Economics 202

... 1. What is the European Central Banks primary method of changing the money supply? 2. What is the Federal Reserves primary method of changing the money supply? 3. How can a Central Bank change the money supply without changing the monetary base? 4. How can the public cause a change in the money supp ...

... 1. What is the European Central Banks primary method of changing the money supply? 2. What is the Federal Reserves primary method of changing the money supply? 3. How can a Central Bank change the money supply without changing the monetary base? 4. How can the public cause a change in the money supp ...

Macroeconomics - University of Oxford

... why is money growth volatile? • Month-to-month monetary base growth rates are very, very noisy. Banks' demands for reserves and public demand for currency fluctuates a lot on a month-to-month basis, especially when expressed as an annual growth rate. For example, take a look at the month-to-month c ...

... why is money growth volatile? • Month-to-month monetary base growth rates are very, very noisy. Banks' demands for reserves and public demand for currency fluctuates a lot on a month-to-month basis, especially when expressed as an annual growth rate. For example, take a look at the month-to-month c ...

The New View On Monetary Policy: The New Consensus And Its

... and the level of unused resources in the economy – whether measured by the unemployment rate, the capacity utilization rate, or the deviation of real GDP from potential GDP. Monetary policy is thus neutral in the long run. An increase in money growth will have no long-run impact on the unemployment ...

... and the level of unused resources in the economy – whether measured by the unemployment rate, the capacity utilization rate, or the deviation of real GDP from potential GDP. Monetary policy is thus neutral in the long run. An increase in money growth will have no long-run impact on the unemployment ...

Chapter 36 THE INTERNATIONAL MONETARY SYSTEM: ORDER OR

... whose: ■Inflation rates are lower than other countries’ ■Economic growth rates are slower ■Interest rates are higher ...

... whose: ■Inflation rates are lower than other countries’ ■Economic growth rates are slower ■Interest rates are higher ...

Speech of Mr. Ivan Iskrov, Governor of the BNB, delivered during the

... companies resulting from the increased consumption and investment inevitably gave rise to a deficit on the BoP current account. Challenges facing the policy-makers As a result the current account deficit increased, reaching levels of more than 5% from the GDP in 2003 and 2004, and increased even fur ...

... companies resulting from the increased consumption and investment inevitably gave rise to a deficit on the BoP current account. Challenges facing the policy-makers As a result the current account deficit increased, reaching levels of more than 5% from the GDP in 2003 and 2004, and increased even fur ...

NBER WORKING PAPER SERIES MACROECONOMICS OF STAGFLATION UNDER FLEXIBLE EXCHANGE RATES

... New York University, Helsinki University and the National Bureau of Economic Research. Paper presented at the 9lth Annual Meeting of' the American Economic Association, Washington, D.C., session on "Recent Developments in Macroeconomic Theory: Implications for Government's Role," Monday, December 28 ...

... New York University, Helsinki University and the National Bureau of Economic Research. Paper presented at the 9lth Annual Meeting of' the American Economic Association, Washington, D.C., session on "Recent Developments in Macroeconomic Theory: Implications for Government's Role," Monday, December 28 ...

The Renminbi`s Dollar Peg at the Crossroads

... (RMB) price of the United States dollar within a very narrow range. On July 21, 2005, China’s authorities moved to an adjustable basket peg against the dollar, at the same time carrying out a 2.1 percent step revaluation of the central yuan/dollar rate relative to the prior central rate of 8.28 yuan ...

... (RMB) price of the United States dollar within a very narrow range. On July 21, 2005, China’s authorities moved to an adjustable basket peg against the dollar, at the same time carrying out a 2.1 percent step revaluation of the central yuan/dollar rate relative to the prior central rate of 8.28 yuan ...

Final Exam

... 4. [4 points] The growth of the money supply is always 6.25% and the growth rate of real output is always 2.75%. If velocity is always constant, what is the long run inflation rate? If the average real interest rate is 2.5%, what would be the average nominal interest rate? Inflation rate is 3.5% and ...

