Modern Macroeconomics and Monetary Policy

... • With stable prices, supply and demand in the loanable funds market are in balance at a real & nominal interest rate of 4%. • If rapid monetary expansion leads to a long-term 5% inflation rate, borrowers and lenders will build the higher inflation rate into their decision making. • As a result, the ...

... • With stable prices, supply and demand in the loanable funds market are in balance at a real & nominal interest rate of 4%. • If rapid monetary expansion leads to a long-term 5% inflation rate, borrowers and lenders will build the higher inflation rate into their decision making. • As a result, the ...

Textbook of Economics

... that many students have deficiencies in mathematics as many of them had finished high school years ago. Therefore where mathematics is necessary a Math Box is included. Each chapter is followed by Numerical Examples that can be used in seminars to practice the acquired knowledge. The examples and th ...

... that many students have deficiencies in mathematics as many of them had finished high school years ago. Therefore where mathematics is necessary a Math Box is included. Each chapter is followed by Numerical Examples that can be used in seminars to practice the acquired knowledge. The examples and th ...

Banking and Currency Crises: How Common Are Twins?

... financial turmoil has drawn renewed attention to the interrelationship between these two phenomena. Banking and currency crises appeared to arise virtually at the same time in Thailand, Indonesia, Malaysia, and Korea in 1997-98. In fact, the incidence of “twin” crises has been relatively widespread, ...

... financial turmoil has drawn renewed attention to the interrelationship between these two phenomena. Banking and currency crises appeared to arise virtually at the same time in Thailand, Indonesia, Malaysia, and Korea in 1997-98. In fact, the incidence of “twin” crises has been relatively widespread, ...

Slide 1

... A frayed social safety net and an under-developed financial sector (Chamon and Prasad 2008; Blanchard and Giavazzi 2006; Kuijs 2006). Policies that favor industry at the cost of jobs and ...

... A frayed social safety net and an under-developed financial sector (Chamon and Prasad 2008; Blanchard and Giavazzi 2006; Kuijs 2006). Policies that favor industry at the cost of jobs and ...

Parkin-Bade Chapter 28

... To decide when to work, people compare the return from working in the current period with the expected return from working in a later period. The when-to-work decision depends on the real interest rate. The lower the real interest rate, the smaller is the supply of labor today. Many economists belie ...

... To decide when to work, people compare the return from working in the current period with the expected return from working in a later period. The when-to-work decision depends on the real interest rate. The lower the real interest rate, the smaller is the supply of labor today. Many economists belie ...

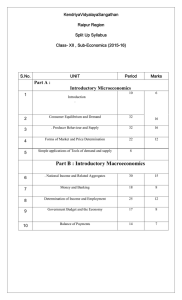

- Kendriya Vidyalaya No. 2 Raipur

... Answer- It is subject matter of microeconomics which is determination of relative prices of different goods and services. So it is called price theory. (4) What is meant by increasing marginal opportunity cost along a PPC mean? Answer-Increasing MOC along a PPC means that as we produce more and more ...

... Answer- It is subject matter of microeconomics which is determination of relative prices of different goods and services. So it is called price theory. (4) What is meant by increasing marginal opportunity cost along a PPC mean? Answer-Increasing MOC along a PPC means that as we produce more and more ...

answer key - U of L Personal Web Sites

... 29. Calculate GDP using the table above. A) 5,570. B) 5,600. C) 6,050. D) 6,320. Ans: B 30. If you know that a meal costing $40 in Canada would cost $2 in Bangladesh and that this is representative of the relative prices of most goods, you also know that A) purchasing power parity would decrease com ...

... 29. Calculate GDP using the table above. A) 5,570. B) 5,600. C) 6,050. D) 6,320. Ans: B 30. If you know that a meal costing $40 in Canada would cost $2 in Bangladesh and that this is representative of the relative prices of most goods, you also know that A) purchasing power parity would decrease com ...

Real Exchange Rates and Competitiveness: The Political Economy

... model estimated here, Swedish prices, for example, are nearly 40% higher on average than U.S. prices across the 29-year time span. This cannot be due to barriers to trade because we focus on the period since the end of Bretton Woods, which is widely regarded as the beginning of a truly globalized in ...

... model estimated here, Swedish prices, for example, are nearly 40% higher on average than U.S. prices across the 29-year time span. This cannot be due to barriers to trade because we focus on the period since the end of Bretton Woods, which is widely regarded as the beginning of a truly globalized in ...

