Slide 1

... Real Estate and the U.S. Economy Real Estate and U.S. Society Local and Regional Markets Characteristics of U.S. Homes Commercial Real Estate ...

... Real Estate and the U.S. Economy Real Estate and U.S. Society Local and Regional Markets Characteristics of U.S. Homes Commercial Real Estate ...

P 0 - Faculty Pages

... company < required return k. In this case, the company would choose to pay 100% of the earning as dividends and let the stockholders invest in the market by themselves Has investment opportunities: if the company has investment opportunity, expected return of projects is higher than required return ...

... company < required return k. In this case, the company would choose to pay 100% of the earning as dividends and let the stockholders invest in the market by themselves Has investment opportunities: if the company has investment opportunity, expected return of projects is higher than required return ...

Questioni di Economia e Finanza

... assistance inevitable’ (Honohan, 2013). Di Cesare et al. (2012) present evidence that, for several countries, risk premiums reached levels well above what could be justified on the basis of fundamentals. Among the possible reasons for this, they focus on the perceived risk of a break‐up of the EA. S ...

... assistance inevitable’ (Honohan, 2013). Di Cesare et al. (2012) present evidence that, for several countries, risk premiums reached levels well above what could be justified on the basis of fundamentals. Among the possible reasons for this, they focus on the perceived risk of a break‐up of the EA. S ...

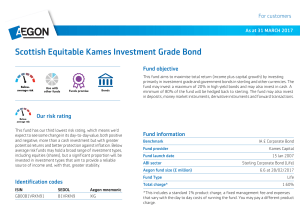

Scottish Equitable Kames Investment Grade Bond

... for example, technology. This increases the risk to you if this is your only investment. That's why it's best used in combination with other funds or types of investment so you're not entirely reliant on the success of one region or type of company. Some funds in this category may be more suitable f ...

... for example, technology. This increases the risk to you if this is your only investment. That's why it's best used in combination with other funds or types of investment so you're not entirely reliant on the success of one region or type of company. Some funds in this category may be more suitable f ...

Audit 2014 - Xavier Society for the Blind

... The Society is a not-for-profit organization, as defined in Section 501(c)(3), and is exempt from Federal income taxes under Section 501(a) of the Internal Revenue Code. The Society has been classified as an organization that is not a private foundation under Section 509(a) and qualifies for the 50% ...

... The Society is a not-for-profit organization, as defined in Section 501(c)(3), and is exempt from Federal income taxes under Section 501(a) of the Internal Revenue Code. The Society has been classified as an organization that is not a private foundation under Section 509(a) and qualifies for the 50% ...

6% Marginal Cost of Capital

... sunk cost (e.g., asset specificity in manufacturing) • Input suppliers and buyers also have market power and once they enter into a contract they may engage in opportunistic behaviour • They may get away with it when the transaction cost of switching to an alternative source of supply or demand is h ...

... sunk cost (e.g., asset specificity in manufacturing) • Input suppliers and buyers also have market power and once they enter into a contract they may engage in opportunistic behaviour • They may get away with it when the transaction cost of switching to an alternative source of supply or demand is h ...

GDB Position paper to BCBS365_9.docx

... Consequently, we disagree to option A, which in the case of a purchase, would add the purchase price or market value of the purchased securities with a Credit Conversion Factor (CCF) of 100% to the total exposure value (Off balance sheet item) while the cash remains in the exposure value (double cou ...

... Consequently, we disagree to option A, which in the case of a purchase, would add the purchase price or market value of the purchased securities with a Credit Conversion Factor (CCF) of 100% to the total exposure value (Off balance sheet item) while the cash remains in the exposure value (double cou ...

Pricing models of covered bonds—a Nordic study

... The two approaches are regarded as somewhat competing models by academics and practitioners, but they approach the default mechanism from different viewpoints. Structural models assume that the default is triggered when the assets of the company are less than the liabilities of the company, whereas ...

