How to view electricity

... ST- Generation resource optimization and helps transfer power from surplus to deficit region in a geographically seasonally diverse country like India Is short term market a procurement market or a balancing market? Utilities to decided their own expectation of the market prices and demand projectio ...

... ST- Generation resource optimization and helps transfer power from surplus to deficit region in a geographically seasonally diverse country like India Is short term market a procurement market or a balancing market? Utilities to decided their own expectation of the market prices and demand projectio ...

Budget Presentation for Fiscal Year 2009/2010

... another group, American Sugar Refinery (ASR), is about to consummate a deal to become the new majority owners of BSI. This comes hard on the heels of the most successful sugar crop in recent memory, with expected bonuses to cane farmers of around $30.0 million. Going forward, we are in the process o ...

... another group, American Sugar Refinery (ASR), is about to consummate a deal to become the new majority owners of BSI. This comes hard on the heels of the most successful sugar crop in recent memory, with expected bonuses to cane farmers of around $30.0 million. Going forward, we are in the process o ...

Moody`s Credit Opinion - (16 Dec 2015)

... ending in December 2019. Fiscal policy continues to be the cornerstone of the government agenda, guided by the principles set out in the Medium Term Fiscal Strategy (MTFS) that the administration established upon taking office in August 2013. In the current 2015/16 fiscal year, the administration i ...

... ending in December 2019. Fiscal policy continues to be the cornerstone of the government agenda, guided by the principles set out in the Medium Term Fiscal Strategy (MTFS) that the administration established upon taking office in August 2013. In the current 2015/16 fiscal year, the administration i ...

Desperate Remedies: Lessons from the Crisis (PDF, 1977 KB)

... double your equity in just a few years, provided you retain it. So there would have been an overflow of equity if they had kept it in the banks. The shareholder value principle meant that equity had to be taken out of the bank to secure it over time. This was the deeper reason for the crisis. There ...

... double your equity in just a few years, provided you retain it. So there would have been an overflow of equity if they had kept it in the banks. The shareholder value principle meant that equity had to be taken out of the bank to secure it over time. This was the deeper reason for the crisis. There ...

derivatives - Borsa İstanbul

... 1 - Long position in the underlying currency at the spot market for the price of X TRY (Buy at Spot) 2 - Floor: A long position in put option with (X-a) exercise price, maturity at t in the underlying (Buy a Put) 3 - Ceiling: A short position in call option with (X+b) exercise price and maturity at ...

... 1 - Long position in the underlying currency at the spot market for the price of X TRY (Buy at Spot) 2 - Floor: A long position in put option with (X-a) exercise price, maturity at t in the underlying (Buy a Put) 3 - Ceiling: A short position in call option with (X+b) exercise price and maturity at ...

Andre Schneider

... P&G also became a beacon of employee rights for the nation when it built its worker-friendly Ivory factory in 1886 and instituted one of the nation’s first profit-sharing programs to boost worker productivity and pride. In 1911, P&G expanded its product base to include the revolutionary Crisco short ...

... P&G also became a beacon of employee rights for the nation when it built its worker-friendly Ivory factory in 1886 and instituted one of the nation’s first profit-sharing programs to boost worker productivity and pride. In 1911, P&G expanded its product base to include the revolutionary Crisco short ...

PART I: A STANDARD ANALYSIS OF FACTOR MOBILITY

... increase in x, each firm will increase its employment of labor by εLx percent, where εLx is its elasticity of labor demand with respect to output, so that the sector’s demand for labor will increase by εLx percent. On the other hand, due to the decline in the number of firms in the industry, the ind ...

... increase in x, each firm will increase its employment of labor by εLx percent, where εLx is its elasticity of labor demand with respect to output, so that the sector’s demand for labor will increase by εLx percent. On the other hand, due to the decline in the number of firms in the industry, the ind ...

here [PDF 930KB]

... by The Economist magazine in 1986, compares the prices of McDonald’s Big Mac burgers around the world. The Big Mac index is partly a joke but can be suggestive and confirms our suspicions that the pound is undervalued – according to the Big Mac Index purchasing power parity works out at $1.70 and €1 ...

