European borrowing costs, drawing money from around the world into dollar-denominated ass ...

Institute of Actuaries of India Subject CT7 – Business Economics INDICATIVE SOLUTIONS

... a. In Actuaria, 3 more units of Bikes can be produced by giving up 5 units of Cars. The opportunity cost ratio is 3B ≡ 5C, or .6B ≡ 1C. b. In Economia, 10 additional units of Bikes can be produced by giving up 8 units of Cars. The opportunity cost ratio is 10B ≡ 8C, or 1.25B ≡ 1C. c. Actuaria has a ...

... a. In Actuaria, 3 more units of Bikes can be produced by giving up 5 units of Cars. The opportunity cost ratio is 3B ≡ 5C, or .6B ≡ 1C. b. In Economia, 10 additional units of Bikes can be produced by giving up 8 units of Cars. The opportunity cost ratio is 10B ≡ 8C, or 1.25B ≡ 1C. c. Actuaria has a ...

Competition between Banks and Bond Markets

... Over the longer term, the development of bond markets may have slowed the growth of banks but it does not appear to have caused their business to contract. Of 25 major emerging economies the domestic corporate bond market was larger (relative to GDP) in 2000 than in 1995 in all but India and Brazil. ...

... Over the longer term, the development of bond markets may have slowed the growth of banks but it does not appear to have caused their business to contract. Of 25 major emerging economies the domestic corporate bond market was larger (relative to GDP) in 2000 than in 1995 in all but India and Brazil. ...

Table of listed below articles

... Its hallmark is securitisation. Banks that once made loans and held them on their books now pool and sell the repackaged assets, from mortgages to car loans. In 2001 the value of pooled securities in America overtook the value of outstanding bank loans. Thereafter, the scale and complexity of this r ...

... Its hallmark is securitisation. Banks that once made loans and held them on their books now pool and sell the repackaged assets, from mortgages to car loans. In 2001 the value of pooled securities in America overtook the value of outstanding bank loans. Thereafter, the scale and complexity of this r ...

FINMA Newsletter 15 Risks in business dealings with Iran

... may be refused correspondent banking services by American banks where they knowingly facilitate significant transactions or render significant financial services on behalf of U.S.-listed IRGC (Iranian Revolutionary Guard Corps) persons and entities or for U.S.-listed financial institutions in connec ...

... may be refused correspondent banking services by American banks where they knowingly facilitate significant transactions or render significant financial services on behalf of U.S.-listed IRGC (Iranian Revolutionary Guard Corps) persons and entities or for U.S.-listed financial institutions in connec ...

Financialization

Financialization is a term sometimes used in discussions of the financial capitalism that has developed over the decades between 1980 and 2010, in which financial leverage tended to override capital (equity), and financial markets tended to dominate over the traditional industrial economy and agricultural economics.Financialization describes an economic system or process that attempts to reduce all value that is exchanged (whether tangible or intangible, future or present promises, etc.) into a financial instrument. The intent of financialization is to be able to reduce any work product or service to an exchangeable financial instrument, like currency, and thus make it easier for people to trade these financial instruments.Workers, through a financial instrument such as a mortgage, may trade their promise of future work or wages for a home. The financialization of risk sharing is what makes possible all insurance. The financialization of a government's promises (e.g., US government bonds) is what makes possible all government deficit spending. Financialization also makes economic rents possible.