Foreign Affairs and National Security

... has to do what individual chore. You can mow the lawn in 2 hours, your sister can do it in 5 hours. You can clean the house in 3 hours and your sister can do it in 3 and a half. Because you are faster in both cutting the lawn and cleaning the house – Does this mean your sister should do nothing at ...

... has to do what individual chore. You can mow the lawn in 2 hours, your sister can do it in 5 hours. You can clean the house in 3 hours and your sister can do it in 3 and a half. Because you are faster in both cutting the lawn and cleaning the house – Does this mean your sister should do nothing at ...

Economics review gen ed-Animated

... Oil is the major export of Saudi Arabia to many different countries. Saudi Arabia’s international trade in oil is made much easier by A. Use of a world wide currency. B. A system to exchange currency between countries. C. Trading only with countries that have the same currency. D. Trade of oil for o ...

... Oil is the major export of Saudi Arabia to many different countries. Saudi Arabia’s international trade in oil is made much easier by A. Use of a world wide currency. B. A system to exchange currency between countries. C. Trading only with countries that have the same currency. D. Trade of oil for o ...

show

... γ expenditure share on foreign goods θ elasticity of substitution between home and foreign goods ...

... γ expenditure share on foreign goods θ elasticity of substitution between home and foreign goods ...

Effects of an exchange rate change on agricultural

... The figure shows the effect of an exchange rate change on equilibrium price and quantity using the traditional two country-one commodity closed system of Kost. 3 Kost's analysis is modified by the addition of a currency exchange sector. The trade sector is measured in dollars; changes in the export ...

... The figure shows the effect of an exchange rate change on equilibrium price and quantity using the traditional two country-one commodity closed system of Kost. 3 Kost's analysis is modified by the addition of a currency exchange sector. The trade sector is measured in dollars; changes in the export ...

Venezuela_en.pdf

... abolishing the BsF 2.6 per dollar rate. The implicit rate of BsF 5.3 per dollar was maintained in SITME for operations not eligible for the BsF 4.3 per dollar rate authorized by CADIVI. Despite the devaluation of the bolívar fuerte in January 2011, the country’s persistently high inflation in the ea ...

... abolishing the BsF 2.6 per dollar rate. The implicit rate of BsF 5.3 per dollar was maintained in SITME for operations not eligible for the BsF 4.3 per dollar rate authorized by CADIVI. Despite the devaluation of the bolívar fuerte in January 2011, the country’s persistently high inflation in the ea ...

Economics, by R. Glenn Hubbard and Anthony Patrick O`Brien

... Does not include output from agriculture, construction, transportation, communications, and service industries. Measures changes in the volume of goods produced (does not take price into account) IP corresponds to real GDP (close relationship between DIP and DGDP) Manufacturing is most cyclically se ...

... Does not include output from agriculture, construction, transportation, communications, and service industries. Measures changes in the volume of goods produced (does not take price into account) IP corresponds to real GDP (close relationship between DIP and DGDP) Manufacturing is most cyclically se ...

Macro3 Summary and Teaching Tips

... As in Macro2 the student sets government spending, taxes, and the money supply. As in Macro2 fiscal policy results reflect crowding out effects. Crowding out is more severe in this module than in Macro2, with an effective multiplier result of about .02. This is only partly due to the choice of the m ...

... As in Macro2 the student sets government spending, taxes, and the money supply. As in Macro2 fiscal policy results reflect crowding out effects. Crowding out is more severe in this module than in Macro2, with an effective multiplier result of about .02. This is only partly due to the choice of the m ...

Brasil_en.pdf

... demonstrations in Brazil in June and the consequent loss of investor confidence. In order to guide expectations and ensure the supply of foreign currency, in August 2013 the central bank introduced an auction system of daily swaps and weekly dollar credit lines, which is being maintained in 2014, wi ...

... demonstrations in Brazil in June and the consequent loss of investor confidence. In order to guide expectations and ensure the supply of foreign currency, in August 2013 the central bank introduced an auction system of daily swaps and weekly dollar credit lines, which is being maintained in 2014, wi ...

solutions

... 5. Describe an investment strategy using derivatives, which yields a positive payoff in case of low volatility and limited losses in case of high volatility. E.g., butterfly spread. 6. Is it possible for a pension fund to achieve perfect insurance against interest rate risk? If yes, how? This can b ...

