Third, it explores the evolution of market power in MENA countries

... frontier approach. Journal of Banking & Finance, 34(8), 1808–1817. [7] Carbó, S., Humphrey, D., Maudos, J., & Molyneux, P. 2009. Cross-country comparisons of competition and pricing power in European banking. Journal of International Money and Finance, 28(1), 115–134. [8] Claessens, S., Laeven, L., ...

... frontier approach. Journal of Banking & Finance, 34(8), 1808–1817. [7] Carbó, S., Humphrey, D., Maudos, J., & Molyneux, P. 2009. Cross-country comparisons of competition and pricing power in European banking. Journal of International Money and Finance, 28(1), 115–134. [8] Claessens, S., Laeven, L., ...

تحميل الملف المرفق

... ٨ ﻡ ...

... ٨ ﻡ ...

Relationship between Interest Rate and Bank Common Stock Return

... are used as those in part 1 and 2. The findings suggest that, after the crisis, changes in longterm interest rates exhibit an even more significant impact on banks’ common stock returns than that before the financial crisis. ...

... are used as those in part 1 and 2. The findings suggest that, after the crisis, changes in longterm interest rates exhibit an even more significant impact on banks’ common stock returns than that before the financial crisis. ...

Poor monsoons to put pressure on domestic bourses

... in at a dismal -1.8%, way below the street estimate of 1%. The number suggests that all gains accumulated in the previous month have been wiped out. The IIP figure for the month of May 2012, however, has been revised slightly higher to 2.5% from 2.4%. Amid slowdown in economic activities, the govern ...

... in at a dismal -1.8%, way below the street estimate of 1%. The number suggests that all gains accumulated in the previous month have been wiped out. The IIP figure for the month of May 2012, however, has been revised slightly higher to 2.5% from 2.4%. Amid slowdown in economic activities, the govern ...

Introduction. - Homework Market

... which ensures in the perfect financial reporting systems and process. The bond of the big firms with their client facilitate this through additional of information and there are greater details explained. Many multinational companies ensures that the implementation and adoption of the IFRS is succes ...

... which ensures in the perfect financial reporting systems and process. The bond of the big firms with their client facilitate this through additional of information and there are greater details explained. Many multinational companies ensures that the implementation and adoption of the IFRS is succes ...

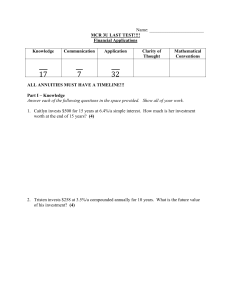

Test Chapter 8 Spring `14

... years, the interest rate changes to 9%/a compounded semi-annually. Calculate the value of the investment two years after this change. (7) ...

... years, the interest rate changes to 9%/a compounded semi-annually. Calculate the value of the investment two years after this change. (7) ...

"The euro - stability anchor in turbulent times

... shows how allotted amounts increased in autumn 2008 as the Eurosystem accommodated the risen liquidity demand of the banking sector. 2.2.2. Lengthening of maturities As of September 2009, the Eurosystem not only provides unlimited amounts of liquidity, it also does so at longer maturities than befor ...

... shows how allotted amounts increased in autumn 2008 as the Eurosystem accommodated the risen liquidity demand of the banking sector. 2.2.2. Lengthening of maturities As of September 2009, the Eurosystem not only provides unlimited amounts of liquidity, it also does so at longer maturities than befor ...

Emerging Economic Entity Crises in Post Financial Crisis Era – The

... appreciated relative to dollars, and the currency of other countries were all depreciated, with the average depreciation 7.77%. The depreciation rates of India rupee, Brazil Real and Turkey new lira were up to over 10%, among which the depreciation rate of India rupee was the largest, namely 17%. We ...

... appreciated relative to dollars, and the currency of other countries were all depreciated, with the average depreciation 7.77%. The depreciation rates of India rupee, Brazil Real and Turkey new lira were up to over 10%, among which the depreciation rate of India rupee was the largest, namely 17%. We ...

Common Currency and Determinants of Government Bond

... question. Were extensive deficits in the Economic and Monetary Union (EMU) the result of necessary Keynesian fiscal policy or were they a shortcoming of the common backbone in the form of the euro currency? Confronted with the crisis, the EMU Member States substantially increased their public debt r ...

... question. Were extensive deficits in the Economic and Monetary Union (EMU) the result of necessary Keynesian fiscal policy or were they a shortcoming of the common backbone in the form of the euro currency? Confronted with the crisis, the EMU Member States substantially increased their public debt r ...

Equity-Style Portfolio Construction

... • DAA is an active strategy of changing a bond and equity mix over time and in response to stock market changes in order to achieve a certain return distribution at the end of a period. • For example, at the end of five years the objetive may be to have a return on the portfolio that matches the mar ...

... • DAA is an active strategy of changing a bond and equity mix over time and in response to stock market changes in order to achieve a certain return distribution at the end of a period. • For example, at the end of five years the objetive may be to have a return on the portfolio that matches the mar ...

title slide is in sentence case. green background. 2016 half

... – Given sustainable recovery in recent years, the UK enters this period of uncertainty from a position of strength • Transformation of the business since 2010 and low risk business model position us well • Going forward, will continue to help Britain prosper through support to key customer segments ...