University of Lethbridge — Department of Economics

... A) "The extra money pumped into the economy by the central bank is creating more exports." B) "Businesses are investing more, now that monetary policy has become less expansionary." C) "The extra money pumped into the economy by the central bank is creating fewer jobs." D) "The tightening of money g ...

... A) "The extra money pumped into the economy by the central bank is creating more exports." B) "Businesses are investing more, now that monetary policy has become less expansionary." C) "The extra money pumped into the economy by the central bank is creating fewer jobs." D) "The tightening of money g ...

The CPI and the Cost of Living C H A P T E R C H E C K L I S T

... Explain the limitations of the CPI and describe other measures of the price level. ...

... Explain the limitations of the CPI and describe other measures of the price level. ...

15.2 THE CPI AND OTHER PRICE LEVEL MEASURES The

... Explain the limitations of the CPI and describe other measures of the price level. ...

... Explain the limitations of the CPI and describe other measures of the price level. ...

The Currency Market and its Satellites

... B European governments had officially fixed the rate as e.g. DEM / USD 4, their own natural quote ...

... B European governments had officially fixed the rate as e.g. DEM / USD 4, their own natural quote ...

Leaving the euro: A practical guide

... section 2.4. In Appendix 5, we briefly discuss how far these problems would be significantly different if it were a strong country that left the union. To keep the drafting simple, we assume that Greece is the weak country that is first to leave, and that its new currency is called the drachma. Simi ...

... section 2.4. In Appendix 5, we briefly discuss how far these problems would be significantly different if it were a strong country that left the union. To keep the drafting simple, we assume that Greece is the weak country that is first to leave, and that its new currency is called the drachma. Simi ...

A model of secular stagnation

... permanently negative. The key here is that households shift from borrowing to saving over their lifecycle. If a borrower takes on less debt today (due to the deleveraging shock) then when tomorrow comes, he has greater savings capacity since he has less debt to repay. This implies that deleveraging ...

... permanently negative. The key here is that households shift from borrowing to saving over their lifecycle. If a borrower takes on less debt today (due to the deleveraging shock) then when tomorrow comes, he has greater savings capacity since he has less debt to repay. This implies that deleveraging ...

Quantitative Easing in a Small Open Economy: An International

... by the small open economy. The strong co-movement between domestic and foreign term premia is also consistent with the evidence presented in literature. The left panel in Figure 2 shows term premium estimates over time for several small open economies, obtained from Wright (2011). For comparison, th ...

... by the small open economy. The strong co-movement between domestic and foreign term premia is also consistent with the evidence presented in literature. The left panel in Figure 2 shows term premium estimates over time for several small open economies, obtained from Wright (2011). For comparison, th ...

710171717171171717171MMEICIETE11171711711 EJ Cl Cl Cl 1

... If on the other hand, there are more targets than policy variables, the system has more equations than unknowns. It will not then, in general, be possible to find a set of values for the policy tools that will satisfy all the equations, that is, that will permit all targets to be achieved. In everyd ...

... If on the other hand, there are more targets than policy variables, the system has more equations than unknowns. It will not then, in general, be possible to find a set of values for the policy tools that will satisfy all the equations, that is, that will permit all targets to be achieved. In everyd ...

A Comparison of Twelve Macroeconomic Models

... expectations and by factor disequilibrium in labour or product markets. Under the money matters paradigm, inflation is determined mainly by monetary disequilibrium. Although most models are based on the conventional paradigm, there are nevertheless important differences within that paradigm. In part ...

... expectations and by factor disequilibrium in labour or product markets. Under the money matters paradigm, inflation is determined mainly by monetary disequilibrium. Although most models are based on the conventional paradigm, there are nevertheless important differences within that paradigm. In part ...

(AS) Curve

... Wages are a large fraction of total costs and wage changes lag behind price changes. This gives us an upward sloping short-run AS curve. ...

... Wages are a large fraction of total costs and wage changes lag behind price changes. This gives us an upward sloping short-run AS curve. ...

The Effectiveness of Unconventional Monetary Policy Tools at the

... Topic characteristics In the last a few decades, many central banks around the world tried to reduce and stabilize inflation and they were successful. However, as a consequence nominal interest rates were lowered to such a level which increased the likelihood of binding zero bound on nominal interes ...

... Topic characteristics In the last a few decades, many central banks around the world tried to reduce and stabilize inflation and they were successful. However, as a consequence nominal interest rates were lowered to such a level which increased the likelihood of binding zero bound on nominal interes ...

