The Impact of Financial Development and Asset Tangibility

... The mechanism of this influence can be elaborated as follows. In an incomplete contract setting, external finance dependence and the agency problem are inextricably linked and form the defining characteristics of the entrepreneur-financier relationship. Factors that can be broadly categorized as th ...

... The mechanism of this influence can be elaborated as follows. In an incomplete contract setting, external finance dependence and the agency problem are inextricably linked and form the defining characteristics of the entrepreneur-financier relationship. Factors that can be broadly categorized as th ...

SUPERVISION in the EU - European Commission

... capital provisioning and options and discretions) to be adopted by the COM January 2011 1st set of amendments to the CRD have to be implemented ...

... capital provisioning and options and discretions) to be adopted by the COM January 2011 1st set of amendments to the CRD have to be implemented ...

The Relationship between Ownership Structure and the Probability

... same industry. In order to avoid the influence of a financial crisis, a corporate could conduct window dressing of its financial statements.Hsieh (2011) suggests that when firms face financial problems, they will manipulate earnings to match analysts’ forecasts. Because they need to provide financia ...

... same industry. In order to avoid the influence of a financial crisis, a corporate could conduct window dressing of its financial statements.Hsieh (2011) suggests that when firms face financial problems, they will manipulate earnings to match analysts’ forecasts. Because they need to provide financia ...

Chapter 9

... The Maastricht Treaty of 1993 set the stage for the eventual creation of the Euro created an integrated system of European central banks overseen by a single European Central Bank (ECB) The Euro (€), the currency of the European Union (EU), began trading on January 1, 1999 when eleven European cou ...

... The Maastricht Treaty of 1993 set the stage for the eventual creation of the Euro created an integrated system of European central banks overseen by a single European Central Bank (ECB) The Euro (€), the currency of the European Union (EU), began trading on January 1, 1999 when eleven European cou ...

Pension fund equity investment

... Application to pension funds Pension fund liabilities comprise a sequence of payments extending many years into the future. Such liabilities are not at call. Auto-correlation of share investment returns over such long periods invalidates the assumptions underlying the simple financial economics appr ...

... Application to pension funds Pension fund liabilities comprise a sequence of payments extending many years into the future. Such liabilities are not at call. Auto-correlation of share investment returns over such long periods invalidates the assumptions underlying the simple financial economics appr ...

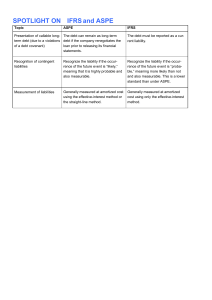

SPOTLIGHT ON*IFRS and ASPE

... Presentation of callable long- The debt can remain as long-term term debt (due to a violations debt if the company renegotiates the loan prior to releasing its financial of a debt covenant) statements. ...

... Presentation of callable long- The debt can remain as long-term term debt (due to a violations debt if the company renegotiates the loan prior to releasing its financial of a debt covenant) statements. ...

Commission rings changes for 4th Anti- money

... also provides in Article 75, under certain conditions, for the possibility to take administrative measures to achieve the objectives of Article 67 TFEU as regards the preventing and combating of terrorism. These measures would put in place common standards on the assets to be frozen, identify which ...

... also provides in Article 75, under certain conditions, for the possibility to take administrative measures to achieve the objectives of Article 67 TFEU as regards the preventing and combating of terrorism. These measures would put in place common standards on the assets to be frozen, identify which ...

Notes chapter 5

... The numerical problems on the exam will be similar to the ones in the notes How does the present value of an amount in the future change as the time is extended and as the interest rate increases? DO NOT need to prepare Annuity Due, section 5-17 for the exam. Need to learn how to use the financial c ...

... The numerical problems on the exam will be similar to the ones in the notes How does the present value of an amount in the future change as the time is extended and as the interest rate increases? DO NOT need to prepare Annuity Due, section 5-17 for the exam. Need to learn how to use the financial c ...

Adverse Effects of Ultra-Loose Monetary Policies on Investment

... Although the drop in interest rates and the dramatic expansion of central bank balance sheets had a stabilizing effect on financial markets and employment, investment and growth may be dampened in the medium and long term. This is most evident in Japan, where an exuberant financial market boom (the ...

... Although the drop in interest rates and the dramatic expansion of central bank balance sheets had a stabilizing effect on financial markets and employment, investment and growth may be dampened in the medium and long term. This is most evident in Japan, where an exuberant financial market boom (the ...

Gains from Financial Globalization

... losses on external liabilities are not the result of price or exchange rate effects. They are gains that cannot be otherwise measured. As a result, some skeptics call these capital gains “statistical manna from heaven.” • This financial gain for the U.S. is a loss for the rest of the world. As a res ...

... losses on external liabilities are not the result of price or exchange rate effects. They are gains that cannot be otherwise measured. As a result, some skeptics call these capital gains “statistical manna from heaven.” • This financial gain for the U.S. is a loss for the rest of the world. As a res ...

Lending-Standards-Business-Loans-and-Output-CEA-JUNE

... • Results reminiscent of ones for the U.S.: Recall that the GFC did not materially affect Canada’s financial sector but we did have a drop in GDP • Negative impact on GDP from a tightening of standards disappears in the extended model • Small (but stat sig) response of loans from STANDARDS • Real ti ...

... • Results reminiscent of ones for the U.S.: Recall that the GFC did not materially affect Canada’s financial sector but we did have a drop in GDP • Negative impact on GDP from a tightening of standards disappears in the extended model • Small (but stat sig) response of loans from STANDARDS • Real ti ...

Emerging Capital Markets

... 1980s and 1990s saw the rapid growth of economies in East Asia because of policies that emphasized reliance on export-led growth and the government involvement in determining industry strategy. So successful was this prolonged episode of economic growth that it was dubbed “the Asian miracle” and hel ...