... 4. [4 points] The growth of the money supply is always 6.25% and the growth rate of real output is always 2.75%. If velocity is always constant, what is the long run inflation rate? If the average real interest rate is 2.5%, what would be the average nominal interest rate? Inflation rate is 3.5% and ...

Practice Final Exam Economics 503 Fundamentals of Economic

... 2. [3 points] The velocity rate is constant over time at V = .5. The growth rate of real GDP is 5% per year and the growth rate of the money supply is 7% per year. Calculate the level of the real inflation tax when Real GDP is HK$1 trillion dollars. Unfortunately, we did not get a chance to cover th ...

... 2. [3 points] The velocity rate is constant over time at V = .5. The growth rate of real GDP is 5% per year and the growth rate of the money supply is 7% per year. Calculate the level of the real inflation tax when Real GDP is HK$1 trillion dollars. Unfortunately, we did not get a chance to cover th ...

Untitled

... rates continue for years, the result is called creeping inflation. A rapid increase in price levels is called galloping inflation. If the rate exceeds 50 percent per month, it is called hyperinflation. Deflation, which is a decrease in general price levels, happens very rarely. 3. Name the two main ...

... rates continue for years, the result is called creeping inflation. A rapid increase in price levels is called galloping inflation. If the rate exceeds 50 percent per month, it is called hyperinflation. Deflation, which is a decrease in general price levels, happens very rarely. 3. Name the two main ...

PDF

... and how, with the current exchange rate and trade regimes, the free international movement of short-term capital undermines the ability of countries to induce economic development by robbing them of even the minimal economic instruments they retain. II-1. Governments’ Role in Initiating Development ...

... and how, with the current exchange rate and trade regimes, the free international movement of short-term capital undermines the ability of countries to induce economic development by robbing them of even the minimal economic instruments they retain. II-1. Governments’ Role in Initiating Development ...

An investigating Zeros Elimination of the National

... community for financial transactions. Also, with checks collected 500 thousand Riyals in Iran's central bank, these problems will be exacerbated also, burnout machines (ATMs), due to their frequent use, is due to the high volume of paper required. If you add such reasons of safety problems and theft ...

... community for financial transactions. Also, with checks collected 500 thousand Riyals in Iran's central bank, these problems will be exacerbated also, burnout machines (ATMs), due to their frequent use, is due to the high volume of paper required. If you add such reasons of safety problems and theft ...

Insert title here

... Cost-push inflation can lead to a wage-price spiral — the process by which rising wages cause higher prices, and higher prices cause higher wages. ...

... Cost-push inflation can lead to a wage-price spiral — the process by which rising wages cause higher prices, and higher prices cause higher wages. ...

This PDF is a selection from an out-of-print volume from... of Economic Research

... thrown open to foreign investment in the asset markets and in the area of direct investment. The country has normalized relations with the rest of the world. Politically, an understanding has been reached with Britain. In the Gulf War, Argentina was among the first to commit troops. In the economic ...

... thrown open to foreign investment in the asset markets and in the area of direct investment. The country has normalized relations with the rest of the world. Politically, an understanding has been reached with Britain. In the Gulf War, Argentina was among the first to commit troops. In the economic ...

Research and Monetary Policy Department Working Paper No:07/04

... emerging markets context including Turkey, the exchange rate has a distinct role, because its fluctuations may be more costly compared to those in developed economies. Based on the pre-float experience of the Turkish economy, the reason can be attributed to a number of problematic issues such as dol ...

... emerging markets context including Turkey, the exchange rate has a distinct role, because its fluctuations may be more costly compared to those in developed economies. Based on the pre-float experience of the Turkish economy, the reason can be attributed to a number of problematic issues such as dol ...

Third Hour Examination - Department of Agricultural Economics

... running at 100 percent capacity. Assume the own price elasticity of demand for fruit juice is -.5612 and its income elasticity is 1.1254. The economy of Lower Slobovia is currently experiencing an interest rate of 8% and a real GDP of $2,000. This level of GDP puts it in the perfectly elastic (Keyne ...

... running at 100 percent capacity. Assume the own price elasticity of demand for fruit juice is -.5612 and its income elasticity is 1.1254. The economy of Lower Slobovia is currently experiencing an interest rate of 8% and a real GDP of $2,000. This level of GDP puts it in the perfectly elastic (Keyne ...