International Economics, 10e (Krugman/Obstfeld/Melitz) Chapter 22

... 16) Describe some of the features hindering developing countries from growing faster. Answer: One of the features that can be hold developing countries from growing faster is corruption. The way governments control the economy by developing restrictions that would not allow international trade amon ...

... 16) Describe some of the features hindering developing countries from growing faster. Answer: One of the features that can be hold developing countries from growing faster is corruption. The way governments control the economy by developing restrictions that would not allow international trade amon ...

NBER WO~G PAPER SERIES MACROECONOMIC POLICY ~ THE PRESENCE OF STRUCTURAL

... structural budget deficit, and indirectly, by encouraging structural reform, potentially reducing the structural budget deficit itself. In 1992-93 several European countries dropped out of the ERM to pursue more expansionary monetary policies. The difference in the performance of these countties and ...

... structural budget deficit, and indirectly, by encouraging structural reform, potentially reducing the structural budget deficit itself. In 1992-93 several European countries dropped out of the ERM to pursue more expansionary monetary policies. The difference in the performance of these countties and ...

BALANCE OF PAYMENTS ADJUSTMENT

... expresses the relationship between a country‘s balance of payments and its money supply (Chacholiades, 1990:463). MABP shows that the overall balance of payments (measured by international reserves) is influenced by imbalances prevailing in the money market. Under a system of fixed exchange rates ex ...

... expresses the relationship between a country‘s balance of payments and its money supply (Chacholiades, 1990:463). MABP shows that the overall balance of payments (measured by international reserves) is influenced by imbalances prevailing in the money market. Under a system of fixed exchange rates ex ...

Interest Rates and Their Role in the Economy during Transition. The

... M2 to the level of GNP, is at very low level – about 15-17% in 1999-2000. He showed that this coefficient is less than in some other developed countries, such as Great Britain and France – about 100% and 65% respectively. The monetisation of the Ukrainian economy was decreasing since 1992 (monetisa ...

... M2 to the level of GNP, is at very low level – about 15-17% in 1999-2000. He showed that this coefficient is less than in some other developed countries, such as Great Britain and France – about 100% and 65% respectively. The monetisation of the Ukrainian economy was decreasing since 1992 (monetisa ...

Inflation Report 4/2000

... inflation in Norway is gradually reduced to the level aimed at by the European Central Bank (ECB). At the same time, monetary policy must not in itself contribute to deflationary recessions as this could undermine confidence in the krone. The labour market is tight. The rate of increase in labour co ...

... inflation in Norway is gradually reduced to the level aimed at by the European Central Bank (ECB). At the same time, monetary policy must not in itself contribute to deflationary recessions as this could undermine confidence in the krone. The labour market is tight. The rate of increase in labour co ...

Exchange rate

.jpg?width=300)

In finance, an exchange rate (also known as a foreign-exchange rate, forex rate, FX rate or Agio) between two currencies is the rate at which one currency will be exchanged for another. It is also regarded as the value of one country’s currency in terms of another currency. For example, an interbank exchange rate of 119 Japanese yen (JPY, ¥) to the United States dollar (US$) means that ¥119 will be exchanged for each US$1 or that US$1 will be exchanged for each ¥119. In this case it is said that the price of a dollar in terms of yen is ¥119, or equivalently that the price of a yen in terms of dollars is $1/119.Exchange rates are determined in the foreign exchange market, which is open to a wide range of different types of buyers and sellers where currency trading is continuous: 24 hours a day except weekends, i.e. trading from 20:15 GMT on Sunday until 22:00 GMT Friday. The spot exchange rate refers to the current exchange rate. The forward exchange rate refers to an exchange rate that is quoted and traded today but for delivery and payment on a specific future date.In the retail currency exchange market, a different buying rate and selling rate will be quoted by money dealers. Most trades are to or from the local currency. The buying rate is the rate at which money dealers will buy foreign currency, and the selling rate is the rate at which they will sell the currency. The quoted rates will incorporate an allowance for a dealer's margin (or profit) in trading, or else the margin may be recovered in the form of a commission or in some other way. Different rates may also be quoted for cash (usually notes only), a documentary form (such as traveler's cheques) or electronically (such as a credit card purchase). The higher rate on documentary transactions has been justified to compensate for the additional time and cost of clearing the document, while the cash is available for resale immediately. Some dealers on the other hand prefer documentary transactions because of the security concerns with cash.