* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download ch11 LG Student

Survey

Document related concepts

Transcript

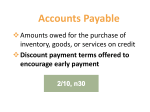

ACCT 201 FINANCIAL REPORTING Chapter 11 Dr. Lale Guler Office: CAS 102 E-Mail: [email protected] 11-1 Chapter 11 Current Liabilities and Contingencies Plan for the Hour 11-2 Current liabilities Notes payable Unearned revenues Current maturities of long term debt Contingent liabilities Recording Disclosure Accounting for Current Liabilities Current liability is debt with two key features: 1. Company expects to pay the debt from existing current assets or through the creation of other current liabilities. 2. Company will pay the debt within one year. Current liabilities include notes payable, accounts payable, unearned revenues, and accrued liabilities such as taxes payable, salaries payable, and interest payable. 11-3 Accounting for Current Liabilities Question To be classified as a current liability, a debt must be expected to be paid: a. out of existing current assets. b. by creating other current liabilities. c. within 2 years. d. both (a) and (b). 11-4 Accounting for Current Liabilities Notes Payable 11-5 Written promissory note. Requires the borrower to pay interest. Issued for varying periods. Accounting for Current Liabilities Illustration: First National Bank agrees to lend $100,000 on September 1, 2012, if Cole Williams Co. signs a $100,000, 12%, four-month note maturing on January 1. Instructions a) Prepare the entry on September 1st. b) Prepare the adjusting entry on Dec. 31st, assuming monthly adjusting entries have not been made. c) Prepare the entry at maturity (Jan. 1, 2013). 11-6 Accounting for Current Liabilities Illustration: First National Bank agrees to lend $100,000 on September 1, 2012, if Cole Williams Co. signs a $100,000, 12%, four-month note maturing on January 1. a) Prepare the entry on Sept. 1st. b) Prepare the adjusting entry on Dec. 31st. 11-7 Accounting for Current Liabilities Illustration: First National Bank agrees to lend $100,000 on September 1, 2012, if Cole Williams Co. signs a $100,000, 12%, four-month note maturing on January 1. c) Prepare the entry at maturity. 11-8 Accounting for Current Liabilities Unearned Revenue Cash received before the company delivers goods or provides services. Illustration 11-2 11-9 Accounting for Current Liabilities Illustration: Superior University sells 10,000 season football tickets at $50 each for its five-game home schedule. The university makes the following entry for the sale of season tickets: Aug. 6 As the school completes each of the five home games, it would record the revenue earned. Sept. 7 11-10 Accounting for Current Liabilities Current Maturities of Long-Term Debt 11-11 Portion of long-term debt that comes due in the current year. Reported as a current liability. No adjusting entry required. Statement Presentation and Analysis Illustration 11-3 11-12 Financial Statement Presentation and Analysis Illustration 11-4 Liquidity refers to the ability to pay maturing obligations and meet unexpected needs for cash. Current ratio permits us to compare the liquidity of different-sized companies and of a single company at different times. 11-13 Illustration 11-5 Contingent Liabilities A contingency is an uncertainty as to whether an obligation exists. Thean uncertainty willinbe Potential liabilityreally that may become actual liability resolved only when some future events occurs. the future. Three levels of probability: An excerpt from Ford Motor Company’s Financials: Note 12: Litigation and Claims Various legal actions, governmental investigations and proceedings and claims pending or maypossible. be instituted or asserted in the future against the areReasonably company and its subsidiaries, including those arising out of alleged Remote. defects in the company’s products, governmental regulations relating to safety, emissions and fuel economy, financial services, intellectual property rights, product warranties and environmental matters. Certain of the pending legal actions are, or purport to be, class actions. Some of the foregoing matters involve compensatory, punitive or antitrust or damage claims in very large amounts or demands for recall campaigns, environmental remediation programs, sanctions, or other relief which if granted, would require very large expenditures. 11-14 Probable. Contingencies A loss contingency is an existing uncertain situation involving potential loss depending on whether some future event occurs. Two factors affect whether a loss contingency must be accrued and reported as a liability: 1. the likelihood that the confirming event will occur. 2. whether the loss amount can be reasonably estimated. 11-15 Contingencies – Likelihood of Occurrence Probable Reasonably Possible The chance the confirming event will occur is more than remote, but less than likely. Remote 11-16 A confirming event is likely to occur. The chance the confirming event will occur is slight. Accounting for Contingencies Dollar Amount of Potential Loss Likelihood Probable Reasonably possible Remote 11-17 Known Reasonably Possible Record liability Disclosure note only No disclosure required Record liability Disclosure note only No disclosure required Not Reasonably Estimable Disclosure note only Disclosure note only No disclosure required Contingent Liabilities Question A contingent liability should be recorded in the accounts when: a. it is probable the contingency will happen, but the amount cannot be reasonably estimated. b. it is reasonably possible the contingency will happen, and the amount can be reasonably estimated. c. it is probable the contingency will happen, and the amount can be reasonably estimated. d. it is reasonably possible the contingency will happen, but the amount cannot be reasonably estimated. 11-18 Contingent Liabilities Recording a Contingent Liability Product Warranties Promise made by a seller to a buyer to make good on a deficiency of quantity, quality, or performance in a product. Estimated cost of honoring product warranty contracts should be recognized as an expense in the period in which the sale occurs. 11-19 Contingent Liabilities Illustration: Denson Manufacturing Company sells 10,000 washers and dryers at an average price of $600 each. The selling price includes a one-year warranty on parts. Denson expects that 500 units (5%) will be defective and that warranty repair costs will average $80 per unit. In 2012, the company honors warranty contracts on 300 units, at a total cost of $24,000. At December 31, compute the estimated warranty liability. Illustration 11-6 Computation of estimated product warranty liability 11-20 SO 5 Contingent Liabilities Illustration: Denson Manufacturing Company sells 10,000 washers and dryers at an average price of $600 each in December 2011. The selling price includes a one-year warranty on parts. Denson expects that 500 units (5%) will be defective and that warranty repair costs will average $80 per unit. In 2012, the company honors warranty contracts on 300 units, at a total cost of $24,000. At December 31, compute the estimated warranty liability. Make the required adjusting entry. 11-21 Contingent Liabilities Illustration: Prepare the entry to record the repair costs incurred in 2012 to honor warranty contracts on 2012 sales. . 11-22