Alessio Anzuini, Martina Cecioni and

... rate differentials: after controlling for price and growth differentials, an interest rate shock come closer to a monetary policy shock. After 2012 the cyclical positions of the two areas were different: the euro area was in recession in 2012 and started recovering at the end of 2013, while the U.S ...

... rate differentials: after controlling for price and growth differentials, an interest rate shock come closer to a monetary policy shock. After 2012 the cyclical positions of the two areas were different: the euro area was in recession in 2012 and started recovering at the end of 2013, while the U.S ...

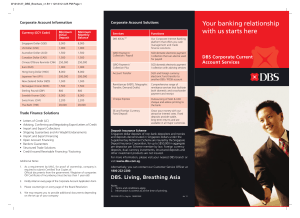

Your banking relationship with us starts here

... For passport / IC, the party certifying cannot be IC / Passport holder Note: All signatures (including authorised signatories’ and directors’ signatures in the board resolution) are to be verified by DBS staff / Notary Public ...

... For passport / IC, the party certifying cannot be IC / Passport holder Note: All signatures (including authorised signatories’ and directors’ signatures in the board resolution) are to be verified by DBS staff / Notary Public ...

Economics and Political Economy

... Esaka (2010a) examines the link between de facto exchange rate regimes and the incidence of currency crises in 84 countries from 1980 to 2001 using probit models. The author employs the de facto classification of Reinhart & Rogoff (2004) and finds no evidence that intermediate regimes have a signifi ...

... Esaka (2010a) examines the link between de facto exchange rate regimes and the incidence of currency crises in 84 countries from 1980 to 2001 using probit models. The author employs the de facto classification of Reinhart & Rogoff (2004) and finds no evidence that intermediate regimes have a signifi ...

IOSR Journal of Economics and Finance (IOSR-JEF)

... parent can ensure that it gets to borrow at the most competitive rates and secondly, it minimizes foreign Currency risk. Initial Exchange of Principal: The bank exchanges with the US parent an amount of INR equal to the principal of the intercompany loan in return for an equivalent amount of US doll ...

... parent can ensure that it gets to borrow at the most competitive rates and secondly, it minimizes foreign Currency risk. Initial Exchange of Principal: The bank exchanges with the US parent an amount of INR equal to the principal of the intercompany loan in return for an equivalent amount of US doll ...

Exchange rate

.jpg?width=300)

In finance, an exchange rate (also known as a foreign-exchange rate, forex rate, FX rate or Agio) between two currencies is the rate at which one currency will be exchanged for another. It is also regarded as the value of one country’s currency in terms of another currency. For example, an interbank exchange rate of 119 Japanese yen (JPY, ¥) to the United States dollar (US$) means that ¥119 will be exchanged for each US$1 or that US$1 will be exchanged for each ¥119. In this case it is said that the price of a dollar in terms of yen is ¥119, or equivalently that the price of a yen in terms of dollars is $1/119.Exchange rates are determined in the foreign exchange market, which is open to a wide range of different types of buyers and sellers where currency trading is continuous: 24 hours a day except weekends, i.e. trading from 20:15 GMT on Sunday until 22:00 GMT Friday. The spot exchange rate refers to the current exchange rate. The forward exchange rate refers to an exchange rate that is quoted and traded today but for delivery and payment on a specific future date.In the retail currency exchange market, a different buying rate and selling rate will be quoted by money dealers. Most trades are to or from the local currency. The buying rate is the rate at which money dealers will buy foreign currency, and the selling rate is the rate at which they will sell the currency. The quoted rates will incorporate an allowance for a dealer's margin (or profit) in trading, or else the margin may be recovered in the form of a commission or in some other way. Different rates may also be quoted for cash (usually notes only), a documentary form (such as traveler's cheques) or electronically (such as a credit card purchase). The higher rate on documentary transactions has been justified to compensate for the additional time and cost of clearing the document, while the cash is available for resale immediately. Some dealers on the other hand prefer documentary transactions because of the security concerns with cash.