... – Given sustainable recovery in recent years, the UK enters this period of uncertainty from a position of strength • Transformation of the business since 2010 and low risk business model position us well • Going forward, will continue to help Britain prosper through support to key customer segments ...

1. You were hired as a consultant to Keys Company, and you were

... 5. The Nunnally Company has equal amounts of low-risk, average-risk, and high-risk projects. Nunnally estimates that its overall WACC is 12%. The CFO believes that this is the correct WACC for the company’s average-risk projects, but that a lower rate should be used for lower risk projects and a hig ...

... 5. The Nunnally Company has equal amounts of low-risk, average-risk, and high-risk projects. Nunnally estimates that its overall WACC is 12%. The CFO believes that this is the correct WACC for the company’s average-risk projects, but that a lower rate should be used for lower risk projects and a hig ...

Public Debt: Private Asset

... only one of many debt issuers, it plays a significant role in our financial markets for several reasons. First, it is significant simply because it issues so much debt. For example, in fiscal 1997, the Treasury issued more than $867 billion in bonds, bills and notes, not only to finance the deficit ...

... only one of many debt issuers, it plays a significant role in our financial markets for several reasons. First, it is significant simply because it issues so much debt. For example, in fiscal 1997, the Treasury issued more than $867 billion in bonds, bills and notes, not only to finance the deficit ...

FRBSF E L

... concrete example. Low interest rates boost fundamental valuation of assets. In a world of rational expectations, asset prices adjust and that’s it. But, if one allows for limited information, the resulting bull ...

... concrete example. Low interest rates boost fundamental valuation of assets. In a world of rational expectations, asset prices adjust and that’s it. But, if one allows for limited information, the resulting bull ...

Financial Stability, Regulatory Buffers, and Economic Growth

... As shown below, the emphasis on economic growth leads regulators to focus on specific indicators of financial health to guide their supervisory actions, but those indicators are not effective at identifying financial fragility. In addition, whenever regulatory actions are proposed to restrain innov ...

... As shown below, the emphasis on economic growth leads regulators to focus on specific indicators of financial health to guide their supervisory actions, but those indicators are not effective at identifying financial fragility. In addition, whenever regulatory actions are proposed to restrain innov ...

Lecture / Chapter 3

... 3. Lender obtains credit reports of borrower from three sources 4. Borrower provides to the lender W-2 tax information, income statements, verification of employment and history, proof of assets (bank ...

... 3. Lender obtains credit reports of borrower from three sources 4. Borrower provides to the lender W-2 tax information, income statements, verification of employment and history, proof of assets (bank ...

McNaughton Report

... coal once again rose sharply, up 20% during the month, though this month it was outdone by thermal coal, which rose 33% during the month. The lift in thermal and coking coal prices in October likely reflected a continued contraction in Chinese domestic coal production. Markets Bonds and Credit Yield ...

... coal once again rose sharply, up 20% during the month, though this month it was outdone by thermal coal, which rose 33% during the month. The lift in thermal and coking coal prices in October likely reflected a continued contraction in Chinese domestic coal production. Markets Bonds and Credit Yield ...

BusinessFutures Public Spending report 2015 Does debt matter?

... in their accounts the unfunded future spending commitments they, and previous administrations, have made. Even where legally-enforceable commitments to pensions for public-sector workers are accounted for, commitments to future State pensioners in terms of income, social care and healthcare, are not ...

... in their accounts the unfunded future spending commitments they, and previous administrations, have made. Even where legally-enforceable commitments to pensions for public-sector workers are accounted for, commitments to future State pensioners in terms of income, social care and healthcare, are not ...

13 – Environment and Economics

... What is the relationship between economics and the environment? ...

... What is the relationship between economics and the environment? ...

A New View of Mortgages (and life)

... • An insurance company has a large real estate portfolio. • The insurance company projects that it will need $1 million next year to fund possible claims. • What can it do to protect itself from changes in value to its real estate portfolio between now and when the claims will have to be paid. ...

... • An insurance company has a large real estate portfolio. • The insurance company projects that it will need $1 million next year to fund possible claims. • What can it do to protect itself from changes in value to its real estate portfolio between now and when the claims will have to be paid. ...

Financialization

Financialization is a term sometimes used in discussions of the financial capitalism that has developed over the decades between 1980 and 2010, in which financial leverage tended to override capital (equity), and financial markets tended to dominate over the traditional industrial economy and agricultural economics.Financialization describes an economic system or process that attempts to reduce all value that is exchanged (whether tangible or intangible, future or present promises, etc.) into a financial instrument. The intent of financialization is to be able to reduce any work product or service to an exchangeable financial instrument, like currency, and thus make it easier for people to trade these financial instruments.Workers, through a financial instrument such as a mortgage, may trade their promise of future work or wages for a home. The financialization of risk sharing is what makes possible all insurance. The financialization of a government's promises (e.g., US government bonds) is what makes possible all government deficit spending. Financialization also makes economic rents possible.