... 1980s and 1990s saw the rapid growth of economies in East Asia because of policies that emphasized reliance on export-led growth and the government involvement in determining industry strategy. So successful was this prolonged episode of economic growth that it was dubbed “the Asian miracle” and hel ...

1494308082-Create a 10

... (d)How many Coca-Cola common shares are outstanding at December 31, 2014? How many PepsiCo shares of capital stock are outstanding at December 31, 2014? (e)What amounts of cash dividends per share were declared by Coca-Cola and PepsiCo in 2014? What were the dollar amount effects of the cash dividen ...

... (d)How many Coca-Cola common shares are outstanding at December 31, 2014? How many PepsiCo shares of capital stock are outstanding at December 31, 2014? (e)What amounts of cash dividends per share were declared by Coca-Cola and PepsiCo in 2014? What were the dollar amount effects of the cash dividen ...

IM Chapter 14

... use of accounting information. Throughout the first twelve chapters we have shown not, only how accounting information is developed, but also how it is interpreted and used. We feel that it is appropriate at this point in the course to spend some amount of time concentrating on this theme. After rev ...

... use of accounting information. Throughout the first twelve chapters we have shown not, only how accounting information is developed, but also how it is interpreted and used. We feel that it is appropriate at this point in the course to spend some amount of time concentrating on this theme. After rev ...

The Final Exam is Tuesday May 4th at 1:00 in the normal Todd

... The Final Exam is Tuesday May 4th at 1:00 in the normal Todd classroom The final exam is comprehensive. The best way to prepare is to review tests 1 and 2, the reviews for Test 1 and Test 2, and the Aplia assignments that were reviews for Tests 1 and 2. The final exam will focus on the core concepts ...

... The Final Exam is Tuesday May 4th at 1:00 in the normal Todd classroom The final exam is comprehensive. The best way to prepare is to review tests 1 and 2, the reviews for Test 1 and Test 2, and the Aplia assignments that were reviews for Tests 1 and 2. The final exam will focus on the core concepts ...

brexit: european equities positioning

... performance is not a guide to future performance. The value of investments and any income is not guaranteed and can go down as well as up and may be affected by exchange rate fluctuations. This means that an investor may not get back the amount invested. This material is for information only and doe ...

... performance is not a guide to future performance. The value of investments and any income is not guaranteed and can go down as well as up and may be affected by exchange rate fluctuations. This means that an investor may not get back the amount invested. This material is for information only and doe ...

Assignment 6 - cloudfront.net

... have pertaining to the clip. Ask if anyone would like to share what they wrote, then discuss. ...

... have pertaining to the clip. Ask if anyone would like to share what they wrote, then discuss. ...

RESOURCE LOG – SEPTEMBER 2014 Article Title Detail

... level since 2011, reflecting an investor scramble to place bets on an expected Federal Reserve rate increase as soon as next spring. Yields rise when prices fall… The softness of longer-term yields highlights concerns shared by many analysts and policy makers about the uneven growth of the U.S. econ ...

... level since 2011, reflecting an investor scramble to place bets on an expected Federal Reserve rate increase as soon as next spring. Yields rise when prices fall… The softness of longer-term yields highlights concerns shared by many analysts and policy makers about the uneven growth of the U.S. econ ...

doc

... explanatory factor of saving definitions of the money supply: narrow money = currency + demand deposits broad money = currency + demand deposits + time and saving deposits page 480, table 13-1 - broad money as a fraction of GDP: poor countries have a lower ratio of broad money to GDP than do ...

... explanatory factor of saving definitions of the money supply: narrow money = currency + demand deposits broad money = currency + demand deposits + time and saving deposits page 480, table 13-1 - broad money as a fraction of GDP: poor countries have a lower ratio of broad money to GDP than do ...

Paper

... short-term capital flows. Dubbed as one of East Asia’s “star economies”, Malaysia’s growth averaged 8.9 per cent between 1988 and 1996 while successfully maintaining a low inflation rate of approximately 3-4 per cent per annum over the period. At the same time, Malaysia has one of the highest saving ...

... short-term capital flows. Dubbed as one of East Asia’s “star economies”, Malaysia’s growth averaged 8.9 per cent between 1988 and 1996 while successfully maintaining a low inflation rate of approximately 3-4 per cent per annum over the period. At the same time, Malaysia has one of the highest saving ...

Research Reports - American Institute for Economic Research

... the price has since dropped back to about $1,000, it has still nearly doubled in three years. And just since October 2008, it has increased by 50 percent. This upswing has been attributed to various factors. Primarily, investors are said to be worried about the uncertain consequences of the financia ...

... the price has since dropped back to about $1,000, it has still nearly doubled in three years. And just since October 2008, it has increased by 50 percent. This upswing has been attributed to various factors. Primarily, investors are said to be worried about the uncertain consequences of the financia ...

Financialization

Financialization is a term sometimes used in discussions of the financial capitalism that has developed over the decades between 1980 and 2010, in which financial leverage tended to override capital (equity), and financial markets tended to dominate over the traditional industrial economy and agricultural economics.Financialization describes an economic system or process that attempts to reduce all value that is exchanged (whether tangible or intangible, future or present promises, etc.) into a financial instrument. The intent of financialization is to be able to reduce any work product or service to an exchangeable financial instrument, like currency, and thus make it easier for people to trade these financial instruments.Workers, through a financial instrument such as a mortgage, may trade their promise of future work or wages for a home. The financialization of risk sharing is what makes possible all insurance. The financialization of a government's promises (e.g., US government bonds) is what makes possible all government deficit spending. Financialization also makes economic rents possible.