... 5. Describe an investment strategy using derivatives, which yields a positive payoff in case of low volatility and limited losses in case of high volatility. E.g., butterfly spread. 6. Is it possible for a pension fund to achieve perfect insurance against interest rate risk? If yes, how? This can b ...

Diapositiva 1

... Risk of Default! If borrowing countries invest capital inflow in productive investments with higher return rates, without sizable adverse shocks, and compatible maturity they would generate the right income for timely debt repayment. ...

... Risk of Default! If borrowing countries invest capital inflow in productive investments with higher return rates, without sizable adverse shocks, and compatible maturity they would generate the right income for timely debt repayment. ...

PDF Download

... The money stock M3 had declined to just below 7% following its peak in December 2001 – still far above the ECB target of 4.5%. In January the annual rate of growth of M3 rose to 7.4% from 6.8% in the preceding month. The three-month moving average of the annual growth rates of M3 was 7.1% for the pe ...

... The money stock M3 had declined to just below 7% following its peak in December 2001 – still far above the ECB target of 4.5%. In January the annual rate of growth of M3 rose to 7.4% from 6.8% in the preceding month. The three-month moving average of the annual growth rates of M3 was 7.1% for the pe ...

WILL THE RENMINBI BECOME A WORLD CURRENCY?

... respect to its production of goods and services and for international income comparisons. In PPP terms, China‘s GDP exceeds that of all countries except the United States; it is also below that of the euro area11. As development proceeds, Chinese non-traded goods prices should rise relative to those ...

... respect to its production of goods and services and for international income comparisons. In PPP terms, China‘s GDP exceeds that of all countries except the United States; it is also below that of the euro area11. As development proceeds, Chinese non-traded goods prices should rise relative to those ...

The effects of the Russian economy and low oil prices on

... Systemic under-supply of local currency financing FX risk is very high and increasing Loan impairments increasing and credit crunch unfolding – systemic risk increasing/perfect storm (Moody’s – July 2015 Announcement ) Large majority of SMEs do not export. When an SME borrows in FX, it bears ...

... Systemic under-supply of local currency financing FX risk is very high and increasing Loan impairments increasing and credit crunch unfolding – systemic risk increasing/perfect storm (Moody’s – July 2015 Announcement ) Large majority of SMEs do not export. When an SME borrows in FX, it bears ...

Internationalization and the Evolution of Corporate Valuation

... The second-round effects of the crisis were transmitted both through the financial and the real channel ...

... The second-round effects of the crisis were transmitted both through the financial and the real channel ...

Chapter 21. Exchange Rate Regimes

... through price adjustment and changes in the real exchange rate over the medium run. In emergency situations, adjustment happens through devaluation, often forced on policymakers through currency crisis. Thus, the adjustment mechanism of fixed exchange rates does not appear terribly attractive. On th ...

... through price adjustment and changes in the real exchange rate over the medium run. In emergency situations, adjustment happens through devaluation, often forced on policymakers through currency crisis. Thus, the adjustment mechanism of fixed exchange rates does not appear terribly attractive. On th ...

Lecture 5

... Households in LDCs attach much less value to lives saved in the future than to lives saved today Relationship between time preference and income, life expectancy and education not consistent across countries. Other factors are important, e.g. perceived mortality risk, political instability and cultu ...

... Households in LDCs attach much less value to lives saved in the future than to lives saved today Relationship between time preference and income, life expectancy and education not consistent across countries. Other factors are important, e.g. perceived mortality risk, political instability and cultu ...

Argentina: Where To Go From Here?

... system, President Duhalde claims that the corralito is like a time bomb, which, if not deactivated slowly, can explode with harmful consequences. President Duhalde does not seem to realize that the bomb already exploded back in December of 2001. Because banks operating in Argentina are unable to con ...

... system, President Duhalde claims that the corralito is like a time bomb, which, if not deactivated slowly, can explode with harmful consequences. President Duhalde does not seem to realize that the bomb already exploded back in December of 2001. Because banks operating in Argentina are unable to con ...

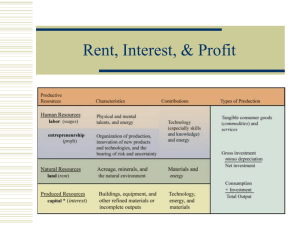

Rent, Interest, and Profit

... Government Regulation of Interest Rates Although many interest rates are influenced by the Federal Reserve’s rates for borrowing money from Uncle Sam, private lenders can set rates at whatever price they like…should government limit private lenders’ interest rates (usury laws)? Explain. ...

