The Euro, the Dollar, and the International

... The falling value of the euro during the first 6 months of its introduction caused great concern to Wim Duisenberg (the Governor of the ECB), Hans Tietmayer, and Ernest Welteke (respectively, the retiring and the incoming president of the Bundesbank or German Central Bank), Dominique Strauss-Khan (t ...

... The falling value of the euro during the first 6 months of its introduction caused great concern to Wim Duisenberg (the Governor of the ECB), Hans Tietmayer, and Ernest Welteke (respectively, the retiring and the incoming president of the Bundesbank or German Central Bank), Dominique Strauss-Khan (t ...

NBER WORKING PAPER SERIES EXCHANGE CONTROLS, CAPITAL CONTROLS, AND INTERNATIONAL FINANCIAL MARKETS

... Thanks go to Michael Dotsey, Marvin Goodfrjend, Bennett McCalluni, Torsten Persson, Lars E. 0. Svensson, and participants in workshops at the lIES, Stockholm, the Federal Reserve Bank of Richmond, and Princeton. Stockman gratefully acknowledges support from the National Science Foundation. The resea ...

... Thanks go to Michael Dotsey, Marvin Goodfrjend, Bennett McCalluni, Torsten Persson, Lars E. 0. Svensson, and participants in workshops at the lIES, Stockholm, the Federal Reserve Bank of Richmond, and Princeton. Stockman gratefully acknowledges support from the National Science Foundation. The resea ...

E

... Since lending rates were fully liberalized in 2013, the complete removal of the deposit rate ceiling is the only remaining key step of interest rate liberalization.9 This ceiling is clearly binding, as evidenced by the higher rate banks are paying on wealth management products. This final move will ...

... Since lending rates were fully liberalized in 2013, the complete removal of the deposit rate ceiling is the only remaining key step of interest rate liberalization.9 This ceiling is clearly binding, as evidenced by the higher rate banks are paying on wealth management products. This final move will ...

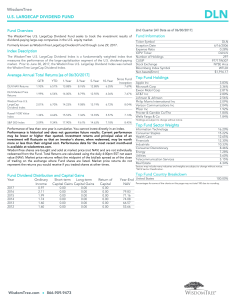

WisdomTree LargeCap Dividend Fund

... Performance of less than one year is cumulative. You cannot invest directly in an index. Performance is historical and does not guarantee future results. Current performance may be lower or higher than quoted. Investment returns and principal value of an investment will fluctuate so that an investor ...

... Performance of less than one year is cumulative. You cannot invest directly in an index. Performance is historical and does not guarantee future results. Current performance may be lower or higher than quoted. Investment returns and principal value of an investment will fluctuate so that an investor ...

Dollar & Cents Shopping Center

... Pakistan Malaysia India Hong Kong Australia Spain Netherlands Italy Greece Germany France Belgium Austria Euro area Canada Britian China Japan United States ...

... Pakistan Malaysia India Hong Kong Australia Spain Netherlands Italy Greece Germany France Belgium Austria Euro area Canada Britian China Japan United States ...

The Impact of High Lending Rates on Borrowers` Ability to pay Back

... Customers of banks and other financial institutions borrow for a number of reasons and their ability to pay back their loans can be attributed to a number of factors which include inflation and lending rates at which they borrowed the loans. Inflation can be described as the instability or frequent ...

... Customers of banks and other financial institutions borrow for a number of reasons and their ability to pay back their loans can be attributed to a number of factors which include inflation and lending rates at which they borrowed the loans. Inflation can be described as the instability or frequent ...

Investment Strategy for Pensions Actuaries A Multi Asset Class

... Securities that are not listed on a stock exchange and hence are generally illiquid and thought of as long term investments. Typical examples are management buy-outs and new start-up companies. ...

... Securities that are not listed on a stock exchange and hence are generally illiquid and thought of as long term investments. Typical examples are management buy-outs and new start-up companies. ...

Business Review Jan-June 2010

... It was ensured that Fiscal discipline would not be abandoned after the expiry of the IMF Agreement but enforced by the Parliament of the country. A legal framework in form of Fiscal Responsibility Law has been enacted with clear timeline for reducing the level of fiscal deficit and the extent of ind ...

... It was ensured that Fiscal discipline would not be abandoned after the expiry of the IMF Agreement but enforced by the Parliament of the country. A legal framework in form of Fiscal Responsibility Law has been enacted with clear timeline for reducing the level of fiscal deficit and the extent of ind ...

Do Equity Indices In Malaysia, The Philippines, Taiwan, Thailand And The Us Follow A Random Walk?

... should be matched with regulations to protect investors in order to increase market efficiency and economic growth. Lamba (2005, pp. 364-365) observes that Countries in the South and Southeast Asian region have experienced considerable political and social turmoil over the past few years. This empir ...

... should be matched with regulations to protect investors in order to increase market efficiency and economic growth. Lamba (2005, pp. 364-365) observes that Countries in the South and Southeast Asian region have experienced considerable political and social turmoil over the past few years. This empir ...

Accounting 3-4 Course Description

... BAPB01.01.02.00 Calculate and enter data for a given situation on appropriate forms or reports. BAPB05.02.02.01 Journalize transactions in appropriate journals. BAPB05.02.02.02 Post from journals to ledgers. Chapter 4 – Financial Reporting for a Departmentalized Business Chapter Objectives: Distin ...