... by The Economist magazine in 1986, compares the prices of McDonald’s Big Mac burgers around the world. The Big Mac index is partly a joke but can be suggestive and confirms our suspicions that the pound is undervalued – according to the Big Mac Index purchasing power parity works out at $1.70 and €1 ...

ALGEBRA 2

... The value of a car can be modeled by y a(0.75)t where y is the value of the car, a is the initial cost of the car and t is the time (in years) since the car was manufactured. The initial cost of the car was $25,000. _______________a. Does the model represent exponential growth or exponential decay ...

... The value of a car can be modeled by y a(0.75)t where y is the value of the car, a is the initial cost of the car and t is the time (in years) since the car was manufactured. The initial cost of the car was $25,000. _______________a. Does the model represent exponential growth or exponential decay ...

UNIT 1:

... 12. A famous quarterback just signed a contract providing $3 million a year for 5 years. A less famous receiver signed a 5-year contract providing $4 million today and $2 million a year for 5 years. Who is better paid if interest rate is 10% compounded annually? ...

... 12. A famous quarterback just signed a contract providing $3 million a year for 5 years. A less famous receiver signed a 5-year contract providing $4 million today and $2 million a year for 5 years. Who is better paid if interest rate is 10% compounded annually? ...

Completing the Audit

... situations exist. No related entries have been made in the accounting records. 1.Marco Corporation has guaranteed the payment of interest on the 10-year, first mortgage bonds of Chen Corp., an affiliate. Outstanding bonds of Chen Corp. amount to $150,000 with interest payable at 8 percent per annum, ...

... situations exist. No related entries have been made in the accounting records. 1.Marco Corporation has guaranteed the payment of interest on the 10-year, first mortgage bonds of Chen Corp., an affiliate. Outstanding bonds of Chen Corp. amount to $150,000 with interest payable at 8 percent per annum, ...

Degree of Financial and Operating Leverage and

... operating cost of the company which has the propensity of decreasing the margin of the operating profit of the organisation in the long run. In effect if the variable cost component is predominant among the operating cost of the organisation then there is also the likelihood that the operating lever ...

... operating cost of the company which has the propensity of decreasing the margin of the operating profit of the organisation in the long run. In effect if the variable cost component is predominant among the operating cost of the organisation then there is also the likelihood that the operating lever ...

Financial Capability in the United States

... While the 2009 NFCS interviews were being conducted in June through October 2009, the seasonally adjusted national unemployment rate rose from 9.5% to 10.0%, which were levels that had not been experienced in the U.S. in over 25 years. From July through October 2012, when the most recent NFCS was in ...

... While the 2009 NFCS interviews were being conducted in June through October 2009, the seasonally adjusted national unemployment rate rose from 9.5% to 10.0%, which were levels that had not been experienced in the U.S. in over 25 years. From July through October 2012, when the most recent NFCS was in ...

Chapter 6

... – Also measured by proprietorship ratio, which is the ratio of shareholders’ funds to total assets Indicates firm’s longer-term financial viability/stability. A higher ratio indicates less reliance on external funding ...

... – Also measured by proprietorship ratio, which is the ratio of shareholders’ funds to total assets Indicates firm’s longer-term financial viability/stability. A higher ratio indicates less reliance on external funding ...

the Treasury Management Strategy Statement 2017/18

... incurring losses from defaults and the risk of receiving unsuitably low investment income. Where balances are expected to be invested for more than one year, the Council will aim to achieve a total return that is equal or higher than the prevailing rate of inflation, in order to maintain the spendin ...

... incurring losses from defaults and the risk of receiving unsuitably low investment income. Where balances are expected to be invested for more than one year, the Council will aim to achieve a total return that is equal or higher than the prevailing rate of inflation, in order to maintain the spendin ...

