Risk Management and Value Creation in Financial Institutions

... risk management is necessary, and many banks argue that superior risk management can create (shareholder) value. However, from a theoretical point of view, it is not immediately clear if and how risk management at the corporate level can be useful. Very little research has been conducted as to why t ...

... risk management is necessary, and many banks argue that superior risk management can create (shareholder) value. However, from a theoretical point of view, it is not immediately clear if and how risk management at the corporate level can be useful. Very little research has been conducted as to why t ...

Saudi Capital Market Overview

... Real Estate Investment Traded Funds, or REITs, are financial instruments that allow all types of investors to obtain investment exposure to the Real Estate Market. This is achieved through collective ownership of constructed developed real estate qualified to generate periodic and rental income. REI ...

... Real Estate Investment Traded Funds, or REITs, are financial instruments that allow all types of investors to obtain investment exposure to the Real Estate Market. This is achieved through collective ownership of constructed developed real estate qualified to generate periodic and rental income. REI ...

DOC - Investis

... comprised of 25 A Shares, 22 B Shares, 35 D Shares and 35 L Shares; and in the United States in the form of Global Depositary Shares, or GDSs, each GDS representing 5 CPOs. The number of CPOs and shares issued and outstanding for financial reporting purposes under Mexican FRS and U.S. GAAP is diffe ...

... comprised of 25 A Shares, 22 B Shares, 35 D Shares and 35 L Shares; and in the United States in the form of Global Depositary Shares, or GDSs, each GDS representing 5 CPOs. The number of CPOs and shares issued and outstanding for financial reporting purposes under Mexican FRS and U.S. GAAP is diffe ...

increasing the sustain ability of european pension systems

... access to funding under reasonable conditions. Second, they should produce benefits for all participating states, both weak and strong. Third, they should not introduce moral hazard but rather increase budgetary discipline where possible. Fourth, they would preferably be selffunding, so that any pro ...

... access to funding under reasonable conditions. Second, they should produce benefits for all participating states, both weak and strong. Third, they should not introduce moral hazard but rather increase budgetary discipline where possible. Fourth, they would preferably be selffunding, so that any pro ...

Determinants of Capital Structure: Evidence from a Major

... determinants, a first in the capital structure literature on developing economies. Our findings indicate that each of the four broad types of leverage determinants does indeed play an economically important role in shaping the capital structure decisions of Turkish non-financial firms during our sam ...

... determinants, a first in the capital structure literature on developing economies. Our findings indicate that each of the four broad types of leverage determinants does indeed play an economically important role in shaping the capital structure decisions of Turkish non-financial firms during our sam ...

Debunking myths about ETF liquidity

... a fund on a stock exchange was not new or innovative; closed-end funds had been doing that for decades before the first ETFs. What was new about ETFs was that they addressed a particular challenge of closed-end funds, which often trade at significant discounts or premiums to NAV because the supply o ...

... a fund on a stock exchange was not new or innovative; closed-end funds had been doing that for decades before the first ETFs. What was new about ETFs was that they addressed a particular challenge of closed-end funds, which often trade at significant discounts or premiums to NAV because the supply o ...

Risk Management Terms - Society of Actuaries

... measurement used by the organization. We also encouraged respondents to answer questions based on their personal understanding of the terms rather than to identify an organization-wide definition. Respondents could also supply definitions for only a subset of risk terms. We were interested in their ...

... measurement used by the organization. We also encouraged respondents to answer questions based on their personal understanding of the terms rather than to identify an organization-wide definition. Respondents could also supply definitions for only a subset of risk terms. We were interested in their ...

Public Private Partnership in South East Asia

... economies with rapid rates of economic and population growth. Lack of infrastructure has been a major concern of many Southeast Asian leaders, triggered by the wide gap between demand and supply. Apart from lacking an adequate supply of infrastructure to support economic growth and rapid urbanisatio ...

... economies with rapid rates of economic and population growth. Lack of infrastructure has been a major concern of many Southeast Asian leaders, triggered by the wide gap between demand and supply. Apart from lacking an adequate supply of infrastructure to support economic growth and rapid urbanisatio ...

Brand equity, Age and the number of employees are in all models

... (Pauwels, 2004) (Srinivasan & Hanssens, 2009). ‘Companies that make steady gains in mind and heart will inevitably make gains in market share and profitability’ (Kotler 2003, pp. 38– 39). Lehman’s paper (2004) states that if marketing wants to play an important role in business decision making, you ...

... (Pauwels, 2004) (Srinivasan & Hanssens, 2009). ‘Companies that make steady gains in mind and heart will inevitably make gains in market share and profitability’ (Kotler 2003, pp. 38– 39). Lehman’s paper (2004) states that if marketing wants to play an important role in business decision making, you ...

Wage Indexation, Supply Shocks, and Monetary Policy in a Small

... the money supply to lower inflation. The key question has been whether, in the absence of an active monetary response, labor markets can adjust without costly deviations from full employment (see, for example, Gordon 1975; 1984; Phelps 1978; Blinder 1981; Rasche and Tatom 1981; and Fischer 1985). Ou ...

... the money supply to lower inflation. The key question has been whether, in the absence of an active monetary response, labor markets can adjust without costly deviations from full employment (see, for example, Gordon 1975; 1984; Phelps 1978; Blinder 1981; Rasche and Tatom 1981; and Fischer 1985). Ou ...

