Realpool Investment Fund - British Columbia Investment

... purpose of investment by means of investment units of participation in a pooled investment portfolio.” In addition, pooled investment portfolios previously established under the Financial Administration Act and the Pooled Investment Portfolios Regulation (“Regulations”), B.C. Reg. 84/86, were contin ...

... purpose of investment by means of investment units of participation in a pooled investment portfolio.” In addition, pooled investment portfolios previously established under the Financial Administration Act and the Pooled Investment Portfolios Regulation (“Regulations”), B.C. Reg. 84/86, were contin ...

How is money laundered?

... • Regulated firms are required to: – “establish, implement and maintain adequate policies and procedures sufficient to ensure compliance of the firm including its managers, employees and appointed representatives , with its obligations under the regulatory system and for countering the risk that the ...

... • Regulated firms are required to: – “establish, implement and maintain adequate policies and procedures sufficient to ensure compliance of the firm including its managers, employees and appointed representatives , with its obligations under the regulatory system and for countering the risk that the ...

Main heading goes in here second line of main heading

... • The two systems started out very differently, with a large number of differences between the two • Accounting standards moved closer to GFS over time as they moved toward greater use of fair value (matching GFS market value) • Engagement with statistical people at both national and international l ...

... • The two systems started out very differently, with a large number of differences between the two • Accounting standards moved closer to GFS over time as they moved toward greater use of fair value (matching GFS market value) • Engagement with statistical people at both national and international l ...

Setting aside the debate on when the exact date of an interest rate

... Low absolute levels of interest actually significantly reduce the potential for future returns. One of the primary goals of a zero interest rate policy is to reduce the cost of financing for companies. Companies have been able to issue bonds to investors at all‐time low interest rates. While t ...

... Low absolute levels of interest actually significantly reduce the potential for future returns. One of the primary goals of a zero interest rate policy is to reduce the cost of financing for companies. Companies have been able to issue bonds to investors at all‐time low interest rates. While t ...

Ameriprise® Stock Market Certificate

... Ameriprise Certificates are backed by Ameriprise Certificate Company, the largest issuer of face amount certificates in the United States. Ameriprise Certificate Company and its parent company Ameriprise Financial have a consistent record of safety that started in 1894, extended through the Great De ...

... Ameriprise Certificates are backed by Ameriprise Certificate Company, the largest issuer of face amount certificates in the United States. Ameriprise Certificate Company and its parent company Ameriprise Financial have a consistent record of safety that started in 1894, extended through the Great De ...

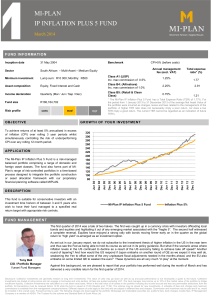

mi-plan ip inflation plus 5 fund

... The first quarter of 2014 was a tale of two halves. The first was caught up in a currency crisis with investors offloading local bonds and equities and hightailing it out of any emerging market associated with the “fragile 5”. The second half witnessed a complete reversal. Equities have enjoyed a st ...

... The first quarter of 2014 was a tale of two halves. The first was caught up in a currency crisis with investors offloading local bonds and equities and hightailing it out of any emerging market associated with the “fragile 5”. The second half witnessed a complete reversal. Equities have enjoyed a st ...

2017 U.S. Rates Strategy - Aegon USA Investment Management

... > Complicating the dynamic monetary policy landscape is the potential for substantial changes to U.S. fiscal policy in the coming months. With Republicans now in control over both houses of Congress and the White House, Party leaders have indicated a desire to achieve substantial tax reform, regulat ...

... > Complicating the dynamic monetary policy landscape is the potential for substantial changes to U.S. fiscal policy in the coming months. With Republicans now in control over both houses of Congress and the White House, Party leaders have indicated a desire to achieve substantial tax reform, regulat ...

Business Organizations

... limited liability and are not liable for the actions or debts of the corporation. The relatively large size of the corporation allows for specialized functions and large-scale manufacturing within the firm. Disadvantages of corporations include the cost of obtaining charters, limited shareholder i ...

... limited liability and are not liable for the actions or debts of the corporation. The relatively large size of the corporation allows for specialized functions and large-scale manufacturing within the firm. Disadvantages of corporations include the cost of obtaining charters, limited shareholder i ...

The Pros and Cons of Regulating Corporate Reporting: A Critical

... market failure. For example, regulation can reduce enforcement costs, redundancies in information production, and opportunistic behavior, or can mitigate failure linked to externalities where firms do not fully internalize the consequences of their disclosure decisions. However, while markets may be ...

... market failure. For example, regulation can reduce enforcement costs, redundancies in information production, and opportunistic behavior, or can mitigate failure linked to externalities where firms do not fully internalize the consequences of their disclosure decisions. However, while markets may be ...

The Economic and Geopolitical Impacts of Global Aging

... Source: United Nations (2004); Census Bureau for U.S. (2004) * Includes all Europe plus Asian Russia (47 countries) ...

... Source: United Nations (2004); Census Bureau for U.S. (2004) * Includes all Europe plus Asian Russia (47 countries) ...

