(Should) Keeps Utility Execs Awake at Night? Sandy Williams, Foley

... ©2012 Foley & Lardner LLP • Attorney Advertising • Prior results do not guarantee a similar outcome • Models used are not clients but may be representative of clients • 321 N. Clark Street, Suite 2800, Chicago, IL 60654 • 312.832.4500 ...

... ©2012 Foley & Lardner LLP • Attorney Advertising • Prior results do not guarantee a similar outcome • Models used are not clients but may be representative of clients • 321 N. Clark Street, Suite 2800, Chicago, IL 60654 • 312.832.4500 ...

Managerial Economics - e

... Leverage is a business term that refers to borrowing. If a business is "leveraged," it means that the business has borrowed money to finance the purchase of assets. The other way to purchase assets is through use of owner funds, or equity. One way to determine leverage is to calculate the Debt-toEqu ...

... Leverage is a business term that refers to borrowing. If a business is "leveraged," it means that the business has borrowed money to finance the purchase of assets. The other way to purchase assets is through use of owner funds, or equity. One way to determine leverage is to calculate the Debt-toEqu ...

Document

... (1995) adopt a new approach to valuing risky debt by extending Merton’s (1973) and Black and Cox’s (1976) models in two ways. Firstly, their model incorporates both default risk and interest rate risk. Secondly, they derive the model in such a way that allows for deviations from strict absolute prio ...

... (1995) adopt a new approach to valuing risky debt by extending Merton’s (1973) and Black and Cox’s (1976) models in two ways. Firstly, their model incorporates both default risk and interest rate risk. Secondly, they derive the model in such a way that allows for deviations from strict absolute prio ...

global economy report - 2015

... hosting the World Expo in 2020, which is a six-month long exhibition of trade, innovation and products from around the world. The expo will be held on a proposed giant 438-hectare site on the edge of Dubai and is expected to generate a financial return of around AED139bn. In order to meet these obje ...

... hosting the World Expo in 2020, which is a six-month long exhibition of trade, innovation and products from around the world. The expo will be held on a proposed giant 438-hectare site on the edge of Dubai and is expected to generate a financial return of around AED139bn. In order to meet these obje ...

Slide 1 - JRDeLisle

... Determining market value Determining when distressed prices are the market Confirming details of all transactions Staying on top of market and explaining it Dealing with diverse leases and transactions ...

... Determining market value Determining when distressed prices are the market Confirming details of all transactions Staying on top of market and explaining it Dealing with diverse leases and transactions ...

Analysis of the RMB`s Chance to be Included in the SDR The

... either. Since the data series refer to offshore deposits, based on China’s own releases, offshore RMB deposits at the end of 2014 amounted to RMB2.8 trillion, with RMB1.2 trillion found in Hong Kong’s banking system (including CDs). Using the prevailing exchange rate of 1 US dollar for RMB6.20, it e ...

... either. Since the data series refer to offshore deposits, based on China’s own releases, offshore RMB deposits at the end of 2014 amounted to RMB2.8 trillion, with RMB1.2 trillion found in Hong Kong’s banking system (including CDs). Using the prevailing exchange rate of 1 US dollar for RMB6.20, it e ...

Bank Capital: Lessons from the Financial Crisis

... capital ratios fared in predicting U.S. bank failures in the early 1990s, and finds that a leverage ratio performs just as well as a risk-adjusted measure of capital. Berger and Bouwman (2009) explore the relationship between bank capital and different aspects of banks performance in crises and tran ...

... capital ratios fared in predicting U.S. bank failures in the early 1990s, and finds that a leverage ratio performs just as well as a risk-adjusted measure of capital. Berger and Bouwman (2009) explore the relationship between bank capital and different aspects of banks performance in crises and tran ...

Policy Rate, Mortgage Rate and Housing Prices

... housing represented 74% of gross household assets in 2011. Rising house prices ...

... housing represented 74% of gross household assets in 2011. Rising house prices ...

answer key - Iowa State University Department of Economics

... A) the bonds' relative default risks. B) the bonds' relative liquidity. C) the bond's relative tax treatment. D) all of the above. E) only (a) and (b) of the above. Answer: D 20) Factors that influence interest rates on bonds include A) risk. B) liquidity. C) tax considerations. D) term to maturity. ...

... A) the bonds' relative default risks. B) the bonds' relative liquidity. C) the bond's relative tax treatment. D) all of the above. E) only (a) and (b) of the above. Answer: D 20) Factors that influence interest rates on bonds include A) risk. B) liquidity. C) tax considerations. D) term to maturity. ...

International Capital Flows and House Prices: Theory and Evidence*

... home values and capital ‡ows during the boom based on asset bubbles. Assuming a bubble in the housing market, they argue that the rise in housing wealth generated by the bubble led to higher consumption, which in turn led to greater borrowing from abroad and a substantial net capital in‡ow to the U ...

... home values and capital ‡ows during the boom based on asset bubbles. Assuming a bubble in the housing market, they argue that the rise in housing wealth generated by the bubble led to higher consumption, which in turn led to greater borrowing from abroad and a substantial net capital in‡ow to the U ...