... Government Regulation of Interest Rates Although many interest rates are influenced by the Federal Reserve’s rates for borrowing money from Uncle Sam, private lenders can set rates at whatever price they like…should government limit private lenders’ interest rates (usury laws)? Explain. ...

How strong dollar adversely affects Kenyan economy

... things are not so neat. Although most emergingmarket firms that borrow in foreign currency do so in dollars, exporters may trade ...

... things are not so neat. Although most emergingmarket firms that borrow in foreign currency do so in dollars, exporters may trade ...

The Advantages of a Community Currency – An OCA Perspective

... behavior due to subsidies out of the profit created by the currency (Holdsworth and Boyle 2004). Another possibility could be more attractive financing conditions for sustainable investment projects like in renewable energy systems (Turnbull 2009). Next to environmental benefits, there are also soci ...

... behavior due to subsidies out of the profit created by the currency (Holdsworth and Boyle 2004). Another possibility could be more attractive financing conditions for sustainable investment projects like in renewable energy systems (Turnbull 2009). Next to environmental benefits, there are also soci ...

FRBSF E L CONOMIC ETTER

... measure the relative contributions of productivity improvements and the transfer of labor out of agriculture into high-productivity activities.They find that between 1978 and 1995 the reallocation of labor from agriculture to nonagriculture accounted for over one-third of China’s average annual incr ...

... measure the relative contributions of productivity improvements and the transfer of labor out of agriculture into high-productivity activities.They find that between 1978 and 1995 the reallocation of labor from agriculture to nonagriculture accounted for over one-third of China’s average annual incr ...

current account

... a financial asset—from a foreigner, that foreigner will often want to be paid in their own currency. • The rate at which one country’s currency can be traded for another’s is known as the nominal exchange rate. Example: If one U.S. dollar can purchase 100 Japanese yen, then the exchange rate is ¥100 ...

... a financial asset—from a foreigner, that foreigner will often want to be paid in their own currency. • The rate at which one country’s currency can be traded for another’s is known as the nominal exchange rate. Example: If one U.S. dollar can purchase 100 Japanese yen, then the exchange rate is ¥100 ...

Chapter 24A

... Companies that do business internationally are exposed to exchange rate risk The more volatile the exchange rates, the more difficult it is to predict the firm’s cash flows in its domestic currency If a firm can manage its exchange rate risk, it can reduce the volatility of its foreign earnings ...

... Companies that do business internationally are exposed to exchange rate risk The more volatile the exchange rates, the more difficult it is to predict the firm’s cash flows in its domestic currency If a firm can manage its exchange rate risk, it can reduce the volatility of its foreign earnings ...

Exchange rate

.jpg?width=300)

In finance, an exchange rate (also known as a foreign-exchange rate, forex rate, FX rate or Agio) between two currencies is the rate at which one currency will be exchanged for another. It is also regarded as the value of one country’s currency in terms of another currency. For example, an interbank exchange rate of 119 Japanese yen (JPY, ¥) to the United States dollar (US$) means that ¥119 will be exchanged for each US$1 or that US$1 will be exchanged for each ¥119. In this case it is said that the price of a dollar in terms of yen is ¥119, or equivalently that the price of a yen in terms of dollars is $1/119.Exchange rates are determined in the foreign exchange market, which is open to a wide range of different types of buyers and sellers where currency trading is continuous: 24 hours a day except weekends, i.e. trading from 20:15 GMT on Sunday until 22:00 GMT Friday. The spot exchange rate refers to the current exchange rate. The forward exchange rate refers to an exchange rate that is quoted and traded today but for delivery and payment on a specific future date.In the retail currency exchange market, a different buying rate and selling rate will be quoted by money dealers. Most trades are to or from the local currency. The buying rate is the rate at which money dealers will buy foreign currency, and the selling rate is the rate at which they will sell the currency. The quoted rates will incorporate an allowance for a dealer's margin (or profit) in trading, or else the margin may be recovered in the form of a commission or in some other way. Different rates may also be quoted for cash (usually notes only), a documentary form (such as traveler's cheques) or electronically (such as a credit card purchase). The higher rate on documentary transactions has been justified to compensate for the additional time and cost of clearing the document, while the cash is available for resale immediately. Some dealers on the other hand prefer documentary transactions because of the security concerns with cash.