Outlook 2015: In Transit - Northstar Wealth Partners

... potential growth rate. The lack of inflation has allowed the Fed to be patient in its journey toward removing the massive amount of stimulus it has added to the economy since 2008; but another solid year of economic growth in 2015 could tighten labor market conditions and likely begin to drive wages ...

... potential growth rate. The lack of inflation has allowed the Fed to be patient in its journey toward removing the massive amount of stimulus it has added to the economy since 2008; but another solid year of economic growth in 2015 could tighten labor market conditions and likely begin to drive wages ...

rising inequality and the financial crises of 1929 and 2008

... The same basic scenario played out again over the three decades of rising inequality prior to the crisis of 2008. The struggle to keep up was especially intense in housing. As those at the pinnacle of wealth and income competed among themselves for status, they bought and had constructed ever-larger ...

... The same basic scenario played out again over the three decades of rising inequality prior to the crisis of 2008. The struggle to keep up was especially intense in housing. As those at the pinnacle of wealth and income competed among themselves for status, they bought and had constructed ever-larger ...

Lecture 4: Cost of capital and CAPM. First lecture

... Further reading A study into certain aspects of the cost of capital for regulated utilities in the UK February 2003 Paper 08/03 from Ofgem or www.ofcom.org.uk/static/archive/ oftel/publications/pricing/2003/cofk0203.htm Authors are academics and core paradigm is non-diversifiable risk, as above. ...

... Further reading A study into certain aspects of the cost of capital for regulated utilities in the UK February 2003 Paper 08/03 from Ofgem or www.ofcom.org.uk/static/archive/ oftel/publications/pricing/2003/cofk0203.htm Authors are academics and core paradigm is non-diversifiable risk, as above. ...

Determinants of loan rates

... • Many central banks fine tune discount rates to improve short term economic performances. • However, short term monetary policies have long term consequences, which often do not concern policy makers and general public as much. • They don’t fully understand the precise relations among the various f ...

... • Many central banks fine tune discount rates to improve short term economic performances. • However, short term monetary policies have long term consequences, which often do not concern policy makers and general public as much. • They don’t fully understand the precise relations among the various f ...

Correlation of Risks, Integrating Risk Measurement – Risk

... interest rate risk management practices at individual thrifts Identify outlier thrifts that need more supervisory attention Identify systemic interest rate risk trends within the thrift industry Designed to spot storm clouds on the horizon Fair valuation of all balance sheet items in disaggreg ...

... interest rate risk management practices at individual thrifts Identify outlier thrifts that need more supervisory attention Identify systemic interest rate risk trends within the thrift industry Designed to spot storm clouds on the horizon Fair valuation of all balance sheet items in disaggreg ...

Determinants of non-performing loans in Central and Eastern

... The dependent variable here is the ratio of NPLs to total (gross) loans. The definition of NPLs differs across countries and regions, so it is necessary to be cautious when making international comparisons. The main problem with the NPL data is that there is no internationally accepted standard for ...

... The dependent variable here is the ratio of NPLs to total (gross) loans. The definition of NPLs differs across countries and regions, so it is necessary to be cautious when making international comparisons. The main problem with the NPL data is that there is no internationally accepted standard for ...

Stock market

... equilibrium, having priced in all public knowledge.) The 'hard' efficientmarket hypothesis is sorely tested by such events as the stock market crash in 1987, when the Dow Jones index plummeted 22.6 percent—the largest-ever one-day fall in the United States. This event demonstrated that share prices ...

... equilibrium, having priced in all public knowledge.) The 'hard' efficientmarket hypothesis is sorely tested by such events as the stock market crash in 1987, when the Dow Jones index plummeted 22.6 percent—the largest-ever one-day fall in the United States. This event demonstrated that share prices ...

Buying or Leasing a Car and Your Credit Score

... When it comes to purchasing a home, every credit score point is important and can help save you money by allowing you to secure the best available mortgage rate, said Claudia Mott, a certified financial planner with Epona Financial Solutions in Basking Ridge. She said whether you choose to lease a n ...

... When it comes to purchasing a home, every credit score point is important and can help save you money by allowing you to secure the best available mortgage rate, said Claudia Mott, a certified financial planner with Epona Financial Solutions in Basking Ridge. She said whether you choose to lease a n ...

Financialization

Financialization is a term sometimes used in discussions of the financial capitalism that has developed over the decades between 1980 and 2010, in which financial leverage tended to override capital (equity), and financial markets tended to dominate over the traditional industrial economy and agricultural economics.Financialization describes an economic system or process that attempts to reduce all value that is exchanged (whether tangible or intangible, future or present promises, etc.) into a financial instrument. The intent of financialization is to be able to reduce any work product or service to an exchangeable financial instrument, like currency, and thus make it easier for people to trade these financial instruments.Workers, through a financial instrument such as a mortgage, may trade their promise of future work or wages for a home. The financialization of risk sharing is what makes possible all insurance. The financialization of a government's promises (e.g., US government bonds) is what makes possible all government deficit spending. Financialization also makes economic rents possible.