Investment Strategy â Second Quarter 2015 - Morgans

... began its program of Quantitative Easing during the quarter. This meant that the ECB began purchasing Euro denominated public sector securities in the secondary market. They also continued purchasing asset backed securities and covered bank bonds. The combined monthly purchases of public and private ...

... began its program of Quantitative Easing during the quarter. This meant that the ECB began purchasing Euro denominated public sector securities in the secondary market. They also continued purchasing asset backed securities and covered bank bonds. The combined monthly purchases of public and private ...

Monthly Economic and Financial Developments November 2004

... prospects for policy adjustments in the short-term, given export weakness and higher oil prices that have slowed growth during the second half of 2004. For Japan, the Central Bank’s stance remains accommodative of financial market liquidity needs, with the economy’s performance expected to firm duri ...

... prospects for policy adjustments in the short-term, given export weakness and higher oil prices that have slowed growth during the second half of 2004. For Japan, the Central Bank’s stance remains accommodative of financial market liquidity needs, with the economy’s performance expected to firm duri ...

jyske bank group credit profile - Information for investors and

... The merger with the Danish mortgage institution BRFkredit on 30 April 2014, firmly established the Jyske Bank Group as the fourth largest financial service group in Denmark with total assets of DKK 542bn, a total of 4,191 employees, 890,000 customers and a market share of 8 % of aggregate Danish mor ...

... The merger with the Danish mortgage institution BRFkredit on 30 April 2014, firmly established the Jyske Bank Group as the fourth largest financial service group in Denmark with total assets of DKK 542bn, a total of 4,191 employees, 890,000 customers and a market share of 8 % of aggregate Danish mor ...

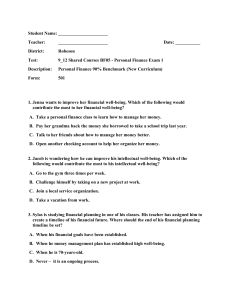

PF Pretest

... 1. Jenna wants to improve her financial well-being. Which of the following would contribute the most to her financial well-being? A. Take a personal finance class to learn how to manage her money. B. Pay her grandma back the money she borrowed to take a school trip last year. C. Talk to her friends ...

... 1. Jenna wants to improve her financial well-being. Which of the following would contribute the most to her financial well-being? A. Take a personal finance class to learn how to manage her money. B. Pay her grandma back the money she borrowed to take a school trip last year. C. Talk to her friends ...

Advising the Behavioral Investor

... wake of the credit meltdown; economic growth is stagnant; unemployment is rampant, and equity market volatility remains high. According to the National Bureau of Economic Research (NBER), the US recession that officially ended in June 2009 was the longest since the Great Depression. Coming out of it ...

... wake of the credit meltdown; economic growth is stagnant; unemployment is rampant, and equity market volatility remains high. According to the National Bureau of Economic Research (NBER), the US recession that officially ended in June 2009 was the longest since the Great Depression. Coming out of it ...

Financialization

Financialization is a term sometimes used in discussions of the financial capitalism that has developed over the decades between 1980 and 2010, in which financial leverage tended to override capital (equity), and financial markets tended to dominate over the traditional industrial economy and agricultural economics.Financialization describes an economic system or process that attempts to reduce all value that is exchanged (whether tangible or intangible, future or present promises, etc.) into a financial instrument. The intent of financialization is to be able to reduce any work product or service to an exchangeable financial instrument, like currency, and thus make it easier for people to trade these financial instruments.Workers, through a financial instrument such as a mortgage, may trade their promise of future work or wages for a home. The financialization of risk sharing is what makes possible all insurance. The financialization of a government's promises (e.g., US government bonds) is what makes possible all government deficit spending. Financialization also makes economic rents possible.

![here [PDF 930KB]](http://s1.studyres.com/store/data/015583737_1-d7b211cd32cfe2b3ea9542c07b5cf992-300x300.png)