Office of the Registrar of Joint Stock Companies and Firms 1 Kawran

... (c) experience in similar operating environments and conditions; (d) availability of appropriate experience and professional qualifications among Applicant's staff and adequate resources to carry out the assignment ; and (e) managerial strength and financial capacity The firm must be a registered co ...

... (c) experience in similar operating environments and conditions; (d) availability of appropriate experience and professional qualifications among Applicant's staff and adequate resources to carry out the assignment ; and (e) managerial strength and financial capacity The firm must be a registered co ...

other economic flows

... • When bonds and bills are issued at a discount the price will gradually rise over the life of the bond until it reaches the maturity value. This increase in price is not a holding gain. • The value of bonds and bills changes when the market rates of interest change. Changes attributable to market r ...

... • When bonds and bills are issued at a discount the price will gradually rise over the life of the bond until it reaches the maturity value. This increase in price is not a holding gain. • The value of bonds and bills changes when the market rates of interest change. Changes attributable to market r ...

America and the Profit Motive - Our Reason Not to Abandon It

... to introduce the reader to a more theoretical way of thinking about this topic. Imagine we only have nonprofit organizations. As I argued previously, it is highly questionable whether non-profits better serve the whole society. However, let us assume that institutions are no longer eligible to provi ...

... to introduce the reader to a more theoretical way of thinking about this topic. Imagine we only have nonprofit organizations. As I argued previously, it is highly questionable whether non-profits better serve the whole society. However, let us assume that institutions are no longer eligible to provi ...

ACICO Industries Company New(1). - Kuwait University

... This is good for speculators because of the high opportunity for the stock price to increase. ACICO'S ROE is about 4.85% which is higher than the sector median (4.67%) by a little bit. This indicates that ACICO's ROE is in the normal range when compared to the sector. Kuwait has a dynamic constructi ...

... This is good for speculators because of the high opportunity for the stock price to increase. ACICO'S ROE is about 4.85% which is higher than the sector median (4.67%) by a little bit. This indicates that ACICO's ROE is in the normal range when compared to the sector. Kuwait has a dynamic constructi ...

Guidelines for using this template

... Ensures funds and ETFs on your sell list are most suitable to recommend • Leveraging Broadridge’s “scorecard ranking” fund evaluation service, firms can assess the appropriateness of their fund lineup benchmarked against all U.S. Mutual Funds and ETFs EDGAR-sourced data to pre-populate online forms ...

... Ensures funds and ETFs on your sell list are most suitable to recommend • Leveraging Broadridge’s “scorecard ranking” fund evaluation service, firms can assess the appropriateness of their fund lineup benchmarked against all U.S. Mutual Funds and ETFs EDGAR-sourced data to pre-populate online forms ...

Joseph B. McCarthy MBA, CPA - National Association of Corporate

... operation. o Transactional Bank Relationships: Analyzed, standardized and optimized accounts, services, infrastructure and fees with US and international banks. Reduced bank fees by $2MM (15%), by standardizing rates within merged banks, eliminating non-electronic services, and volume discounts ac ...

... operation. o Transactional Bank Relationships: Analyzed, standardized and optimized accounts, services, infrastructure and fees with US and international banks. Reduced bank fees by $2MM (15%), by standardizing rates within merged banks, eliminating non-electronic services, and volume discounts ac ...

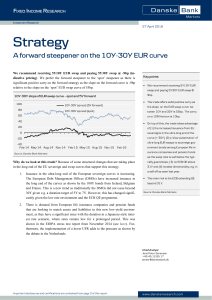

Strategy: A forward steepener on the 10

... to the rules and regulation of the relevant regulators in all other jurisdictions where it conducts business. Danske Bank is subject to limited regulation by the Financial Conduct Authority and the Prudential Regulation Authority (UK). Details on the extent of the regulation by the Financial Conduct ...

... to the rules and regulation of the relevant regulators in all other jurisdictions where it conducts business. Danske Bank is subject to limited regulation by the Financial Conduct Authority and the Prudential Regulation Authority (UK). Details on the extent of the regulation by the Financial Conduct ...

mmi07 Steger final 4388002 en

... Kraay (1998) and Edison et al. (2004) looked at various measures of gross capital flows and stocks over GDP as quantitative indicators for the degree of international financial integration. Eichengreen (2001) and Edison et al. (2004) discuss the advantages of both approaches. Clearly, the choice of ...

... Kraay (1998) and Edison et al. (2004) looked at various measures of gross capital flows and stocks over GDP as quantitative indicators for the degree of international financial integration. Eichengreen (2001) and Edison et al. (2004) discuss the advantages of both approaches. Clearly, the choice of ...

Corporate Governance and Its Effect on the Corporate Financial

... interest of loan is the acceptable tax cost and this reduces the effective cost of loan especially if the rate of return resulted from these sources is higher than the cost rate of financing. Second, lenders cannot vote and shareholders can have more control of the larger companies with less money. ...

... interest of loan is the acceptable tax cost and this reduces the effective cost of loan especially if the rate of return resulted from these sources is higher than the cost rate of financing. Second, lenders cannot vote and shareholders can have more control of the larger companies with less money. ...

Statement Pursuant to U.S. Treasury Regulation § 1.1273

... February 15, 2021 (the “New Notes”), cash of $54,000,000 and 4,300,000 shares of common stock, par value $0.001 per share, for $214,400,000 aggregate principal amount of 10% Senior Notes due 2017 (“Old Notes”). 1. The New Notes are “traded on an established market” within the meaning of Treasury Reg ...