... BAPB01.01.02.00 Calculate and enter data for a given situation on appropriate forms or reports. BAPB05.02.02.01 Journalize transactions in appropriate journals. BAPB05.02.02.02 Post from journals to ledgers. Chapter 4 – Financial Reporting for a Departmentalized Business Chapter Objectives: Distin ...

Nonagency MBS, CMBS, ABS

... Prepayment protection can take the form of prepayment penalties, provisions prohibiting prepayment for a specified period, and defeasance. Note: Defeasance is an agreement whereby the borrower agrees to invest funds in risk-free securities in an amount that would match the cash flows of a prepay ...

... Prepayment protection can take the form of prepayment penalties, provisions prohibiting prepayment for a specified period, and defeasance. Note: Defeasance is an agreement whereby the borrower agrees to invest funds in risk-free securities in an amount that would match the cash flows of a prepay ...

Bonds - Headwater Investment Consulting

... these different securities will react differently in response to changes in US interest rates and inflation. Our model portfolios also include a specific allocation that invests in products designed to protect against the threat of rising inflation. One of the most common ways to have inflation prot ...

... these different securities will react differently in response to changes in US interest rates and inflation. Our model portfolios also include a specific allocation that invests in products designed to protect against the threat of rising inflation. One of the most common ways to have inflation prot ...

Are markets anticipating a new world order?

... The increased uncertainty about how the US will interact economically and politically with the rest of the world under the new administration might indeed justify higher risk premia in markets – all other things being equal. But other political and economic developments are currently unfolding that ...

... The increased uncertainty about how the US will interact economically and politically with the rest of the world under the new administration might indeed justify higher risk premia in markets – all other things being equal. But other political and economic developments are currently unfolding that ...

Bank Liabilities Channel

... do not involve significant intermediation of funds in the current period but create the conditions for future payments as in the case of derivatives. In other cases, intermediaries simply facilitate the direct issuance of liabilities by non-financial sectors as in the case of public offering of corp ...

... do not involve significant intermediation of funds in the current period but create the conditions for future payments as in the case of derivatives. In other cases, intermediaries simply facilitate the direct issuance of liabilities by non-financial sectors as in the case of public offering of corp ...

instructions for preparing and publishing the annual

... Eliminate other financing sources, uses and expenditures associated with debt service. From an accrual perspective, debt issuance has no impact on net assets, but rather affects only accounts reported on the statement of position (debt payable, premiums, discounts, issuance costs, difference between ...

... Eliminate other financing sources, uses and expenditures associated with debt service. From an accrual perspective, debt issuance has no impact on net assets, but rather affects only accounts reported on the statement of position (debt payable, premiums, discounts, issuance costs, difference between ...

MA162: Finite mathematics - Financial Mathematics

... How much of Murray’s first payment is due to interest? The first payment is due at the end of the first month. He borrowed $11,000 and interest accrues at i = 0.005 per month. So his outstanding balance right before the first payment is $11, 000 · (1.005) = $11, 055. Therefore, $55 of his first paym ...

... How much of Murray’s first payment is due to interest? The first payment is due at the end of the first month. He borrowed $11,000 and interest accrues at i = 0.005 per month. So his outstanding balance right before the first payment is $11, 000 · (1.005) = $11, 055. Therefore, $55 of his first paym ...

Austrian Draft Budgetary Plan 2015

... A new calculation methodology for assessing public debt in EU Member States results in an increase of Austria’s sovereign debt. Wind-up companies and defeasance structures – such as KA Finanz AG – will be attributed to the state sector. Therefore all liabilities of the entirely state-owned KA Finan ...

... A new calculation methodology for assessing public debt in EU Member States results in an increase of Austria’s sovereign debt. Wind-up companies and defeasance structures – such as KA Finanz AG – will be attributed to the state sector. Therefore all liabilities of the entirely state-owned KA Finan ...

Contemporary Logistics The Research on Credit Risk of Manufacturing Listed Companies

... manufacturing listed companies, the predictive efficiency is pretty good. Principal component analysis can be an effective way to solve the problem of financial data’s multicollinearity. In the final model, principal component F1 and F2 have a significant impact on dependent variable. The two princi ...

... manufacturing listed companies, the predictive efficiency is pretty good. Principal component analysis can be an effective way to solve the problem of financial data’s multicollinearity. In the final model, principal component F1 and F2 have a significant impact on dependent variable. The two princi ...

Financialization

Financialization is a term sometimes used in discussions of the financial capitalism that has developed over the decades between 1980 and 2010, in which financial leverage tended to override capital (equity), and financial markets tended to dominate over the traditional industrial economy and agricultural economics.Financialization describes an economic system or process that attempts to reduce all value that is exchanged (whether tangible or intangible, future or present promises, etc.) into a financial instrument. The intent of financialization is to be able to reduce any work product or service to an exchangeable financial instrument, like currency, and thus make it easier for people to trade these financial instruments.Workers, through a financial instrument such as a mortgage, may trade their promise of future work or wages for a home. The financialization of risk sharing is what makes possible all insurance. The financialization of a government's promises (e.g., US government bonds) is what makes possible all government deficit spending. Financialization also makes economic rents possible.