... The two approaches are regarded as somewhat competing models by academics and practitioners, but they approach the default mechanism from different viewpoints. Structural models assume that the default is triggered when the assets of the company are less than the liabilities of the company, whereas ...

national bank of the republic of macedonia interset rate policy in the

... Interest rate is the price for using the credit (financial) assets in certain period and it is formed on the financial market. Generally speaking, the benefits from the financial resources are higher in the present moment in relation to the future, and there is a need a certain price to be paid for ...

... Interest rate is the price for using the credit (financial) assets in certain period and it is formed on the financial market. Generally speaking, the benefits from the financial resources are higher in the present moment in relation to the future, and there is a need a certain price to be paid for ...

British Airways Plc Year ended 31 December 2015

... BA has set a solid foundation for the future, generating a £1,264 million pre-exceptional operating profit in 2015 (2014: £975 million). Going forward, BA will target a return on capital of at least 15 per cent with an operating margin in the range of 12-15 per-cent. Improving the customer experienc ...

... BA has set a solid foundation for the future, generating a £1,264 million pre-exceptional operating profit in 2015 (2014: £975 million). Going forward, BA will target a return on capital of at least 15 per cent with an operating margin in the range of 12-15 per-cent. Improving the customer experienc ...

Japan: 2008 Article IV Consultation—Staff Report; Staff Statement; and Public

... trade. Headline CPI inflation has edged up, reflecting higher commodity prices, but wages remain sluggish, and inflation risks so far appear contained. Risks to the growth outlook have become more balanced in recent months, although considerable uncertainty remains, particularly regarding global com ...

... trade. Headline CPI inflation has edged up, reflecting higher commodity prices, but wages remain sluggish, and inflation risks so far appear contained. Risks to the growth outlook have become more balanced in recent months, although considerable uncertainty remains, particularly regarding global com ...

Consolidated Financial Statements

... Intangible assets include trademarks, customer relationships and software that is not an integral part of the related hardware. Intangible assets are initially recorded at their transaction fair values. Indefinite life intangibles are subsequently carried at cost less any impairment losses. Definite ...

... Intangible assets include trademarks, customer relationships and software that is not an integral part of the related hardware. Intangible assets are initially recorded at their transaction fair values. Indefinite life intangibles are subsequently carried at cost less any impairment losses. Definite ...

Assets

... is Key to Addressing Systemic Risk • If all (or most) individual institutions are safer, the system is less likely to experience runs, contagion, multiple failures. • Note: Shadow banking institutions cannot be ignored, all risk must be considered. • Easiest remedy: more equity funding, less leverag ...

... is Key to Addressing Systemic Risk • If all (or most) individual institutions are safer, the system is less likely to experience runs, contagion, multiple failures. • Note: Shadow banking institutions cannot be ignored, all risk must be considered. • Easiest remedy: more equity funding, less leverag ...

Laddered Bond Portfolio Corporate Fixed Income

... When investing in bonds, it is important to note that as interest rates rise, bond prices will fall. Other risks include the risk of principal loss should the issuer default on either principal or interest payments. This portfolio invests in bonds which are obligations of corporations, and not the U ...

... When investing in bonds, it is important to note that as interest rates rise, bond prices will fall. Other risks include the risk of principal loss should the issuer default on either principal or interest payments. This portfolio invests in bonds which are obligations of corporations, and not the U ...

Financialization

Financialization is a term sometimes used in discussions of the financial capitalism that has developed over the decades between 1980 and 2010, in which financial leverage tended to override capital (equity), and financial markets tended to dominate over the traditional industrial economy and agricultural economics.Financialization describes an economic system or process that attempts to reduce all value that is exchanged (whether tangible or intangible, future or present promises, etc.) into a financial instrument. The intent of financialization is to be able to reduce any work product or service to an exchangeable financial instrument, like currency, and thus make it easier for people to trade these financial instruments.Workers, through a financial instrument such as a mortgage, may trade their promise of future work or wages for a home. The financialization of risk sharing is what makes possible all insurance. The financialization of a government's promises (e.g., US government bonds) is what makes possible all government deficit spending. Financialization also makes economic rents possible.