... February 15, 2021 (the “New Notes”), cash of $54,000,000 and 4,300,000 shares of common stock, par value $0.001 per share, for $214,400,000 aggregate principal amount of 10% Senior Notes due 2017 (“Old Notes”). 1. The New Notes are “traded on an established market” within the meaning of Treasury Reg ...

Don`t let market sentiment derail your portfolio from achieving your

... Inflation remains finely balanced (with realised inflation progress offset by a slippage in expectations), the Fed's confidence in the economic outlook is likely downgraded (from “uncertain” to “a reason for pause”), and financial conditions – while easier at the margin – remain volatile and uncerta ...

... Inflation remains finely balanced (with realised inflation progress offset by a slippage in expectations), the Fed's confidence in the economic outlook is likely downgraded (from “uncertain” to “a reason for pause”), and financial conditions – while easier at the margin – remain volatile and uncerta ...

Regime-Switching Measure of Systemic Financial Stress

... Treasury yield, is a measure of short-term credit risk in the banking sector. Other studies, such as Hakkio and Keeton (2009) and Hatzius, Hooper, Mishkin, Schoenholtz, and Watson (2010), also find the information in the TED spread useful for constricting their financial stress and financial condit ...

... Treasury yield, is a measure of short-term credit risk in the banking sector. Other studies, such as Hakkio and Keeton (2009) and Hatzius, Hooper, Mishkin, Schoenholtz, and Watson (2010), also find the information in the TED spread useful for constricting their financial stress and financial condit ...

Single Market, National Companies?

... therefore built up around these seven cases, or rather, the central cases that illustrate the main politically driven obstacles to cross-border mergers and acquisitions in these cases. Despite a strong EU merger regime and the establishment of the Single European Market, the present report concludes ...

... therefore built up around these seven cases, or rather, the central cases that illustrate the main politically driven obstacles to cross-border mergers and acquisitions in these cases. Despite a strong EU merger regime and the establishment of the Single European Market, the present report concludes ...

chapter12

... All of the resources (Revenue) that have come into the firm from operating activities. 2- (Cost of goods sold): The money resources that were used up. 3- (Expenses): The money expenses include in doing business. 4- (Profit): What resources were left after all costs and expenses (including taxes) wer ...

... All of the resources (Revenue) that have come into the firm from operating activities. 2- (Cost of goods sold): The money resources that were used up. 3- (Expenses): The money expenses include in doing business. 4- (Profit): What resources were left after all costs and expenses (including taxes) wer ...

The evolution of currency

... Banks in the U.S. earn approximately U.S.$70 billion annually, and it is estimated that some 40% of their profit is derived from their payment systems that enable the money substi- ...

... Banks in the U.S. earn approximately U.S.$70 billion annually, and it is estimated that some 40% of their profit is derived from their payment systems that enable the money substi- ...

How to Invest for Income in a Low Interest Rate

... a fund, which in turn invests into a range of Government Bonds. Not only is this generally more convenient it also allows investors to diversify their holdings across many individual Bond types. There are practical reasons as well: many investors who want to invest in property simply do not have the ...

... a fund, which in turn invests into a range of Government Bonds. Not only is this generally more convenient it also allows investors to diversify their holdings across many individual Bond types. There are practical reasons as well: many investors who want to invest in property simply do not have the ...

Downlaod File

... d. most corporations that consistently invest in foreign short-term investments would have generated the same profits (on average) as from domestic short-term investments. __E__6. Assume that U.S. and British investors require a real return of 2%. If the nominal U.S. interest rate is 15%, and the no ...

... d. most corporations that consistently invest in foreign short-term investments would have generated the same profits (on average) as from domestic short-term investments. __E__6. Assume that U.S. and British investors require a real return of 2%. If the nominal U.S. interest rate is 15%, and the no ...

Bank Runs, Deposit Insurance, and Liquidity Diamond and Dybvig

... Spain, April 2010: Interest rate ceilings on deposits. The Ministry of Finance (MoF) requires that institutions offering deposit interest rates that are considered to be above market rates (determined by M oF) double their contributions to the Fondo de Garantía de Depósitos. April 2013: Spain’s soc ...

... Spain, April 2010: Interest rate ceilings on deposits. The Ministry of Finance (MoF) requires that institutions offering deposit interest rates that are considered to be above market rates (determined by M oF) double their contributions to the Fondo de Garantía de Depósitos. April 2013: Spain’s soc ...

PersonalIncome

... Personal Consumption Expenditures accounts for 2/3 of all economic activity, because of this is that changes in PCE can lead to major shifts in the business cycle. ...

... Personal Consumption Expenditures accounts for 2/3 of all economic activity, because of this is that changes in PCE can lead to major shifts in the business cycle. ...

Financialization

Financialization is a term sometimes used in discussions of the financial capitalism that has developed over the decades between 1980 and 2010, in which financial leverage tended to override capital (equity), and financial markets tended to dominate over the traditional industrial economy and agricultural economics.Financialization describes an economic system or process that attempts to reduce all value that is exchanged (whether tangible or intangible, future or present promises, etc.) into a financial instrument. The intent of financialization is to be able to reduce any work product or service to an exchangeable financial instrument, like currency, and thus make it easier for people to trade these financial instruments.Workers, through a financial instrument such as a mortgage, may trade their promise of future work or wages for a home. The financialization of risk sharing is what makes possible all insurance. The financialization of a government's promises (e.g., US government bonds) is what makes possible all government deficit spending. Financialization also makes economic rents possible.