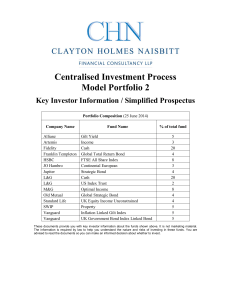

Key Investor Information - Clayton Holmes Naisbitt

... Movements in currency exchange rates can adversely affect the return of your investment. The currency hedging may be used to minimise the effect of this but may not always be successful. The use of financial derivative instruments may result in increased gains or losses within the fund. There is a r ...

... Movements in currency exchange rates can adversely affect the return of your investment. The currency hedging may be used to minimise the effect of this but may not always be successful. The use of financial derivative instruments may result in increased gains or losses within the fund. There is a r ...

Chemtura CORP (Form: 10-Q, Received: 10/28/2014 16:35:23)

... investment in a foreign entity or no longer holds a controlling financial interest in a subsidiary or group of assets that is a nonprofit activity or a business within a foreign entity. The amendments are effective prospectively for fiscal years (and interim reporting periods within those years) beg ...

... investment in a foreign entity or no longer holds a controlling financial interest in a subsidiary or group of assets that is a nonprofit activity or a business within a foreign entity. The amendments are effective prospectively for fiscal years (and interim reporting periods within those years) beg ...

Chapter-012-2 - Testbank Byte

... 75. You would want your financial planner to provide you with an investment policy statement that details your investment philosophy, your financial situation, and the risks you are willing to take, as well as what the advisor will do for you. ANS: T ...

... 75. You would want your financial planner to provide you with an investment policy statement that details your investment philosophy, your financial situation, and the risks you are willing to take, as well as what the advisor will do for you. ANS: T ...

Investor Presentation Renaissance Capital Conference June 24

... Reported revenues were flat YoY, mainly due to depreciation of local currencies against the USD EBITDA increased 3% YoY organically; reported EBITDA increased by 2% YoY supported by operational excellence initiatives (excl. MTR cuts in Italy it would have been 5% YoY) EBIT up 9% YoY reflecting the b ...

... Reported revenues were flat YoY, mainly due to depreciation of local currencies against the USD EBITDA increased 3% YoY organically; reported EBITDA increased by 2% YoY supported by operational excellence initiatives (excl. MTR cuts in Italy it would have been 5% YoY) EBIT up 9% YoY reflecting the b ...

image thumbnail

... themselves represents economic value, quantifiable by proxy with the local cost of providing these services in areas where they are available; • crop-livestock integration above the level of the farm (large-scale/regional integration), made possible by pastoral livestock mobility, increases resilie ...

... themselves represents economic value, quantifiable by proxy with the local cost of providing these services in areas where they are available; • crop-livestock integration above the level of the farm (large-scale/regional integration), made possible by pastoral livestock mobility, increases resilie ...

IFRS Adoption Compliance Issues - Center for IT and e

... IFRS Adoption Compliance Issues and infrastructure. Therefore, companies need to determine what changes, if any, are needed during the planning phase to aid in a smoother implementation. Upstream systems include the financial sub-ledgers, financial instrument valuation systems, and interfaces that ...

... IFRS Adoption Compliance Issues and infrastructure. Therefore, companies need to determine what changes, if any, are needed during the planning phase to aid in a smoother implementation. Upstream systems include the financial sub-ledgers, financial instrument valuation systems, and interfaces that ...

Download attachment

... Ibn Abbas is reported to have said: the Prophet peace be upon him has came to Medina and found that people were selling dates for deferred delivery after a duration of one or two years on a Salam basis. The Prophet peace be upon him said: whoever pays for dates on a deferred delivery basis (salam) s ...

... Ibn Abbas is reported to have said: the Prophet peace be upon him has came to Medina and found that people were selling dates for deferred delivery after a duration of one or two years on a Salam basis. The Prophet peace be upon him said: whoever pays for dates on a deferred delivery basis (salam) s ...

Financial Value of Brands in Mergers and Acquisitions: Is Value in

... was attributed to brands with the purchase of Gillette, and at other end, less than 1.51% was attributed to the brand value in the acquisition of Latitude by Cisco Systems. What is the source of heterogeneity in the target firms’ brand value across M&As? The extant marketing literature suggests that ...

... was attributed to brands with the purchase of Gillette, and at other end, less than 1.51% was attributed to the brand value in the acquisition of Latitude by Cisco Systems. What is the source of heterogeneity in the target firms’ brand value across M&As? The extant marketing literature suggests that ...

Form: 10-K, Received: 03/06/2014 12:43:05

... The Company We are one of the largest manufacturers and suppliers of commercial vehicle components in North America. Our products include commercial vehicle wheels, wheel-end components and assemblies, and ductile and gray iron castings. We market our products under some of the most recognized brand ...

... The Company We are one of the largest manufacturers and suppliers of commercial vehicle components in North America. Our products include commercial vehicle wheels, wheel-end components and assemblies, and ductile and gray iron castings. We market our products under some of the most recognized brand ...

Financialization

Financialization is a term sometimes used in discussions of the financial capitalism that has developed over the decades between 1980 and 2010, in which financial leverage tended to override capital (equity), and financial markets tended to dominate over the traditional industrial economy and agricultural economics.Financialization describes an economic system or process that attempts to reduce all value that is exchanged (whether tangible or intangible, future or present promises, etc.) into a financial instrument. The intent of financialization is to be able to reduce any work product or service to an exchangeable financial instrument, like currency, and thus make it easier for people to trade these financial instruments.Workers, through a financial instrument such as a mortgage, may trade their promise of future work or wages for a home. The financialization of risk sharing is what makes possible all insurance. The financialization of a government's promises (e.g., US government bonds) is what makes possible all government deficit spending. Financialization also makes economic rents possible.