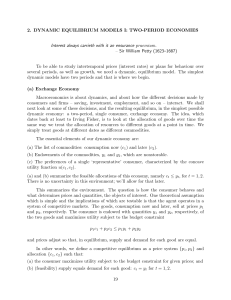

2. DYNAMIC EQUILIBRIUM MODELS I: TWO

... Thus, the allocation {c1 = y1 , c2 = y2 } and prices {p1 = 1, p2 = β(y1 /y2 )} constitute a competitive equilibrium for this economy. Now one of the things we know about competitive equilibria in such economies (in fact, for a large class of economies) is the fundamental theorems of welfare economi ...

... Thus, the allocation {c1 = y1 , c2 = y2 } and prices {p1 = 1, p2 = β(y1 /y2 )} constitute a competitive equilibrium for this economy. Now one of the things we know about competitive equilibria in such economies (in fact, for a large class of economies) is the fundamental theorems of welfare economi ...

ch11 LG Student

... safety, emissions and fuel economy, financial services, intellectual property rights, product warranties and environmental matters. Certain of the pending legal actions are, or purport to be, class actions. Some of the foregoing matters involve compensatory, punitive or antitrust or damage claims in ...

... safety, emissions and fuel economy, financial services, intellectual property rights, product warranties and environmental matters. Certain of the pending legal actions are, or purport to be, class actions. Some of the foregoing matters involve compensatory, punitive or antitrust or damage claims in ...

Chapter 9

... Each firm has an optimal capital structure, defined as that mix of debt, preferred, and common equity that causes its stock price to be maximized. A value-maximizing firm will determine its optimal capital structure, use it as a target, and then raise new capital in a manner designed to keep the act ...

... Each firm has an optimal capital structure, defined as that mix of debt, preferred, and common equity that causes its stock price to be maximized. A value-maximizing firm will determine its optimal capital structure, use it as a target, and then raise new capital in a manner designed to keep the act ...

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

... earnings by $0.02 per share. Highlights during the third quarter included the grand opening of the Arison Maritime Center in Almere, Netherlands, named for Carnival Corporation & plc Chairman Micky Arison and his father, the late Ted Arison, who founded the company. The 110,000-square-foot purpose b ...

... earnings by $0.02 per share. Highlights during the third quarter included the grand opening of the Arison Maritime Center in Almere, Netherlands, named for Carnival Corporation & plc Chairman Micky Arison and his father, the late Ted Arison, who founded the company. The 110,000-square-foot purpose b ...

the benefits of sell-side research

... became more valuable and in greater demand when company financials provided weaker signals about future cash flows (an example of ‘bad times’) 32. Overall, during difficult market conditions, it became almost impossible for uninformed traders to assess the prospects of stock, and even informed trade ...

... became more valuable and in greater demand when company financials provided weaker signals about future cash flows (an example of ‘bad times’) 32. Overall, during difficult market conditions, it became almost impossible for uninformed traders to assess the prospects of stock, and even informed trade ...

united states securities and exchange commission - corporate

... many manufacturing problems, especially those related to large components for products such as automobiles, aircraft, heavy duty construction equipment, and factory retrofits, and 4) the growing demand to capture large volumes of three-dimensional data for modeling and analysis. CAD changes the manu ...

... many manufacturing problems, especially those related to large components for products such as automobiles, aircraft, heavy duty construction equipment, and factory retrofits, and 4) the growing demand to capture large volumes of three-dimensional data for modeling and analysis. CAD changes the manu ...

What is a bond?

... Provision to pay off a loan over its life rather than all at maturity (Rather than the issuer repaying the entire principal of a bond on the maturity date, issuer pays it off over bonds maturity period). Generally corporations make semiannual or annual payments that are used to retire the bonds. ...

... Provision to pay off a loan over its life rather than all at maturity (Rather than the issuer repaying the entire principal of a bond on the maturity date, issuer pays it off over bonds maturity period). Generally corporations make semiannual or annual payments that are used to retire the bonds. ...

Utility Cost of Capital

... ) utilities with shares that trade on a Canadian exchange – There are however a reasonable number of pure-play regulated utilities that issue debt • U.S. utilities may enjoy attractive ROEs but it may not be the case that those returns are available to new investors if they trade at say twice book v ...

... ) utilities with shares that trade on a Canadian exchange – There are however a reasonable number of pure-play regulated utilities that issue debt • U.S. utilities may enjoy attractive ROEs but it may not be the case that those returns are available to new investors if they trade at say twice book v ...

Financialization

Financialization is a term sometimes used in discussions of the financial capitalism that has developed over the decades between 1980 and 2010, in which financial leverage tended to override capital (equity), and financial markets tended to dominate over the traditional industrial economy and agricultural economics.Financialization describes an economic system or process that attempts to reduce all value that is exchanged (whether tangible or intangible, future or present promises, etc.) into a financial instrument. The intent of financialization is to be able to reduce any work product or service to an exchangeable financial instrument, like currency, and thus make it easier for people to trade these financial instruments.Workers, through a financial instrument such as a mortgage, may trade their promise of future work or wages for a home. The financialization of risk sharing is what makes possible all insurance. The financialization of a government's promises (e.g., US government bonds) is what makes possible all government deficit spending. Financialization also makes economic rents possible.